Trading signals are a popular way for traders of all types to find trading and investing opportunities. A wide range of forex brokers and third-party technology providers now offer platforms, tools, and quality information designed to help traders pick forex trading signals.

My guide to the best forex trading signal providers dives into some of the most commonly asked questions (and misconceptions) about trading signals. I'll also show you where you can go to find forex signal providers and help you choose the best forex broker for using trading signals.

My review process at ForexBrokers.com includes hands-on testing, robust fact-checking, and thousands of data points; here are the best forex trading signal providers for 2026, from around the world:

Top picks for forex signal providers

Best broker for forex trading signals – IG

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Trading Signals |

IG IG

|

|

£1 |

0.91 info |

Yes |

IG is my top choice in 2025 for a forex trading signal provider, thanks to its world-class trading platform suite, ability to handle large orders, competitive pricing across a wide range of markets, and the fully integrated nature of its signals offering. I’ve been reviewing IG for over eight years for ForexBrokers.com and I’ve consistently ranked this broker at the top of the pack for a wide range of important categories, and trading signals is no different. Simply put, IG is a great choice if you are in the market for an excellent, highly trusted broker offering trading signals.

Fully integrated signals: Many brokers offer trading signals, but few have integrated them within their trading platform as cleanly as IG. Traders at IG can copy a signal directly to the trade ticket for lightning-fast orders. Trading signals from PIA First (Signal Centre) and Autochartist are directly integrated within IG’s web and mobile platforms. They can be viewed on a screener-like table that allows you to view all recent signals at a glance (or dive deeper simply by clicking on an individual signal). IG's trading signals integration offers a streamlined experience for traders looking to act quickly on market opportunities.

Trading signal analysis: Traders at IG can analyze detailed charts that show current price movements as well as future price projections, giving you a visual roadmap of potential market trajectories. Having these projections directly on the chart allows you to see at a glance whether the analysis aligns with your trading strategy.

Copy to order: Instead of manually inputting order details, IG’s “Copy to Order” feature allows you to simply click a button to populate the order dialogue, which is conveniently placed right alongside the chart. This seamless transition from analysis to action reduces the risk of missing out on an opportunity due to delays in order placement and allows for lightning-fast orders.

Execution capabilities: IG offers dealer execution and the ability to execute large orders in a single click alongside agency execution on its Forex Direct account offering. The quality of trade execution is an important factor when using trading signals, and IG’s excellent execution capabilities help it truly stand out in this category.

For more information about its platform, read my full review of IG.

Great integration of Autochartist signals – Saxo

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Trading Signals |

Saxo Saxo

|

|

$0 |

1.0 info |

Yes |

Saxo is an excellent choice if you are looking for a highly rated broker that offers forex trading signals in 2025. I’ve been reviewing Saxo for ForexBrokers.com since 2016, and the broker continues to rank highly due to its commitment to quality execution practices, ability to handle large orders, and extensive range of available markets.

