Best MetaTrader 4 (MT4) Brokers for 2026

Steven Hatzakis has been reviewing forex brokers for nearly ten years and has 25+ years of experience as a forex trader. His broker reviews are unbiased and independent, and his expertise is sought after for global FX conferences and speaking events around the world. Learn how we test.

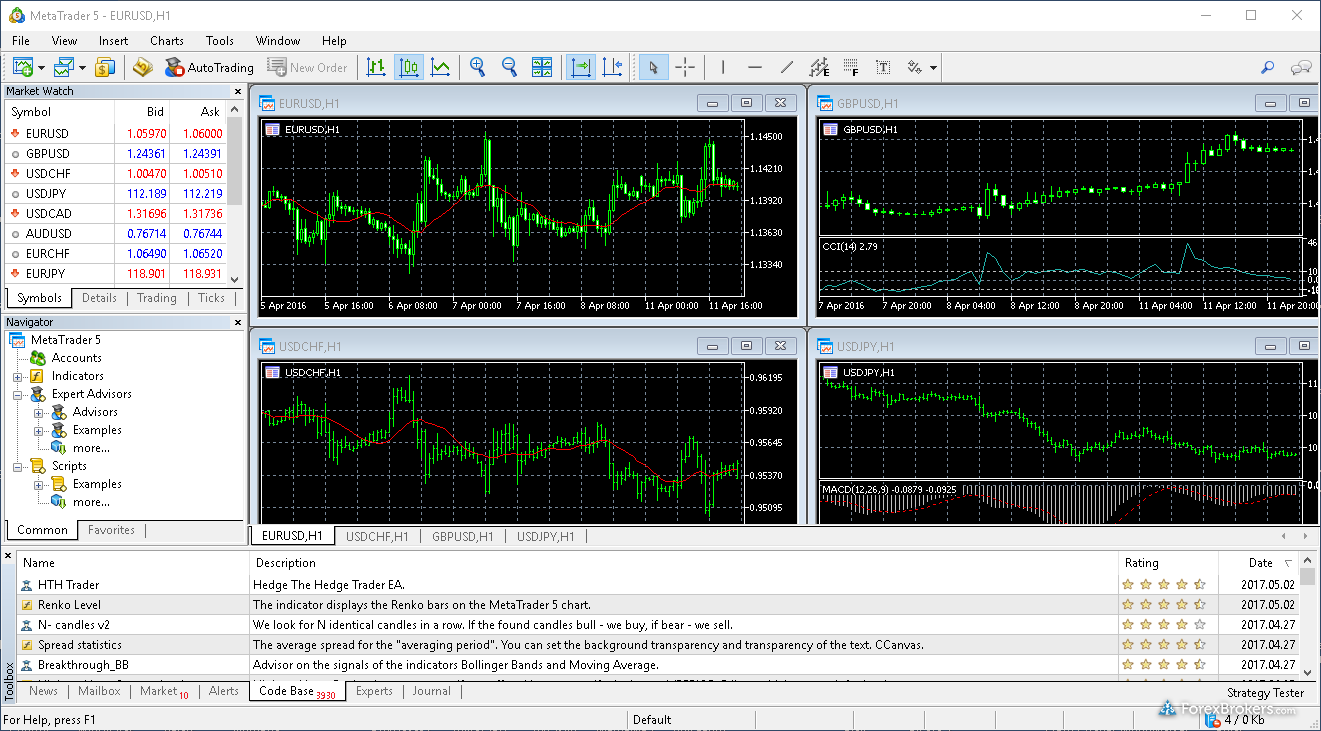

I’ve been trading forex for over 25 years and using MetaTrader (both MetaTrader 4 and its successor, MetaTrader 5) for over a decade. In this guide, I’ll break down MT4's differences with MT5, answer some common questions about this popular trading platform, and share my picks for the best MetaTrader brokers.

I'll begin with an overview of the best forex brokers that support MetaTrader 4 and then share some tips that will help both beginners and advanced users, including notes on how to use it for social copy trading or with automated trading systems.

Best MetaTrader (MT4) Brokers

Trading from the U.S.?

Explore the best MT4 brokers available to U.S. traders.

- Minimum Deposit: $200

- Trust Score: 83

- Tradeable Symbols (Total): 3583

IC Markets’ MetaTrader offering includes an impressive range of third-party research and trading tool plugins; they’ll need to be installed separately, but their ability to enhance the MetaTrader experience helped IC Markets earn our award for the #1 MetaTrader broker in our 2025 Annual Awards. Read full review

- Competitive pricing and low average spreads.

- 3,500+ tradeable symbols and powerful algo trading support.

