Almost everyone has a smartphone these days, but not all mobile apps deliver the same forex trading experience. This guide highlights my picks for the best forex trading apps for 2026 and what sets them apart.

Competition among forex trading apps is fierce, and I have personally tested and scored the mobile trading platforms of more than 60 currency trading brokers to help you choose wisely. To rank each app, I assessed over a dozen factors, including charting indicators, trading tools, and overall usability. All testing was conducted using a Samsung Galaxy S23 Ultra running Android OS 14 to ensure the results reflect real-world trading on mobile.

Based on 13 different variables, here are the brokers that offer the best forex trading apps.

Top picks for trading apps

Best overall forex trading app - IG's IG Trading app

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Mobile Charting - Indicators / Studies |

IG IG

|

|

£1 |

0.91 info |

33 |

I've been reviewing IG for over six years, and I continue to be impressed by IG's powerful suite of mobile applications for everyday forex traders.

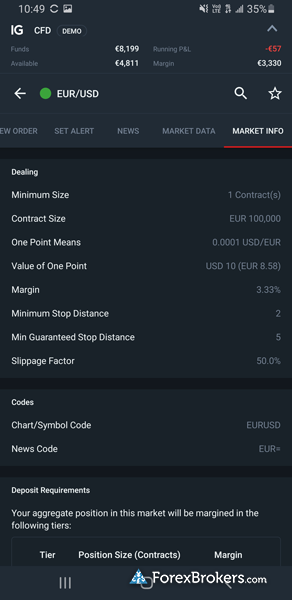

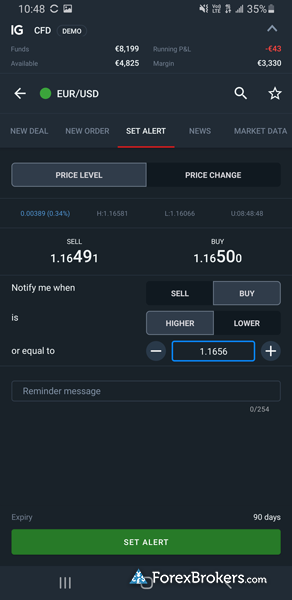

An award-winning mobile app: IG’s flagship mobile forex trading app, IG Trading, won our 2025 Annual Award for #1 Mobile App. I find the IG Trading app to be easy to use and jam-packed with powerful features and intuitive trading tools.

An intuitive layout: IG Trading’s intuitive layout makes it a breeze to navigate between features such as alerts, sentiment readings, trading signals, and highly advanced charts. The app delivers dozens of technical indicators and five distinct chart types. Setting up charts is easy, and zooming in and out across time frames feels quick and precise. IG provides my favorite mobile charts in the industry and IG Trading is a great choice for charting enthusiasts who want to conduct market analysis on the go.

An assortment of additional apps: Traders at IG also gain access to IG Academy, the broker’s standalone educational app. IG Academy features eight interactive courses organized by experience level, each containing nearly a dozen chapters. IG also offers the popular MetaTrader 4 (MT4) app for traders who prefer the MetaTrader experience.

Read my full review of IG to learn more about why it’s the best forex broker for beginners.

Best mobile trading platform user experience - Saxo's SaxoTraderGO app

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Mobile Charting - Indicators / Studies |

Saxo Saxo

|

|

$0 |

1.0 info |

64 |

Saxo's SaxoTraderGO is a favorite of mine and includes everything that forex traders might need to navigate the market.

Consistent platform experience: One of the strengths of Saxo’s mobile platform that continues to impress me is how closely the mobile app mirrors the performance of the broker’s web-based platform. Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app. Saxo has done a great job unifying the excellent SaxoTraderGO platform experience across devices.

Rich charting capabilities: SaxoTraderGO delivers rich charting capabilities and – touching on a theme here – closely matches the experience of the platform’s web-based charts. Charts in the SaxoTraderGO mobile app sync with the browser-based version of the platform. For example, if you draw trend lines and add indicators in the web version, they will appear in the mobile app (and vice versa).

Education and research from the app: The web platform’s economic calendar, educational videos, market news from top-tier sources such as Dow Jones Newswire, and pattern recognition analysis from Autochartist are all accessible on the mobile app.

Saxo was Best in Class in our Mobile Trading Apps category for our 2025 Annual Awards and is a true leader in this category. Read my full review of Saxo to learn more.

Best for TradingView-powered charts and integrated market analysis - FOREX.com

| Company |

Overall Rating |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Mobile Charting - Indicators / Studies |

FOREX.com FOREX.com

|

|

$100 |

1.00 info |

90 |

FOREX.com has earned its place as a leader in mobile trading. Its proprietary mobile app offers an intuitive design, robust charting features, and seamless functionality. The app stands out for traders of all experience levels, delivering a sophisticated yet user-friendly trading environment.

Proprietary mobile app excellence: The FOREX.com mobile app has undergone several recent upgrades over the last few years to become a truly modern trading platform. It combines a minimalist interface with advanced trading features, making it easy for users to monitor positions, execute trades, and stay informed with integrated research and market news. The app offers tools such as real-time price alerts, a "close all" button for quick trade exits, and advanced order types like OCOs and trailing stops, among other subtle features.

Mobile charting powered by TradingView: Charting on the FOREX.com mobile app is powered by TradingView, providing traders with over 80 technical indicators, a vast array of drawing tools, and multiple timeframes. Watchlists are synced across devices for a seamless trading experience, and the "load chart layout" feature allows users to apply saved templates effortlessly.

