AvaTrade Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AvaTrade is a trusted global brand best known for offering an extensive selection of trading platforms for forex and CFD traders. I’ve found the broker excels for both its educational resources and copy trading offerings, earning Best in Class honors for Education, Beginners, and Copy Trading in 2026. However, while AvaTrade offers competitive spreads for professional traders, its retail pricing and research offerings still lag behind industry leaders.

AvaTrade’s platform variety is impressive, with MetaTrader, AvaOptions, and AvaFutures providing something for every type of trader. That said, AvaTrade's proprietary platforms could benefit from more advanced features and better research integration. Overall, it's a great choice for traders seeking comprehensive platforms and strong educational support, but those looking for the most competitive pricing and research tools might find better options elsewhere.

-

Minimum Deposit:

$100 -

Trust Score:

96 -

Tradeable Symbols (Total):

1260

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Risk Management Tool | Winner |

| 2026 | #15 |

| 2025 | #13 |

| 2024 | #12 |

| 2023 | #11 |

| 2022 | #12 |

| 2021 | #12 |

| 2020 | #27 |

| 2019 | #24 |

| 2018 | #30 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

AvaTrade pros & cons

Pros

- Wide platform selection, including many proprietary platforms, trading signals, and MetaTrader.

- Strong educational courses with progress tracking and quizzes.

- Copy trading support with AvaSocial and DupliTrade.

- Active trader discounts with a Premium account.

Cons

- Charts lack drawing tools in AvaTradeGO app.

- Retail spreads aren't as low as top-tier brokers.

- AvaOptions desktop platform is slow to load with an outdated design.

- While active on YouTube, the AvaTrade blog is mostly outdated.

My top takeaways for AvaTrade in 2026:

- AvaTrade is best-suited for beginner traders and traders interested in social copy trading, options trading, and MetaTrader.

- AvaTrade offers 44 forex options, in addition to over 1,200 CFDs, and recently added futures trading to its product offering via the MetaTrader 5 (MT5) platform.

- The Guardian Angel plugin — for risk-management purposes — is offered at AvaTrade for MetaTrader clients and enhances the default MetaTrader experience.

- Research remains limited to Trading Central modules, and market analysis videos posted to the AvaTrade YouTube and Vimeo channels, with a lack of in-house research articles.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is AvaTrade safe?

AvaTrade is considered Highly Trusted, with an overall Trust Score of 96 out of 99. AvaTrade is not publicly traded, does not operate a bank, and is authorised by four Tier-1 regulators (Highly Trusted), three Tier-2 regulators (Trusted), one Tier-3 regulator (Average Risk), and one Tier-4 regulators (High Risk). AvaTrade is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Canadian Investment Regulatory Organization (CIRO), Japanese Financial Services Authority (JFSA), and in the European Union via MiFID . Learn more about Trust Score or see where the different AvaTrade entities are regulated.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Year Founded | 2006 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 3 |

| Tier-3 Licenses | 1 |

| Tier-4 Licenses | 1 |

Range of investments

The range of markets available at AvaTrade will depend on which trading platform you choose, and which of the brand's global entities holds your account. AvaTrade offers 1,260 symbols in MT5 and nearly the same number in WebTrader. In addition to forex, CFDs, and OTC options, AvaTrade also offers futures trading via the CME (and EUREX via the MT5 platform).

The following table summarizes the different investment products available to AvaTrade clients.

Cryptocurrency: Cryptocurrency trading is available at AvaTrade through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents, except those designated as Professional clients.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1260 |

| Forex Pairs (Total) | 53 |

| U.S. Stocks (Shares) | No |

| Global Stocks (Non-U.S. Shares) | No |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

AvaTrade fees

AvaTrade's spreads are close to the industry average at just under one pip (0.9 pips as of June 2024), yet are slightly higher than the spreads available on the entry-level accounts offered by CMC Markets and Tickmill.

Available account types

AvaTrade offers several account types tailored to different trader profiles, including Standard, Premium, and Professional accounts. Each comes with its own benefits and qualifications. It’s also worth noting that AvaTrade’s inactivity fee is 50 units of currency (i.e., $50 if your account is USD-based), which is steep: it kicks in after just 90 days of inactivity, followed by a 100-unit fee after 12 months.

Standard account: The Standard account is the default option for most retail traders. It offers access to the full suite of platforms and products, including forex, CFDs, options, and social trading tools, with no commissions and spreads starting from 0.9 pips.

