CMC Markets Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets is well-trusted across the globe and delivers a terrific trading experience thanks to its excellent pricing and selection of over 12,000 tradeable instruments.

CMC Markets’ proprietary Next Generation trading platform is packed with quality research and innovative trading tools, and its low-cost offerings won CMC Markets our 2025 Annual Awards for #1 Commissions & Fees as well as finishing Best in Class across five categories, including Overall.

-

Minimum Deposit:

$0 -

Trust Score:

99 -

Tradeable Symbols (Total):

12029

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Most Currency Pairs | Winner |

| 2026 | #5 |

| 2025 | #4 |

| 2024 | #4 |

| 2023 | #4 |

| 2022 | #3 |

| 2021 | #3 |

| 2020 | #3 |

| 2019 | #3 |

| 2018 | #3 |

| 2017 | #3 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

CMC Markets pros & cons

Pros

- More than 12,000 instruments and over 282 forex pairs available (including both quote directions, e.g. EUR/USD and USD/EUR).

- Next Gen platform is packed with tools, charts, pattern recognition, sentiment data, and news headlines from Reuters.

- Industry-best pricing with low spreads and active trader perks.

- Launched 24/7 crypto trading, following its acquisition of StrikeX.

Cons

- MetaTrader 4 offering has fewer symbols and limited product depth.

- Spreads have worsened slightly year-over-year on certain pairs.

- No automated trading on CMC’s proprietary platform.

- Education lacks progress tracking or interactive features.

- The quantity of research content produced has slowed compared to previous years.

My top takeaways for CMC Markets in 2026:

- CMC Markets is a leader for low-cost forex trading, with measurably lower trading costs compared to the industry.

- CMC Markets delivers a terrific user experience, as well as advanced tools, market research, and an excellent mobile trading app.

- CMC Markets’ Dynamic Trading product for professional clients allows for the fine-tuning of allocations through percentage weightings of investment portfolios.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is CMC Markets safe?

CMC Markets is considered Highly Trusted, with an overall Trust Score of 99 out of 99. CMC Markets is publicly traded, does not operate a bank, and is authorised by six Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 licenses (High Risk). CMC Markets is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Canadian Investment Regulatory Organization (CIRO), Monetary Authority of Singapore (MAS), Financial Markets Authority (FMA), and the Financial Conduct Authority (FCA) and the European Union via MiFID. Learn more about Trust Score or see where the different CMC entities are regulated.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Year Founded | 1989 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 6 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

Range of investments

CMC Markets is a top broker for CFD trading and offers nearly 12,000 CFDs, a large number of forex pairs, and access to international equity markets (such as Australia). CMC Markets also quotes its 141 currency pairs both ways (not just EUR/USD – but also the inverse USD/EUR quote). This unique feature doubles the number of CMC Markets’ available pairs – bringing the total up to 282 and helping CMC win our 2025 Annual Awards for #1 Most Currency Pairs.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

Share dealing at CMC Markets

If you live in the U.K., check out the review of CMC Invest at our sister site, UK.StockBrokers.com. CMC Invest is a share dealing app for U.K. investors, launched by CMC Markets Group. CMC Invest is available via mobile on a stand-alone basis with commission-free trading across all account types.

The following table summarizes the different investment products available to CMC Markets clients.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 12029 |

| Forex Pairs (Total) | 141 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

CMC Markets fees

In our 2025 Annual Awards, CMC Markets won #1 in our Commissions and Fees category thanks to its consistently low spread offering, which is available for all customer segments and account types.

Average spreads: CMC Markets offers competitive pricing that ranks above the industry average, with typical spreads of 0.65 pips on the EUR/USD – according to CMC Markets’ price data for June 2025.

Active trader program: CMC Markets recently revised its active trader offering as part of its new Price Plus Scheme. This program allows you to realize discounts on trading costs based on your collected Trading Points. Trading Points are calculated based on the markets you trade and on your overall monthly volumes. Two Trading Points can be earned for every standard lot (100,000 units) traded, for example. In this scenario, an investor would need to trade 1,250 standard lots in a given month to trigger the 20% spread discount available at Tier 4.

Commission-based pricing: In 2022, CMC Markets launched a new pricing structure called FX Active, which charges a commission per trade on top of highly competitive spreads. Rolled out in the Southeast Asia region, as well as in Australia, New Zealand, Canada, and the U.K., FX Active is available on both MT4 and Next Generation platforms.

