Tickmill Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In this Tickmill review, I found a broker that has matured beyond its MetaTrader roots and now caters well to cost-conscious, professional, and algo-driven traders. The commission-based Raw account offers ultra-competitive spreads, and the platform lineup has caught up with a proprietary Tickmill Trader app alongside the return of TradingView and the full MetaTrader suite. Advanced users get discounts on VPS hosting, API connectivity, and access to CQG and AgenaTrader for exchange-traded products, while research is bolstered by Signal Centre, Acuity tools, and CME-sourced education.

The trade-off is scope: its range of investments trails top multi-asset rivals, pricing on its Classic account is merely average, and several third-party tools were retired in 2025. If low costs and algorithmic workflows matter most, Tickmill deserves a close look.

-

Minimum Deposit:

$100 -

Trust Score:

85 -

Tradeable Symbols (Total):

637

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| 2026 | #23 |

| 2025 | #22 |

| 2024 | #23 |

| 2023 | #24 |

| 2022 | #21 |

| 2021 | #18 |

| 2020 | #24 |

| 2018 | #29 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Tickmill pros & cons

Pros

- Raw account pricing earned Best in Class for fees in 2025.

- Offers the full MetaTrader suite with platform add-ons.

- Supports algo trading and pro-level tools like CQG.

- Trading signals powered by Signal Centre and Acuity.

Cons

- Lags top brokers in asset variety.

- Classic account pricing is average; VIP account was removed.

- Autochartist, Pelican, and Capitalise.ai were removed in 2025.

My top takeaways for Tickmill in 2026:

- Education from the CME, along with interactive sentiment data and website widgets from Acuity Trading help to complement research at Tickmill.

- Tickmill is a solid choice for professional trading and algo trading.

- Powered by DXtrade, Tickmill recently rolled out its proprietary Tickmill Trader web and mobile platform globally, and reintroduced TradingView for forex and CFD trading.

Trust Score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Tickmill safe?

Tickmill is considered Trusted, with an overall Trust Score of 85 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by two Tier-1 regulators (Highly Trusted), two Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Tickmill is authorised by the following Tier-1 regulators: Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Tickmill entities are regulated.

| Feature |

Tickmill Tickmill

|

|---|---|

| Year Founded | 2014 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

Tickmill offers 600+ tradeable symbols encompassing CFDs on 62 currency pairs, 22 indices, 19 commodities, 4 bonds, 25 ETFs, 490 stocks, and 15 cryptocurrencies. There are also at least 109 symbols available for futures and options trading which are all accessible through a separate dedicated account via the CQG and AgenaTrader platforms. The following table summarizes the different investment products available to Tickmill clients.

Cryptocurrency: Cryptocurrency trading at Tickmill is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

| Feature |

Tickmill Tickmill

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 637 |

| Forex Pairs (Total) | 63 |

| U.S. Stocks (Shares) | No |

| Global Stocks (Non-U.S. Shares) | No |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Tickmill fees

Tickmill offers two accounts: Classic and Raw. The Raw account replaced the Pro account, introducing a new, increased commission structure of $3 per side (up from $2 per side) or $6 per standard lot. Despite the recent increase, Tickmill still ranks among the best brokers for active traders, thanks to its low average spreads and effective all-in cost after factoring in the per-trade commission on the Raw account.

Classic account: The Classic account, comparable to a standard account, is commission-free, and traders pay only the bid/ask spread. But at 1.70 pips (October 2025), average spreads are significantly higher than Tickmill’s Raw account.

Raw account: Tickmill’s Raw account, which replaced the Pro account after discontinuing the VIP offering, delivers the broker’s most competitive pricing. Average spreads on the EUR/USD were just 0.10 pips in Ocotber 2025, resulting in an all-in cost of 0.70 pips when factoring in the round-turn commission equivalent of 0.6 pips ($3 per side). This pricing is highly competitive and better than the industry average. It's worth mentioning that Tickmill records typical spread data under normal market conditions when spreads are narrower.

With a low minimum deposit of just $100, the Raw account remains accessible to a broad range of traders. The per-trade commission is $3 per side per 100,000 units, and while this is a recent increase, the combination of tight spreads, low barrier to entry, and versatile execution policies for algo trading makes the Raw account an excellent choice for most traders.

| Feature |

Tickmill Tickmill

|

|---|---|

| Minimum Deposit | $100 |

| Average spread (EUR/USD) - Standard account | 1.70 |

| All-in Cost EUR/USD - Active | 0.70 |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Tickmill has evolved from a MetaTrader-only broker, with MT4 and MT5 apps available for iOS and Android, to a multi-platform provider offering a range of trading apps. Its lineup now includes specialised platforms for futures and options, such as CQG and AgenaTrader. Tickmill has also launched Tickmill Trader, its proprietary mobile app with full trading functionality, available globally and positioning the broker to compete more closely with leading mobile platforms.

