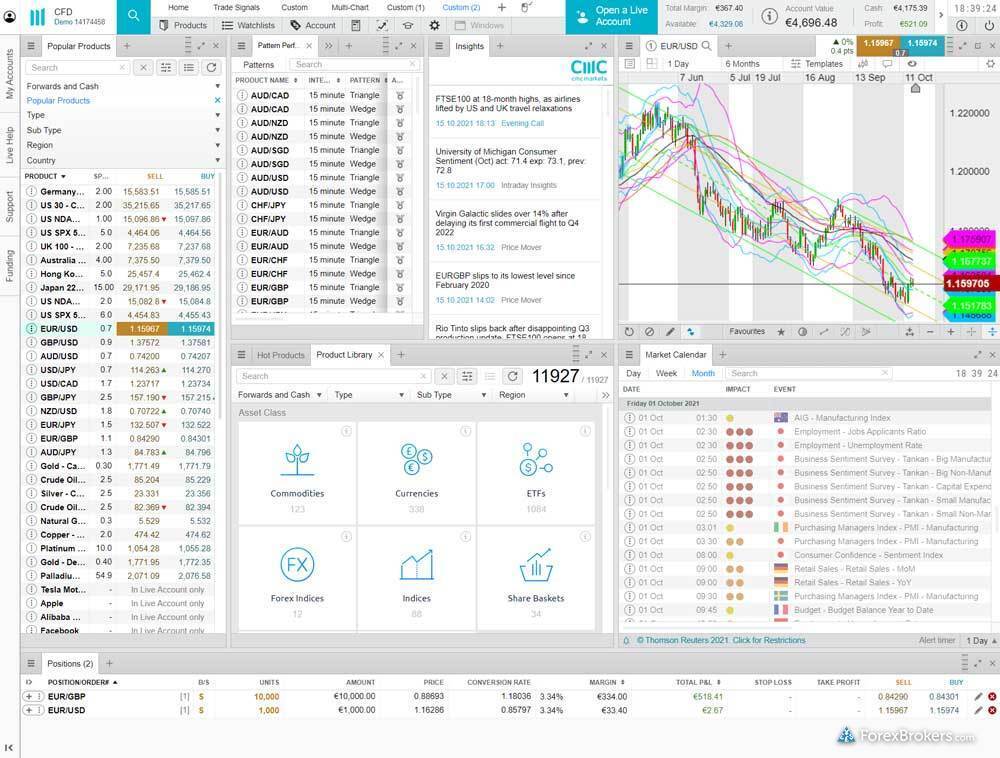

Compare Forex Brokers

The forex brokers comparison tool compares all forex broker ratings, features, and fees side by side. Filter your brokers and compare the most popular brokers and widely used tools, mobile apps, platforms, spreads, and more. To best support your experience, providers are displayed based on your geo location. Please note: Product offerings may vary depending on your country of residence.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.