Historical Forex Broker Reviews

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ForexBrokers.com has always been committed to providing the most accurate and transparent broker reviews in the industry. As part of our 2026 update, we’ve retired coverage for a number of brokers that we no longer actively review. To preserve the value of our past research, we’ve created this archive of historical broker reviews.

Here, you’ll find a list of brokers we previously covered, along with their last trust score and a brief description based on our 2025 data. While these reviews are no longer updated, they remain a helpful reference point for traders researching the history of these firms. If you’re looking for our latest, up-to-date reviews, please visit our main forex broker reviews section or head over to our guide to the best forex brokers in the industry.

About our historical forex broker reviews

These historical reviews provide a snapshot of our past research into forex brokers. Each entry reflects the broker’s last trust score and a condensed summary of their services as of 2025. While these reviews are no longer updated, they remain an important resource for traders who want to look back at how a broker was evaluated. At ForexBrokers.com, transparency has always been our priority, which is why we’ve preserved this information for reference. If you’re searching for current insights, our main broker reviews section remains the most up-to-date source of analysis.

Why we retired these broker reviews

As the forex industry evolves, so does our coverage. Going into 2026, we’ve chosen to streamline our ecosystem of brokers, reducing the number we review or cover from 63 down to 36. This decision allows us to dedicate more resources to providing deeper, higher-quality reviews of the brokers that matter most to traders today. Rather than remove our work entirely, we’ve archived these historical reviews to preserve their value. This ensures that traders who encounter these names can still access the last version of our research, while avoiding the risk of outdated or incomplete coverage in our active reviews.

How to use this archive

Think of this page as a historical reference rather than a recommendation guide. Each broker listed includes its most recent trust score, along with a short description summarizing our final 2025 findings. This information can be helpful if you come across an old review elsewhere, are researching a broker’s history, or simply want to see how the landscape of forex brokers has changed over time. Keep in mind that the details here are not current, and should not be used to make trading decisions today. For the latest, fully updated reviews, we encourage you to explore our main forex broker reviews hub.

Historical broker reviews

- ACY Securities Review (Historical)

- Admirals Review (Historical)

- BDSwiss Review (Historical)

- Fineco Review (Historical)

- LegacyFX Review (Historical)

- Moneta Markets Review (Historical)

- MultiBank Group Review (Historical)

- RoboForex Review (Historical)

- TMGM Review (Historical)

- TopFX Review (Historical)

- Trade Nation Review (Historical)

- VT Markets Review (Historical)

- Xtrade Review (Historical)

- Archived Broker Ratings

ACY Securities Review (Historical)

- Trust Score (2025): 75/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #42 in 2025, #39 in 2024, #39 in 2023, #32 in 2022

- Minimum Deposit: $50

- Total Symbols: 2,200+

ACY Securities offers the full MetaTrader suite (MT4 and MT5) along with its proprietary LogixTrader platform. The broker provides access to more than 2,200 CFDs across forex, indices, commodities, equities, ETFs, metals, and cryptocurrencies (as derivatives). Account options range from a low-deposit Standard account to commission-based ProZero and Bespoke accounts, with competitive pricing especially for Australian clients.

Strengths include a broad range of markets, discounted commissions for high-volume traders, and access to tools like Capitalise.ai for automated trading. Weaknesses include limitations in LogixTrader, which supports only 161 symbols and lacks features such as trading from charts, as well as average-quality education and research compared to industry leaders.

ACY Securities is authorized by ASIC (Tier-1 regulator) and operates additional offshore entities. With a Trust Score of 75, ForexBrokers.com classified the broker as Average Risk as of 2025.

