Why you can trust us

Why you can trust us

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Canada remains a well-regulated environment for retail forex trading, supported by a national framework designed to safeguard clients and ensure transparent market practices. For anyone evaluating the best forex brokers in Canada, the starting point is the Canadian Investment Regulatory Organization (CIRO). As the country’s investment dealer and derivatives regulator, CIRO authorizes firms, supervises conduct, and enforces standards across leveraged forex and CFD trading.

CIRO’s rulebook influences nearly every aspect of a broker’s operations, from capital requirements and client fund protection to disclosures, trading practices, and platform oversight. This framework is reinforced by FINTRAC, Canada’s financial intelligence unit, which mandates strict anti–money-laundering controls and record-keeping obligations. Together, these agencies create a regulatory environment where expectations are clearly defined and investor protections are consistently applied.

This guide highlights the top CIRO-regulated forex brokers available to Canadian residents. You’ll find insights into pricing, platforms, research quality, and the key factors that matter when choosing a safe and well-supervised broker in Canada.

Best forex brokers in Canada

1. Interactive Brokers - Best forex broker in Canada

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

Interactive Brokers Interactive Brokers

|

check |

check

|

|

0.226 info |

$0 |

Interactive Brokers (IBKR) is the highest ranked broker regulated in Canada, and my pick for the best forex broker in Canada. Its extensive range of tradeable markets, instruments, and symbols helped IBKR earn our 2025 Annual Award for #1 Range of Investments. Founded in 1977, Interactive Brokers is a highly trusted, publicly traded (NASDAQ: IBKR) brand regulated in an impressive nine Tier-1 jurisdictions.

Range of investments: Interactive Brokers offers a vast selection of global financial markets, from stocks and options to futures and spot forex. Traders also gain access to spot bitcoin trading (in the U.S.), spot gold, and spot bitcoin ETFs. IBKR also offers over a dozen micro futures, including for major forex pairs.

Platform: Though Interactive Brokers does not offer MetaTrader 4 or MetaTrader 5, it does deliver a modern, institutional-grade trading platform suite that helped it win our 2025 Annual Award for #1 Institutional Clients.

