ForexBrokers.com is committed to the highest ethical standards and reviews services independently. Learn How We Make Money

Best Forex Chart Websites of 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Whether you are a beginner forex trader or a seasoned technical analyst, being able to chart the forex markets is an important skill. Basic forex charts help traders understand historical prices on a high level.

Advanced forex charting tools help traders assess potential trends, analyze historical patterns, and perform sophisticated technical analysis. This guide will help you navigate the rich variety of forex charting technologies and dive into the best forex charting providers in 2023.

Best forex charting websites in 2023

Here are my picks for the best forex charting websites in 2023. These companies have developed advanced charting technologies that are relied upon by millions of traders each year for their technical analysis needs.

1. TradingView

The TradingView software suite delivers high-quality charts, website widgets, a web trading platform and mobile app, and a range of open-source tools. Offered for free by many of the best forex brokers, TradingView has long been a preferred choice for technical analysis enthusiasits for its dynamic charting software. Today, TradingView has evolved into a fully-fledged trading platform used by a growing number of online forex brokerages.

TradingView also offers its Pine Script programming language to support the needs of algorithmic traders and developers of custom indicators. Combined with its native social network features and chart-reply functionality, TradingView has risen to the top as one of the best forex trading platform providers. TradingView won our 2024 Annual Award for #1 Charting Technology Provider.

Read my TradingView guide to find a highly rated broker that offers TradingView.

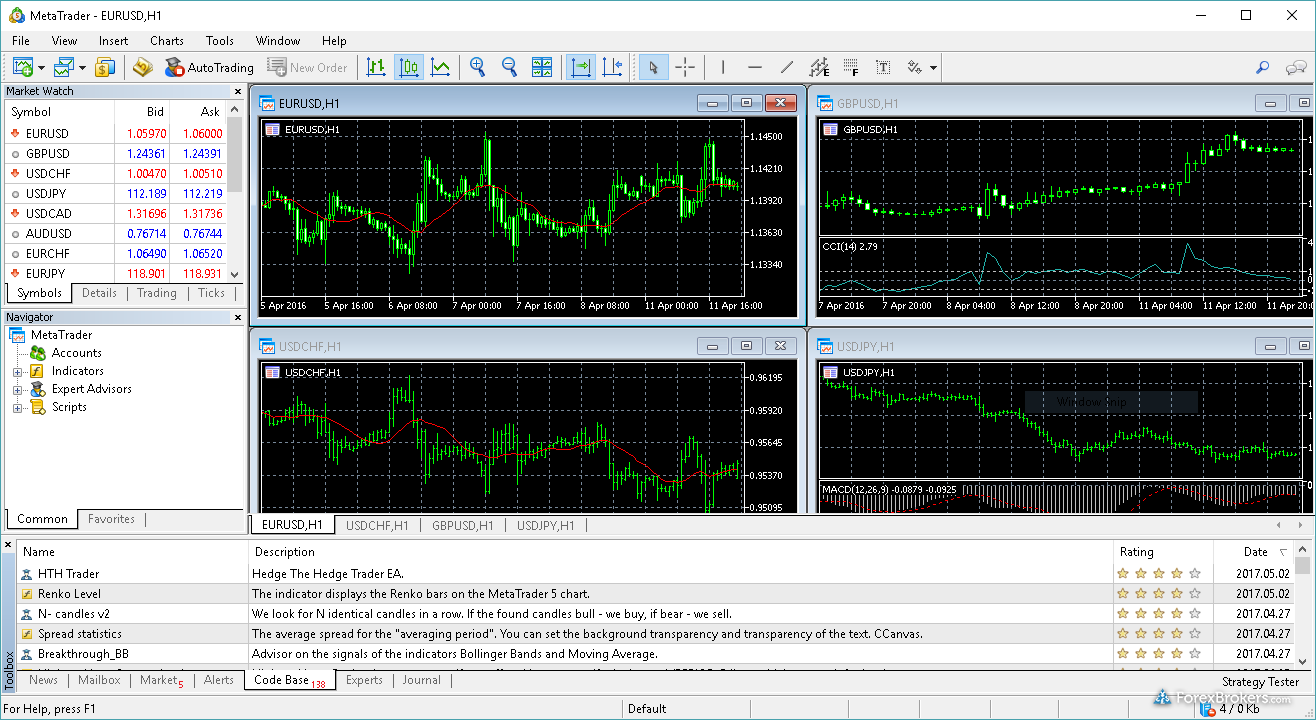

2. MetaTrader (MetaQuotes Software Corporation)

The popular MetaTrader 5 (MT5) platform and its predecessor MetaTrader 4 (MT4) are both available for free on desktop, web, and mobile. MetaTrader still reigns as one of the most widely-used forex charting applications by retail forex traders globally. I’ve been using MetaTrader since 2005, and I’ve long been a fan of MetaTrader’s charting technology. MetaTrader charts allow for multiple tabs and windows, offer the ability to add overlays with multiple instruments per chart, and allow traders to add pre-built, custom, and third-party indicators.