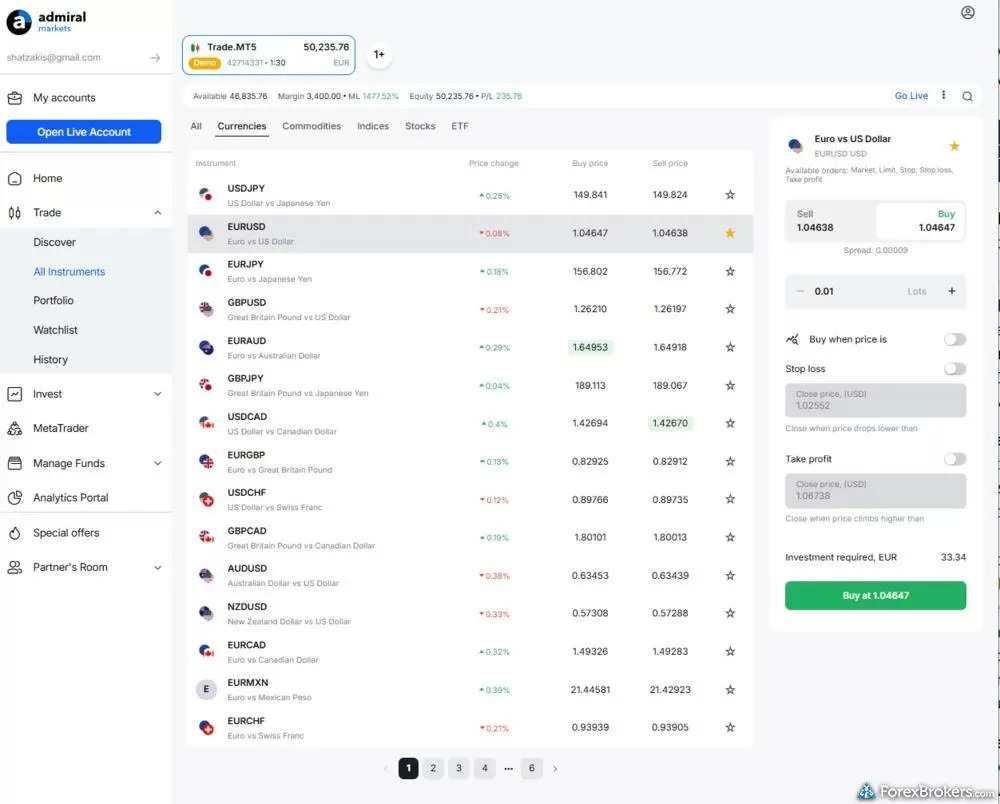

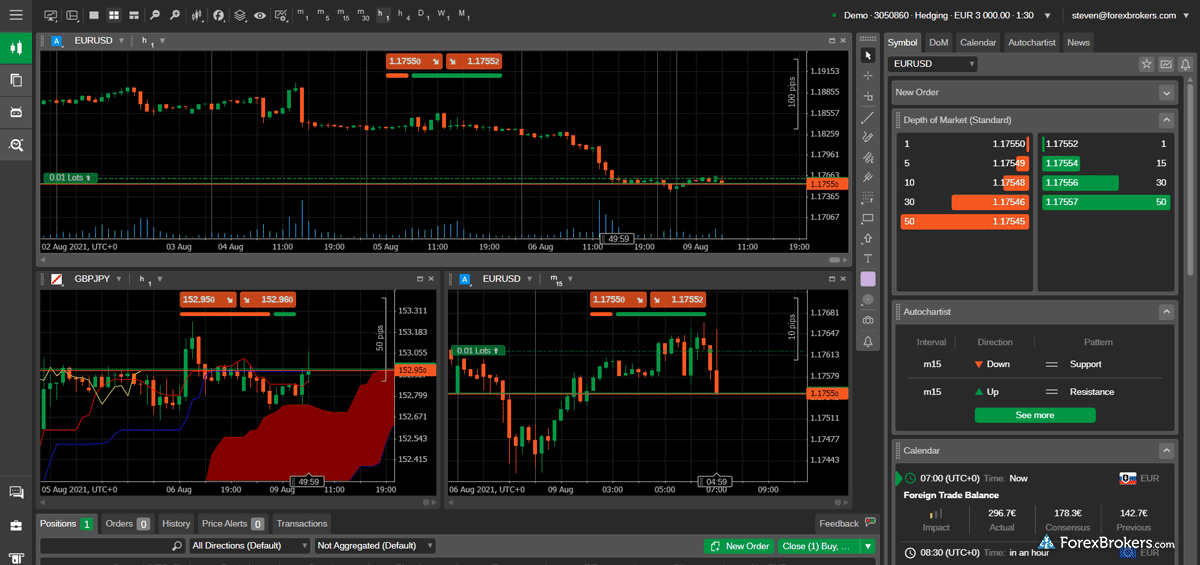

Admirals Review (Historical)

