Best High-Frequency Trading Software for 2026

Steven Hatzakis has been reviewing forex brokers for nearly ten years and has 25+ years of experience as a forex trader. His broker reviews are unbiased and independent, and his expertise is sought after for global FX conferences and speaking events around the world. Learn how we test.

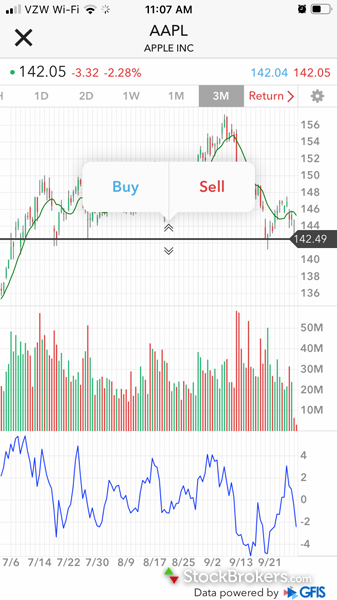

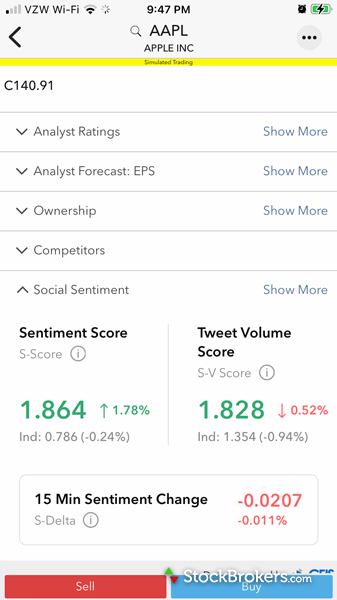

High-frequency trading (HFT) systems are based on sophisticated algorithms that can execute trades with lightning speed. These advanced trading programs utilize cutting-edge technology and highly advanced computers in order to make trades in just fractions of a second, which allows them to rapidly take advantage of market movements and arbitrage opportunities.

In my guide to high-frequency trading, I explain how high-frequency trading works, whether it can be profitable, and how you can get started with high-frequency trading software. I also dive into some of the pros and cons that come with using automated trading strategies, and I’ll also help you pick the best broker for using a high-frequency trading system, drawing from my years of experience researching these strategies.

Top picks for high-frequency trading platforms

Our research team has evaluated more than 60 of the biggest brokers in the industry (read more about how we test). We tested and conducted research on the top forex brokers that offer algorithmic trading and API access to produce our list of the best platforms for high-frequency trading:

