OANDA Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A trusted global brand, OANDA stands out for its reputation and quality market research. Its regulatory track record is strong, and its support for third-party features bolsters its overall offering.

OANDA recently expanded its range of markets in certain jurisdictions, yet its below-average pricing puts it just behind the best forex brokers, unless you deposit $10,000 for its Core Pricing or qualify for its Elite Trader discounts which help bring its costs closer to the industry average.

-

Minimum Deposit:

$0 -

Trust Score:

92 -

Tradeable Symbols (Total):

4172

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| 2026 | #13 |

| 2025 | #12 |

| 2024 | #14 |

| 2023 | #17 |

| 2022 | #17 |

| 2021 | #19 |

| 2020 | #15 |

| 2019 | #12 |

| 2018 | #13 |

| 2017 | #17 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Yes, based on your detected country of US, you can open an account with this broker.

Table of Contents

Pros & cons

Pros

- MarketPulse and OANDA's new Trade Tap Blog offer quality daily research and analysis.

- OANDA Trade app is user-friendly with solid functionality.

- TradingView and MT4 support with VPS hosting.

- Algo Labs supports API trading (not in Australia).

Cons

- Fewer YouTube video updates than peers in research and educational categories.

- New Smart videos education series are mostly platform tutorials.

- Spreads are high compared to the best overall brokers.

- OANDA Trade platform trails best-in-class leaders.

My top takeaways for OANDA in 2026:

- The OANDA Trade mobile app has a great balance of features and ranks highly for ease of use.

- The TradingView platform is available in certain regions (but not under the broker's OANDA Global Markets entity), alongside several VPS services.

- OANDA provides multiple options for algo trading, including via API as part of its Algo Labs offering (not available in Australia).

- OANDA recently rebranded its Advanced Trader program to Elite Trader, revising its perks and rebate tiers for high-volume traders (available exclusively to traders in the U.S. and Canada).

- OANDA's flagship OANDA Trade desktop and web trading platform is good – not great – and trails platform leaders such as IG and Saxo.

Trust Score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is OANDA safe?

OANDA is considered Highly Trusted, with an overall Trust Score of 92 out of 99. OANDA is not publicly traded, does not operate a bank, and is regulated by seven Tier-1 regulators (Highly Trusted), zero tier-2 regulators (average trust), zero Tier-3 regulator (Average Risk), and one Tier-4 regulator (High Risk). OANDA is regulated by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Canadian Investment Regulatory Organization (CIRO), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different OANDA entities are regulated.

Note: Regulated brokers are not immune from running into trouble, and our risk assessment is by no means a guarantee of solvency for the indefinite future.

| Feature |

OANDA OANDA

|

|---|---|

| Year Founded | 1996 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 7 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

The range of available markets at OANDA will vary slightly depending on which of its entities regulates your account. CFDs are not available in the U.S., whereas in select regions OANDA offers as many as 4,172 symbols (CFDs and shares) and 69 forex pairs, as well as the option to trade Bitcoin, Ethereum, Litecoin, and other cryptos as CFDs. Note: The availability of tradeable symbols varies by region. Please reference OANDA's website to verify what is available in your country or region.

Cryptocurrency: Cryptocurrency trading is available at OANDA in select regions through CFDs. Traders at OANDA in the U.S. can trade underlying crypto assets (for example, purchasing actual Bitcoin) via its Paxos account offering. Paxos is a separate company from OANDA and all crypto trades for U.S. clients are conducted through them, but managed on the OANDA platform. Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except for Professional clients).

The following table summarizes the different investment products available to OANDA clients:

| Feature |

OANDA OANDA

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 4172 |

| Forex Pairs (Total) | 69 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | Yes |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

OANDA fees

OANDA’s forex trading costs are generally steep, with high effective spreads across both its default and core pricing, compared to the best brokers. While not a discount broker, OANDA’s main advantage is its automated execution across its account offering.