- Trust Score (2025): 93/99

- Overall Rating (2025): 4.5/5.0 Stars

- Historical Ranking: #18 in 2025, #16 in 2024, #18 in 2023, #14 in 2022, #12 in 2020, #19 in 2018, #18 in 2017

- Minimum Deposit: $100

- Total Symbols: 8,702+

Admirals, formerly known as Admiral Markets, offers an extensive multi-asset lineup with more than 8,700 instruments, including forex, CFDs, shares, ETFs, and commodities. Traders benefit from the full MetaTrader suite enhanced with Admirals’ Supreme add-ons, which provide advanced charting, analytics, and trading tools. Pricing is competitive, with typical EUR/USD spreads averaging 0.8 pips, and the broker also supports fractional investing and automated recurring investments for stocks and ETFs.

Strengths include excellent investor education, a wide variety of markets, indemnity insurance coverage from Lloyd’s of London, and premium research powered by Trading Central, Acuity Trading, and Dow Jones news. Weaknesses include inactivity fees, limited social trading functionality, and a mobile app that lacks the polish of top-tier competitors.

Admirals is authorized by four Tier-1 regulators, including the FCA and ASIC, alongside multiple Tier-2 regulators. With a Trust Score of 93, ForexBrokers.com classified Admirals as Highly Trusted as of 2025.

BDSwiss Review (Historical)

- Trust Score (2025): 73/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #36 in 2025, #33 in 2024, #27 in 2023, #25 in 2022

- Minimum Deposit: $10–$5,000 (varies by account)

- Total Symbols: 1,081+

BDSwiss caters to more than 1.6 million registered traders and offers the full MetaTrader suite (MT4 and MT5) alongside its own BDSwiss WebTrader and Mobile apps. The broker provides access to over 1,000 tradeable symbols spanning forex, indices, commodities, equities, and crypto derivatives. Order execution quality is a key strength, with monthly statistics published that highlight low slippage and zero requotes.

Strengths include transparent execution data, strong research output, and multiple account types tailored to different deposit levels. Weaknesses include relatively high spreads on its Classic account (EUR/USD at 1.6 pips), limited proprietary platform functionality, and a $30 inactivity fee after just 90 days. BDSwiss also no longer accepts EU residents following regulatory scrutiny and restrictions.

BDSwiss is authorized by one Tier-1 regulator and holds additional Tier-4 licenses. With a Trust Score of 73, ForexBrokers.com classified BDSwiss as Average Risk as of 2025.

Fineco Review (Historical)

- Trust Score (2025): 94/99

- Overall Rating (2025): 4.5/5.0 Stars

- Historical Ranking: #25 in 2025, #24 in 2024, #23 in 2023, #23 in 2022

- Minimum Deposit: $0

- Total Symbols: 9,770+

Fineco is a multi-asset broker and publicly traded bank regulated in Italy, passported across the EU, and formerly active in the U.K. The broker provides access to nearly 10,000 instruments across forex, CFDs, global shares, ETFs, bonds, and funds, making it well-suited for investors seeking a wide product offering under a single account. Fineco’s proprietary platforms, including PowerDesk and FinecoX, are supported by strong charting and screeners.

Strengths include guaranteed stop-loss orders, competitive index CFD pricing, and the stability of a bank-regulated, publicly traded entity. Weaknesses include limited availability (online account access is restricted to Italian residents), underwhelming research and educational content, and higher-than-average forex spreads.

Fineco is authorized by two Tier-1 regulators, including the FCA and Italy’s CONSOB. With a Trust Score of 94, ForexBrokers.com classified Fineco as Highly Trusted as of 2025.

