Charles Schwab Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Charles Schwab is a highly trusted financial institution and multi-asset broker catering to U.S.-based and international forex traders.

Schwab enjoys a dominant position in the equities markets and delivers strong research and educational content across a vast range of securities. Its award-winning thinkorswim platform (acquired as part of its merger with TD Ameritrade) remains one of the best in the industry. That said, the broker’s forex offering is still largely limited to what is available on thinkorswim.

-

Minimum Deposit:

$0 -

Trust Score:

99 -

Tradeable Symbols (Total):

40000

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Charting Technology | Winner |

| 2026 | #6 |

| 2025 | #6 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Charles Schwab pros & cons

Pros

- Top-tier platform thinkorswim supports advanced forex trading.

- Massive multi-asset access, including 40,000+ tradeable symbols.

- Live webinars and strong educational content across markets.

Cons

- Forex trading is only available on thinkorswim and not Schwab's other platforms. It is also only available to US residents.

- Trading signals and copy trading are not available at Schwab.

- Forex-specific education is limited compared to stocks or other assets.

My top takeaways for Charles Schwab in 2026:

- Substantial multi-asset offering includes ETFs, stocks, options, futures, forex, and bonds.

- Highly resourceful and knowledgeable staff, including licensed brokers that understand market dynamics. Schwab is one of the largest financial institutions with over $10 trillion in assets and 36.5 million customers.

- Powerful charting and analysis capabilities, hundreds of indicators, and algo trading via thinkScripts and its newly-launched API.

- The thinkorswim platform can be intimidating for beginners or inexperienced forex traders. Additionally, the minimum forex trade size of 10,000 units can be a hurdle for low-budget investors.

Trust Score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Schwab safe?

Schwab is considered Highly Trusted, with an overall Trust Score of 99 out of 99. Schwab is publicly traded, operates a bank, and is authorised by five Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulator (Average Risk), and zero Tier-4 regulators (High Risk). Schwab is authorised by the following Tier-1 regulators: Canadian Investment Regulatory Organization (CIRO), Securities Futures Commission (SFC), Monetary Authority of Singapore (MAS), Financial Conduct Authority (FCA), and the Commodity Futures Trading Commission (CFTC). Learn more about Trust Score.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Year Founded | 1971 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 5 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

Range of investments

In addition to forex trading on nearly 70 currency pairs from 11 underlying currencies, Schwab offers trading on U.S. regional stock exchanges and futures exchanges, including options trading. Like all U.S. brokers that offer futures and stock trading, Schwab also offers cryptocurrency futures, ETFs, and trusts. Traders that open a Schwab Global account gain access to local markets in over 30 countries.

The following table summarizes the different investment products available to Schwab clients.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 40000 |

| Forex Pairs (Total) | 73 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | No |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Trading stocks at Schwab

Interested in trading stocks with Schwab? Head over to StockBrokers.com and check out their Schwab review, which covers all things stock trading and U.S. equities.

Charles Schwab fees

Schwab’s lack of a minimum deposit requirement for its primary brokerage account types makes for a low barrier to entry for forex trading. Schwab offers a whopping 18 different financial account types; for this review, I focused on Schwab’s two account types that grant access to the thinkorswim platform and the ability to trade forex – Schwab One and Schwab Global.

Forex traders can access thinkorswim (and the ability to trade forex) via the Schwab One account. It's worth mentioning that all trades – including forex trades – are settled in U.S. dollars. It’s also worth noting that the smallest trade size allowed is 10,000 units, which means the minimum margin required to trade that much currency in USD would be $500 (based on 20:1 leverage). Learn more about trading with leverage.

Note: While you can trade international securities with a Schwab One account in U.S. dollars, if you want to place trades in a given international currency you'll need to actually call Schwab on the phone.

The Schwab Global account provides access to twelve international markets in their respective local currencies (conversion fees apply if funding with a different currency from the respective foreign market). These fees can vary from 0.2% to 1%, depending on your account balance size. The Schwab Global account might be more appropriate for people who trade a lot of international securities and are comfortable juggling multiple currencies or cash balances.

Trading costs: Schwab doesn’t charge commissions for forex trading; trading costs consist of the bid/ask spread across its available currency pairs. The average spread on the EUR/USD during the month of October 2025 stood at 1.27 pips, which is at the higher end of the industry average. It’s worth noting that Schwab lists its overnight carry charges within the thinkorswim platform in a handy calculator, so you can estimate the cost of holding positions overnight.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Minimum Deposit | $0 |

| Average spread (EUR/USD) - Standard account | 1.27 |

| All-in Cost EUR/USD - Active | 1.27 |

| Non-wire bank transfer | Yes |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Schwab offers two mobile trading apps: the Schwab Mobile app for banking and trading securities (such as futures, options, and other asset classes) and the mobile version of the thinkorswim platform. As a long-time user of both applications, I’ve found that Schwab provides some of the best mobile trading apps in the industry. Simply put, Schwab delivers a world-class mobile experience for traders, and thinkorswim especially remains an innovative mobile app for forex and futures traders.