Spreads: OANDA’s bid/ask spreads (the fees clients pay to trade) are most comparable to FOREX.com and FxPro, while the minimum spread cost (or lowest advertised rate) may be slightly higher than those firms that list a sub-pip spread (less than 1.0 pip). For example, the average non-core pricing at OANDA was 1.69 pips on the EUR/USD pair during August 2025.

Core pricing: OANDA’s core pricing features lower spreads, but includes a per-side commission of $5 per $100,000 worth of currency (or roughly $10 per round turn standard lot). This option requires a $10,000 minimum deposit, and when factoring in the commission, the all-in cost ends up being slightly better than the commission-free pricing. For example, let’s say the spread on the EUR/USD is 1.69 pips under the default pricing structure, and the spread for core pricing is only 0.4 pips. Once you factor in the commission-equivalent of 1 pip (0.5 pips per side), the total cost for core pricing ends up coming to 1.4 pips – just under the default price.

Micro lots: In most cases, the smallest contract size for trading forex is one micro lot. However, OANDA brings this minimum trade size down by three orders of magnitude – to 1 unit or 0.001 micro lot.

Elite Trader program: OANDA offers rebates in select jurisdictions for active traders executing volumes of 10 million or more, as well as spread discounts based on deposit amounts. There are five rebate tiers, ranging from $5 to $17 per million. Additional perks include TradingView subscription reimbursements for Essential and Plus plan users when opening Premium or Elite accounts, which require EUR 3,000 and EUR 10,000, respectively. Premium and Elite accounts also feature up to 30% spread reductions, which would lower the example August 2025 average spread from 1.69 to 1.18.

Transparency: As part of its push for greater pricing transparency, OANDA continually publishes a trailing average of its spread across nearly all time frames. Using this tool, I was able to compute an average spread of 1.69 pips for the month of August 2025 for the EUR/USD at OANDA. This average value for August includes rollover periods when spreads widen (but even excluding rollover, spreads are still high, averaging 1.58 pips).

Note: The applicability of information within this section will depend on your country of residence. For example, certain data (including spreads, pricing, and product offerings) was obtained from OANDA's U.S. entity (the OANDA Corporation) and may not be applicable if you reside in another country. For example, Crypto CFDs are available outside of the U.S. and U.K. from certain OANDA global entities but are not available to U.S. or U.K. retail clients (professional clients in the U.K. can access crypto CFDs from OANDA Europe).

| Feature |

OANDA OANDA

|

|---|---|

| Minimum Deposit | $0 |

| Average spread (EUR/USD) - Standard account | 1.68 |

| All-in Cost EUR/USD - Active | 1.69 |

| Non-wire bank transfer | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

OANDA's flagship Trade mobile app is easy to use and provides quality market research and excellent charting features.

Apps overview: OANDA offers the popular MetaTrader 4 (MT4) mobile app developed by MetaQuotes Software Corporation, alongside its own proprietary Trade mobile app. OANDA also recently introduced MetaTrader 5 (MT5) at select locations, such as its BVI entity, and in Europe and the Middle East.

Mobile charting in OANDA's fxTrade mobile app allows you to view a watchlist, a chart preview, and an open position all at once. I liked that you can enter orders directly within the chart.

Ease of use: Opening a chart on the Trade app is as easy as clicking the graph icon at the bottom of the watchlist. Whether setting up a trade or adding a price alert, I found the overall layout to be straightforward and easy to use. Beyond its intuitive design, charting with the Trade app is balanced with features such as research from Autochartist and news headlines.

Steven's take

"A neat feature that stood out to me was the seamless transition to the trade ticket window from within the charts. Users can quickly enter their orders from the chart, then adjust their stop-loss and limit order levels with a simple drag and drop function."

Charting: The Trade app’s versatile charting features 33 technical indicators, 13 drawing tools, and the ability to select from over a dozen time frames. Zooming in and out of charts on Trade is a fluid experience thanks to the apps’ responsive design.