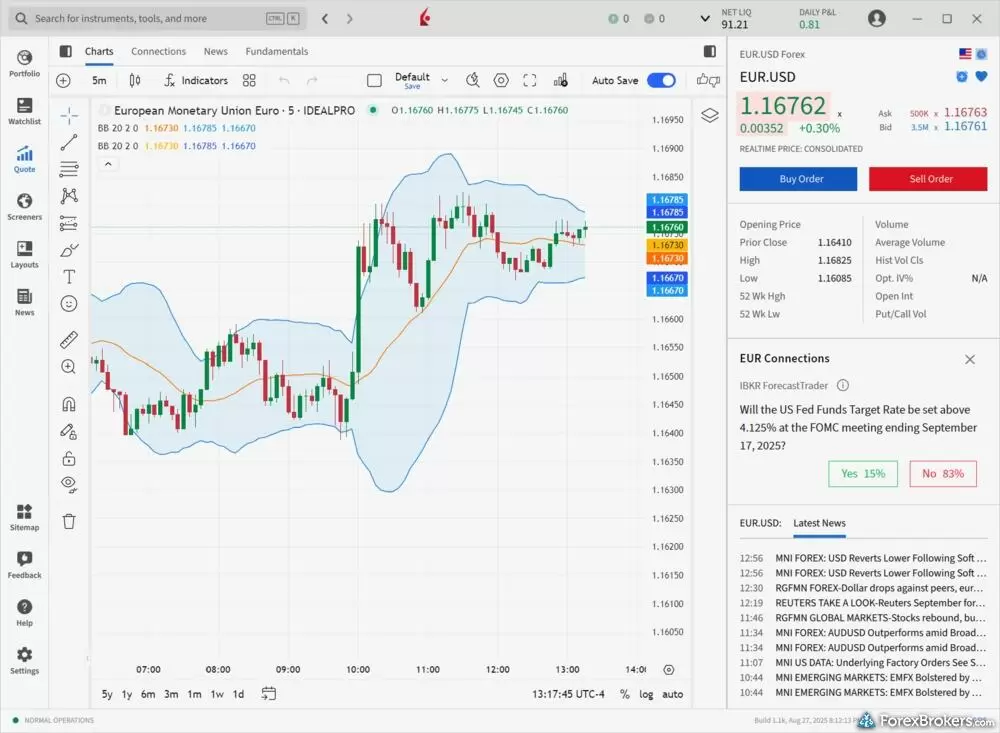

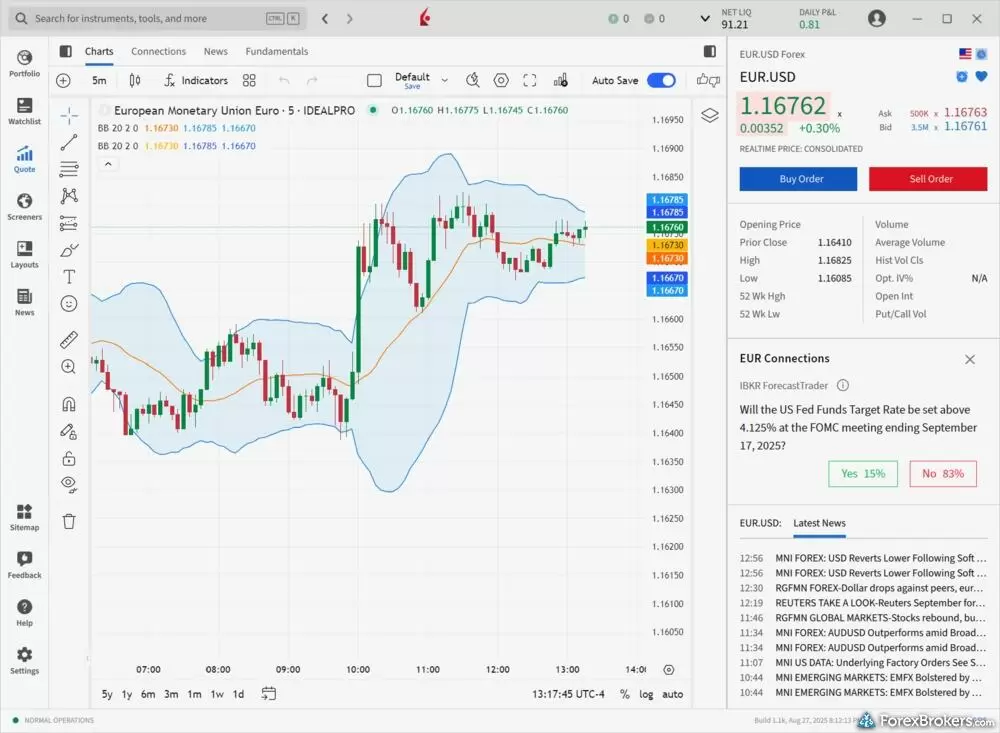

My layout on the IBKR Desktop platform includes a chart of the EUR/USD pair, a trading panel, and news headlines from Reuters.

Steven's take:

"The Trader Workstation (TWS) desktop platform offers a variety of advanced trading tools and sophisticated order types that will delight professionals and advanced forex traders."

Steven Hatzakis

It’s worth noting that beginner forex and CFD traders might be intimidated by the broker’s miscellaneous fees and the complexity of its proprietary platforms. Learn more by reading my full Interactive Brokers review.

2. FOREX.com - Great educational content

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

FOREX.com FOREX.com

|

check |

check

|

|

1.00 info |

$100 |

FOREX.com is a highly rated broker that delivers some of my favorite educational content for forex traders. Founded in 1999, FOREX.com is a GAIN Capital brand under the parent company of StoneX Group (NASDAQ: SNEX), and is regulated in seven Tier-1 jurisdictions.

Education: The launch of FOREX.com’s Trading Academy helped the broker make significant strides in our Education category. I found the interactive courses within the broker’s Trading Academy to be rich with detail and highly informative for traders of all experience levels. Trading Academy courses include progress tracking, quizzes, and other interactive features that make the learning experience fun. I was so impressed with the interactive aspects of the broker’s educational content that I awarded FOREX.com’s Trading Academy our Annual Award for #1 Interactive Educational Experience the year of its launch.

Trading platform: It’s also worth noting that FOREX.com now supports MetaTrader 5 in the U.S. and Canada. The RAW account is also now available to FOREX.com’s clients in Canada. FOREX.com’s RAW Spread account delivers commission-based pricing (similar to its STP account) and volume-based rebates for active traders.

The default workspace of the FOREX.com web platform includes charts, a watchlist, news, and a view of open positions.

Learn more about why FOREX.com is a great choice for forex traders in Canada by checking out my full FOREX.com review.