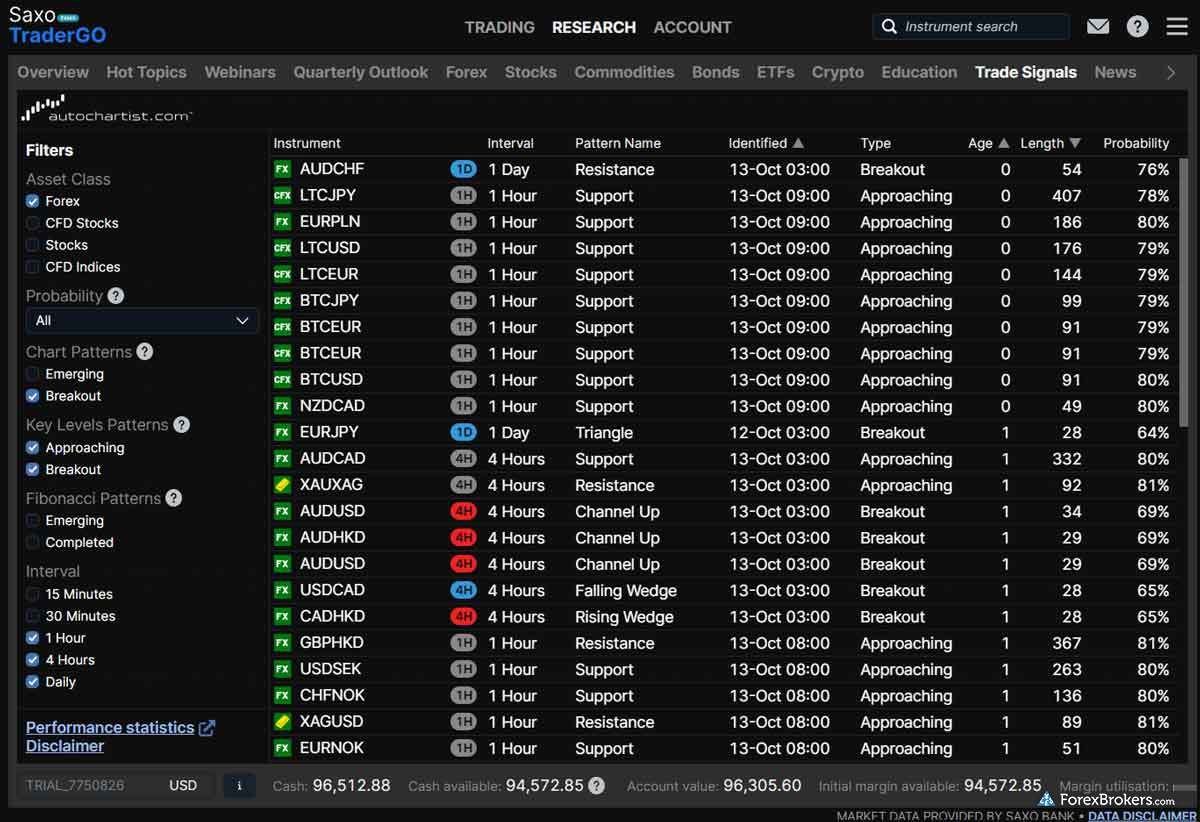

Autochartist: Historically, Autocharist was offered as a plugin or on a standalone basis, but brokers like Saxo have fully integrated Autochartist into the platform experience via API, blurring the lines between third-party service and native integrated feature. Saxo’s choice to fully integrate this popular signals provider effectively lowers the barrier for entry for traders who are looking to access trading signals. I’m a big fan of Saxo’s integration and I’ve been a longtime fan of its award-winning platform suite, which includes the SaxoTraderGO app for web and mobile and the SaxoTraderPRO desktop platform.

Trading signals analysis: There are a few standout features offered by Saxo that I appreciate — including its screener which lists high-level signal parameters for each signal generated across asset classes, as well as the ability to analyze the signal in greater detail and copy it to the trade ticket window integrated into the preview screen. Standout features include being able to toggle the expected trading range to get an idea of the future price expectation, and quickly copy the details into the integrated order window. The signal is automatically copied to the trade ticket window, and you have the option to tick a checkmark box to add a take profit and stop-loss to the order.

Trading signals analysis: One of Saxo’s excellent features is its screener. This tool lists high-level parameters for each signal generated across asset classes, giving traders the ability to analyze each signal in greater detail — and then copy it directly to the trade ticket window in the preview screen. I also like that you can toggle the expected trading range to get an idea of the future price expectation — those details can also be quickly copied into the integrated order window. Once your signal is copied into the trade ticket, you have the option to tick a checkmark box to add a take-profit and stop-loss to the order.

Execution standards: There are several things about Saxo order execution policies that I appreciate, including its commitment to the Global FX Code (a set of principles established to promote the integrity of the foreign exchange market, developed jointly a group of central banks and private market participants). Saxo also regularly publishes execution statistics and can handle large orders in a single trade, making it ideal for all types of signals trading.

For more analysis about this broker, check out my complete Saxo review.

Fully integrated pattern recognition signals – CMC Markets

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Trading Signals |

CMC Markets CMC Markets

|

|

$0 |

1.3 info |

Yes |

A highly trusted, well-regulated broker, CMC Markets is a great choice for a forex trading signal provider in 2025. CMC Markets offers integrated pattern recognition within the NextGeneration platform, an extensive selection of markets to trade, and some of the lowest spreads in the industry (including within the broker’s FXActive account option for active forex traders).

Integrated signals in NextGeneration web platform: CMC Markets offers integrated trading signals within its excellent NextGeneration platform. Known as “patterns” within CMC Markets’ ecosystem, they appear on charts along with trajectory lines for support and resistance levels, akin to a price forecast. Traders can view emerging patterns and the historical performance of past patterns. Historical performance data can include when a signal is triggered and any related price projections and/or success rates — ranging from failures to successes.

