Eightcap Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Eightcap is more than just a MetaTrader broker. It also offers the popular TradingView platform, and other third-party resources.

Though Eightcap’s crypto offering continues to impress me, the broker’s narrow range of overall markets, lack of standout educational content, and limited research materials leave it struggling to keep up with the best forex brokers in the industry.

-

Minimum Deposit:

$100 -

Trust Score:

87 -

Tradeable Symbols (Total):

803

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| 2026 | #30 |

| 2025 | #38 |

| 2024 | #37 |

| 2023 | #34 |

| 2022 | #31 |

| 2021 | #24 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Eightcap pros & cons

Pros

- Vast selection of 86+ crypto CFDs and robust crypto tools.

- Offers MetaTrader, TradingView, and MT5's FlashTrader EA plug-in.

- AI-powered economic calendar driven by Acuity.

Cons

- Research content is sparse and videos are outdated.

- Range of markets available is narrow compared with the top multi-asset brokers.

- No proprietary mobile app; relies on third-party platforms.

My top takeaways for Eightcap in 2026:

- Offers a decent selection of over 86 cryptocurrency CFDs and received best-in-class honors for Crypto Trading in our 2026 Awards.

- Eightcap offers the award-winning TradingView platform (TradingView is the sole platform option for Eightcap's U.K.-based clients).

- Educational content has improved slightly with the launch of the Eightcap Labs section which contains a good variety of articles.

- While Eightcap’s research content has improved with the launch of Trade Zone, fresh content remains sparse, with few new articles and videos being produced.

- The range of markets, accounts, and execution methods available at Eightcap simply can’t compete with the best MetaTrader brokers.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Eightcap safe?

Eightcap is considered Trusted, with an overall Trust Score of 87 out of 99. Eightcap is not publicly traded, does not operate a bank, and is authorised by three Tier-1 regulators (Highly Trusted), one Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and two Tier-4 regulators (High Risk). Eightcap is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and regulated by CySEC, allowing registration in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Eightcap entities are regulated.

| Feature |

Eightcap Eightcap

|

|---|---|

| Year Founded | 2009 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 3 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

Range of investments

Eightcap’s 56 forex pairs and just over 800 CFDs put its range of investments in line with the industry average. Eightcap offers various asset classes, including shares, indices, commodities, and cryptocurrencies. The range of markets available at Eightcap will depend on the platform you use, your country of residence, and the Eightcap entity that holds your account. The following table summarizes the different forex and CFD investment products available to Eightcap clients.

Cryptocurrency: Cryptocurrency trading is available at Eightcap through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

Eightcap Eightcap

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 803 |

| Forex Pairs (Total) | 55 |

| U.S. Stocks (Shares) | No |

| Global Stocks (Non-U.S. Shares) | No |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Eightcap fees

Eightcap offers two account types across its global entities, including those licensed in Australia, the Bahamas, the U.K., and Cyprus. The commissions and fees you pay will depend on whether you choose the commission-based Raw account or the spread-only Standard account.

Raw account: The Raw account at Eightcap features average spreads of 0.11 pips during September 2025, for the EUR/USD pair, excluding the rollover period when spreads tend to widen. While this pricing is better than its Standard account spreads, it’s important to remember that the Raw account incurs a per trade commission of roughly $7 per standard lot round turn ($3.5 per side), bringing the all-in cost closer to 0.81 pips.

Standard account: The standard account at Eightcap is their option for commission-free forex trading. The average spread on the Standard account at Eightcap during September 2025 was 1.16 pips for EUR/USD, making this a slightly more expensive option compared to the Raw account.

Overall, Eightcap is slightly more expensive than the lowest-cost forex brokers.

| Feature |

Eightcap Eightcap

|

|---|---|

| Minimum Deposit | $100 |

| Average spread (EUR/USD) - Standard account | 1.0 |

| All-in Cost EUR/USD - Active | 0.76 |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

With no proprietary mobile app available, Eightcap simply can’t compete with industry leaders like IG and Saxo. For our top picks among trading apps, read our guide to best forex trading apps.

