The differences between the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms have long been a topic of discussion among forex traders. In this guide, I take you through the ins and outs of the MT4 vs MT5 debate from the perspective of a long-time forex trader and list the best brokers that offer both versions of MetaTrader.

I first started using the MetaTrader trading platform suite in 2005. Since then, I’ve tested hundreds of trading platforms, placed thousands of trades, carried out hundreds of hours of backtesting, and reviewed the individual MetaTrader offerings of dozens of forex brokers.

FAQs

What is MetaTrader 4 (MT4)?

MetaTrader 4 (MT4) is arguably the world’s most well-known forex trading platform. It belongs to the MetaTrader suite of trading platforms developed by MetaQuotes Software Corp. In the nearly 20 years since its launch (2005), MT4 has become known for its customizable functions, wide range of built-in technical indicators, integrated programming language, automated trading capabilities, and sophisticated analysis tools.

MetaTrader 4 is not a broker; it is a third-party trading platform that connects to a forex broker for forex trading. You’ll still need to choose a great forex broker, whether you use MT4 or MT5.

downloadMT4 remains wildly popular

MT4 has been downloaded over 10 million times from the Google Play store and holds a rating of 4.8 stars (with over 68,000 user ratings) in Apple’s App Store. MT4 is available for desktop and as a mobile trading app.

What is MetaTrader 5 (MT5)?

MetaTrader 5 is a next-generation trading platform and the successor to MetaTrader 4. Like MT4, MT5 is free to use (so long as your forex broker has paid to license the platform for its clients). Though the two platforms have a similar look, MT5’s wider range of tradeable instruments can better meet the needs of multi-asset traders looking to trade instruments such as commodities, stocks, CFDs, futures, options, and bonds.

MT5 also offers a deeper set of advanced tools and features, such as the MQL5 programming language, additional graphical objects and indicators, new statistical functions, an enhanced version of Strategy Tester, and the ability to both hedge and net trades.

announcementMore about MetaTrader 5

Learn more about MT5’s unique functions by checking out my guide to MetaTrader 5.

Key differences between MT4 and MT5

Technical Analysis Tools

Technical analysis tools enable traders to assess investments and identify trading opportunities in the market - whether they are bullish, bearish, or sideways. Common tools for technical analysis include charts, drawing tools, and backtests.

Here, MT5 outshines MT4. I'll show you why:

Charting:

The MT5 platform delivers a wider range of default studies with 38 technical indicators, 44 analytical objects, and 21 time frames. Because of MT5’s processing capabilities, certain custom indicators and strategies can only run on MT5.

Meanwhile, MT4 only provides studies with 30 technical indicators, 23 analytical objects, and 9 time frames.

Drawing Tools:

Also known as analytical objects, these annotation tools enable traders to mark chart lines, channels, tools, geometric shapes, symbols, and graphical objects, but they differ from technical indicators in that they must be plotted manually. MT5 gives you greater precision and more options for marking up your charts.

Strategy Tester:

MT5’s revamped Strategy Tester supports multi-core and multi-threaded backtests optimized for 64-bit machines. As a result, MT5 has a greater capacity to handle large backtest projects (a backtest that takes a few hours on MT5 might take hundreds of hours to perform on MT4).

Hedging

You can use both MT4 and MT5 to hedge your trades (learn more about hedging by checking out my full guide on forex hedging), but MT5 offers the added functionality of being able to net your trades. Let’s say you have an open trade. Under MT5’s netting system, if you open a trade on the same market in the opposite direction, your initial trade will be closed, lowered in volume, or reversed.

zoom_inFind a hedging forex broker

Hedging isn't permitted by every broker or in every region. Check out my guide to the best hedging brokers to find a broker that allows you to explore a hedging strategy.

Cost

MT4 and MT5 are both free to use for retail forex traders (though your forex broker will need to offer the platforms to its clients). It’s worth noting that forex brokers offering MT4 and/or MT5 may still charge you commissions, spreads, fees, or a combination of such trading costs (depending on the broker and its account offering). Looking for a low-cost broker? Check out my guide to the Best Zero Spread Brokers to find forex brokers with the lowest spreads in the industry.

Tradeable symbols

Since forex brokers license MetaTrader platforms from MetaQuotes, the total tradeable symbols available will vary by broker. It’s worth noting that the developer has imposed a symbol cap on MT4. For example, CMC Markets has over 12,000 total tradeable symbols on its CMC Next Generation platform, but the symbol cap limits CMC Markets’ MT4 offering to 1,024 instruments.

Why use MT4 over MT5?

MetaTrader 4 has been on the market for twenty years and has established a strong, loyal client base. MT4 can be used with hundreds of brokers around the world. When deciding between MT4 and MT5, you should always consider the account options, range of markets, and execution methods available to you with your broker’s MetaTrader offering.

updateImportant note:

MetaQuotes Software has announced they will no longer update MT4. Over time, more traders will gravitate towards MT5.