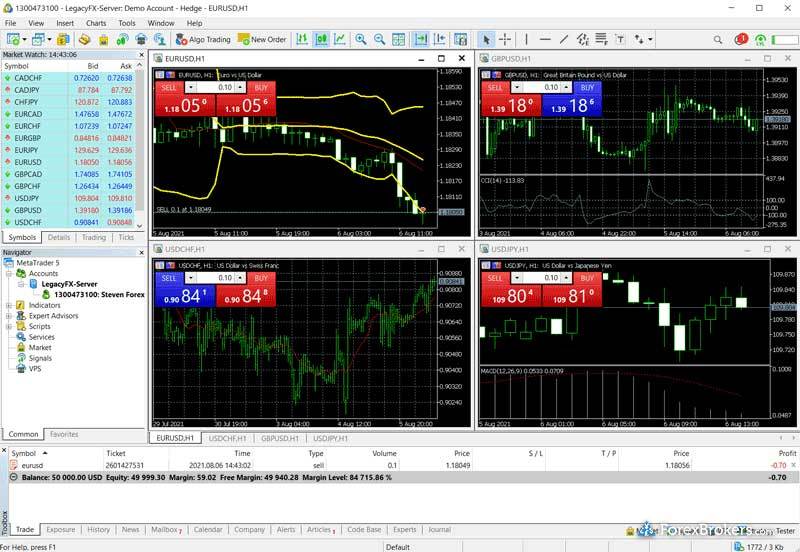

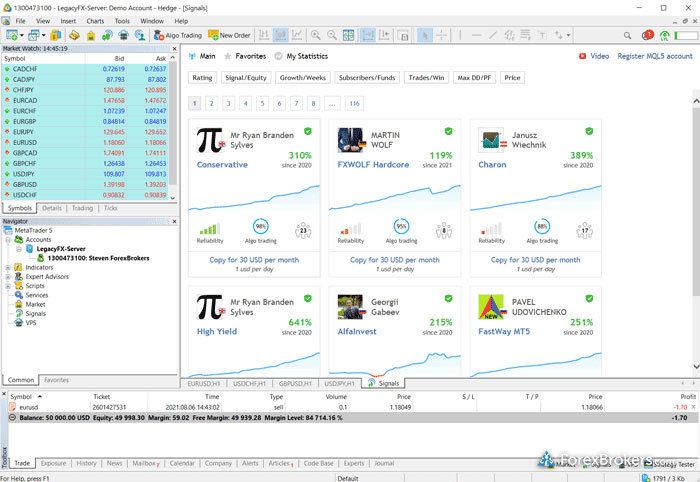

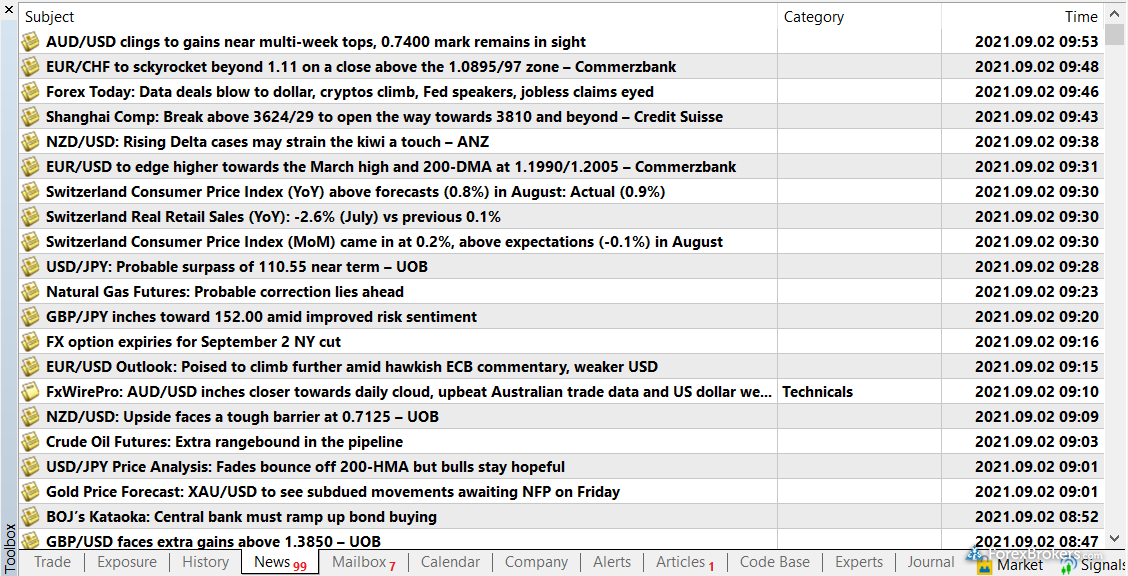

LegacyFX Review (Historical)