Syncing: I’d like to see Trade add the ability to sync watchlists, and it’s worth noting that mobile chart indicators do not sync with the desktop or web version of Trade. Lastly, adding educational and market analysis videos would be a logical (and helpful) next step in the evolution of the Trade app.

| Feature |

OANDA OANDA

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | No |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 30 |

Trading platforms

OANDA’s Trade trading platform suite is a good option for market news and charting (powered by TradingView) but falls short in other areas. For example, I found OANDA’s integration of research and trading tools within its desktop and web platforms to be imperfect.

Platform overview: OANDA primarily offers two platform suites; the popular MetaTrader 4 (MT4) platform, developed by MetaQuotes Software Corporation and available for web and desktop, and OANDA’s Trade web and desktop trading platform. MetaTrader 5 (MT5) is now available at OANDA in Japan, the U.K., and in emerging markets, from the broker’s BVI entity. MT5 is not available in the U.S. for OANDA clients, and new MetaTrader clients can only choose MT5 at select OANDA entities where available.

This is the OANDA Trade web platform. I like the platform, but it's not quite as good as what you'd see from the best proprietary trading platforms.

Charting: OANDA’s Trade platform features charts powered by TradingView, with over 80 indicators and various additional features, such as the ability to overlay multiple currency pairs within a single chart for comparison. I also appreciated that the web-based and desktop versions of Trade are identical to each other, which makes swapping between versions simple and painless.

However, many of the integrated features in the platform will trigger a new browser window to open – even when you are on the desktop version. Other brokers integrate such features directly into the platform, which allows you to stay focused without a distracting flurry of new windows popping into your screen.

Trading tools: Additional platforms are available from third-party developers within OANDA’s Marketplace. The Seer Trading Platform, for example, supports algorithmic trading system development – including back-testing and forward-testing automated trading systems. OANDA also supports trading connectivity with multiple charting platforms such as TradingView, NinjaTrader, MultiCharts, and MotiveWave. Lastly, OANDA’s Algo Labs provides API access with various supported languages, including Python and C#.

Account management: OANDA combines several services within its online account management portal, making it easy to transfer money between accounts and access your statements.

TradingView

OANDA was one of the first brokers to integrate TradingView charts, and you can now log into the TradingView web platform and connect your OANDA account to unlock the full trading platform experience. Check out our guide to TradingView to learn more.

Note: While OANDA's Trade platform is available globally, TradingView is only available to residents of the U.S., U.K. and Canada.