Apps overview: Eightcap offers the MetaTrader platform suite; iOS and Android versions of the MT4 and MT5 app are both available for download from the Apple App Store and Google Play store, respectively. In addition, the popular TradingView mobile app, widely known for its powerful charting capabilities, is available at Eightcap. Learn more by checking out our TradingView guide.

A chart in MetaTrader 4's mobile app, accessed through Eightcap's offering.

| Feature |

Eightcap Eightcap

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 30 |

Trading platforms

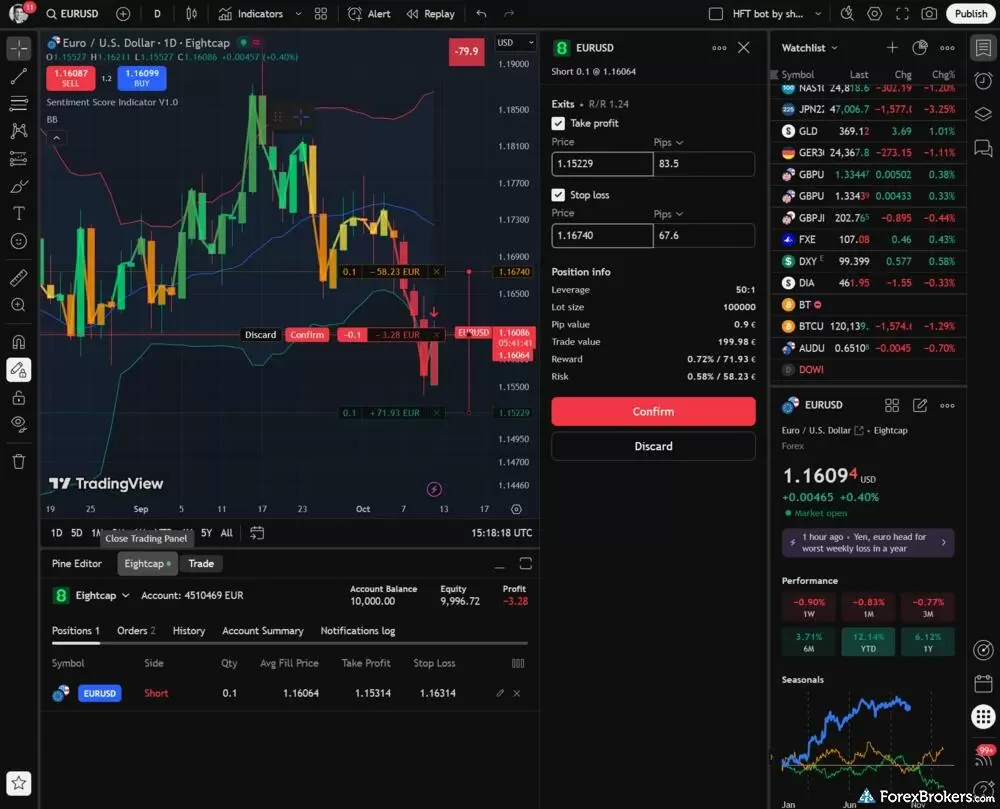

Eightcap offers the full MetaTrader platform suite (MetaTrader 4 and the newer MetaTrader 5), along with TradingView. To enhance the default MT5 experience, Eightcap also provides the FlashTrader EA, an automated trading tool that adds stops and targets to every trade, allowing you to focus more on strategy. A plugin from Acuity is also available at Eightcap for use with MetaTrader 5.

Eightcap seamlessly integrates with TradingView, enabling traders to execute strategies using industry-leading technical analysis tools without leaving the platform.

Platform availability, however, may vary depending on the jurisdictional entity covering your account. Under the FCA entity for U.K. clients, only TradingView is available (not MetaTrader). Meanwhile, under the CySEC entity, only MT5 (not MT4) and TradingView are offered.