- Minimum Deposit: $200

- Trust Score: 83

- Tradeable Symbols (Total): 3583

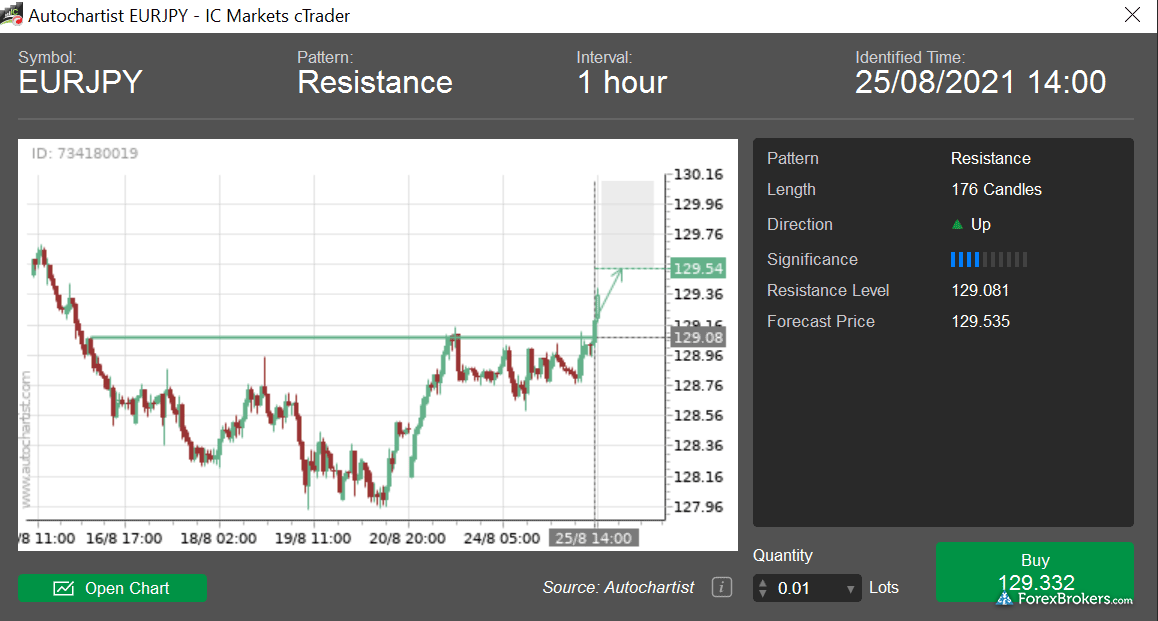

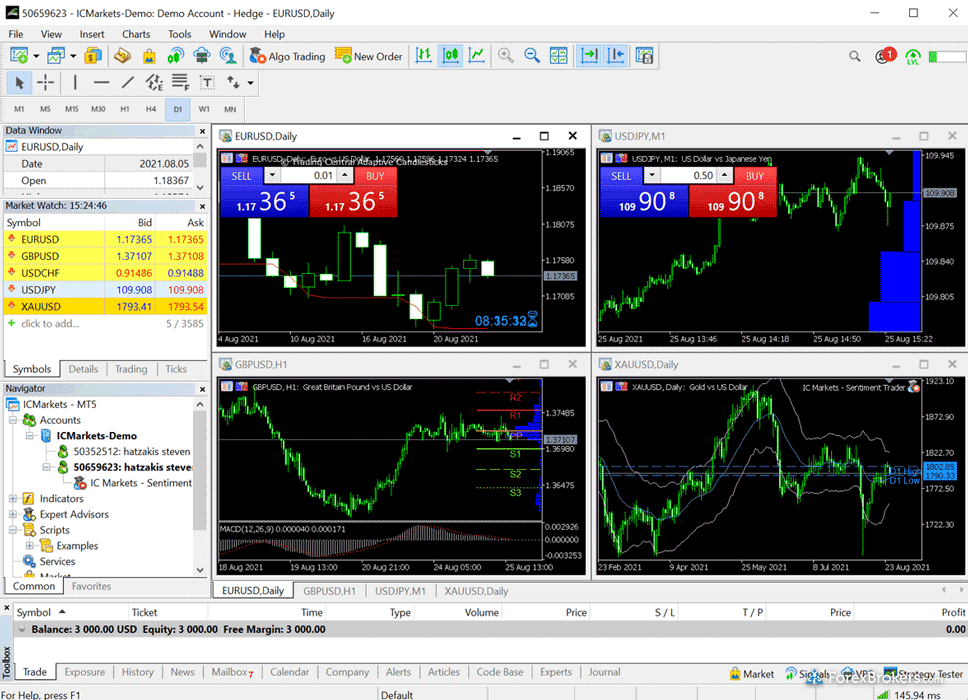

IC Markets’ competitive pricing and scalable execution make it an excellent option for algorithmic traders. Though it supports an impressive range of third-party tools and plugins, IC Markets’ research and education offerings are not as impressive as those offered by industry leaders. Read full review

- Competitive pricing and low average spreads.

- 3,500+ tradeable symbols and powerful algo trading support.

- MetaTrader broker with integrated third-party plugins.

- Educational content and research still have room for improvement.

- No proprietary forex trading app.

- Share trading is limited to Aussie stocks via IC Shares.

- Minimum Deposit: $0

- Trust Score: 94

- Tradeable Symbols (Total): 1726

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms. Read full review

- Won Best in Class for MT5, algo trading, and more.

- Offers MetaTrader and cTrader for algo and copy trading.

- Razor account pricing is competitive for active traders.

- New mobile app has solid features and strong usability.

- Education lacks depth.

- MT5 offering has limited symbols.

- Minimum Deposit: Starts from $50

- Trust Score: 95

- Tradeable Symbols (Total): 440

For traders who appreciate advanced trading tools and quality market research, FXCM is a winner, especially for algorithmic trading. Its range of tradeable markets is fairly narrow, however, and the pricing at FXCM is just average. Read full review

- Wide support for algo trading.

- TradingView, MT4, and FXCM's Trading Station available.

- Trading Station charts come with 100+ indicators and tools.