Integrated research and education: The FOREX.com app includes research tools powered by Trading Central, such as Analyst Views and Technical Insight, alongside news from Reuters and an economic calendar. Its Trading Academy offers interactive educational content, making FOREX.com a top choice for traders seeking to improve their skills. Last but not least, I found that in-house content from FOREX.com’s research team is high-quality with insightful market coverage that includes technical and fundamental analysis.

Check out my in-depth review of FOREX.com to learn more about their offering.

Best forex trading apps comparison

Using our forex brokers comparison tool, here's a summary of the features offered by the best currency trading apps.

Comparison Tool:

Compare 50+ features side-by-side

How to compare the best forex trading apps

When choosing a new forex broker account for online trading, consider these five areas of the trading experience:

- Trust (regulatory status): You want a broker that you can trust, above all else. Your broker will preferably be regulated in multiple top-tier jurisdictions, such as the U.S., U.K., Australia, Singapore, Canada, Hong Kong, Japan, or Switzerland. At ForexBrokers.com, we track over 250 regulatory licenses for 60+ forex brokers; learn more by checking out our Trust Score page.

- Trading platforms: Our research finds that most proprietary platforms are superior to third-party software

like MetaTrader. Either way, be sure to select the trading platform that meets your needs across devices, whether that's on the web, your desktop, or with a mobile trading app.

- Trading tools: When I evaluate the research content, trading tools, and educational materials available from brokers, I expect them to be rich with features and easy to use. The more comprehensive each category is within the mobile app you choose, the better off you will be in maximizing trading opportunities.

- Tradeable markets: Consider the total available markets and the number of instruments that are available for you to trade at a given broker. For example, one broker may offer a small selection of currency pairs but a vast array of CFDs on other markets like stocks, commodities, ETFs, futures, cryptocurrency, and other asset classes. Conversely, maybe you want to trade some exotic currencies and want a broker with a larger selection of forex pairs.

- Demo accounts: Opening a free demo account allows you to learn the ins and outs of a trading app, like test-driving a car before you buy it. You get to use the virtual account across all supported devices, such as web, desktop, and mobile. If the platform meets your needs, then you can fund a live account. Some traders also use demo accounts to test various trading strategies before trying them out with real funds.

FAQs

Can you trade forex on your phone?

Yes, if you have a modern smartphone running either an Android or iOS operating system, you can install forex trading apps on your phone. After opening the app, you can log in to your forex account and begin trading from your phone. If you are interested in trading CFDs, there is a range of great mobile options available from some of the top brokers in the industry. Check out our guide to the Best CFD Brokers and Trading Platforms to learn more about CFDs (and to check out our picks for the best CFD brokers).

Does forex have an official app?

No, there is no official app or website because the foreign exchange (forex) market is decentralized — that is, there is no single location or site for the market. The currency trading market consists of central banks and financial institutions such as brokers, dealers, banks, and corporations. Read more at our What is forex? educational article.

Many trustworthy forex brokers do offer mobile apps for trading. There is a wide selection available, including apps that are developed by brokers in-house, as well as apps from third-party developers. To avoid forex scams, you should only use regulated banks and brokers that are properly licensed to offer forex trading services in your country of residence. For example, if you live in the U.K., check the Financial Conduct Authority (FCA) to verify a broker is regulated.

Note: If you're looking specifically for the broker FOREX.com, it offers both a proprietary app, called FOREX.com mobile, and the popular MetaTrader 4 (MT4) app. Read our full-length review of FOREX.com, or check out our MetaTrader guide.

What is the best forex trading app?

My testing found that IG offers the best smartphone app — IG Trading — for forex trading in 2025. IG is regulated globally, and its IG Trading app provides access to a variety of quality trading tools alongside multiple news sources for researching trading opportunities. Charting on the IG Trading app is also rich with features. Check out my full-length review of IG to learn more about IG’s suite of mobile apps.

This gallery of screenshots was taken by our research team while testing IG's highly-rated mobile trading app.

What's the best forex trading app for beginners?

The IG Trading app is an excellent choice for beginners, due to its range of tools, integrated content, and the ability to access educational material from IG Academy and DailyFx (it even has a standalone mobile app for education). IG is a leader in education, making its IG Trading mobile app the best forex trading app for beginners in 2025.

As an alternative, Plus500's easy-to-navigate app provides the essentials for trading, and makes viewing available markets a breeze. That said, just because an app is easy to use doesn't mean it is easy to make money. It's worth noting that forex trading is only available at Plus500 via CFDs.

schoolForex trading for beginners

New to trading forex? Check out our guide to trading forex for beginners here. We'll help you pick a forex broker that's great for beginners, and go over some of the forex fundamentals to help jumpstart your forex education.

Which is the most trusted trading app?

In my experience, the IG Trading app is the most trusted forex trading app you can download in 2025. IG has earned my top trust ranking for years because it is well-capitalized, publicly traded, and holds regulatory licenses in nearly every major financial jurisdiction. Its mobile app, IG Trading, reflects the same high standards for safety and transparency that IG maintains as a broker.

IG is authorised by eight Tier-1 regulators, including the Financial Conduct Authority (FCA) in the UK, the Monetary Authority of Singapore (MAS), and the Commodity Futures Trading Commission (CFTC) in the US. I’ve tested IG Trading extensively and found it offers an intuitive, secure trading experience with access to real-time market data, robust charting tools, and dependable execution. If trust and global regulation matter most to you, the IG Trading app is an excellent choice.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

IG

IG

Saxo

Saxo

FOREX.com

FOREX.com

Interactive Brokers

Interactive Brokers

CMC Markets

CMC Markets

Charles Schwab

Charles Schwab

OANDA

OANDA