- Trust Score (2025): 67/99

- Overall Rating (2025): 3.5/5.0 Stars

- Historical Ranking: #62 in 2025, #60 in 2024, #54 in 2023, #38 in 2022

- Minimum Deposit: $500

- Total Symbols: 425+

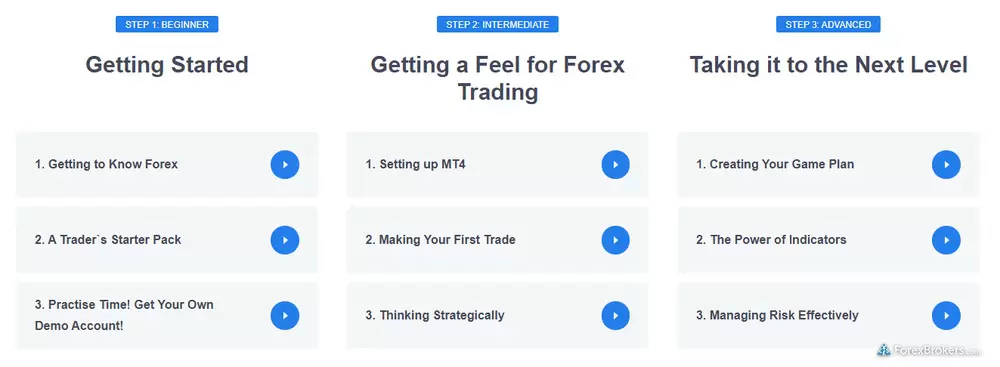

LegacyFX is a MetaTrader 5 (MT5) broker offering 425 CFDs across forex, commodities, equities, ETFs, metals, and cryptocurrencies. Traders have access to multiple account types with varying deposit requirements, starting from $500. The broker also provides Autochartist integration for signals, as well as an educational academy with structured video lessons.

Strengths include access to the full MT5 platform suite, social trading support, and a solid foundation of video-based research and education. Weaknesses include the absence of average spread data, limited written research, higher trading costs on entry-level accounts, and a regulatory profile that combines both Tier-1 and Tier-4 licenses.

LegacyFX is authorized under CySEC in the EU (Tier-1) and operates an additional offshore entity. With a Trust Score of 67, ForexBrokers.com classified LegacyFX as High Risk as of 2025.

Moneta Markets Review (Historical)

- Trust Score (2025): 79/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #35 in 2025, #36 in 2024, #36 in 2023, #29 in 2022, #22 in 2021

- Minimum Deposit: $50

- Total Symbols: 1,016+

Moneta Markets offers the full MetaTrader suite (MT4/MT5) plus a TradingView-powered web and mobile experience via Pro Trader/AppTrader. The broker supports copy trading through Pelican and DupliTrade, and rounds out its toolkit with Trading Central features such as Market Buzz and Featured Ideas. Pricing depends on account type: the commission-free Direct STP account carries wider spreads, while Prime ECN tightens spreads with a $6 round-trip per lot commission; Ultra ECN lowers commission to $2 round-trip but requires a $20,000 deposit.

Strengths include TradingView charting with trade-from-chart, multi-platform flexibility, and a Trust Score boost from obtaining a U.K. Tier-1 FCA license (via VIBHS). Weaknesses include research and education that trail leaders, occasional site quality issues, and costs that are not especially low unless you opt for higher-tier accounts.

Moneta Markets is authorized by one Tier-1 regulator (FCA), one Tier-2, and holds an additional Tier-4 license. With a Trust Score of 79, ForexBrokers.com classified Moneta Markets as Average Risk as of 2025.