FX Active’s commission-based pricing comes in at $2.50 per side with minimum spreads of zero pips, resulting in a 1.15 pip all-in cost when trading the EUR/USD (using June 2025 data based on 0.65 pip average spreads). For contrast, the spread for the EUR/USD on CMC Markets’ standard account offering on MetaTrader comes in at 1.3 pips as per June 2025 data.

It’s always important to examine the average spread – rather than the minimum spread – when comparing spreads and trading costs across different forex brokers. That said, CMC Markets’ average spreads have historically not deviated much from its advertised minimum spreads, which is one of the reasons that we rank CMC Markets highly in this category. FX Active has only further solidified CMC Market’s position as a pricing leader.

Alpha rebates for shares trading: CMC Markets’ Alpha offering (only available in the U.K., New Zealand, Canada, and Australia) provides free access to services such as premium reports, and market data. Alpha discounts on spreads can reach as high as 20% for the most active traders (tier 5) depending on your monthly trading volumes. Alpha consists of three tiers – Classic, Active Investor, and Premium Trader – each with its own trading requirements. The Classic base tier requires 11 trades per month, while the Active Investor tier requires 11-30 trades per month – or five trades with at least $500 in commission spend. Lastly, Premium Trader becomes available if you place more than 30 transactions per month. Each tier comes with a base charge of AUD 9.90 per trade, in addition to respective discounts ranging from 0.1 bps to as little as 0.075 bps for larger trade sizes.

Guaranteed Stop-Loss Order (GSLO): Like many of its peers, CMC Markets offers GSLOs. These orders guarantee the stop-loss order price will be honored, though – like with most brokers – there is a premium for using GSLOs. The extra cost is displayed in the trade ticket window, and CMC Markets refunds this cost automatically if the GSLO is not triggered.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Minimum Deposit | $0 |

| Average spread (EUR/USD) - Standard account | 1.3 |

| All-in Cost EUR/USD - Active | 0.65 |

| Non-wire bank transfer | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | No |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

CMC Markets offers multiple apps for mobile trading, including MetaTrader, TradingView, its in-house Next Generation CMC Trading App, and CMC Invest for exchange-traded securities. For the purpose of this review, I focus on CMC Markets Next Generation, also known as the CMC Trading App mobile app, which supports over 12,000 markets, including forex, CFDs, shares and crypto.

CMC Markets' mobile app is cleanly designed and comes packed with multiple research tools, powerful charts, predefined watchlists, integrated news and educational content, and much more. Bottom line: CMC Markets delivers a terrific mobile experience and one of the best mobile trading apps.

Steven's take:

"As far as ease of use for the app I only found one minor drawback; indicators added in the web version do not automatically sync with its mobile counterpart – a feature provided by industry titans Saxo and Charles Schwab."

Watchlists do sync with the web-version, and once indicators have been added, the layout can be saved as a preset to apply to other charts on CMC Markets’ mobile app.

App overview: The overall look and feel of the CMC Markets mobile app closely resembles the web-based version of the Next Generation platform. There’s no question; CMC Markets invested ample time in the app's development, especially given the challenge of organizing so much information with such limited screen space.

The trade ticket on the CMC Markets Next Generation mobile app, showing take profit and stop-loss levels before trade submission.

Charting: Charting on CMC Markets’ mobile app is just as impressive as the web version of the Next Generation platform. Even though just 30 of the 79 technical indicators are available, it is still a strong offering compared to many of CMC Markets' competitors.

Market research: CMC Markets’ in-house staff provides research under the Intraday Update, Morning Call, Evening Call, and Price Mover categories, along with a slew of other themes available in the Next Generation mobile app. Available research material includes CMC TV, integrated educational content, webinars, and 23 videos that cover trading strategies. Also, a notable useful feature: once subscribed to an event in CMC Markets’ economic calendar, you’ll receive an alert to notify you when the event or news release time approaches.

Other tools: The predefined watch lists in the CMC Markets mobile app are great for identifying trade opportunities. Watch lists include popular products, price movers, and currently trending categories.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 29 |

Trading platforms

The CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders; it’s fast, reliable, and packed with impressive tools and features.