Tickmill's MT5 mobile app charts with multi-time-frame charting and technical indicators.

| Feature |

Tickmill Tickmill

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | No |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 30 |

Trading platforms

Tickmill continues to cement its status as a multi-asset broker with the launch of MetaTrader 5 from its U.K. and EU entity. Evolving beyond its MetaTrader roots, Tickmill now also provides multiple additional platforms, including its proprietary Tickmill Trader. For futures and options trading, U.K. traders can access the CQG platform, while the Mercury-version of AgenaTrader and other third-party applications are available with Direct Market Access (DMA) to major U.S. and European futures exchanges. Tickmill has also reintroduced TradingView for forex and CFD trading. These additions reflect significant strides in its platform offerings, positioning Tickmill to compete with the industry’s leading brokers.

Tickmill Trader: Tickmill Trader, the web-based platform powered by DXtrade, features a modern interface and supports drag-to-modify orders directly on charts, which is a standard I now expect from top platforms. Its charts offer over 90 indicators, though you can only apply five at a time, a minor limitation on otherwise powerful charting. The dashboard includes insightful performance metrics, such as average winning versus losing trade holding hours and net P&L, making it useful for refining strategies.

The broker's web platform, Tickmill Trader, supports drag-to-modify trading functionality on its charts.

TradingJournal: Building on the performance analytics theme, the TradingJournal tab allows you to tag previous trades with keywords like 'news,' 'impulse,' 'strategy,' 'market event,' and 'error' to extract lessons from past outcomes. Overall, Tickmill Trader has a solid foundation, and adding more research tools like news headlines and trading signals could further enhance the platform.

Steven's take:

"I was also able to test its newly launched Tickmill Trader web platform, which has streamlined charts, a customizable modern layout, trading from the chart, and performance analytics. I look forward to seeing it evolve as it already has a great foundation for such a new platform, despite the lack of some common features like news headlines."

Trading tools: Among Tickmill’s highlights are FX Blue add-ons through the Advanced Trading toolkit, VPS hosting for algorithmic traders, and an API supporting third-party platform connectivity. Tickmill Trader’s web platform also includes strong performance analytics under the Trading Dashboard tab, offering metrics like average profit and loss, risk-reward ratios, and other key data points.

A trade ticket in the proprietary Tickmill Trader platform, with stop loss and take profit both enabled.

| Feature |

Tickmill Tickmill

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 91 |

| Charting - Trade From Chart | Yes |

Research

Tickmill remains competitive in market research and continues to improve each year, highlighted by its newly redesigned 2025 blog, which offers a modern look and smooth layout. However, it still lags behind leaders like IG and Saxo in depth, personalization, and overall quality. For example, despite the improved layout, its market coverage articles lack the breadth and frequency offered by top competitors.