In addition to charting, MetaTrader has set the bar for algorithmic trading tools for retail traders with its proprietary programming languages (MQL4 and MQL5).

computerMore about MetaTrader

Check out my guide to the MetaTrader suite, or learn more about the latest version of MetaTrader by reading my in-depth guide to MetaTrader 5. Can’t decide which version to use? My MT4 vs MT5 guide gives you all the info you need to make an informed decision.

3. cTrader (Spotware Systems)

cTrader’s platform suite is available for desktop, web, and mobile. I’ve been using cTrader since 2018, and the platform’s modern charting technology has always stood out to me. Charts on the cTrader platform are sleek and powerful. cTrader leverages the C# programming language (hence the “c” in cTrader) and supports algorithmic trading capabilities alongside custom chart indicators and studies. Traders can build and use custom tools available via trading API. These features, combined with its integrated social copy trading network help cTrader hold its position as one of the best technology providers for forex charting.

Check out my cTrader guide to learn more about this platform suite and find an excellent broker that offers the cTrader platform.

Best free charting tools provided by forex brokers

Many traders use the trading platform and integrated charts available directly from their forex broker. I’ve tested the platforms and charting tools of dozens of the top forex brokers. Below you’ll find my picks for the best free charting tools provided directly from the best brokers.

-

Saxo

- Saxo's SaxoTraderPRO and SaxoTraderGO platforms deliver powerful charting.

-

IG

- IG’s top-tier mobile charts add value to IG’s formidable trading platform suite.

-

Interactive Brokers

- Great charts in the TWS platform for desktop and web (and the IBKR mobile app).

-

CMC Markets

- Charts in the NextGeneration web platform feature integrated pattern recognition.

-

TD Ameritrade

- The thinkorswim platform has long been an industry leader for its charting.

-

FXCM

- Trading Station’s integrated charting features customizable indicators and scripts.

-

FOREX.com

- FOREX.com delivers powerful charts across its web platforms (and even more bells and whistles on its desktop platform).

Why is forex charting important?

Every day across the world, millions of investors and traders use forex charts to assess price actions and historical market trends to plot potential future price trajectories. Charts are an important visual aid that can help forex traders analyze both the past and the present in the hopes of predicting a future outcome.

Even if you don’t believe in the importance of historical prices in predicting future trends, advanced charting tools can be useful. The best charting tools allow you to drag and drop trade orders directly on the chart, manage your risk/reward levels, and view economic calendar events plotted into the future. The availability and usefulness of these features will of course vary depending on the provider, broker, and/or platform you are using.

What is technical analysis?

Typically performed within a forex chart, technical analysis is the study of historical market prices leading up to present market conditions. The goal of technical analysis is to identify potential trends and levels of support and resistance. Technical analysis can be conducted manually (using indicators, for example) or programmatically as part of an automated trading strategy that executes when certain technical conditions are met (again using traditional or custom indicators).

The most basic form of forex technical analysis involves drawing a simple horizontal trend line on a chart to denote where prices are supported or resisted. Diagonal trend lines, on the other hand, can capture ascending and descending market price movements while plotting potential future trajectories.

bar_chartSignals and charts

Charts are also an ideal place for creating and using trading signals, which is why many brokers integrate signals directly into their charts using popular third-party providers. Check my Trading Signals guide to learn more.

Types of forex charts

The best chart providers will let you choose from numerous chart types that are far more complex than your run-of-the-mill line charts (where an ascending line means prices are rising and a descending line means prices are falling). I’ve been using forex charts of all kinds for over 20 years; below you’ll find some helpful explanations of some of the most popular chart types for forex traders.

Common chart types

Tick chart

In a tick chart, every “tick” (represented as a bar) expresses a price update. There can be multiple price ticks per second, and the price changes can be small or significant. Tick charts are not bound by time like candlestick charts. Tick charts represent the smallest level granularity for measuring intervals.

Mountain chart

Mountain charts function similarly to line charts. If you take a line chart and fill in the space below the line with color, you have a mountain chart. The resulting visual resembles a mountain, and the ridgeline represents the historical mountain price.

Candlestick chart

A candlestick chart is a way to interpret data about open, high, low, and close (OHLC) pricing information for a given duration. The “wick” of the candle can extend above and below the main candle formation to denote the high and lows of a given session. The bottom and top of the candle represent the open or close. If the close is lower than the open, the candle will typically be colored a shade of red, whereas if the candle closed higher than the opening price of the candle it will usually be colored a shade of green.

Advanced chart types

Heikin-Ashi chart

Similar to the candlestick charts, Heikin-Ashi charts take into consideration the open, high, low, and close prices (OHLC) but go a step further by factoring prices from the previous period in an effort to average out the prices and create a smoother appearance. As a result, some more granular information may be lost, but the chart may be easier to read. Heikin-Ashi charts are still available at a wide number of brokerages but are not as popular as traditional candlestick charts. Heikin-Ashi are slightly more complex and typically favored by traders experienced with technical analysis.

Renko chart

Renko charts appear as a series of blocks (also known as boxes or bricks) that are set a 45-degree angle from each other resulting in diagonal lines that either ascend or descend (depending on market conditions). With Renko charts, the block size can be calibrated to represent a specific number of points or pips. For example, if you have a block size set to 10 pips or points, then the market will need to move up (or down) more than 10 points in order for a new block to appear on the chart.