| Feature |

OANDA OANDA

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 89 |

| Charting - Trade From Chart | Yes |

Research

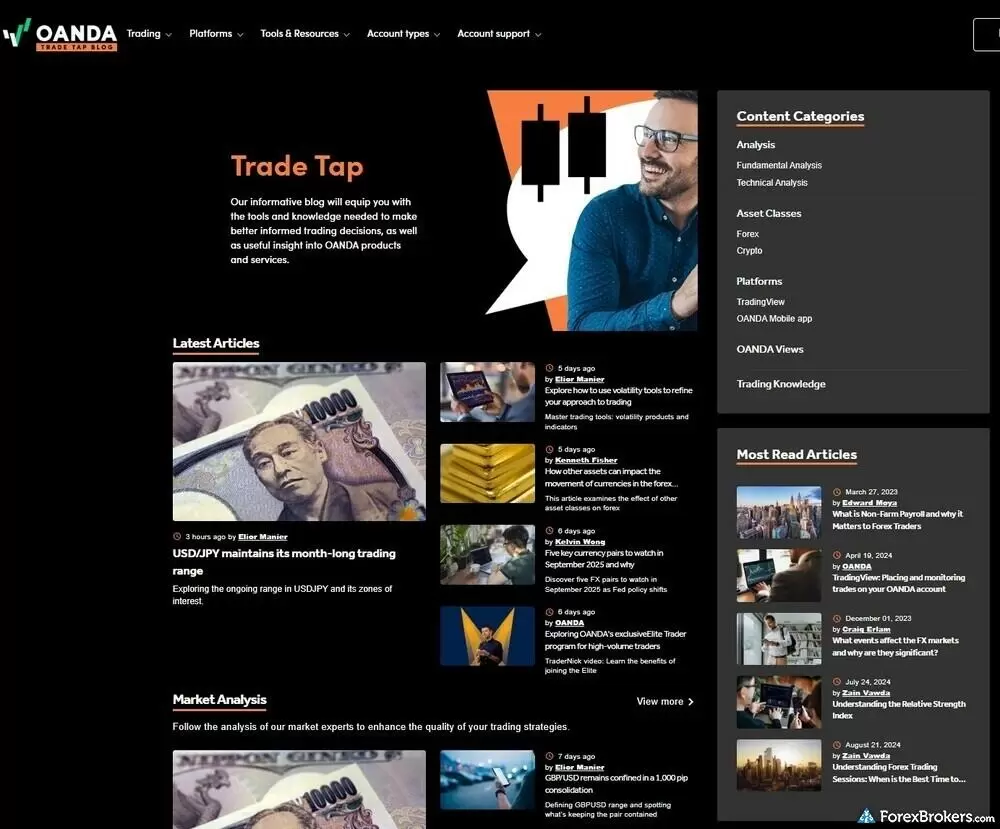

OANDA equips forex and CFD traders with everything needed to navigate the markets, offering multiple daily articles, podcasts, and research tools. One minor annoyance is that some research resources open in a separate browser window instead of within the platform. Its video strategy has been revamped with YouTube Shorts, a weekly market analysis series, and the 'Daily Dose of Market Insights' from its Singapore channel. Traders can also subscribe to OANDA’s upcoming YouTube live streams, which align with macroeconomic events. The new Trade Tap Blog, though less active than MarketPulse, remains a strong addition. Year over year, OANDA’s improvements have solidified its Best in Class status in this category.

OANDA's new research offering, the Trade Tap blog, offers market analysis on current news and topics.

Research overview: OANDA offers a broad range of research tools for forex traders. Its MarketPulse site delivers an excellent selection of articles, organised by category, with multiple updates daily. On OANDA’s MetaTrader 4 (MT4) and Trade platforms, news headlines stream directly from Dow Jones Newswire and other providers. Autochartist integration within the web platform and mobile app supplies trading signals and automated technical analysis. The main shortcoming is that video content on MarketPulse and OANDA’s YouTube channel is less extensive than that of top competitors. However, the addition of new research content, such as short-form videos, upcoming live streams, and a Market Insights podcast on Spotify and Apple Podcasts, is a welcome improvement.

Market news and analysis: OANDA’s MarketPulse site has dedicated news, research, and analysis content, alongside its new Trade Tap Blog. OANDA’s Trade mobile app streams news from Dow Jones as well as the company’s blog. One feature I quite like about OANDA's research is the ability to filter between headlines and trading signals from within its news feeds and under its alerts stream.

Premium content: OANDA offers Dow Jones Select, and third-party technical analysis software is available from MotiveWave and MultiCharts.

| Feature |

OANDA OANDA

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central | No |

| Client sentiment data | Yes |

Education

OANDA offers educational content, including webinars, conducted by its staff yet lacks an extensive range of educational articles and videos (including on its YouTube channel). Expanding its range of videos and written articles would help elevate OANDA's educational offering, which does not currently measure up to education leaders such as IG and AvaTrade.

The OANDA website's educational hub features webinars and videos covering current events and financial analysis.

Learning center: OANDA recently revised its learning portal with a dedicated "Learn" section, although compared to the courses it had previously the new section is very thin on content. That said, I did find that the few articles available in the new Learn section are well-written and of high quality. There is also a dedicated landing page to the U.S. elections with high quality educational content and a related webinar by OANDA staff, which I found to be well prepared.

Premium webinar series: OANDA recently launched a number of premium webinar recordings focused on educational lessons spanning a 10 part webinar series "Forward-thinking traders." It's worth noting that the Premium webinars are only available to live account holders.