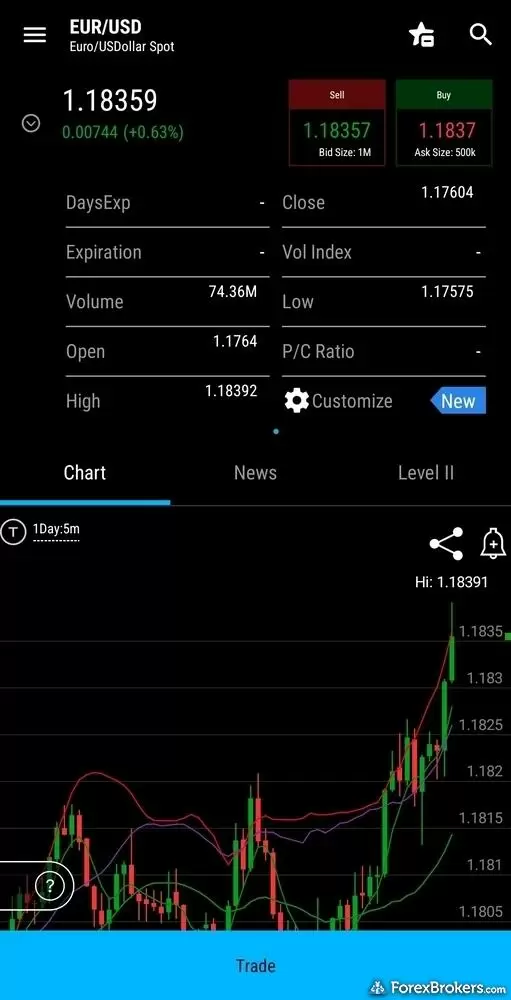

App overview: Forex trading at Schwab is currently only available on thinkorswim. The thinkorswim mobile app is available for iOS on the Apple Store and for Android on Google Play, and has long been a reliable trading software suite for sophisticated investors across numerous markets and asset classes, including forex trading.

Charting: Perhaps my favorite aspect of thinkorswim is the platform’s impressive charting capabilities. Hundreds of indicators are available and traders using thinkorswim can add multiple indicators simultaneously. Another great feature (one I don’t often see on other platforms) is the ability to view a tick chart, which updates with each price tick, compared to candle charts which only show the open, high, low, and close prices. On the thinkorswim platform, you can even set the number of ticks to customize the time-frames or select other intervals and historical periods for analysis.

Schwab's thinkorswim mobile app showing a forex chart of the EUR/USD currency pair with indicators in addition to an open order window alongside a trade button.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 374 |

