Best MetaTrader 5 (MT5) Forex Brokers for 2026

Led by Steven Hatzakis, Director of Online Broker Research, the ForexBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of forex trader, including beginners and active traders. We carefully track data on international regulators, commissions, and spreads to rate forex brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

I've been trading forex for more than 25 years and have spent over a decade working with the MetaTrader platform. My experience includes extensive use of both MetaTrader 4 (MT4) and its successor, MetaTrader 5 (MT5). This guide will help you explore some of MT5's most important features and functions.

The platform's upgrades and improvements over its predecessor, MT4, have pushed more of the best MetaTrader brokers to offer MT5. As a result, trading volume on MT5 has now eclipsed MT4 (as of April 2025). If you’ve decided that you want to use the MT5 platform (and there are good reasons for doing so), you’ll still need to pick a trustworthy, well-regulated forex broker to start trading.

Best MetaTrader 5 (MT5) brokers

When testing MT5 brokers, I download the latest version of the software and load the full list of available symbols for each broker. The core MetaTrader experience often varies little from one broker to another; to differentiate I evaluate the range of markets, account types, trading fees, execution methods, and availability of third-party plugins and custom indicators.

I also factor in whether brokers offer VPS hosting and other tools that support algorithmic trading on MetaTrader platforms. Learn more about how we test brokers and check out my list of the best MT5 forex brokers.

Trading from the U.S.?

Explore the best MT5 brokers available to U.S. traders.

- Minimum Deposit: $200

- Trust Score: 83

- Tradeable Symbols (Total): 3583

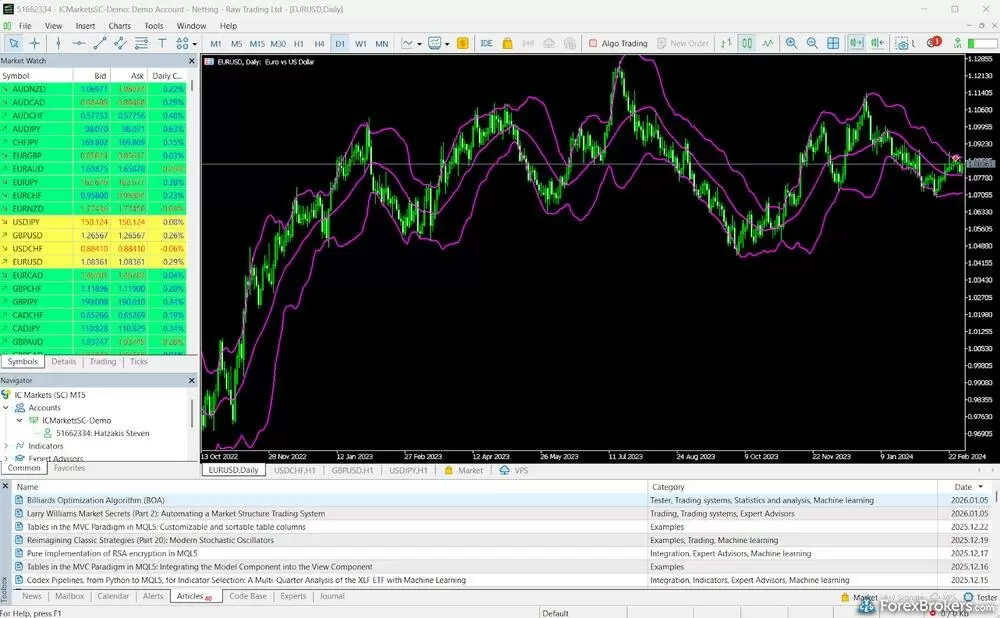

IC Markets’ competitive pricing and scalable execution make it an excellent option for algorithmic traders. Though it supports an impressive range of third-party tools and plugins, IC Markets’ research and education offerings are not as impressive as those offered by industry leaders. Read full review

- Competitive pricing and low average spreads.

- 3,500+ tradeable symbols and powerful algo trading support.

- MetaTrader broker with integrated third-party plugins.

- Educational content and research still have room for improvement.

- No proprietary forex trading app.

- Share trading is limited to Aussie stocks via IC Shares.