3. CMC Markets - Low fees for forex traders

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

CMC Markets CMC Markets

|

check |

check

|

|

1.3 info |

$0 |

CMC Markets is a great choice for forex traders in Canada in 2025. Founded in 1989, CMC Markets is a highly trusted, publicly traded brand that holds five Tier-1 licenses regulatory licenses, including the Canadian Investment Regulatory Organization (CIRO).

Trading platform: Forex traders looking for a great mobile trading app will enjoy CMC Markets' Next Generation platform. The app closely resembles the web version of the broker’s Next Generation platform and comes loaded with charting tools, integrated research and education, predefined watchlists, and more. CMC Markets’ excellent mobile experience has helped it earn Best in Class honors for Mobile Trading Apps in the ForexBrokers.com Annual Awards eight years in a row.

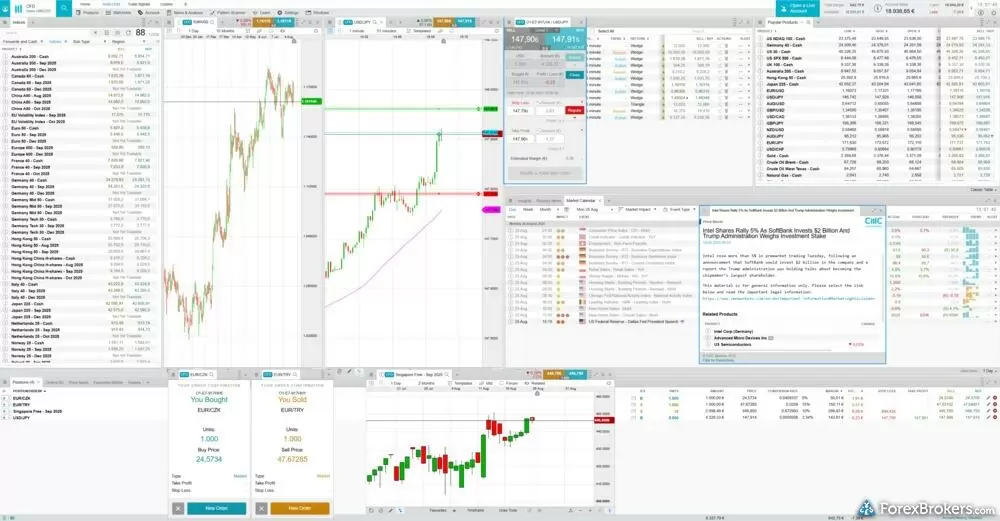

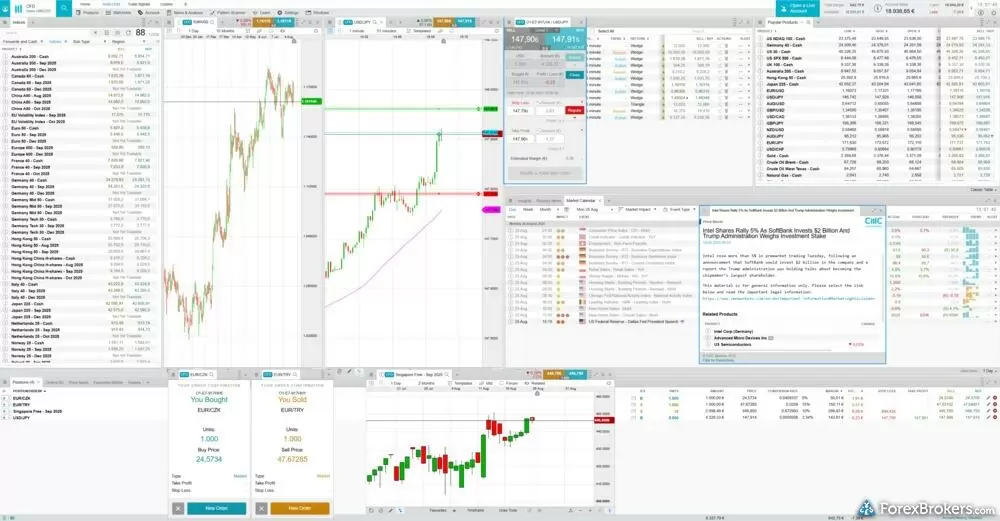

The layout of the CMC Markets Next Generation web platform including open windows for a watchlist of indices, multiple charts, product library, market calendar, insights, and positions.