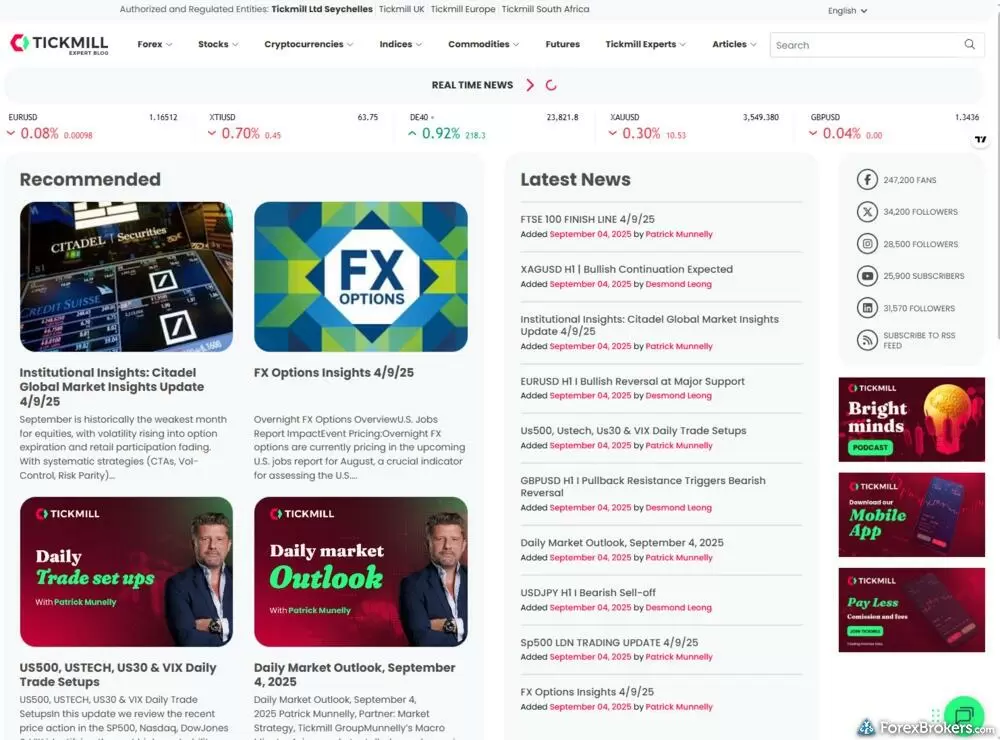

Research overview: Tickmill produces daily articles on its Expert Blog that cover technical and fundamental analysis, along with video updates published on its YouTube channel. Tickmill’s third-party research tools consist of forex news headlines which stream from Investing.com, and TradingView widgets power the broker's economic calendar, along with widgets from Acuity. Tickmill also delivers content across social media, such as its dedicated Facebook group and its Telegram channel.

The "Expert Blog" section of the Tickmill website contains daily articles with expert analysis.

Market news and analysis: Tickmill does a fine job pairing solid market coverage with a good balance of research content. There are articles that focus on technical analysis, paired with offerings like the Weekly Live Markets & Trade Analysis series that analyze market fundamentals. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its YouTube page – such as its daily Chart Hits series which are quick one-minute updates, and Session with Charlie Burton, consisting of live market analysis. Finally, Tickmill offers CME-based interactive sentiment data, built-in sentiment widgets, and trading signals from the Signal Centre powered by Acuity Trading.

Copy trading: Besides the native Signals market available in MetaTrader, Tickmill now only offers two platforms for social copy-trading that connect directly to your MetaTrader account, following the discontinuation of its ZuluTrade and Pelican Trading offer globally (except for grandfathered clients). There is Tickmill Social, the company's in-house copy trading solution which is only available in its Seychelles entity, and the AutoTrade feature of Myfxbook that is available to clients not registered under the firm's U.K. or EU branches.

| Feature |

Tickmill Tickmill

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | No |

| Client sentiment data | Yes |

Education

Tickmill’s educational content is on par with the industry average. It offers access to a large archive of webinars and an expanding library of courses but lacks variety in educational articles beyond the integrated content in its CME Group-powered Education Hub, which focuses on futures trading. Notably, Tickmill’s new podcast, "The Trader’s Clinic," features TV-quality production and insightful deep dives led by professional money managers.

Learning center: Highlights include live educational courses, a handful of comprehensive eBooks, infographics, and weekly webinars that are hosted in various languages and archived on YouTube.

Tickmill’s educational video series on YouTube, this one covering an introduction to futures trading.

Room for improvement: Tickmill continues to expand its educational offering, in both its scope of material and variety of formats. For instance, its recently introduced Masterclass series, available on YouTube channel, features hour-long sessions that cover topics of interest for beginners and advanced traders. Tickmill also offers its Bright Minds series and the T-Show podcast-style series; I found these series insightful and educational, although the firm's UK channel has not been as active in recent months, compared to its global channel with "The Trader's Clinic" podcast.

By adding a dedicated educational portal to its Education Hub, Tickmill has strengthened its offering, though it remains focused on futures and the CQG platform. The best brokers provide multi-asset courses with quizzes and progress tracking, which Tickmill does not yet offer.

| Feature |

Tickmill Tickmill

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

Tickmill primarily appeals to high-volume, high-balance traders interested in trading only the most popular forex and CFD instruments. Its offering includes a variety of copy-trading platforms and two main account types: spread-only and commission-based.

Thanks to its low effective average spreads (factoring in per-trade commissions and Raw account pricing), Tickmill earned Best in Class honors for Commissions & Fees in our 2025 Annual Awards. It also achieved Best in Class recognition for Copy Trading, MetaTrader, and Algo Trading.

However, its drawbacks include a limited market range, modest research materials, and underwhelming educational content. And while Raw account pricing is highly competitive, the top forex brokers deliver more than just low-cost trading.

Tickmill Star Ratings

| Feature |

Tickmill Tickmill

|

|---|---|

| Overall Rating |

|

| Trust Score | 85 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Different Tickmill Regulation Tickmill Education, Tickmill YouTube channel

Read next

- Best Brokers for TradingView for 2026

- Best Copy Trading Platforms for 2026

- Best Low Spread Forex Brokers for 2026

- Compare Forex Brokers

- Best Forex Trading Apps for 2026

- Best Forex Brokers for Beginners of 2026

- Best Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- International Forex Brokers Search

More Forex Guides

Popular Forex Broker Reviews

About Tickmill

Tickmill was founded in 2014 by Brothers Ingmar and Illimar Mattus, both long-time forex industry entrepreneurs with significant experience in financial services. Today the Tickmill brand holds regulatory status in the U.K., Cyprus, South Africa, The United Arab Emirates, and Seychelles. According to its website, Tickmill Group has over 250 staff and more than 327,000 customers.