Premium account: The Premium account is available based on deposit thresholds or annual trading volume as part of AvaTrade’s VIP offering. VIP status for Premium account holders has four tiers, starting at Silver if you trade $30m in volume or deposit $10k, up to Diamond for the most active clients who deposit $150k or trade $600m per year. Benefits include interest on available margin, priority support and withdrawals, access to exclusive events, and, for some clients, dedicated support plus additional education or research resources. While it’s not clear what spread discounts are offered by tier, it’s good to see this initiative launched to enhance the Premium account offering with an active trader-style program at AvaTrade.

Professional account: If you qualify under ESMA rules (or an equivalent standard), the Professional account offers tighter spreads, down to 0.6 pips on EUR/USD, and higher leverage (up to 1:400) outside the EU. However, it comes with fewer regulatory protections, so it’s best suited to experienced traders who understand the risks.

Demo account: AvaTrade also offers a demo account that replicates live market conditions and includes all platform features. This is ideal for beginners wanting to test risk‑free before committing capital, especially if you're new to AvaOptions or the MetaTrader ecosystem.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Minimum Deposit | $100 |

| Average spread (EUR/USD) - Standard account | 0.93 |

| All-in Cost EUR/USD - Active | 0.61 |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

AvaTrade's proprietary apps provide a mobile experience that will satisfy most traders (including beginners), though they aren’t quite as advanced as the best mobile trading apps provided by category leaders such as Saxo, CMC Markets, or Charles Schwab Review (U.S. residents only). That said, AvaTrade continues to make incremental improvements in this category, and provides a generally well-rounded suite of apps.

Apps overview: AvaTrade provides its own proprietary mobile platforms, AvaTradeGO and AvaOptions, as well as the full MetaTrader suite (MT4 and MT5) for Android and iOS devices.

Ease of use: The AvaTradeGo app closely resembles its web counterpart, and features a robust default set of syncing watchlists as well as a volatility protection feature called AvaProtect. AvaProtect allows a trader to reduce the risk on an open trade by partially hedging their position with a forex option – for an added cost.

Charting: Charts in the AvaTradeGo app come with 93 indicators – though I found that it took multiple steps to access them. However, there are no drawing tools and only three selectable chart types. Trading Central provides integrated research and related tools, mirroring what’s available within the web platform. Overall, mobile charts at AvaTrade are good, but have room to improve.

A view of the EUR/USD chart on the AvaTradeGo mobile app.

AvaOptions: The AvaOptions app is well-designed, and takes a unique approach to displaying option-chain data. AvaTrade overlays strike prices onto a chart, allowing traders to change the strike price simply by dragging it higher or lower – a feature I found to be incredibly helpful. There are also 14 default options-trading strategies available, and selecting an option plan will automatically populate the order ticket with the related options contracts. One notable annoyance: the entire app experience was displayed in landscape mode, forcing me to hold my phone like a gaming controller.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 73 |

Trading platforms

Thanks to AvaTrade's extensive offering of copy trading platform options, AvaTrade once again finished Best in Class for Copy Trading in 2026.

Platforms overview: AvaTrade offers three proprietary platforms, AvaTrade WebTrader, AvaOptions, and AvaFutures, the full MetaTrader suite, DupliTrade, and TradingView (offered under AvaFutures).

Charting: Charts on AvaTrade’s WebTrader platform come with 90 indicators, 13 drawing tools, 10 time frames, and three chart types. That said, WebTrader still has a ways to go if it wants to compete with the depth and rich quality of features found on proprietary platforms from industry leaders such as IG, Saxo, and CMC Markets.

AvaTrade web trader platform chart layout with watchlist and trading signals and expanded instrument detail with sentiment and contract specifications.

Trading tools: I found AvaTrade’s proprietary WebTrader platform to have a well-designed responsive layout. I was also pleased to find a suite of trading tools from Trading Central directly integrated within the platform. Though alerts are only found in the mobile version, the AvaProtect feature is included in both platforms.

Copy trading: AvaTrade's steady progress in expanding and enhancing its copy trading offering has helped it compete with industry leaders such as eToro and Pepperstone. AvaTrade offers DupliTrade and the native Signals market in MetaTrader. Trading signals are also integrated into the AvaTrade web platform alongside news headlines, both powered by Trading Central. In addition, AvaTrade launched AvaSocial in the U.K., as part of its partnership with Pelican Exchange.