Platform usability: During my testing of CMC Markets’ platforms, I was extremely impressed with Next Generation’s design, which focuses on speed and usability. The platform’s layout wizard lets you choose between floating or fixed windows, in addition to predefined layouts or custom setups. Module linking is supported and features five color-coded levels. This useful function saves time, by prompting an update to the instrument displayed on your chart when you click on the corresponding symbol in your watchlist. Though it takes some time to set up the platform if you don’t use the default layout, the ease-of-use factor is comparable to Saxo’s SaxoTraderGO platform – another favorite of mine.

Charting: The Next Generation platform (or, the CMC Markets Platform for Australian users) features rich charting, with 80 technical indicators and studies, 40 drawing tools, and 60 easily attachable candlestick patterns (or 73 if you count the 13 available chart patterns). Standout charting features for the Next Generation platform include its Breakout and Emerging Patterns tools. These chart patterns auto-adjust when the chart time-scale is changed, enabling traders to scan from a one-minute chart to a monthly chart, and easily identify any existing patterns. You can also trade from the charts, including the ability to drag-to-modify your stop-loss or limit, but the process to do so isn't readily apparent and can take a few clicks to figure out, as you have to click on your order visible on the chart to activate the feature.

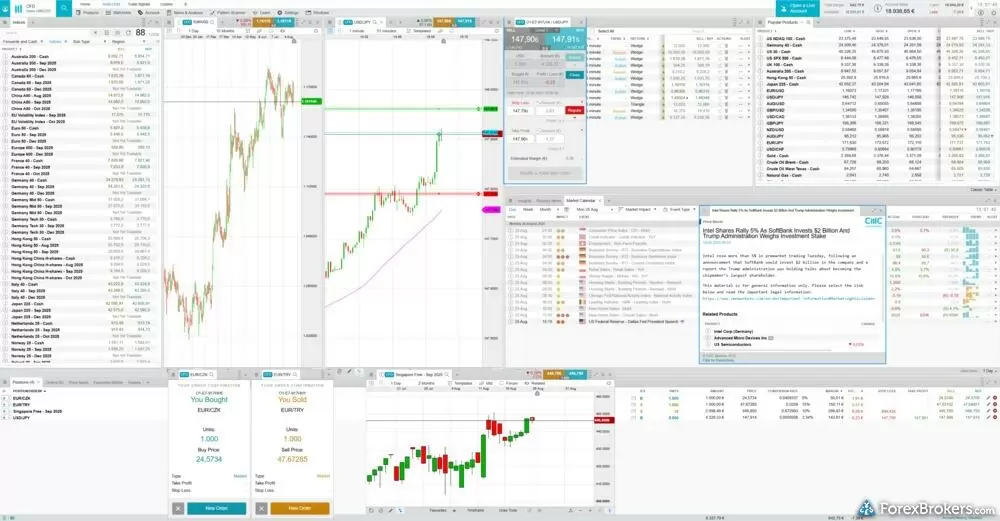

The layout of the CMC Markets Next Generation web platform including open windows for a watchlist of indices, multiple charts, product library, market calendar, insights, and positions.

Automated trading: CMC Markets’ Next Generation platform doesn't feature the ability to run automated trading strategies – though advanced order types (such as its Boundary Order) are available to help traders set deviation parameters and limit potential slippage. Traders looking for an automated trading experience can use CMC Markets’ MT4 offering – though its product range is far more limited.

MetaTrader: The range of forex pairs that CMC Markets offers on MetaTrader was boosted from 38 to 176, bringing the total tradeable products to 220. This doesn’t yet compete with the staggering 12,029 products that are offered on the CMC Markets Next Generation platform, but CMC Markets’ MT4 offering continues to improve with numerous enhancements designed to align its execution quality with the proprietary platform.

TradingView: CMC Markets recently integrated TradingView, the popular charting platform, further expanding its platform offering to meet traders’ needs. All 12,000+ instruments are available on TradingView as well, making CMC a formidable choice as a TradingView broker.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 73 |

| Charting - Trade From Chart | Yes |

Research

CMC Markets secured Best in Class honors for its research offering in our 2025 Annual Awards, thanks to its diverse lineup of high-quality in-house and third-party market research and analysis.