- MetaTrader broker with integrated third-party plugins.

- Educational content and research still have room for improvement.

- No proprietary forex trading app.

- Share trading is limited to Aussie stocks via IC Shares.

- Minimum Deposit: $100 AUD

- Trust Score: 90

- Tradeable Symbols (Total): 10000

FP Markets offers a versatile MetaTrader experience, albeit without advanced research and educational content. Highly-competitive pricing can be found through its MetaTrader offering, making it one of the most cost-competitive brokers – at least for its commission-based ECN account. Read full review

- Ultra-competitive spreads on Raw ECN account.

- Supports MetaTrader, cTrader, TradingView, and Autochartist tools.

- Access to 10,000+ tradeable symbols via the Iress platform.

- Mobile app lacks in tools and charting.

- Research and education content trails leading brokers like IG.

- Iress platform fees add up.

- Minimum Deposit: $0

- Trust Score: 94

- Tradeable Symbols (Total): 1726

Pepperstone’s dual offering of MetaTrader and cTrader is a great fit for algorithmic traders and copy traders, and its wide range of available third-party tools and plugins enhances its already-impressive suite of available platforms. Read full review

- Won Best in Class for MT5, algo trading, and more.

- Offers MetaTrader and cTrader for algo and copy trading.

- Razor account pricing is competitive for active traders.

- New mobile app has solid features and strong usability.

- Education lacks depth.

- MT5 offering has limited symbols.

- Minimum Deposit: $100

- Trust Score: 99

- Tradeable Symbols (Total): 5500

FOREX.com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. It offers a wide range of markets and provides an impressive suite of proprietary platforms – alongside limited access to MetaTrader. Read full review

- Trading Academy is great for all experience levels.

- Advanced charting through TradingView with 5,500+ symbols.

- Pro-grade trading tools on web and desktop.

- Spreads are higher than other low-cost brokers.

- Pricing is average unless you qualify for active trader discounts.

- Stock and futures trading require a separate StoneXone account.

- Minimum Deposit: $10

- Trust Score: 80

- Tradeable Symbols (Total): 209

Exness is a global forex broker best known for its flexible execution, instant withdrawals, and access to extremely high leverage, alongside multiple account types and a growing ecosystem of trading tools. Read full review

- Innovative web platform with drag-to-modify order features.

- Wide forex coverage with 96 pairs and flexible account types.

- MetaTrader, Trading Central, and social trading all supported.

- Newly improved educational content on the Insights blog.

- Research content is limited and lags behind top-tier brokers.

- Narrow product range with just over 200 total tradeable symbols.

- Spreads on Standard Cent accounts are higher than other account types.

- Minimum Deposit: $100

- Trust Score: 93

- Tradeable Symbols (Total): 2249

FxPro competes among the top MetaTrader brokers, featuring multiple account options and various execution methods. It provides its own proprietary FxPro Edge app alongside access to the BnkPro app (which isn’t yet available in all regions). Read full review

- 2,200+ CFDs including forex, stocks, and commodities.

- Offers MetaTrader, cTrader, and its own FxPro Edge platform.

- Strong algo trading support.

- Trading costs are higher than top low-cost forex brokers.

- FxPro Edge still lags behind leading proprietary platforms.

- Limited educational content.

- Minimum Deposit: $100

- Trust Score: 93

- Tradeable Symbols (Total): 8702

Traders choose Admirals for its excellent investor education and advanced MetaTrader features – such as the Supreme add-ons – alongside an extensive range of shares, forex and CFD markets, and premium research content. Read full review

- Competitive pricing on the EUR/USD pair

- Outstanding educational content

- Wide selection of 8,425 tradeable symbols

- Narrower range of symbols for the Admiral Prime account (MT5)

- Admirals App is relatively unsophisticated

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ForexBrokers.com Overall Rankings

Now that you've seen our picks for the best brokers on this guide, check out ForexBrokers.com's overall broker rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Also take a look at our full-length, in-depth forex broker reviews.

Other Forex Trading Platform Guides

- Best cTrader Brokers for 2026

- Best MetaTrader 5 (MT5) Forex Brokers for 2026

- Best Trading Central Forex Brokers for 2026

- Best Brokers for ZuluTrade for 2026

- Best Copy Trading Platforms for 2026

- Best Brokers for TradingView for 2026

Popular Forex Guides

Popular Forex Broker Reviews

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IC Markets

IC Markets

FP Markets

FP Markets

Pepperstone

Pepperstone

FOREX.com

FOREX.com

Exness

Exness

FxPro

FxPro

Admirals

Admirals