Signal risk-management: It’s important to note that there are no risk-management parameters provided for CMC’s patterns. In other words, if you decide to act on a pattern using CMC’s NextGeneration platform, the onus is on you to determine the ideal stop-loss and take-profit for your trade (check out our risk management trade simulator for inspiration).

Chart pattern library: Traders at CMC markets can manually add patterns to charts from the available library, which offers over a dozen patterns, including triangle formations, wedge formations, and head and shoulders patterns.

Highly competitive trading costs: CMC Markets boasts some of the lowest spreads in the industry, based on data provided to ForexBrokers.com for its EUR/USD pricing. Furthermore, CMC Markets’ FXActive account pricing, akin to a zero-spread account for commission-based trading (based on $2.50 per side, or $5.0 per round turn standard lot) brings the effective costs down to 0.5 pips using the broker’s sample data. This means that whether you use its standard spread-only pricing, or FXActive to implement trading signals, CMC Markets offers highly competitive trading costs in 2025 (winning our #1 Commissions & Fees category in our 2025 Annual Awards).

Head on over to my review of CMC Markets to learn more about its offering.

FAQs

What are forex signals?

Similar to social copy trading, forex signals are a way for traders to share trading opportunities with other traders and investors. When a trading opportunity is identified, or when certain predefined conditions are met, forex signal providers can share that information (typically a buy-or-sell recommendation) with other forex traders.

Traders that receive forex signals can choose whether to act upon the signal’s recommendation. Generally speaking, trading signals are either bullish (indicating a buying opportunity), or bearish (indicating a selling opportunity).

Some signal providers are fellow human traders, and some signals are created by computer programs, but nearly all trading signals are technical in nature and utilize some underlying form of technical analysis – often involving indicators which perform calculations on the price action of an asset.

Best Forex Trading Signals Providers

Trading signals are just one tool in your trading arsenal, and should not replace your own trading strategy. That said, there are some forex signal services, platforms, and technology providers that deliver a great experience for traders who want to discover forex trading signals.

Here are some of my favorite signal providers (in alphabetical order):

Acuity Trading

Founded in 2013, Acuity Trading delivers a full suite of innovative products designed to help traders analyze market data information, including price action, market news, and economic calendar events. In March 2021, Acuity Trading announced its acquisition of Signal Centre, previously known as PIA First, which provides trading signals and remains an independent brand following the acquisition.

Acuity Trading also provides actionable market sentiment data. In 2017, Acuity formed a strategic partnership with Dow Jones Newswire to help power its calendar products and economic events analysis, which are available at a growing number of forex and CFD brokers.

Autochartist

Founded in 2004, Autochartist is a platform technology company that offers a suite of products and powerful analytical tools for traders and investors. Over the years, it has grown into a global brand that is in compliance with over a dozen global regulations from related authorities, and its technologies are used by many popular online forex and CFD brokers. Autochartist is perhaps best known for its automated chart patterns, “trade setups” (similar to trading signals), its web-based platform, and its MetaTrader plugin.

Autochartist provides trading signals driven by its database of technical charting patterns, and a plethora of other resources for traders, such as macroeconomic and fundamental news analysis, price forecasts, and risk calculations. Autochartist also offers social sentiment data on forex currency pairs and a range of other assets, updated on a minute-to-minute basis with data pulled from Twitter. Autochartist won the #1 Trading Signals Technology Provider award for the ForexBrokers.com 2025 Annual Awards.

MetaTrader Signals Market

MetaTrader is a platform suite developed by MetaQuotes Software that includes the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. When you are trading with a MetaTrader broker, you receive access by default to the MetaTrader Signals Market within the desktop platform and on MQL5 (except in rare cases where it is restricted by your broker).

Within the MetaTrader Signals Market, signal providers may use fully automated trading systems, discretionary trading systems (in which the provider decides when to place trades), or a combination of both types. Traders have the ability to view each trading signal provider’s number of subscribers (as well as other qualitative and quantitative metrics) to help assess the provider's performance.

Note: Some signal providers in the MetaTrader Signals Market may charge a recurring subscription fee for using their trading signals.

Signal Centre

Formerly known as PIA First, Signal Centre was acquired by Acuity Trading in early 2021 and has since remained an independent provider, though it can now leverage the technology from its parent company to power a growing list of participating brokers. Signal Centre is regulated by the Financial Conduct Authority (FCA) in the U.K., which is a requirement for companies that offer trading signals to U.K. investors.