MultiBank Group Review (Historical)

- Trust Score (2025): 84/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #40 in 2025, #38 in 2024

- Minimum Deposit: $50

- Total Symbols: 1,042+ (14,145 advertised; additional markets by request)

MultiBank Group is a multi-asset broker offering forex and CFDs via MT4/MT5, plus TradingView-powered MultiBank-Plus on web and a proprietary mobile app. The brand also operates a regulated crypto exchange (MEX Digital) for trading underlying crypto assets. Copy trading is available through an in-house platform and MetaTrader Signals, and Dow Jones headlines integrate into MetaTrader. Pricing spans three account types: Standard (higher spreads, $50 min), Pro ($1,000 min, lower spreads), and ECN ($10,000 min, competitive spreads with ~$3 round-trip commission). An inactivity fee of $60/month applies after 90 days without trading.

Strengths include broad brand coverage, multiple platform choices, competitive ECN pricing, and real crypto access. Weaknesses include limited research depth, minimal education, above-average spreads on the Standard account, and only 1,042 of 14,145 advertised markets enabled by default without manual requests.

MultiBank Group holds three Tier-1 licenses (including ASIC and MAS), one Tier-2, and three Tier-4 licenses. With a Trust Score of 84, ForexBrokers.com classified MultiBank Group as Trusted as of 2025.

RoboForex Review (Historical)

- Trust Score (2025): 73/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #46 in 2025, #40 in 2024, #41 in 2023

- Minimum Deposit: $100

- Total Symbols: 8,400+

RoboForex and RoboMarkets, separate brands under the same group, provide access to forex and CFDs through MT4, MT5, TradingView, and the proprietary R StocksTrader platform. With up to 8,400 symbols available on R StocksTrader, the broker offers a wide multi-asset lineup. Account choices range from commission-free to ECN-style pricing, and copy trading is supported through CopyFX. Third-party research from Trading Central and Acuity Trading supplements the platform offering.

Strengths include extensive market access, diverse platform options, algo-trading support, and multiple account types. Weaknesses include high spreads on certain accounts, limited educational content, a lack of fresh research, and blog content that is often outdated.

RoboForex and RoboMarkets are authorized by one Tier-1 regulator in the EU under MiFID and hold additional Tier-4 licenses. With a Trust Score of 73, ForexBrokers.com classified RoboForex as Average Risk as of 2025.

TMGM Review (Historical)

- Trust Score (2025): 83/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #37 in 2025, #35 in 2024, #28 in 2023, #36 in 2022

- Minimum Deposit: $100

- Total Symbols: 12,000+

TMGM offers forex and CFDs through MT4 and MT5, with additional access to equities via the IRESS platform. Traders can choose between the spread-only Classic account or the commission-based Edge account, which charges $3.50 per side ($7 per round-trip) alongside tight spreads. The broker also supports crypto CFDs on 12 pairs, VPS hosting for algo trading, and tools from Trading Central and Acuity Trading.

Strengths include low minimum deposits, competitive commission pricing, and support for both MT4 and MT5. Weaknesses include limited research and education (the TMGM Academy was discontinued in 2023), undisclosed spread data, and MT5’s restricted symbol count compared to the broker’s broader advertised range. The IRESS platform expands market access but requires a $5,000 deposit and is less suited for forex traders.

TMGM is authorized by two Tier-1 regulators (ASIC and FMA) and also holds Tier-4 licenses. With a Trust Score of 83, ForexBrokers.com classified TMGM as Trusted as of 2025.