- Under 500 tradable symbols.

- No MetaTrader 5 (MT5) support across any platforms.

- Research and education trail top-tier brokers like IG and Saxo.

- Minimum Deposit: $100

- Trust Score: 85

- Tradeable Symbols (Total): 637

Tickmill is a run-of-the-mill MetaTrader broker that offers a limited selection of tradeable securities. The broker does offer very competitive commission-based pricing for professionals through its VIP and Pro accounts. Read full review

- Offers the full MetaTrader suite with platform add-ons.

- Supports algo trading and pro-level tools like CQG.

- Trading signals powered by Signal Centre and Acuity.

- Lags top brokers in asset variety.

- Classic account pricing is average; VIP account was removed.

- Autochartist, Pelican, and Capitalise.ai were removed in 2025.

- Minimum Deposit: $100 AUD

- Trust Score: 90

- Tradeable Symbols (Total): 10000

FP Markets shines as a low-cost broker for trading forex and CFDs – as long as you use the MetaTrader platform. The Iress platform suite offers well over 10,000 tradeable symbols, but it’s mostly a share trading platform – and is generally a much pricier option. Read full review

- Ultra-competitive spreads on Raw ECN account.

- Supports MetaTrader, cTrader, TradingView, and Autochartist tools.

- Access to 10,000+ tradeable symbols via the Iress platform.

- Mobile app lacks in tools and charting.

- Research and education content trails leading brokers like IG.

- Iress platform fees add up.

- Minimum Deposit: $100

- Trust Score: 93

- Tradeable Symbols (Total): 2249

FxPro competes among the top MetaTrader brokers, featuring multiple account options and various execution methods. It provides its own proprietary FxPro Edge app alongside access to the BnkPro app (which isn’t yet available in all regions). Read full review

- 2,200+ CFDs including forex, stocks, and commodities.

- Offers MetaTrader, cTrader, and its own FxPro Edge platform.

- Strong algo trading support.

- Trading costs are higher than top low-cost forex brokers.

- FxPro Edge still lags behind leading proprietary platforms.

- Limited educational content.

- Minimum Deposit: $5

- Trust Score: 93

- Tradeable Symbols (Total): 1394

XM Group is a MetaTrader-only broker that offers a strong selection of high-quality educational content and market research. Read full review

- Offers 1,400+ CFDs and 55 forex pairs.

- Trading Central adds depth to strong in-house research.

- Features daily videos, podcasts, and multilingual live broadcasts.

- Full MetaTrader suite supports copy trading and algo tools.

- Standard account spreads are expensive.

- XM Zero account is only offered in the EU.

- Doesn't offer a proprietary trading platform.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ForexBrokers.com Overall Rankings

Now that you've seen our picks for the best brokers on this guide, check out ForexBrokers.com's overall broker rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Also take a look at our full-length, in-depth forex broker reviews.