AvaOptions: For options traders that deposit at least $1,000, AvaTrade provides AvaOptions – its forex options platform for desktop and mobile powered by Sentry Derivatives. The desktop version is for Windows only, and requires that users install Microsoft's .NET Framework 3.5 SP1. As a seasoned trader, even I found the platform layout to be complex. Clearly suited for professionals, the platform needs a design overhaul. Read my guide to forex options to learn more about the pros and cons of trading forex options.

AvaFutures: AvaTrade recently expanded its product offering with the addition of exchange-traded futures contracts via the CME. As part of this offering, AvaTrade offers a dedicated futures trading platform called AvaFutures, where you can trade forex futures and futures of other asset classes offered by the CME, including different contract sizes such as Standard, e-mini, and even micro contracts. While we didn't focus on this platform for the purpose of this review, the move aligns with recent trends towards greater adoption of futures by forex traders, with more brokers beginning to offer futures products.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 80 |

| Charting - Trade From Chart | Yes |

Research

AvaTrade's research offerings are modest and geared more towards being educational than market-insightful. The platform produces daily in-house research content in video and article format, and grants access to Trading Central research modules. While AvaTrade has made improvements in this category, its research offering can’t stack up against what the best forex brokers offer.

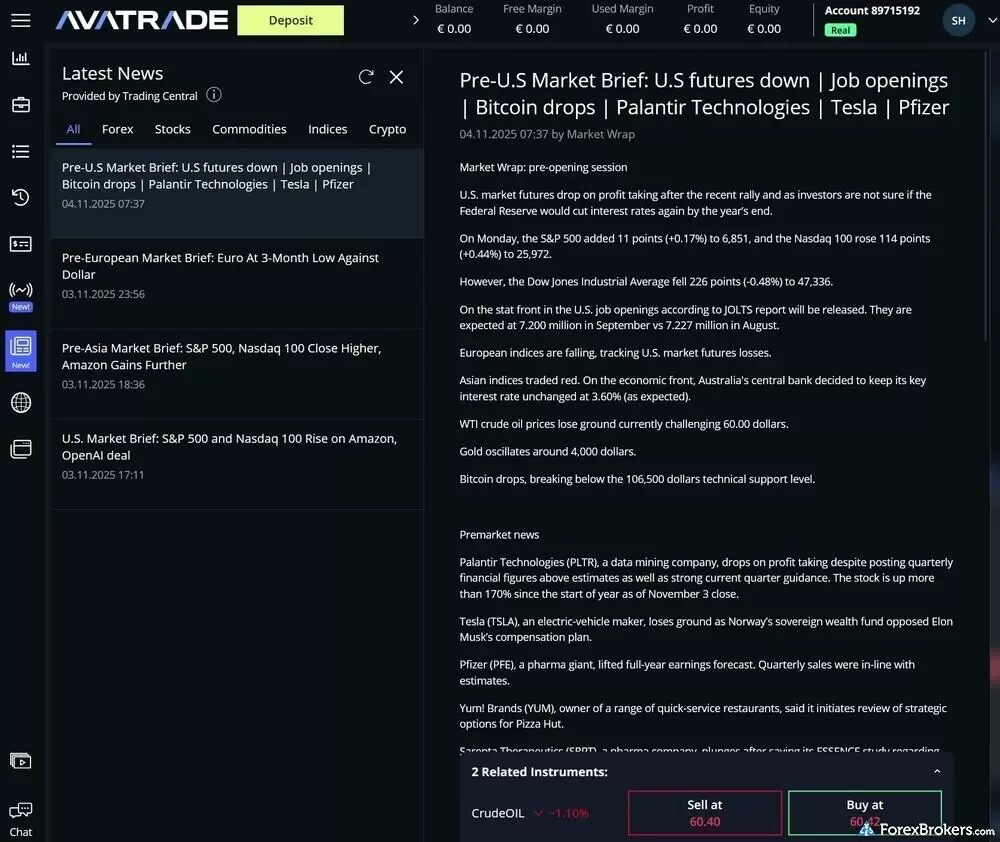

Research overview: Beyond AvaTrade’s support for AvaSocial and DupliTrade for copy trading, the main highlight from AvaTrade's research offering is Trading Central. Trading Central is directly integrated within the AvaTrade web platform and includes a variety of TC-powered features, such as its Market Buzz, Analyst Views, and Featured Ideas tools, as well as an economic calendar and streaming news (available in MT5). Trading signals are also integrated into the AvaTrade web experience, although I found it frustrating that there is no way to directly copy signals into the trade ticket in one-click.