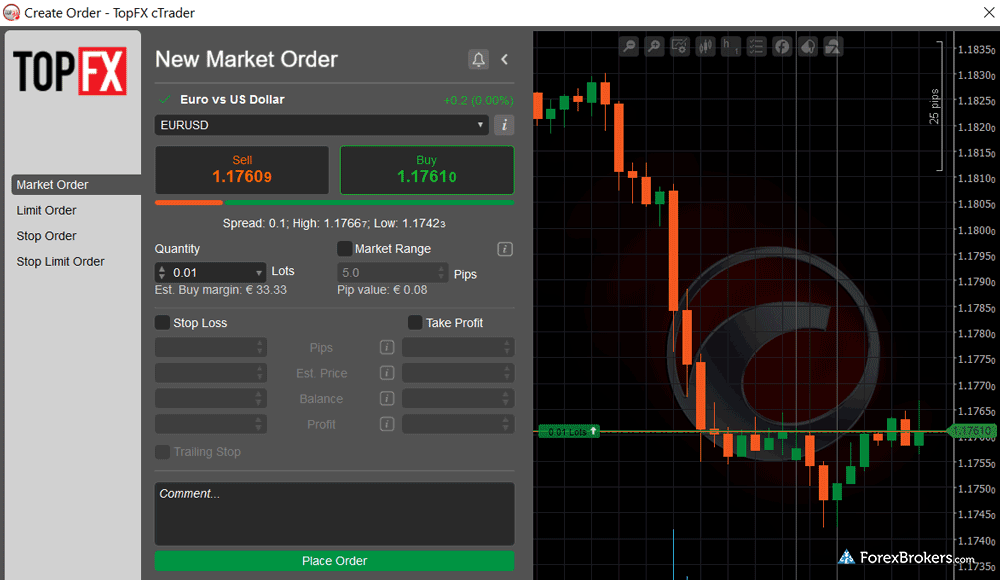

TopFX Review (Historical)

- Trust Score (2025): 67/99

- Overall Rating (2025): 3.5/5.0 Stars

- Historical Ranking: #61 in 2025, #58 in 2024, #57 in 2023, #39 in 2022

- Minimum Deposit: Depends on payment method

- Total Symbols: 655+

TopFX provides access to forex and CFDs through both MetaTrader 4 (MT4) and cTrader, with Autochartist integrated into cTrader. Account options include a commission-free Zero account and a RAW account with tighter spreads and a €2.75 per side commission. The broker supports social trading and offers a medium range of instruments, including 60 forex pairs and crypto CFDs.

Strengths include availability of both MT4 and cTrader, competitive pricing on RAW accounts, and integrated Autochartist tools. Weaknesses include the lack of MetaTrader 5, minimal educational resources, limited research content, and a narrower product range compared to industry leaders.

TopFX is authorized under MiFID in the EU (Tier-1) and also holds a Tier-4 license. With a Trust Score of 67, ForexBrokers.com classified TopFX as High Risk as of 2025.

Trade Nation Review (Historical)

- Trust Score (2025): 85/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #34 in 2025, #34 in 2024, #35 in 2023, #33 in 2022

- Minimum Deposit: $0

- Total Symbols: 1,000+

Trade Nation offers fixed-spread pricing and ease-of-use across its web and mobile trading platforms, including the proprietary TN Trader and support for MetaTrader 4. With over 1,000 tradeable instruments including forex, indices, commodities, metals, bonds, and crypto CFDs, it caters well to beginner and casual traders.

Strengths include highly competitive spreads, access to TradingView, and copy trading via TradeCopier and Pelican. The mobile and web platforms are intuitive and visually clean, helping Trade Nation earn Best in Class for Ease of Use and Commissions & Fees in 2025. However, its education and research offerings remain limited compared to leading brokers, and the TN Trader platform lacks advanced features like economic calendars or drag-to-modify orders on charts.

Regulated by top-tier bodies including the FCA and ASIC, Trade Nation carries a Trust Score of 85. ForexBrokers.com classified the broker as Trusted as of 2025.

VT Markets Review (Historical)

- Trust Score (2025): 70/99

- Overall Rating (2025): 4.0/5.0 Stars

- Historical Ranking: #45 in 2025, #41 in 2024, #38 in 2023, #30 in 2022, #25 in 2021

- Minimum Deposit: $100

- Total Symbols: 1,000+

VT Markets offers forex and CFDs through the MetaTrader suite (MT4 and MT5), as well as its own mobile app and WebTrader Plus powered by TradingView. Social and copy trading are supported via VTrade, and traders who deposit at least $500 gain access to Trading Central tools and signals from Acuity Trading. Account options include Standard STP (commission-free, wider spreads) and Raw ECN (tighter spreads with low commissions).

Strengths include competitive ECN pricing, access to popular third-party tools, and a well-designed proprietary mobile app that integrates news and research. Weaknesses include a smaller range of markets compared to leading MetaTrader brokers, limited education, and modest research offerings that rely heavily on third-party content. Its Trust Score has also declined since becoming independent, as it now holds only two regulatory licenses.