- Minimum Deposit: $0

- Trust Score: 94

- Tradeable Symbols (Total): 1726

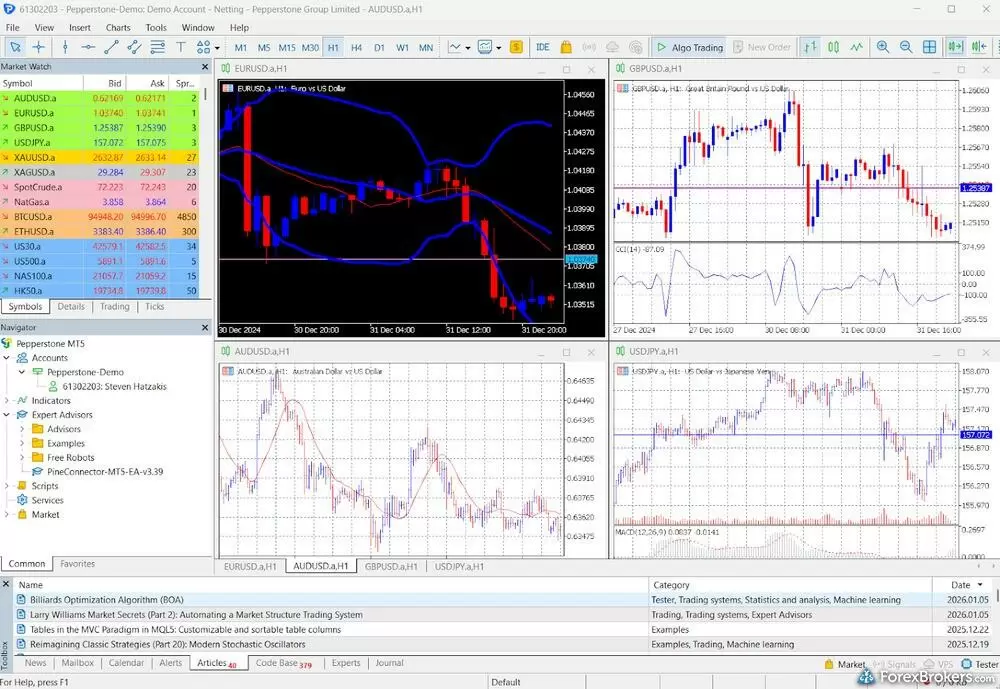

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms. Read full review

- Won Best in Class for MT5, algo trading, and more.

- Offers MetaTrader and cTrader for algo and copy trading.

- Razor account pricing is competitive for active traders.

- New mobile app has solid features and strong usability.

- Education lacks depth.

- MT5 offering has limited symbols.