Trading Central

Founded in 1999, Trading Central has become a major provider of technological solutions for the online brokerage industry. Known for its expanding suite of applications and automated technical analysis, Trading Central delivers a range of robust trading tools and resources such as investment research, economic calendar events, trader sentiment data, and a formidable offering of trading signals.

In the U.S., Trading Central is a Registered Investment Advisor (RIA) and is regulated in Hong Kong by the Hong Kong Securities and Futures Commission (SFC). Within the EU, Trading Central is a member of the self-regulatory organization Association Nationale des Conseils Financiers (ANACOFI-CIF), and registered with ORIAS which manages registrations and is supervised by the treasury department in France.

read_moreMore about Trading Central

Check out our guide to Trading Central to learn more about this popular technology provider, and to see our picks for the best forex brokers that offer Trading Central.

Types of forex trading signals

Some forex trading signals are generated by human traders, while others are 100% computer-driven. Computer-generated trading signals use formulas to perform calculations on the price action of an asset until the pre-defined conditions that generate the signal are met. Human-generated trading signals may incorporate similar technical analysis, but include the element of human discretion.

Are forex signals worth it?

Yes, forex signals can be worth using – provided that you conduct your own analysis and develop a detailed trading strategy. That said, forex signals are not a catch-all solution for successful trading. You still have to identify which signals to follow, which to avoid, and what the size of your trades will be once you’ve identified a trading opportunity. Developing your own risk-management philosophy and creating a trading strategy based on your personal trading goals are just as important when using forex trading signals.

Can forex signals make you rich?

Though not impossible, it’s unlikely that simply following forex trading signals will make you rich. In fact, statistics show that the vast majority of retail forex traders lose money, year after year. Finding success while using forex trading signals has more to do with how you manage your trading strategy and portfolio, and less to do with the particular signals you choose or trades you make.

savingsRemember:

Forex trading – whether you use forex signals or not – is not a way to make fast, easy money. Traders who try to convince you otherwise likely take extreme risks and bank on luck – or are running forex scams. Check out our guide to avoiding forex scams.

Can I get free forex signals?

Yes, the best forex brokers offer access to high-quality free forex signals, usually available within their platform or through a dedicated website. For example, IG directly integrates PIA First and Autochartist within its web-based trading platform. One thing about IG’s integration of trading signals that I appreciate is the ability to copy a trading signal directly into a trade ticket. This feature (which is offered by other top brokers, such as Saxo) allows you to place an order without having to type in every detail, providing a smooth user experience.

Learn how to use trading signals on IG's web platform by checking out our video walkthrough:

Screenshots of trading signal integration at IG:

Screenshots of IG's trading platforms for web and desktop:

Screenshots of Saxo's trading platforms for web and desktop:

What is the best signal for forex?

Simply put, the best signal for forex trading is the one that makes you money. That said, using forex signals when trading is not a get-rich-quick scheme. Choosing forex signals can be complicated, and finding success with forex signals is easier said than done. The quality of a forex signal will depend on a number of factors, including the strength of the signal and the market conditions that could help (or hinder) the signal’s potential. You also still have to be mindful of your trade sizes, expected trade durations, and the way you’ll use stop-loss and limit orders for risk management.

Important factors to consider when analyzing a trading signal:

- Strength - The probability or confidence level that the expected outcome will materialize.

- Recency - The time the signal was published (Has it expired? Has it already reached its target?)

- Event-type quality - Was the signal based on a common event (such as a chart pattern breakout), information from a technical indicator, or from a confluence of multiple factors?

infoPro tip:

Trading signals should never be a replacement for developing your own trading strategy, they should be used to complement an existing strategy.

What’s the difference between copy trading and trading signals?

Copy trading (also known as social trading, mirror trading, or auto trading) is an automatic process. Once you’ve chosen a copy trading signal provider and copied their strategy, all of their trades will automatically be replicated (or, copied) in your brokerage account. With forex trading signals, it’s ultimately up to the trader to decide if they want to follow the signal's recommendation. For example, a trader might receive a forex trading signal that looks promising, but decide to pass on the trading opportunity after conducting their own analysis.

chatInterested in copy trading?

Check out our guide to the best forex brokers for social copy trading to learn more about how copy trading works, and to see our picks for the best copy trading platforms in the industry.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IG

IG

Saxo

Saxo

CMC Markets

CMC Markets