VT Markets is authorized by ASIC (Tier-1) and one Tier-2 regulator. With a Trust Score of 70, ForexBrokers.com classified VT Markets as Average Risk as of 2025.

Xtrade Review (Historical)

- Trust Score (2025): 74/99

- Overall Rating (2025): 3.5/5.0 Stars

- Historical Ranking: #59 in 2025, #63 in 2024, #61 in 2023

- Minimum Deposit: $250

- Total Symbols: 482

Xtrade – also known as OffersFX in Europe – provides forex and CFD trading through its proprietary web and mobile platforms, with access to nearly 500 symbols. Its WebTrader integrates TradingView-powered charts and Finansoft trading signals, while its redesigned mobile app offers an improved user experience with seamless asset switching and sentiment tools.

However, Xtrade trails top brokers in several categories. The range of instruments is smaller than the industry average, educational resources are outdated and basic, and MetaTrader is not supported. Another drawback is the cancellation of Xtrade’s license by ASIC, which negatively impacts its Trust Score.

With one Tier-1, one Tier-2, and one Tier-4 regulatory license, Xtrade holds a Trust Score of 74, placing it in the Average Risk category as of 2025.

Archived Broker Ratings

In addition to our full historical reviews, ForexBrokers.com also collected data, tested features, and assigned ratings to a wider group of brokers. While these brokers did not receive full written reviews, the following archive preserves their key statistics and Trust Scores for reference.

Alpari

- Trust Score (2025): 68/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $20

- Total Symbols: 105

Alpari was included in our annual testing for 2025 but not reviewed in depth.

ATFX

- Trust Score (2025): 85/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $500

- Total Symbols: 150

ATFX was included in our annual testing for 2025 but not reviewed in depth.

Axi

- Trust Score (2025): 82/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $0

- Total Symbols: 175

Axi was included in our annual testing for 2025 but not reviewed in depth.

Doo Prime

- Trust Score (2025): 83/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $100

- Total Symbols: 10,000

Doo Prime was included in our annual testing for 2025 but not reviewed in depth.

Earn (formerly Teletrade)

- Trust Score (2025): 71/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $100

- Total Symbols: 500

Earn was included in our annual testing for 2025 but not reviewed in depth.

easyMarkets

- Trust Score (2025): 84/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $25

- Total Symbols: 230

easyMarkets was included in our annual testing for 2025 but not reviewed in depth.

FXOpen

- Trust Score (2025): 76/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $100

- Total Symbols: 87

FXOpen was included in our annual testing for 2025 but not reviewed in depth.

FXPrimus

- Trust Score (2025): 71/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $100

- Total Symbols: 140

FXPrimus was included in our annual testing for 2025 but not reviewed in depth.

FXGT

- Trust Score (2025): 69/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $5

- Total Symbols: 117

FXGT was included in our annual testing for 2025 but not reviewed in depth.

GBE brokers

- Trust Score (2025): 71/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $1,000

- Total Symbols: 500

GBE brokers was included in our annual testing for 2025 but not reviewed in depth.

iFOREX

- Trust Score (2025): 75/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $100

- Total Symbols: 750

iFOREX was included in our annual testing for 2025 but not reviewed in depth.

IronFX

- Trust Score (2025): 83/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $50

- Total Symbols: 340

IronFX was included in our annual testing for 2025 but not reviewed in depth.

Libertex (Forex Club)

- Trust Score (2025): 73/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $10

- Total Symbols: 300

Libertex was included in our annual testing for 2025 but not reviewed in depth.

Markets.com

- Trust Score (2025): 93/99

- Overall Rating (2025): 4.5/5

- Minimum Deposit: $100

- Total Symbols: 2,179

Markets.com was included in our annual testing for 2025 but not reviewed in depth.

Markets4you

- Trust Score (2025): 61/99

- Overall Rating (2025): 3.5/5

- Minimum Deposit: $0

- Total Symbols: 150

Markets4you was included in our annual testing for 2025 but not reviewed in depth.

ThinkMarkets

- Trust Score (2025): 92/99

- Overall Rating (2025): 4/5

- Minimum Deposit: $50

- Total Symbols: 4,000

ThinkMarkets was included in our annual testing for 2025 but not reviewed in depth.