Pricing and research: CMC Markets also delivers some of the lowest trading costs in the industry. In our 2025 Annual Awards, CMC Markets received our award for #1 Commissions and Fees thanks to its consistently low spread offering, which is available for all customer segments and account types. Beginner forex traders will appreciate CMC’s wide range of educational resources and MetaTrader enthusiasts can use MT4 plugins from Autochartist and FX Blue.

I’ve been testing CMC Markets’ platforms, products, and services since 2017; learn more about this broker by checking out my full CMC Markets review.

4. OANDA - Trusted broker, great research

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

OANDA OANDA

|

check |

check

|

|

1.68 info |

$0 |

OANDA is a long-established global broker best suited for traders who prioritize strong regulatory oversight, straightforward platforms, and high-quality daily research. Its offering includes up to 69 forex pairs and a broad CFD lineup in eligible regions, with access to OANDA Trade, MT4, MT5 (in select jurisdictions), and TradingView connectivity.

Pricing is the main drawback: standard spreads tend to sit above the industry average, with EUR/USD often near the 1.6–1.7 pip range. Costs improve under OANDA’s Core Pricing model or Elite Trader rebates, though both require higher deposits or substantial trading volume. The mobile app remains a highlight, and research from MarketPulse and the Trade Tap Blog adds useful daily context despite limited video output.

5. AvaTrade - Great for beginners and copy trading

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

AvaTrade AvaTrade

|

check |

check

|

|

0.93 info |

$100 |

AvaTrade is a globally regulated broker best suited for beginners, copy-trading enthusiasts, and traders who want lots of platform choice without a steep learning curve. Clients can trade 50+ forex pairs and over 1,200 CFDs, plus forex options and exchange-traded futures, across MetaTrader, WebTrader, AvaTradeGO, AvaOptions, and AvaFutures. Copy trading is a core strength thanks to integrations with ZuluTrade, DupliTrade, and AvaSocial.

Education is another clear highlight: AvaAcademy’s structured courses, quizzes, and progress tracking helped AvaTrade earn Best in Class awards for Education and Beginners. Pricing on the Standard account is close to the industry average, with EUR/USD spreads just under 1 pip, while Professional accounts can access tighter spreads in eligible regions. The trade-off is that research leans heavily on Trading Central modules and video updates, and doesn’t match the depth of top research brokers.

6. Questrade - Great for Canadian traders who want access to forex and stocks

| Company |

Accepts CA Residents |

Regulated by the CIRO |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

Questrade Questrade

|

check |

check

|

|

N/A |

$250 |

Questrade is best suited for Canadian investors who primarily trade stocks but want convenient access to forex and CFDs without switching brokers. Its Questrade Global platform, built on Saxo’s technology, delivers a familiar, multi-asset experience with over 100 forex pairs, 250+ CFDs, and a solid set of integrated third-party tools such as TipRanks, OptionsPlay, and Trading Central.

Platform quality is a clear strength, particularly for traders who value API access or want a single account that supports stocks, ETFs, and leveraged products. However, pricing is less competitive: EUR/USD spreads around 1.9 pips sit well above the category’s leaders, and TradingView isn’t supported for forex trading. Research and education lean almost entirely on external providers, resulting in limited in-house content by comparison.

How to start forex trading in Canada

Verify CIRO authorisation

Forex and CFD brokers serving Canadian residents must be regulated by the Canadian Investment Regulatory Organization (CIRO), the national self-regulatory body formed in 2023 through the merger of IIROC and the MFDA. CIRO oversees conduct standards, capital requirements, client-fund protections, and supervision of leveraged trading. Any broker offering forex or CFDs to Canadians must hold CIRO membership through a Canadian Investment Dealer.

To confirm a broker’s status, look for its legal entity and registration details at the bottom of its Canadian homepage, then search for the firm on CIRO’s AdvisorReport or Firm Directory tools. These listings provide regulatory history, approved activities, and any disciplinary events.

Understand provincial oversight and product rules

While CIRO handles national regulation, each province, via its securities commission, oversees investor protection and certain product rules. This structure means some instruments may be restricted depending on your location. Cryptocurrency CFDs, for example, are subject to local guidance, and leverage limits for retail clients are lower than in many global markets. Most forex pairs are offered with conservative leverage caps, reflecting Canada’s emphasis on risk management and transparency.

Canadian brokers must also participate in the Canadian Investor Protection Fund (CIPF), which provides compensation (up to CAD 1 million per eligible account type) if a CIRO-regulated firm becomes insolvent.