Trading platforms

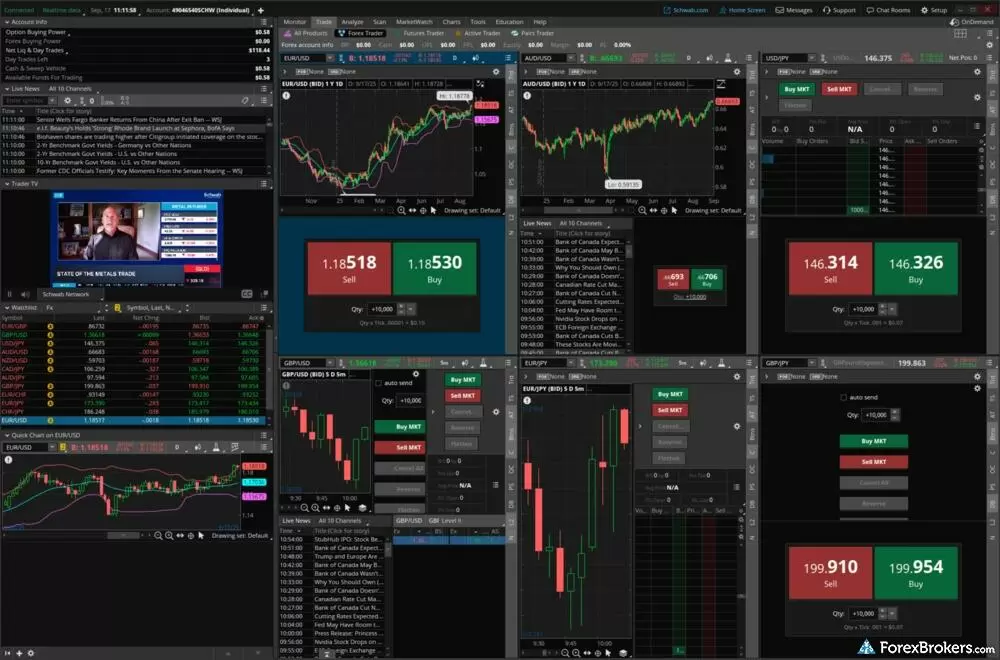

Schwab is a true multi-asset broker, offering an incredible range of products across two trading platforms (down from three, now that StreetSmart has been discontinued). While its flagship website and associated apps are available to any account holder for trading securities, only Schwab’s thinkorswim platform offers the ability to trade forex.

As a long-time user of both the desktop and web versions of thinkorswim, I can attest to the fact that it was a true leap in innovation for the industry when first released. Even with the advances in modern trading platforms over the years, thinkorswim remains one of the best on the market. My main concern is that the desktop version is too complex for beginners, though the web platform is more intuitive and offsets this, at least in part.

thinkorswim platform: Once you have a futures-approved account, you can trade forex on Schwab’s thinkorswim platform on desktop, web, and mobile. The desktop version of the application contains the largest number of features. Alongside its well-known advanced charting capabilities, thinkorswim delivers complex order types with advanced features such as “1st triggered all,” “1st triggers sequence,” or “Blast all” (the last of which, as the name implies, will trigger all orders). These allow for more complex manual trading strategies by staggering orders depending on your market expectations and outlook.

Watchlists are straightforward and there is a dedicated forex layout in the Trade tab, where you can customize the look and feel of the platform interface – though this does take some time to figure out. The active trader tab in thinkorswim has some nifty features, such as the ability to quickly cancel or reverse trades. I like the handy “Flatten” button, which closes all open positions for a specific symbol and cancels all related working orders.

Schwab's thinkorswim desktop platform with the forex trader layout, with integrated TraderTV news headlines, watchlist, and FX currency map showing.

Charting: thinkorswim stands out for its robust and versatile charting application which enables powerful technical analysis. For example, you can add more than five indicators at a time, compared to many other platforms that limit this feature (like the free version of TradingView). Thinkorswim also delivers access to hundreds of indicators; most platforms typically offer less than 100 studies.

Algorithmic trading: There are automated, indicator-driven trading strategies within thinkorswim that can be enabled. The platform supports custom strategies coded from scratch, or you can edit existing strategies using the thinkScript editor. Developer resources include Integrated learning materials and a thinkScript manual.

It’s worth noting that thinkorswim is not as robust for algo trading as other specialty platforms. For example, though you can manually place hypothetical trades using thinkBack, automated backtesting is not supported on thinkorswim. For deep backtesting capabilities, you are better off using popular algo trading platforms like MetaTrader 5 or TradingView. That said, thinkorswim can still be a great stepping stone for advanced traders who are ready for their first foray into automated trading strategies using algorithms.

API connectivity: Schwab has expanded its technology offering with the launch of its Developer Portal, providing API access for both individual traders and businesses. Developers can choose single-app individual access or multi-developer corporate accounts, supporting both personal tools and enterprise-level applications.

The API dashboard offers a simple entry point with basic documentation covering essentials like OAuth authentication and callback URL requirements, though more advanced resources remain limited. Individual Trader API access is typically approved within two business days, while commercial products such as Market Data and Accounts & Trading APIs are aimed at platform developers and enterprise integrations rather than personal use.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| Charting - Indicators / Studies (Total) | 374 |

| Charting - Trade From Chart | Yes |

Research

Schwab has long been known for its comprehensive, high-quality financial market research content for U.S. and international markets, created by in-house staff and third-party analysts. Overall, Schwab is essentially unmatched when it comes to the sheer quantity of research content available. Unfortunately, Schwab falls short when it comes to forex-specific research content.

As with its educational offering, Schwab’s research is primarily focused on the stock market and economic news, only the latter of which applies to forex trading in a broad sense. Research specific to forex trading will be limited to the thinkorswim platform, which offers headlines from Dow Jones and Thomson Reuters alongside TV broadcasting from CNBC and the Schwab Network.

Schwab posts weekly market analysis on YouTube. Shown here is the Weekly Market Outlook from Jeffrey Kleinstop, Schwab's Chief Global Investment Strategist.

