Best Low Spread Forex Brokers for 2026

Led by Steven Hatzakis, Director of Online Broker Research, the ForexBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of forex trader, including beginners and active traders. We carefully track data on international regulators, commissions, and spreads to rate forex brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Forex trading costs continue to decline as forex brokers compete to win you as a client. Many forex brokers now offer zero spread trading accounts as an extra enticement. This guide answers everything you need to know about zero spread accounts and lists my picks for the best low spread forex brokers.

Be aware: Some zero spread account offerings may just be marketing gimmicks. Always read the fine print and read forex reviews before deciding on a broker.

Lowest Spread Forex Brokers

My review process at ForexBrokers.com includes hands-on testing, robust fact-checking, and thousands of hand-collected data points; here are my picks for the best low spread forex brokers for 2026 from around the world:

- Minimum Deposit: 50

- Trust Score: 95

- Tradeable Symbols (Total): 13000

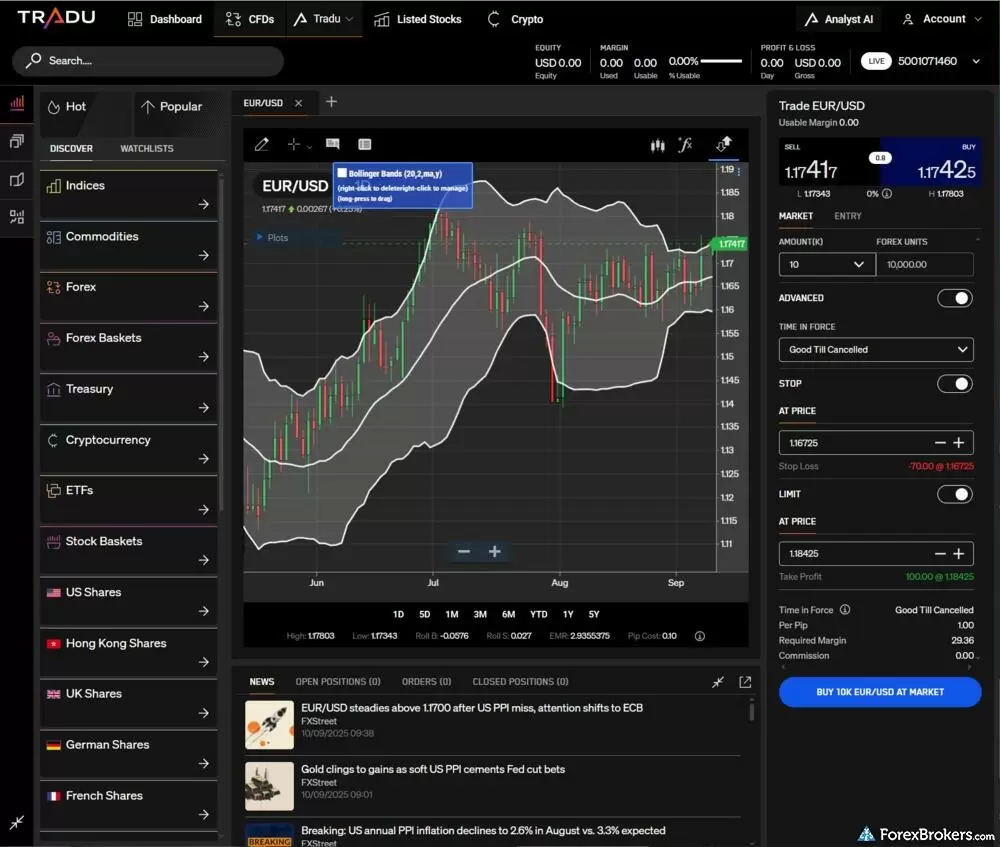

Tradu is a modern multi-asset broker best known for its sleek trading platform, low trading costs, and access to a wide range of global markets, backed by Jefferies and Stratos Group.

- Backed by Jefferies and Stratos Group.

- 13,000+ tradeable assets.

- Includes TradingView and TipRanks tools.

- Offers fractional shares and crypto staking.

- $1 minimum stock commission.

- Crypto trading closed on weekends.