Choose a legal broker operating in Canada

Only a limited number of brokers hold full CIRO approval to offer forex and CFDs. These include FOREX.com, OANDA, and AvaTrade (via regulated Canadian entities). Brokers operating from overseas without CIRO approval cannot legally offer leveraged forex trading to Canadian retail traders. Verifying the firm’s Canadian entity, not just its global brand, is essential.

Open and fund your trading account

Once you select a CIRO-regulated broker, complete the standard application and KYC verification. Funding options typically include bank transfers, Interac, debit cards, and, in some cases, PayPal or other e-wallets. Before trading with real capital, use a demo account to understand the platform layout, order types, and charting tools offered by the broker.

Build a trading plan

Define your risk tolerance, preferred trading style, and time commitment before entering the market. Consider how you will size positions given Canada’s tighter leverage limits, how you will identify trade setups, and how you will manage stop-loss levels. Maintaining a trading journal can help track performance and refine your approach. Education resources, such as broker-provided courses or independent materials, can help you build a foundation before trading live.

FAQs

About CIRO (previously known as IIROC)

As of June 2023, CIRO is the new regulator in Canada, following a rebranding and reorganization from IIROC. IIROC was a national self-regulatory organization (SRO) that was established as a non-profit corporation on June 1st, 2008 as part of the consolidation of the Investment Dealers Association of Canada (IDA) and the Market Regulation Services Inc. (RS). CIRO is recognized by the Canadian Securities Administrators (CSA) which includes all Canadian provinces including the following regulatory bodies in Canada:

For a historical breakdown, here's a link to IIROC's webpage on Wikipedia.

Is forex legal in Canada?

Yes, forex trading is legal in Canada. It’s always recommended to choose a broker that is well-regulated (preferably locally) and highly trusted. Forex trading in Canada is regulated provincially; each Canadian province is regulated by its own respective regulatory authority. It’s worth noting that regulators in certain jurisdictions – such as the British Columbia Securities Commission – regulate more strictly than others.

Do you pay tax on forex trading in Canada?

With the important caveat that we cannot provide tax advice, it should be said that residents of Canada must report all income to the Canadian Government – including all capital gains (or losses) over $200 that come from trading forex.

According to the Canada Revenue Agency (CRA), “Foreign exchange gains or losses from capital transactions of foreign currencies (that is money) are considered to be capital gains or losses. However, you only have to report the amount of your net gain or loss for the year that is more than $200.”

How your tax professional may elect to apply any such gains or losses you have from trading in the financial market may vary depending on your unique circumstances. It may be best for Canadian citizens or residents to consult a tax professional to determine any potential Canadian tax obligations. If you are not a Canadian resident or citizen, you must report your global income from forex trading in the country of your permanent residence.

Who is the best forex broker in Canada?

My top pick for the best forex broker in Canada is Interactive Brokers (IBKR). With its massive range of tradeable markets and advanced trading platforms, IBKR earned our 2025 Annual Award for #1 Range of Investments. Founded in 1977 and regulated in nine Tier-1 jurisdictions, it’s a trusted choice for professional traders.

While IBKR doesn’t support MetaTrader 4 or 5, its Trader Workstation (TWS) platform delivers institutional-grade tools and sophisticated order types. However, beginners may find its advanced platform and fee structure a bit complex, although it has recently begun to broaden its appeal to retail investors with the release of its simpler IBKR Desktop.

What is the best forex trading app in Canada?

The best forex trading app in Canada is IBKR Mobile from Interactive Brokers. This advanced app offers a professional-grade trading experience, featuring 155 indicators, integrated news, and chart-based trading. While it takes time to customize, it competes with the industry’s best multi-asset trading apps.

IBKR also offers GlobalTrader (for passive investors) and IMPACT (focused on ESG investing), but IBKR Mobile is the best for forex traders. The app syncs seamlessly with IBKR’s Trader Workstation (TWS) desktop platform, ensuring a smooth multi-device experience. However, beginners may find it complex compared to more user-friendly alternatives. Learn more at my full review of Interactive Brokers.

What is the best forex broker for beginners in Canada?

AvaTrade is my pick for the best forex broker in Canada for beginner forex traders in 2025. The quality (and quantity) of educational content provided by AvaTrade helped it win Best in Class honors for our Beginners and Education categories in our 2025 Annual Awards. AvaTrade offers over 100 educational articles as well as a wide assortment of videos to help beginners learn the ropes of forex trading. Well over 100 lessons are available, accompanied by dozens of quizzes for beginners to test their forex trading knowledge. Its improvements in 2025 were so extensive, it won our industry award for #1 Interactive Educational Experience. Third-party educational content from award-winning providers, such as Trading Central, is also available to AvaTrade clients. Simply put, AvaTrade delivers a high-quality experience for beginner forex traders.