- Minimum Deposit: $100 AUD

- Trust Score: 90

- Tradeable Symbols (Total): 10000

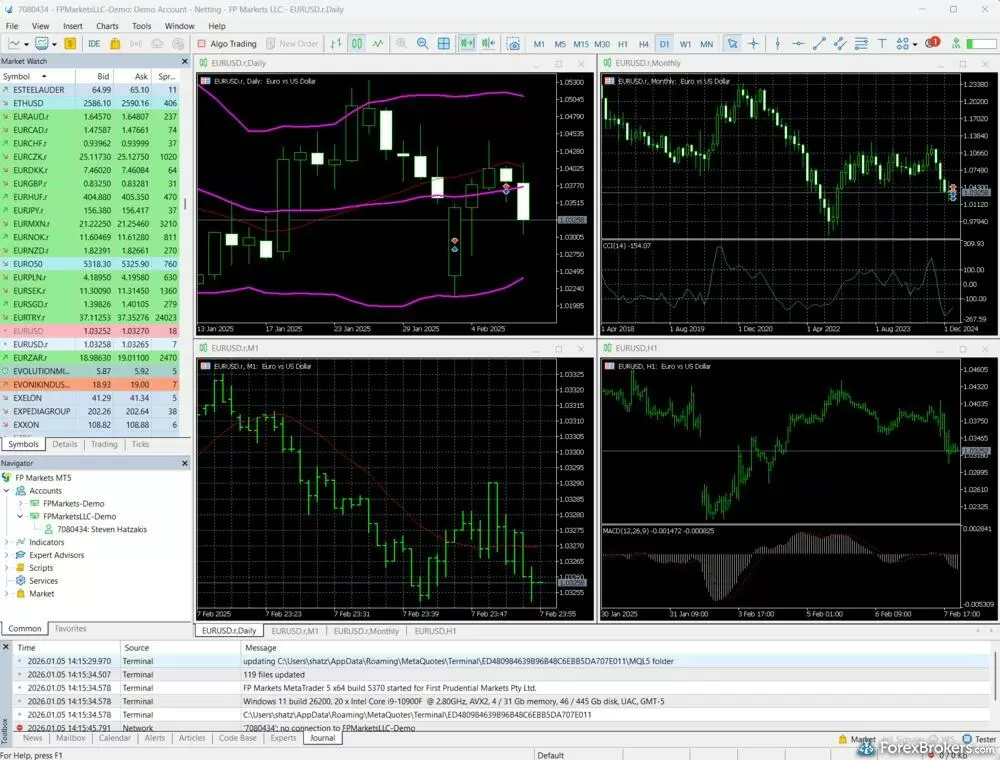

FP Markets shines as a low-cost broker for trading forex and CFDs – as long as you use the MetaTrader platform. The Iress platform suite offers well over 10,000 tradeable symbols, but it’s mostly a share trading platform – and is generally a much pricier option. Read full review

- Ultra-competitive spreads on Raw ECN account.

- Supports MetaTrader, cTrader, TradingView, and Autochartist tools.

- Access to 10,000+ tradeable symbols via the Iress platform.

- Mobile app lacks in tools and charting.

- Research and education content trails leading brokers like IG.

- Iress platform fees add up.

- Minimum Deposit: $100

- Trust Score: 99

- Tradeable Symbols (Total): 5500

FOREX.com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. It offers a wide range of markets and provides an impressive suite of proprietary platforms – alongside limited access to MetaTrader. Read full review

- Trading Academy is great for all experience levels.

- Advanced charting through TradingView with 5,500+ symbols.

- Pro-grade trading tools on web and desktop.

- Spreads are higher than other low-cost brokers.

- Pricing is average unless you qualify for active trader discounts.

- Stock and futures trading require a separate StoneXone account.

- Minimum Deposit: $10

- Trust Score: 80

- Tradeable Symbols (Total): 209

Exness is a global forex broker best known for its flexible execution, instant withdrawals, and access to extremely high leverage, alongside multiple account types and a growing ecosystem of trading tools. Read full review

- Innovative web platform with drag-to-modify order features.

- Wide forex coverage with 96 pairs and flexible account types.

- MetaTrader, Trading Central, and social trading all supported.

- Newly improved educational content on the Insights blog.

- Research content is limited and lags behind top-tier brokers.

- Narrow product range with just over 200 total tradeable symbols.

- Spreads on Standard Cent accounts are higher than other account types.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Other MetaTrader 5 brokers I tested

6. Tickmill – Great VIP account for MetaTrader

| Company | Trading Platforms | Average spread (EUR/USD) - Standard account | Forex Pairs (Total) |

Tickmill Tickmill

|

|

1.70 | 63 |

For algorithmic traders using MetaTrader 5, Tickmill offers an infrastructure optimized for pure efficiency. The Raw Account delivers an all-in cost of roughly 0.7 pips on EUR/USD, critical for preserving alpha in high-frequency strategies. Beyond execution, Tickmill subsidizes VPS hosting for automated systems and enhances the default MT5 terminal with the Advanced Trading toolkit (powered by FX Blue), adding essential utilities like correlation matrices and sentiment analysis that standard installations lack.

7. CMC Markets – Low cost trading on MT5 with FX Active

| Company | Trading Platforms | Average spread (EUR/USD) - Standard account | Forex Pairs (Total) |

CMC Markets CMC Markets

|

|

1.3 | 141 |

By connecting CMC Markets' FX Active account to MetaTrader 5, you gain access to institutional-grade pricing. You get raw spreads from 0.0 pips with a highly competitive $2.50 commission per side, creating an environment where costs won't eat your alpha. While the asset list on MetaTrader is smaller than their proprietary platform, the combination of a 99 Trust Score and this aggressive pricing model makes it a great choice for cost-conscious algo traders.

ForexBrokers.com Overall Rankings

Now that you've seen our picks for the best brokers on this guide, check out ForexBrokers.com's overall broker rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Also take a look at our full-length, in-depth forex broker reviews.

Other Forex Trading Platform Guides

- Best Trading Central Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Brokers for TradingView for 2026

- Best cTrader Brokers for 2026

- Best Brokers for ZuluTrade for 2026

- Best Copy Trading Platforms for 2026

Popular Forex Guides

Popular Forex Broker Reviews

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IC Markets

IC Markets

Pepperstone

Pepperstone

FP Markets

FP Markets

FOREX.com

FOREX.com

Exness

Exness