- No copy trading or algo support.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 8500

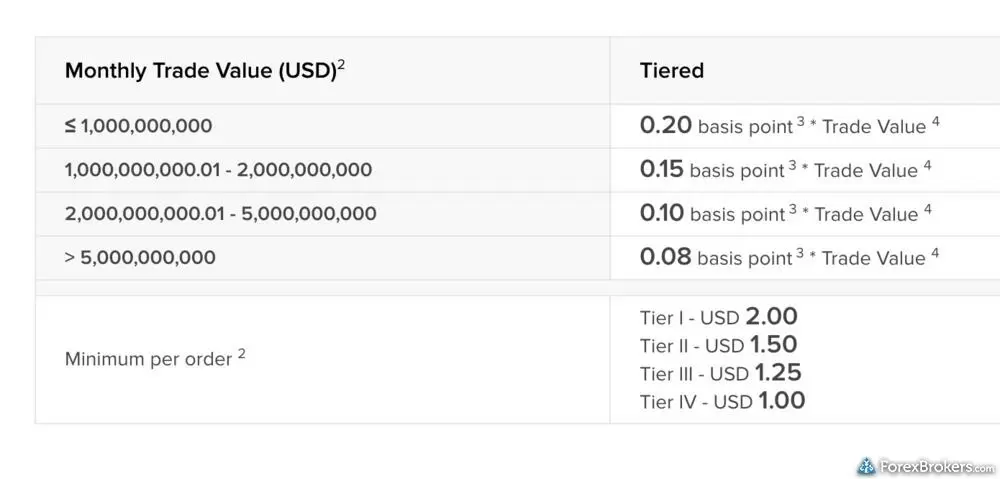

Interactive Brokers is a highly trusted multi-asset broker with an extensive offering of tradeable global markets and competitive fees – though given the minimum commission of $2 per side, trading anything less than 100,000 units of currency becomes proportionally more expensive. Read full review

- Access 150 markets in 34 countries; 28 base currencies.

- TradingView launched for both manual and algo traders.

- TWS desktop offers powerful tools for advanced strategies.

- New IBKR InvestMentor app offers beginner-friendly finance courses.

- TWS platform is overwhelming for beginners.

- No MetaTrader suite or copy trading tools available.

- $2 minimum commission can be costly for small trade sizes.

- Minimum Deposit: $20

- Trust Score: 87

- Tradeable Symbols (Total): 5585

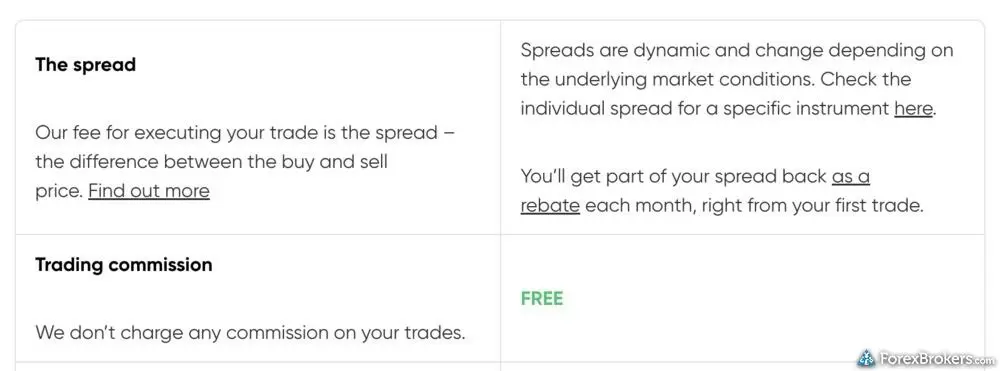

Capital.com stands out for its quality research, strong educational content, and innovative web platform. Capital.com holds fewer regulatory licenses and offers a narrower range of markets than some of the best brokers, but still significantly outperforms the industry average. Read full review

- Drag-to-modify charts & ability to close all positions quickly.

- Excellent education and research.

- Competitive spreads.

- MetaTrader 5 is not available.

- Price alerts only available within mobile.

- Doesn't offer trading signals and copy trading.

- Minimum Deposit: $0

- Trust Score: 99

- Tradeable Symbols (Total): 12029

CMC Markets is a low-cost leader that features consistently low spreads for all customer segments and account types, and competitive pricing for active traders – though the availability of discounts and rebate programs will depend on your country of residence. Read full review

- 12,000+ instruments and over 282 forex pairs available.

- Next Gen platform is packed with tools and charts.

- Industry-best pricing with low spreads and active trader perks.

- Launched 24/7 crypto trading, following its acquisition of StrikeX.

- MetaTrader 4 has fewer symbols and limited product depth.

- Spreads have worsened slightly year-over-year on certain pairs.

- No automated trading on CMC’s proprietary platform.

- Education lacks progress tracking or interactive features.

- The quantity of research content produced has slowed.