What are the best CFD brokers in Canada?

1. Interactive Brokers – 12,000+ CFDs

Interactive Brokers is publicly traded (NASDAQ: IBKR) and among the most trusted brokers in the ForexBrokers.com Trust Score database. IBKR is regulated in Canada and caters well to Canadian investors and traders across its award-winning platform suite. Whether you trade forex, stocks, crypto, or CFDs(over 12,000 CFDs are available), IBKR delivers access to more markets and global exchanges than any other broker we review. IBKR ranks highly across the board, earning Best in Class honors in key categories such as Platforms & Tools, Commissions & Fees, and Range of Investments. Learn more by reading my Interactive Brokers review.

2. CMC Markets – 10,000+ CFDs

CMC Markets is publicly traded (LSE: CMCX) and regulated across multiple Tier-1 jurisdictions – including Canada’s CIRO. Canadian retail clients at CMC Markets are protected against insolvency up to $1 million from the Canadian Investor Protection Fund (this is true of all brokers regulated in Canada). CMC Markets grants access to over 10,000 CFD markets and has won our Annual Awards for #1 Most Currency Pairs for three years and counting. One of CMC Markets’ strong points is its low spreads for forex traders, particularly for active traders. CMC Markets also caters to algo trading via its MetaTrader 4 and MetaTrader 5 platform offerings. Check out my CMC Markets review.

3. FOREX.com - 4,500+ CFDs

FOREX.com, part of StoneX Group (NASDAQ: SNEX), is a highly trusted forex broker holding regulatory licenses across a range of major financial centers. FOREX.com offers over 4,500 CFDs alongside forex across multiple trading platforms, including MetaTrader, TradingView, and its flagship proprietary web and mobile application. FOREX.com's Trading Academy has incredibly detailed and highly informative interactive educational courses. Clients also benefit from FOREX.com’s in-house Performance Analytics, which combines behavioral finance and quantitative analysis of your trading history to deliver feedback on a per-trade and post-trade basis. Find out more by reading my FOREX.com review.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

More about Canada's forex markets and regulation

Canada’s forex and CFD market operates under a unified national framework overseen by the Canadian Investment Regulatory Organization (CIRO), the country’s sole self-regulatory body for investment dealers and leveraged trading. CIRO authorizes all firms offering forex or CFD trading to Canadian residents, setting rules around business conduct, client disclosures, financial reporting, and margin practices. Traders can verify a broker’s authorization by checking CIRO’s AdvisorReport or its list of regulated investment dealers.

Client protection standards in Canada are highly robust. CIRO-regulated brokers must meet strict capital requirements, maintain segregated client funds, undergo ongoing compliance reviews, and follow transparent rules governing pricing, order execution, and risk disclosure. Many brokers also participate in the Canadian Investor Protection Fund (CIPF), which provides additional safeguards for eligible clients in the event of firm insolvency.

Unlike markets with a single nationwide product regime, Canada’s provincial securities regulators, such as the Ontario Securities Commission (OSC) and the British Columbia Securities Commission (BCSC), work in parallel with CIRO. While CIRO oversees the day-to-day operations and supervision of forex brokers, provincial regulators set the broader legal framework and enforce securities laws, including restrictions on unregistered firms and misleading promotions.

Within this regulatory environment, our research team independently verifies every broker’s CIRO authorization and cross-checks their licences across other trusted global jurisdictions. This ensures that Canadian traders receive accurate, reliable guidance when evaluating the best forex brokers in Canada. Learn more about our Trust Score and the 100+ regulatory bodies tracked worldwide by the ForexBrokers.com research team.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Interactive Brokers

Interactive Brokers

FOREX.com

FOREX.com

CMC Markets

CMC Markets

OANDA

OANDA

AvaTrade

AvaTrade

Questrade

Questrade

FP Markets

FP Markets

HFM

HFM

ActivTrades

ActivTrades

Eightcap

Eightcap

Spreadex

Spreadex

Interactive Brokers

Interactive Brokers

FOREX.com

FOREX.com

CMC Markets

CMC Markets

OANDA

OANDA

AvaTrade

AvaTrade

Questrade

Questrade