AvaTrade’s WebTrader incorporates a "Latest News" feed powered by Trading Central, providing traders with real-time, actionable market briefings on key themes like U.S. futures and corporate earnings directly within the platform interface. The layout facilitates immediate execution by displaying live "Buy" and "Sell" buttons for relevant instruments, such as Crude Oil, at the bottom of each analysis piece, ensuring a seamless transition from research to trade.

Market news and analysis: AvaTrade provides daily market analysis in the form of videos published to its Vimeo and YouTube channels, while written articles are few and far between in terms of actual research content (evergreen educational articles don't count). I found the "Mapping out your week ahead" video series at AvaTrade is nicely produced, in terms of market analysis and research. Overall, I would like to see AvaTrade add more written articles to fill the void in its otherwise balanced research offering in order to be comparable to the best brokers in this category. For example, articles on its research blog are mostly outdated, with no new content in recent months.

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Daily Market Commentary (Articles) | No |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | Yes |

| Client sentiment data | Yes |

Education

AvaTrade provides a rich array of educational content from its in-house staff and its AvaAcademy, as well as from third-party providers such as Trading Central. AvaTrade earned Best in Class honors for our Education category in our 2026 Annual Awards.

AvaTrade Academy educational courses overview showing featured courses and sorted by category.

Learning center: AvaTrade is one of our top picks for educational courses and its website features 103 comprehensive articles that cover beginner and advanced topics. As part of its AvaAcademy offering, AvaTrade provides in-depth courses that are organized by experience level. These courses include both video and written content, and feature progress tracking and integrated quizzes. Year over year, the interface has been redesigned with a more modern look and feel, and I enjoyed taking a few courses on AvaTrade Academy, which include good quality video and article content for traders, including short quizzes.

AvaTrade’s 48 educational videos cover a wide range of topics, and explore niche subjects like Donchian Channels (what they are, and how traders can use them). AvaTrade also uploads and archives video webinars on its YouTube and Vimeo channel, which help to round out its offering.

Steven's expert take

"Platform tutorials notwithstanding, the WebTrader and AvaTraderGo web and mobile platforms would benefit from an expansion of integrated video content."

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

AvaTrade stands out for its rich selection of trading platform options, and for its educational content for beginners (AvaTrade earned Best in Class honors for our Beginners category in our 2026 Annual Awards). Its range of tradeable markets has nearly doubled year-over-year, and spreads for clients designated as Professional traders in the EU are quite competitive.

AvaTrade Star Ratings

| Feature |

AvaTrade AvaTrade

|

|---|---|

| Overall Rating |

|

| Trust Score | 96 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

AvaTrade Regulation, AvaTrade Education, YouTube

Read next

- Best Forex Trading Apps for 2026

- Best Forex Brokers for 2026

- Best Low Spread Forex Brokers for 2026

- Compare Forex Brokers

- International Forex Brokers Search

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Brokers for TradingView for 2026

- Best Forex Brokers for Beginners of 2026

- Best Copy Trading Platforms for 2026

More Forex Guides

Popular Forex Broker Reviews

About AvaTrade

Founded in 2006, AvaTrade has offices in 11 countries and provides multiple trading platforms for web, desktop, and mobile devices, offering spot forex and forex options and CFDs on numerous asset classes, including cryptocurrencies. AvaTrade employs over 500 staff, caters to more than 400,000 registered traders who place more than 3 million trades each month, and has executed more than $1.47 trillion in traded value since inception.

AvaTrade holds regulatory licenses in multiple financial hubs across the globe. AvaTrade's headquarters is in Ireland, where its regulator is the Central Bank of Ireland and is a member of the Investor Compensation Company DAC (ICCL), which provides eligible clients up to EUR 20,000 of maximum reimbursement in the extraordinary event of their broker's insolvency. While not directly regulated in Canada, AvaTrade caters to clients in the country through its partnership with Friedberg Direct, which required regulatory approval. Finally, AvaTrade recently acquired regulatory status with the SFC in Colombia, expanding its footprint in South America.