With a variety of extra features that elevate the standard MetaTrader experience, Eightcap has positioned itself closer to what the best MetaTrader brokers provide. In addition to these platforms, Eightcap’s in-house Eightcap Labs initiatives also offer a range of trading tools to further support your trading strategy.

| Feature |

Eightcap Eightcap

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Trade From Chart | Yes |

Research

Eightcap produces a modest variety of research content that includes updates in both written and video formats. However, its research offering doesn’t stack up against what the best brokers offer for research. For example, content on its YouTube channel related to research has not been updated recently, with the last research video published at least seven months ago as of the time of this updated review. There are upcoming webinars scheduled, but I found that they are presented in Mandarin (Chinese) as part of Eightcap’s Practical Strategy & Market analysis webinar series. Expanding webinars to include English language coverage will help balance out Eightcap’s webinar offering.

Research overview: Eightcap’s research primarily takes the form of written updates from its in-house staff, such as its Trading Week Ahead series, accompanied by the occasional video posted to the firm’s YouTube channel, which hosts its Market Update and Trade Zone video series, along with content from Eightcap Labs.

Market news and analysis: Expanding the frequency and consistency of content, and range of research by integrating third-party research tools (such as Autochartist and Trading Central) would help lift Eightcap’s ranking in this category. For instance, adding the AI-powered economic calendar from Acuity Trading was a step in the right direction for Eightcap to build out its research offering.

Economic calendar events within Eightcap’s platform, supporting decision-making and market analysis.

| Feature |

Eightcap Eightcap

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central | No |

| Client sentiment data | Yes |

Education

Eightcap’s educational offering delivers a wide variety of written articles, but only a limited selection of videos. Some of the best brokers in this category offer lesson programs, complete with quizzes and progress tracking – features that are absent at Eightcap.

Learning center: Eightcap offers just a dozen educational videos, and a handful of archived webinars, such as its TraderFest series which covers CFDs and forex. These videos are archived on its YouTube channel and organized by playlist. The selection of written educational content articles has improved, and includes at least 74 articles covering fundamentals and trading strategies, following the launch of Eightcap Labs.

Steven's expert take

"While its new Eightcap Labs section is a nicely re-designed interface, expanding the selection of educational videos and organizing articles by experience level would help balance Eightcap’s overall educational offering, in addition to adding organized educational courses, quizzes, and progress-tracking."

Eightcap Labs features a "Latest Fundamentals" section that provides traders with in-depth strategic guides ranging from Index CFD trading and navigating market volatility to specific breakdowns of EUR and GBP currency crosses.

| Feature |

Eightcap Eightcap

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | No |

Final thoughts

By offering various platform plug-ins and granting access to third-party tools like FlashTrader EA, Eightcap has taken strides to improve on the standard MetaTrader platform suite. Eightcap also offers a stellar cryptocurrency offering, leading us to recognize it for best-in-class honors in our 2026 Annual Awards.

Significant hurdles remain for Eightcap to become a top MetaTrader broker, such as its narrow range of available markets, lack of a proprietary mobile app, and limited market research.

Eightcap Star Ratings

| Feature |

Eightcap Eightcap

|

|---|---|

| Overall Rating |

|

| Trust Score | 87 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Eightcap Regulation Eightcap Education, Eightcap YouTube channel

Read next

- Best Forex Brokers for Beginners of 2026

- Best Brokers for TradingView for 2026

- International Forex Brokers Search

- Best Low Spread Forex Brokers for 2026

- Compare Forex Brokers

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Forex Trading Apps for 2026

- Best Forex Brokers for 2026

- Best Copy Trading Platforms for 2026

More Forex Guides

Popular Forex Broker Reviews

About Eightcap

Eightcap was established in 2009 in Melbourne, Australia, and holds an Australian Financial Service License (AFSL) with the Australian Securities & Investment Commission (ASIC). Eightcap's U.K. entity, Eightcap Group Ltd, is authorised and regulated by the Financial Conduct Authority (FCA), and its EU entity is authorised by the Cyprus Securities and Exchange Commission (CySEC). Finally, in the offshore island nation of the Bahamas, Eightcap Global Pty Ltd holds regulatory status with the Securities Commission of the Bahamas (SCB).