- Minimum Deposit: $200

- Trust Score: 83

- Tradeable Symbols (Total): 3583

IC Markets offers competitive pricing across all account types, with low average spreads and modest minimum deposit requirements. Further discounts are also available for traders that trade over 100 standard lots per month. Read full review

- Competitive pricing and low average spreads.

- 3,500+ tradeable symbols and powerful algo trading support.

- MetaTrader broker with integrated third-party plugins.

- Educational content and research still have room for improvement.

- No proprietary forex trading app.

- Share trading is limited to Aussie stocks via IC Shares.

- Minimum Deposit: $0

- Trust Score: 94

- Tradeable Symbols (Total): 1726

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms. Read full review

- Won Best in Class for MT5, algo trading, and more.

- Offers MetaTrader and cTrader for algo and copy trading.

- Razor account pricing is competitive for active traders.

- New mobile app has solid features and strong usability.

- Education lacks depth.

- MT5 offering has limited symbols.

- Minimum Deposit: £1

- Trust Score: 99

- Tradeable Symbols (Total): 19537

IG offers the ultimate comprehensive trading package, featuring excellent trading and research tools, industry-leading education, and an extensive range of tradeable markets. Read full review

- #1 Overall Broker in our ForexBrokers.com 2026 Awards.

- Highest Trust Score in 2026; most trusted forex broker.

- tastyfx brings IG access to U.S. forex traders.

- IG’s web platform requires some manual setup.

- MT5 is not available on IG.

- Only ~80 symbols available via MetaTrader.

- IG’s DailyFX news and research site has been discontinued.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Other low spread brokers I tested

6. Pepperstone - Low-cost trading on the Razor account

| Company | Overall Rating | Minimum Deposit | Average spread (EUR/USD) - Standard account |

Pepperstone Pepperstone

|

|

$0 | 1.1 |

Pepperstone is a great choice for low-cost trading thanks to its Razor account, which can be used across all of its available platforms, including cTrader, MetaTrader (Pepperstone is one of the best MetaTrader brokers in 2026), TradingView, and its newly-launched proprietary platform.

Average spreads and account types: Based on average spread data of 0.10 pips for the EUR/USD verified during October 2025, the all-in cost at Pepperstone comes to 0.80 pips on the Razor account after factoring in the 0.70 pip commission equivalent ($3.50 per side). Pepperstone's Standard account is less competitive, with spreads averaging 1.1 pips during the same period. That said, Razor account's combination of tight raw spreads and transparent commission structure makes it the better option for cost-conscious traders.

Active trader program: Pepperstone offers an Active Trader program that provides spread rebates based on your monthly trading volume and applicable tier. Rebates range from 10-15% on the base tier to as much as 30% for the most active traders completing over 3,001 standard lots ($300 million) monthly. Note that program availability and tier structures vary across Pepperstone's U.K., EU, and Australian entities, so check with the broker for specifics based on your country of residence.

7. IG - Low-cost forex and 17,000+ CFDs

| Company | Overall Rating | Minimum Deposit | Average spread (EUR/USD) - Standard account |

IG IG

|

|

£1 | 0.91 |

IG is a good choice for low-cost trading thanks in part to its ability to execute large orders and its relatively low average spreads across account types. On its standard CFD account, spreads averaged 0.91 pips on the EUR/USD, verified during October 2025 (increasing to 1.13 pips during the rollover period, when spreads typically widen).

Forex Direct pricing: For traders seeking even lower costs, IG's Forex Direct account (which requires a $1,000 minimum deposit) offers commission-based pricing with raw spreads. Based on average spreads of 0.55 pips on the EUR/USD during October 2025, plus a per-trade commission equivalent of approximately 0.20 pips, the all-in cost comes to roughly 0.75 pips, making Forex Direct the better option for cost-conscious traders at IG.

Active trader discounts: IG offers tiered rebates for high-volume traders on its Forex Direct account. Traders who transact over £50 million in monthly forex volume can earn a 10% spread rebate, increasing to 20% for those trading over £300 million per month. Applied to the base pricing, this could bring the effective all-in cost down to approximately 0.60 pips for the most active traders.

8. Saxo - Best VIP client experience

| Company | Overall Rating | Minimum Deposit | Average spread (EUR/USD) - Standard account |

Saxo Saxo

|

|

$0 | 1.0 |

Saxo has long been a leader in the commissions and fees category, with slight improvements year over year in its average spread data. However, the steep deposit requirements to access its best pricing make the Platinum ($200,000 minimum) and VIP ($1,000,000 minimum) accounts mostly suitable for high-net-worth investors. For comparison, spreads on the Classic entry-level account average around 1.1 pips on the EUR/USD, compared to 1.0 pips on Platinum and 0.9 pips on VIP, though Classic now has no minimum deposit requirement.