Under Schwab’s Ideas & Strategies section, for example, stocks and ETFs receive coverage along with recent analyst ratings from Morningstar and Argus – but there are no forex ideas or trading signals and the economic calendar is focused exclusively on the U.S. market. Likewise, its screeners are highly detailed and comprehensive but don’t yet include forex coverage.

In recent years, the Schwab Network has developed into a leading source of video-based research and analysis, broadcasting TV-quality programming across financial markets with more than 10 dedicated shows each trading day. Its dedicated site allows filtering by Markets, Industries, Personal Finance, and Shows.

Expanding this coverage to include more forex-specific programming, perhaps under the existing Futures category or a new dedicated section for spot forex, would help close a gap in its otherwise broad coverage.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | No |

| Client sentiment data | No |

Education

There are many dimensions to Schwab’s educational offering. Schwab provides a tremendous amount of high-caliber educational content about financial markets. While not specifically designed for forex trading, much of Schwab’s educational resources apply to traders universally – regardless of the market. That said, there are some limitations that brought down Schwab’s score in this category.

Learning Center: The Schwab website contains a dedicated Learn section, which houses its courses, podcasts, the Onward Magazine, and Insights & Education Center. While courses are not forex-specific, there is content that can help you learn general skills applicable to trading any market. For example, there is a four-hour course on stock trading using technical analysis which teaches fundamentals that can easily be applied to forex trading.

An education course on the Schwab website: Introducing Technical Analysis. Detailed is the "Benefits and Risks" lesson.

One feature I like is that certain content in Schwab’s learning center gets tagged with applicable asset classes and categories, such as the “Order Types” article which is tagged for forex, futures, and options. There are hundreds of these types of articles across Schwab’s website and the educational content within the thinkorswim platform suite. Still, I would prefer to see content created primarily for forex-specific trading, as that would help fill the gap for this specific market in an otherwise exhaustive educational offering. The vast majority of Schwab’s educational content is focused on other primary markets with barely a dozen of forex-specific articles.

Webinars: What I found to be the biggest value-add in the education category is the number of daily webinars Schwab holds as part of its Schwab Coaching webcasts. The webcasts are released on a rolling basis, akin to workshops that take place at industry conferences, and are archived on Schwab’s YouTube channel. Schwab is unmatched in this category, offering up to seven calendar events per day, including YouTube live streams as part of its Webcasts and Virtual Workshops under the Trader Talks channel. However, forex-specific content is limited, with only some futures-related videos on the channel, such as analysis of the Micro GBP/USD Futures contract (/M6B).

Room for improvement: Building out its articles and dedicated courses would help boost its already-solid Schwab Coaching and educational framework. Likewise, adding more forex content to the trading product coverage by coaches would round out its overall webcast offering.

Podcasts: Schwab's extensive selection of educational resources also extends to their fantastic network of podcasts. Traders can listen to the Choiceology podcast, the Financial Decoder podcast, WashingtonWISE, Giving with Impact, or the OnInvesting podcast. Each podcast series aims to provide specific financial knowledge about related markets (although some content is more personal-finance related).

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

Schwab is a well-established global financial institution holding trillions in assets for millions of customers. I cannot overstate the quality of Schwab's educational resources nor the caliber of its highly informative support staff.

That said, Schwab’s forex offering is just taking off. Expanding the availability of forex beyond thinkorswim and integrating it across the Schwab website and platform will help level out its offering. Developing its forex-specific research and educational coverage will also grow its value to traders.

Steven's expert take

"Despite not being as focused on forex as many of its competitors in the space, forex trading at Schwab is still appealing due to its phenomenal platform offering, competitive spreads, quality of support, and the safety of dealing with a highly trusted and established brokerage."

Charles Schwab Star Ratings

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Read next

- Compare Forex Brokers

- Best Low Spread Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Copy Trading Platforms for 2026

- Best Forex Brokers for Beginners of 2026

- International Forex Brokers Search

- Best Forex Brokers for 2026

- Best Brokers for TradingView for 2026

- Best Forex Trading Apps for 2026

More Forex Guides

Popular Forex Broker Reviews

About Charles Schwab

Founded in 1971 by founder and current Chairman Charles R. Schwab, the publicly-traded Charles Schwab Corporation (NYSE: SCHW) today holds over $10.10 trillion dollars in assets under management for more than 36.5 million brokerage accounts, as per its latest annual report. In addition to holding regulatory status in the U.S. with both the SEC and CFTC, Schwab holds licenses with the FCA in the U.K. as well as Hong Kong and Singapore under its related international entities. Schwab also operates as a bank under its banking subsidiary, and is one of the largest financial institutions in the world with over 400 offices globally.