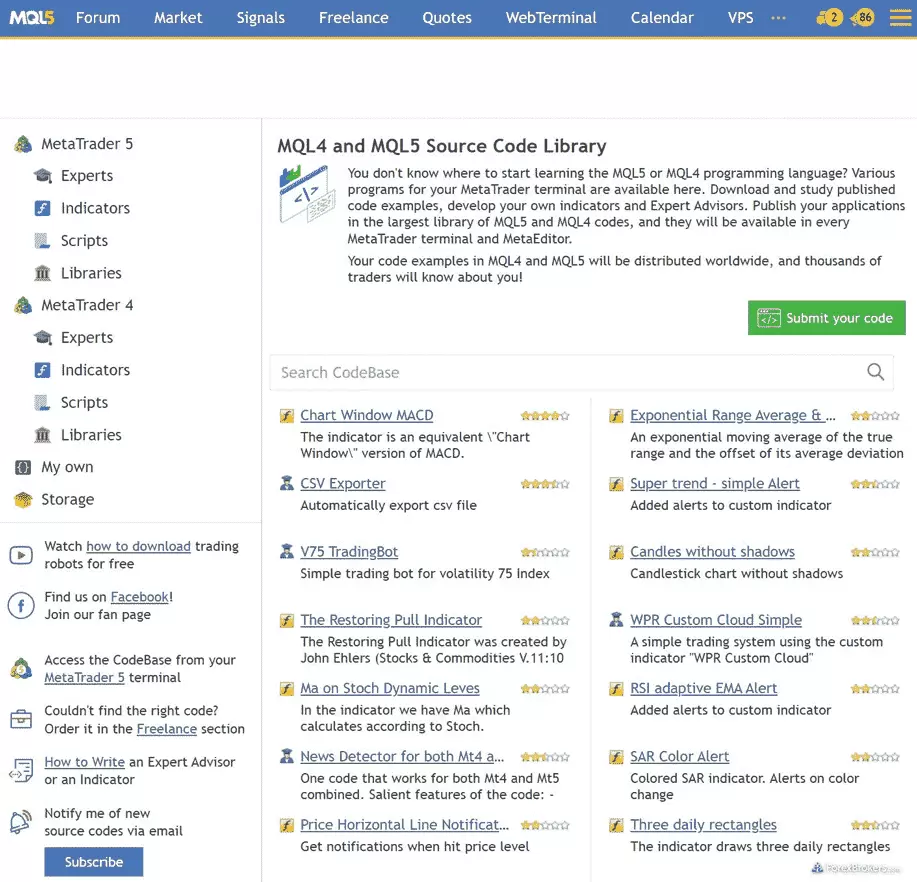

MQL4 vs MQL5: Some traders may choose to use MT4 because they created an Expert using the MQL4 programming language. Bringing that Expert over to MT5 would require rewriting the code in the newer version of MetaQuotes’ programming language (MQL5). This is one of the main reasons why it took so long for many traders to switch over to MT5; the majority of algorithmic trading programs designed for MetaTrader were built for MT4.

Why use MT5 over MT4?

Though MT5 has been slower to gain adoption among forex brokers and retail traders (it took eleven long years for MT5’s use among forex brokers to eclipse MT4), it is beginning to gain momentum among some of the best brokers in the industry. MT5 has officially surpassed MT4 in trading volume since the start of 2025, capturing 54.2% of the combined volume between the two platforms.

Here are just a few reasons to pick MT5 over MT4:

MT5 is a true multi-asset trading platform. Traders using MT5 can trade financial instruments such as commodities, stocks, futures, options, and bonds (MT4 is limited to forex pairs and CFDs).

MT5's MQL5 programming language can handle multi-threading and asynchronous operations, which can carry out faster operations when performing backtesting or executing algorithmic trading via the use of Experts and custom indicators. MT4 meanwhile only supports single-thread operation, which means some complicated programs will take much longer, like backtesting.

MetaTrader 4 and 5 each have their own programming language. MQL5 for MT5 is a cut above MQL4 (MT4’s programming language). MQL5 features specialized elements of C++ which enable developers to build expert advisors (EAs), or trading robots, with a greater level of complexity than was possible with MQL4.

Programmers are able to sell their EAs and indicators in the MQL5 marketplace while still protecting their proprietary code, and these forex robots can be used within MT5’s highly popular algorithmic trading suite. MQL5 even features a development assistant, which enables traders with no programming experience to create very simple trading robots.

MT5’s DOM Toolbox displays market depth information; trade volumes are displayed alongside asset prices for new positions.

MT5’s Strategy Tester includes new advanced settings and supports multi-threaded backtests in 64 bits, leading to faster backtests than was previously possible. MT5’s Strategy Tester enables traders to test and optimize software built with MQL5 – before the software is run on live accounts with real money at stake.

domain_verificationPro tip:

If you’re planning to buy an EA from the MT5 Community, use MT5’s Strategy Tester to evaluate the software before purchase. This can also be done using the demo version of the software.