That said, traders don't choose Saxo for its pricing alone. Saxo's strength lies in its reputation as a financial banking conglomerate with a Trust Score of 99, its award-winning SaxoTraderGO and SaxoTraderPRO platforms, and access to over 70,000 tradeable instruments across virtually every asset class. For traders who value platform quality, research depth, and the security of a well-capitalized institution over rock-bottom spreads, Saxo remains an excellent choice.

9. BlackBull Markets - Multiple copy trading platforms

| Company | Overall Rating | Minimum Deposit | Average spread (EUR/USD) - Standard account |

BlackBull Markets BlackBull Markets

|

|

$0 | 1.16 |

BlackBull Markets has come a long way in recent years, making considerable progress in its product offering following a significant private equity investment and LMAX Group's acquisition of a 20% stake in 2024. The broker now offers over 26,000 tradeable symbols across MetaTrader 4, MetaTrader 5, cTrader, and TradingView. On its Prime account, average spreads of 0.16 pips on the EUR/USD (verified October 2025) equate to an all-in cost of 0.76 pips after factoring in the $6 round-turn commission, making it competitive with other low-cost brokers.

While BlackBull Markets trails industry leaders in research and education, its strengths lie in platform variety and social copy trading options, including ZuluTrade, Myfxbook, and its proprietary BlackBull CopyTrader. The broker also offers free VPS hosting for Prime account holders who deposit at least $2,000 and complete 20 standard lots monthly. Note that BlackBull's Trust Score of 78 reflects its limited regulatory footprint, with only one Tier-1 license (New Zealand's FMA) alongside an offshore Seychelles registration.

10. Tickmill - Good for algo trading

| Company | Overall Rating | Minimum Deposit | Average spread (EUR/USD) - Standard account |

Tickmill Tickmill

|

|

$100 | 1.70 |

Tickmill has evolved beyond its MetaTrader roots and now caters well to cost-conscious and algo-driven traders. On its Raw account, average spreads of just 0.10 pips on the EUR/USD (October 2025) result in an all-in cost of 0.70 pips after factoring in the $6 round-turn commission ($3 per side). The broker also offers VPS hosting for algorithmic traders and API connectivity for third-party platform integration.

Beyond MetaTrader 4 and MT5, Tickmill now offers TradingView and its proprietary Tickmill Trader platform (powered by DXtrade), which features drag-to-modify orders on charts and built-in performance analytics. The broker also provides access to CQG and AgenaTrader for futures and options trading. However, Tickmill's range of investments (637 symbols) trails well behind the best forex brokers, and its Classic account pricing of 1.70 pips average is merely average. For traders prioritizing low costs and algorithmic workflows over breadth of markets, Tickmill deserves a close look.

Lowest spread investment offerings comparison

When comparing accounts offered by the best forex brokers for zero spread trading, spreads will still vary in most cases, and you may incur other fees, trading costs, and/or commissions. Therefore, it is essential to keep the subtle details in mind when reading the fine print for zero spread trading.

Check out a side-by-side comparison of the spread pricing offered by the best zero spread forex brokers based on our independent testing:

| Company | Average spread (EUR/USD) - Standard account | All-in Cost EUR/USD - Active | Order execution: Agency | Order execution: Market Maker |

Tradu Tradu

|

0.43 | 0.6 | No | Yes |

Interactive Brokers Interactive Brokers

|

0.226 | 0.226 | Yes | No |

Capital.com Capital.com

|

0.64 | 0.67 | No | Yes |

CMC Markets CMC Markets

|

1.3 | 0.65 | No | Yes |

IC Markets IC Markets

|

0.62 | 0.62 | Yes | Yes |

Pepperstone Pepperstone

|

1.1 | 0.8 | Yes | Yes |

IG IG

|

0.91 | 0.82 | Yes | Yes |

Note: Brokers listed in the above table rank best in class for Commissions & Fees.

ForexBrokers.com Overall Rankings

Now that you've seen our picks for the best brokers on this guide, check out ForexBrokers.com's overall broker rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Also take a look at our full-length, in-depth forex broker reviews.

Popular Forex Guides

- Best Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- Best Brokers for TradingView for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Forex Trading Apps for 2026

- Best Copy Trading Platforms for 2026

- Compare Forex Brokers

- International Forex Brokers Search

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

FP Markets

FP Markets