Note: Renko charts are not bound to time like candlesticks charts. As such, if prices stay within your block range, then no new block will form until the market prices passes above or below that threshold (which may takes hours, days, weeks, or even months).

Point and Figure chart

Functionally similar to Renko charts, Point and Figure charts display a series of vertically stacked Xs or Os. Each stack is either all Xs or all Os, and the height of each stack is determined by the size of the market movement and the box size for each X or O. For example, if you set the box size to 10 pips and the market increases by 50 pips, you will see 5 vertically stacked Xs. If the market drops by 20 pips, a vertical stack of Os will form with 2 Os.

Kagi charts

Kagi charts are a sophisticated type of line chart, in which the line changes from thick to thin (and vice versa) as market conditions change. Kagi charts factor in previous highs and lows, and are based on a predefined, specified threshold. For example, if you specify a 10-pip threshold, the market will need to reverse from its current levels by at least 10 in order for the chart line to change from thick to thin.

Important charting features for forex traders

Technical studies and indicators: The best charting providers for forex trading provide a comprehensive range of studies and dozens (in some cases, hundreds) of indicators that can be added to charts.

Indicators can be overlaid or added to charts in order to provide provide information via math formulas that can be complex or as simple as a moving average. For example, say you are looking at a daily candle chart with 50 days worth of candles. A simple 20-day moving average would compute the average across the last 20 days of prices and plot that as a line on your chart.

Algorithmic trading tools: Some charting providers will offer integrated algorithmic trading tools. These allow you to code your own strategy or select from a range of available automated trading strategies.

Data quality: The quality and accuracy of the historical forex price data from any chart provider can be an important factor when making calculations about potential future trajectories, as tiny deviations over time can lead to significant differences in the future. The best charting providers use high-quality tick data (which includes every single price update).

Where can I chart forex for free?

In my experience, the best way to use excellent charting tools for free is to open a demo account with one of the top forex brokers and access their trading platforms. Typically, you won’t need to include your credit card to open a demo account with the best forex brokers in the industry. Once you’ve created a demo account, you’ll be able to access sophisticated charting tools for web, desktop, and mobile – for free.

What is the best free forex chart website?

My go-to website for free forex charts is TradingView. Though there are some limitations (you can only add a few indicators per chart), traders using TradingView gain access to real-time market prices from a vast selection of providers as well as a wide range of tools for conducting technical analysis. Experienced traders and developers will appreciate that TradingView’s Pine Script programming language provides the ability to code algorithms for automated trading.

I’ve shared and published charts with my own technical analysis on TradingView’s social network in the past, and I appreciate that you can go back and replay those charts to see how the analysis subsequently unfolded.

Forex chart websites for beginners

It’s worth noting that TradingView could be overwhelming to beginner forex traders or someone who is brand new to using forex charts. For traders who are just starting to get familiar with forex charts, I’d recommend checking out Yahoo Finance or Google Finance. Both of these financial news powerhouses deliver bare-bones (but usable) forex charts.

Below you'll see a basic chart of the EUR/USD currency pair from Yahoo Finance as well as a mountain chart on Google finance.

Final thoughts from a trader’s perspective

If you are just getting started as a forex trader and you are curious about forex charts, I’d recommend checking out some basic charts (like on Yahoo Finance). If, however, you want to dive deeper into the vast world of forex charting, dozens of the best forex brokers offer powerful charting options for free. I also recommend checking out third-party charting technology providers such as TradingView, MetaTrader, and cTrader.

ForexBrokers.com 2023 Overall Rankings

Now that you've seen our picks for the best free charting websites, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our evaluations of online brokers and their products and services are based on our collected quantitative data as well as the qualitative observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the online forex brokerage industry, and we evaluate dozens of international regulator agencies (click here to learn about how we calculate Trust Score).

Our research team, led by Steven Hatazkis, conducts thorough testing on a range of features, including each broker’s individual products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and an exhaustive list of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. For a full explanation and accounting of our research and testing process, please click here to learn more about how we test.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

City Index

City Index

XTB

XTB

eToro

eToro

Swissquote

Swissquote

Capital.com

Capital.com

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

Admirals

Admirals

Pepperstone

Pepperstone

XM Group

XM Group

FP Markets

FP Markets

FxPro

FxPro

IC Markets

IC Markets

Markets.com

Markets.com

Tickmill

Tickmill

Fineco Bank

Fineco Bank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

DooPrime

DooPrime

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Moneta Markets

Moneta Markets

Eightcap

Eightcap

MultiBank

MultiBank

ACY Securities

ACY Securities

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

easyMarkets

easyMarkets

IronFX

IronFX

Spreadex

Spreadex

IFC Markets

IFC Markets

Trade360

Trade360

Octa

Octa

Axi

Axi

TeleTrade

TeleTrade

GKFX

GKFX

Vestle

Vestle

FXOpen

FXOpen

FXPrimus

FXPrimus

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX

Xtrade

Xtrade