Research overview: CMC Markets' research offering is rich with in-house content, including its Insights News module, CMC TV, a bi-monthly print magazine, and the OPTO Trading intelligence portal, which features articles, podcasts and a print magazine published every four months. There is also third-party content from Reuters and Morningstar.

Market news and analysis: In addition to news headlines from Reuters, CMC Markets' team of analysts produces quality research in written format, such as content from OPTO, available under its News and Analysis section. Both the Insight series and Weekly Outlook series provide broad market coverage, and can be filtered by asset class. Additional articles can be found on the CMC Markets OPTO Trading Intelligence portal, including daily market analysis articles that cover global markets.

A research article on CMC Market about the week ahead, showing commentary on Nvidia's Q2 earnings, Tokyo August CPI, and U.S. PCE inflation.

Video content: CMC TV is the broker's flagship in-house broadcasting offering (comparable to IG’s similar IG TV), which produces high-quality market analysis videos. CMC Markets video production has slowed again in 2025, although still maintains multiple official channels featuring weekly forex and CFD content. The broker's OPTO YouTube channel covers share trading and broader macroeconomic themes, with an institutional-grade research feel. CMC Markets won our 2024 Annual Award for #1 Podcast Series, thanks to its excellent OPTO Sessions podcast.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central | No |

| Client sentiment data | Yes |

Education

CMC Markets competes close to the best in the industry by offering forex and CFD traders a diverse selection of education in a variety of formats, including written articles, video updates, podcasts, and live webinars.

Learning center: CMC Markets’ educational offering spans a variety of topics and covers a range of trader experience levels. From forex trading basics with related beginner articles, to advanced strategy guides that feature content about cryptocurrency trading, CMC provides a wealth of educational material. I also counted an additional 140 articles that covered topics such as fundamental and technical analysis.

Educational videos and podcasts: CMC Markets hosts a variety of educational videos, platform tutorials, and podcasts on its YouTube channel. Some of this content is also available on its website and trading platforms – such as the Artful Trader Series, the OPTO Sessions series, and its trading strategies video playlist.

The CMC Markets OPTO Sessions Podcast interviews key executives across industries that might be relevant to your portfolio.

Webinars: CMC Markets provides a good selection of webinars from its offices in Australia and the U.K., led by in-house analysts as well as third-party provider Trade with Precision.

Room for improvement: Adding quizzes and progress tracking, and centralizing all its educational materials in one place for easy accessibility would help CMC Markets to better compete with educational leaders IG and AvaTrade. Despite ramping up production in recent years, in 2025 CMC Markets again slowed production of video content on its main YouTube channel, compared to its OPTO CMC channel which continues to create excellent content.

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Webinars | No |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

With competitive pricing and almost 12,000 instruments spanning virtually every market and asset class, CMC Markets is a great choice for global forex and CFD traders. Furthermore, the CMC Markets Next Generation platform is powerful and versatile, with plenty of customization tools and configuration options.

CMC Markets continues to expand its multi-asset offering through CMC Invest, its recent acquisition of StrikeX to strengthen its crypto products, and its planned move into DeFi and Web3 technologies.

With over $35 billion in asset under custody, CMC Markets is a trusted broker and solid choice in 2025. Overall, CMC Markets won our #1 award for Commissions and Fees and finished Best in Class across five categories in our 2025 Annual Awards, continuing its streak near the top of the industry in many key areas.

CMC Markets Star Ratings

| Feature |

CMC Markets CMC Markets

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

CMC Regulation, OPTO CMC YouTube Channel

Read next

- Best Low Spread Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- International Forex Brokers Search

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Copy Trading Platforms for 2026

- Best Forex Trading Apps for 2026

- Compare Forex Brokers

- Best Brokers for TradingView for 2026

- Best Forex Brokers for 2026

More Forex Guides

Popular Forex Broker Reviews

About CMC Markets

Founded in 1989, CMC Markets (LSE: CMCX) has grown to become one of the leading retail forex and CFD brokerages globally. Including forex clients, CMC Markets serves over 290,000 active clients worldwide - with £37.5 billion in assets under administration - through its 14 offices globally, and with a staff count of nearly 1200 people across its entities regulated in the U.K., Canada, and Australia. CMC Markets holds over £412 million in Tier 1 regulatory capital as of March 31, 2025. The company has a market capitalization of £375 million as of January 2024. Read more on Wikipedia.