Paid education: As part of its partnership with FTMO, OANDA offers paid training through gamified challenges known as 'Prop Trading' (though not to be confused with traditional proprietary trading). These challenges provide a virtual demo balance and impose strict risk management rules; failing to follow them ends the challenge. While they can help prepare you for trading real money, they are not a substitute for live trading and require a paid entry. Beginners may find a free demo account a better starting point for developing and testing strategies before attempting virtual challenges or live trading.

Room for improvement: OANDA’s educational content for beginners is scattered across its website. Adding the ability to filter educational resources by experience level would benefit traders of all competencies. In addition, OANDA would benefit from building out its new Learn center with courses, quizzes, and progress tracking, as well as adding more educational articles in general. The best brokers in this category have a comprehensive offering of both videos and articles. As such, I’d also like to see an increase in the number of educational videos at OANDA, beyond the existing platform tutorials.

| Feature |

OANDA OANDA

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

OANDA’s edge is its strong regulatory track record, with licenses in the strictest major financial centers. It also delivers robust market research content and an excellent mobile app. In our 2025 Annual Awards, OANDA earned Best in Class honors for Mobile Trading Apps and Research. OANDA's U.S. brand holds regulatory status in the U.S., making it one of the few forex brokers that can accept U.S. residents. While OANDA bolstered its range of markets recently, it is still held back by its pricing that simply can’t compete with the best low-cost brokers.

Thanks to its straightforward web and mobile trading apps, OANDA offers something for casual investors while also serving sophisticated traders who prefer to connect via API or use automated trading systems on MT4 (and more recently MT5 in select locations).

OANDA Star Ratings

| Feature |

OANDA OANDA

|

|---|---|

| Overall Rating |

|

| Trust Score | 92 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test. All information contained herein is based on ForexBrokers.com's independent review of this broker's various global brand entities.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Read next

- Best Copy Trading Platforms for 2026

- Best Forex Trading Apps for 2026

- Best Brokers for TradingView for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Low Spread Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- International Forex Brokers Search

- Compare Forex Brokers

- Best Forex Brokers for 2026

More Forex Guides

Popular Forex Broker Reviews

Article resources

About OANDA

Founded in 1996, OANDA operates across eight global financial centers, serving clients in over 196 countries through its entities licensed in six major regulatory jurisdictions, including the U.S., U.K., Canada, Australia, Japan, and Singapore. OANDA also holds regulatory status in other jurisdictions, such as the British Virgin Islands (BVI).

In August 2025, FTMO Group, a global provider of educational and financial training services, announced its acquisition of OANDA from CVC Asia Fund IV.

The OANDA Group has multiple subsidiaries who are licensed to offer products to clients around the globe. The OANDA subsidiary with whom a client contracts depends on their country of residence. Each subsidiary provides different products via different platforms, so clients will experience OANDA differently depending on their country of residence.

OANDA Disclosures and Disclaimers

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF THE NFA AND SUBJECT TO THE NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT THE NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

OANDA (Canada) Corporation ULC is regulated by the Canadian Investment Regulatory Organization (CIRO) and customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of the coverage is available upon request or at www.cipf.ca.

OANDA Europe Limited is a company registered in England number 7110087, and has its registered office at Dashwood House, 69 Old Broad Street, London EC2M 1QS. It is authorised and regulated by the Financial Conduct Authority, No: 542574.

OANDA Australia Pty Ltd is regulated by the Australian Securities and Investments Commission ASIC (ABN 26 152 088 349, AFSL No. 412981) and is the issuer of the products and/or services on this website. It's important for you to consider the current Financial Service Guide (FSG), Product Disclosure Statement ('PDS'), Account Terms and any other relevant OANDA documents before making any financial investment decision.

OANDA Global Markets Ltd is a company registered in BVI number 2026433, and has its registered office at Kingston Chambers, PO Box 173, Road Town, Tortola, British Virgin Islands. It is authorised and regulated by the BVI Financial Services Commission, number: SIBA/L/20/1130.