Strategy Tester allows for deep, highly complex backtesting. As an example, I once performed a backtest on MetaTrader that took over 700 hours to complete and ran through 10,000 different scenarios while testing different configurations for various parameters.

MT5's built-in economic calendar can be pinned to charts so you don’t need to visit external news sites to check potential market-moving events. The economic calendar includes descriptions of macroeconomic indicators and their release dates.

MT5 also offers an advanced Secure Sockets Layer (SSL) certificate feature, which digitally binds cryptographic keys to any data transferred between client terminals and platform servers.

Which is better, MT4 or MT5?

Overall MT5 is the better choice for traders of all types. MT5 is the newest version of the MetaTrader platform and thus receives full support from the developer. MT5 is a great choice for traders who are looking for a more powerful, more advanced trading platform than its predecessor. MT5 offers more order types, technical indicators, analytical objects, time frames, and charts. MT5 is also good for traders who want to perform complex backtesting, thanks to its advanced Strategy Tester features. Unless you are still using a specific plugin or algo that hasn't been imported to MT5, there's simply no reason to pick up MT4 instead.

Let’s take a closer look at what’s new with the MT5 trading platform, and what distinguishes it from its predecessor (MT4):

Top 10 MT5 features (compared to MT4):

- MT5 features two new order types: buy stop-limit and sell stop-limit, bringing the total number of order types up to 6 (compared to MT4’s four).

- MT5 charts support up to 44 graphical objects (including technical indicators) compared to MT4’s 24.

- MT5’s expanded number of time frames (21, compared to MT4’s 9) allows traders to choose additional chart types and quote visualizations.

- MT5’s trade execution buttons now feature Tooltips, which display the number of units of a given asset currently being traded.

- Market depth information is now displayed directly within MT5’s terminal window, and trade volumes are displayed alongside the asset price for new positions.

- MT5’s Journal tab has been reorganized to make it easier to track market occurrences.

- MT5 permits both the hedging and netting of trades (only hedging is permitted in MT4), such as First in First Out (FIFO) – which is not supported on MT4.

- New statistical functions have been introduced and added to MT5’s Standard Library.

- MT5’s Strategy Tester features new advanced settings and supports multi-threaded backtests in 64 bits; this allows traders to complete complex backtests much faster than was previously possible.

- MQL5 allows traders to create indicators, scripts, libraries, and forex robots (or, Expert Advisors) and supports many of the existing features that originally made MT4 so popular.

Will MT4 be phased out?

Though MT5 is more feature-rich than its predecessor and has now surpassed MT4 in terms of the number of companies using the platform, no public statements have been made by MetaQuotes indicating that MT4 will be officially phased out. That said, MetaQuotes discontinued support for MT4 client terminal versions below 1065 in 2017 and stopped issuing MT4 licenses to new clients in 2018. For the time being, the MT4 platform is still available for download via the MetaQuotes Software site (here is the link to the MT4 download landing page).

Can I use both MT4 and MT5?

Yes, you can use both MT4 and MT5, so long as your broker of choice is licensed by MetaQuotes Software to offer the full MetaTrader platform suite. Not all brokers offer both MetaTrader platforms; check out my guides to the best MT4 brokers and the best MT5 brokers to see the list of brokers that offer each platform (and find my picks for the best MetaTrader brokers).

Which platform is better for beginners, MT4 or MT5?

MT5 is more widely supported by the developer and my suggestion for a beginner who has yet to begin learning either platform. Brokers often offer a larger range of markets and better pricing (for trading costs and spreads) on their MT5 offering than what is available using MT4 (this of course depends on your broker and your individual trading account).

Though MT4 and MT5 look nearly identical on the surface, there are some notable differences between the two trading platform versions. That said, either platform can be suitable if you are a beginner forex trader. However, just because MT4 offers fewer charts and a less-specialized trading platform doesn’t mean that its user experience is markedly easier for first-time users, and there's always a chance that MT4 is discontinued completely over the next few years.

How does MetaTrader compare to cTrader?

cTrader offers a more modern user interface and sleeker design, as well as a larger number of time frames (26) than MT4 (9) or MT5 (21). I’m a huge fan of cTrader’s charts and it’s great to see the platform enjoy adoption by a decent number of trusted forex brokers. That said, MetaTrader platforms are far more popular and more widely available.

Final Thoughts - From a Trader’s Perspective

Though MT4 and MT5 were created by the same software developer, they offer a different range of functions and trading abilities. MT4 offers a relatively simple trading experience, whereas MT5 is a feature-rich, multi-asset platform that accommodates instruments and asset classes beyond just forex and CFDs. My view is that MT5 will continue to gain wide adoption, and – as developer support dwindles – MT4 will gradually be left behind.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

IC Markets

IC Markets

Pepperstone

Pepperstone

FP Markets

FP Markets