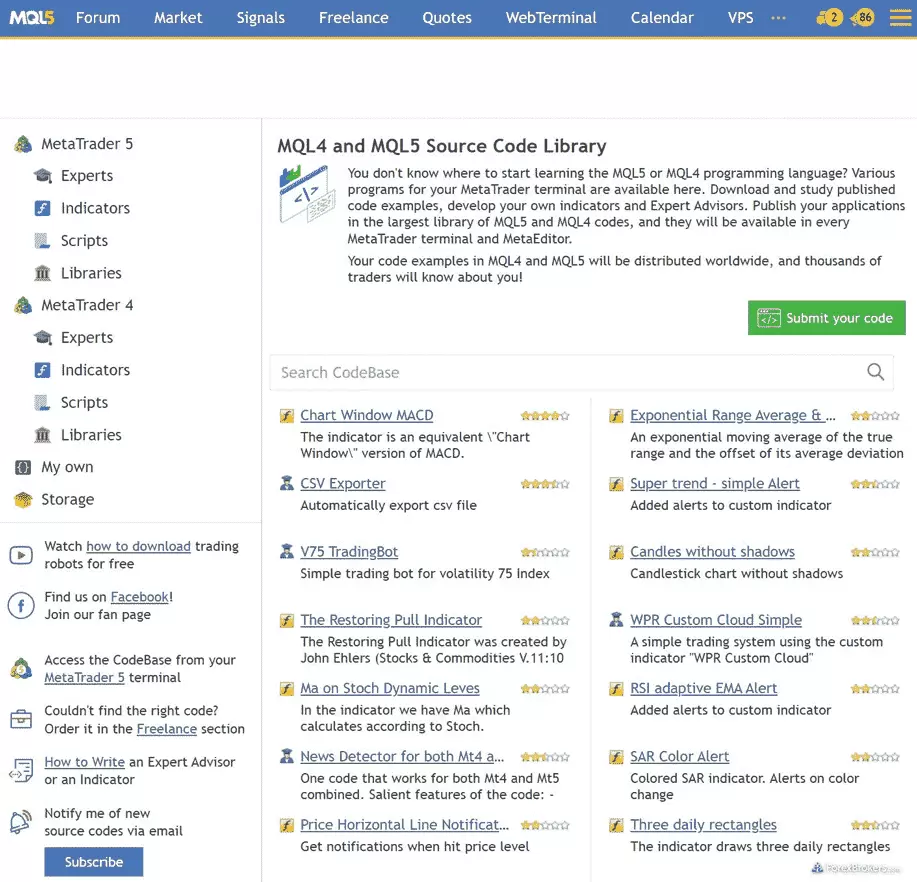

Popular Forex Trading Tools and Platform Guides

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best MetaTrader 5 (MT5) Forex Brokers for 2026

- Best Forex Signal Providers for 2026

- Best Brokers for TradingView for 2026

- Best Trading Central Forex Brokers for 2026

- Best Forex Brokers with Trading APIs

Popular Forex Guides

- Compare Forex Brokers

- Best Forex Brokers for 2026

- Best Brokers for TradingView for 2026

- Best Low Spread Forex Brokers for 2026

- Best Forex Trading Apps for 2026

- International Forex Brokers Search

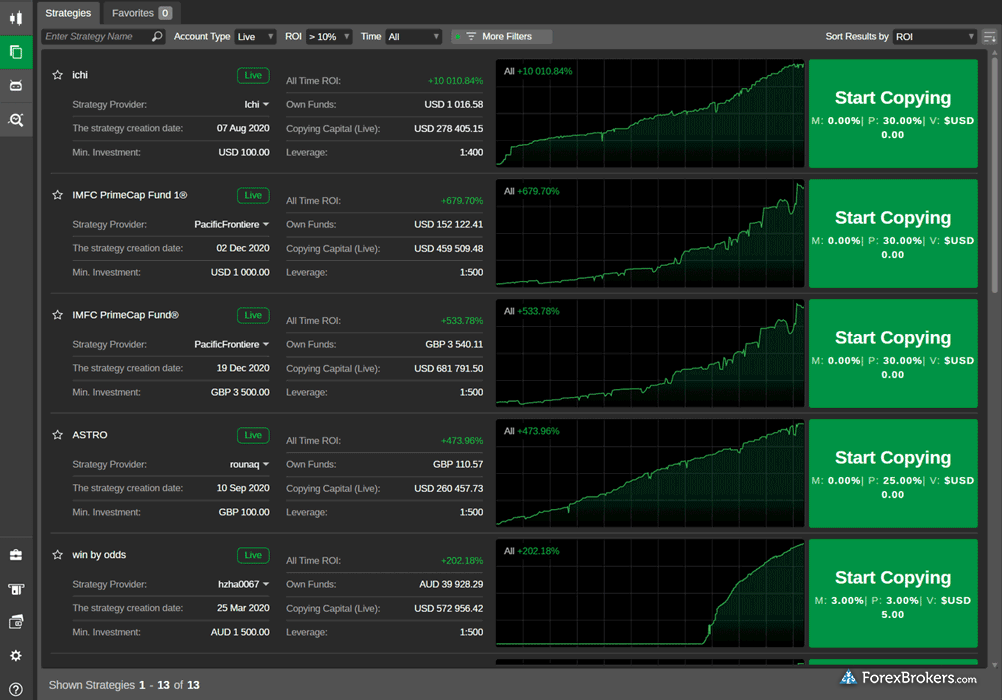

- Best Copy Trading Platforms for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Forex Brokers for Beginners of 2026

More Forex Guides

Popular Forex Broker Reviews

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IC Markets

IC Markets

Pepperstone

Pepperstone

FXCM

FXCM

Tickmill

Tickmill

FP Markets

FP Markets

FxPro

FxPro

XM Group

XM Group