Exness Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading is risky. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In my 2025 Exness review, I found that this broker has evolved into a major global forex broker, offering a unique blend of unlimited leverage, instant withdrawals, and flexible execution. However, traders must note that "unlimited leverage" is a high-risk feature restricted to accounts with under $5,000 in equity. Even for balances over $100,000, Exness still permits 1:500 leverage, a limit that remains exceptionally high and risky compared to regulated standards. Beyond these headlines, Exness continues to expand its ecosystem with multiple account types and a growing library of market research and education.

Despite its global footprint, Exness does not accept retail clients in its Tier-1 regulated entities (UK and Cyprus). To access its flagship features, non-institutional clients must sign up under its offshore entities in the Caribbean and Africa, which is a trade-off that offers higher leverage but fewer regulatory protections than EU-based alternatives.

-

Minimum Deposit:

$10 -

Trust Score:

80 -

Tradeable Symbols (Total):

209

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| 2026 | #31 |

| 2025 | #41 |

| 2024 | #51 |

| 2023 | #43 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Exness pros & cons

Pros

- Innovative web platform with drag-to-modify order features.

- Wide forex coverage with 96 pairs and flexible account types.

- MetaTrader, Trading Central, and social trading all supported.

- Newly improved educational content on the Insights blog.

Cons

- Research content is limited and lags behind top-tier brokers.

- Narrow product range with just over 200 total tradeable symbols.

- Spreads on Standard Cent accounts are higher compared to other account types.

My top takeaways for Exness in 2026:

- I enjoyed using the Exness Terminal web platform due to its minimalist design, featuring quick management of pre-trade and post-trade order types when trading.

- Exness’s Pro account offers both instant and market execution.

- Exness offers two levels of swap-free account statuses that are preferable to different trading activities, such as day trading versus holding positions overnight.

- Exness’s U.K. and Cyprus licensed entities - its only Tier-1 licenses - do not accept retail clients.

- The minimum for social trading at Exness is $500 to copy-trade a strategy provider and $2,000 to become a strategy provider, which can be a hurdle.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Exness safe?

Exness is considered Trusted, with an overall Trust Score of 80 out of 99. Exness is not publicly traded, does not operate a bank, and is authorised by two Tier-1 regulators (Highly Trusted), three Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and three Tier-4 regulator (High Risk). Exness is authorised by the following Tier-1 regulators: Financial Conduct Authority (FCA) and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score.

| Feature |

Exness Exness

|

|---|---|

| Year Founded | 2008 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 3 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 3 |

Range of investments

Although the range and availability of CFD products will depend on the Exness entity that holds your account and the specific account type you choose, there are generally 96 currency pairs for forex trading, 10 indices, 18 commodities, 10 cryptocurrencies, and over 90 stock CFDs.

While Exness offers a smaller range of tradable products than the industry average, it still has the most popular products to help meet the majority of its clients' needs. However, if you are looking to trade a product that Exness doesn't offer you will of course need to use a different broker.

Cryptocurrency: Cryptocurrency trading is available at Exness through ten different CFDs, but not the underlying asset (e.g., you can’t actually purchase and hold bitcoin). Bitcoin, Litecoin, and Ethereum CFDs against the U.S. dollar are obtainable, and the other seven CFDs trade bitcoin against various other currencies or commodities like the Japanese yen or gold.

| Feature |

Exness Exness

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 209 |

| Forex Pairs (Total) | 96 |

| U.S. Stocks (Shares) | No |

| Global Stocks (Non-U.S. Shares) | No |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Exness fees

Exness offers an extensive selection of account types with five primary offerings: two standard accounts and three professional accounts. Note that there are also two specific social copy trading account types, Social Standard and Social Pro, with their own trading conditions for those who wish to share their trading strategies for easy copying.

The trading costs will depend on the account type you select, as the two commission-based accounts have lower spreads compared to the commission-free accounts. All account types use market execution, except for the Pro account which offers both instant and market execution methods.

Standard Cent: This account has the highest spreads, comparatively, and more restrictive risk management in terms of margin stop-out levels, and offers market execution.

Standard: Similar to the Standard Cent account, this one has slightly better spreads, less restrictive margin stop-out levels, and offers market execution.

Pro: The Pro account has even lower spreads than the other two commission-free accounts and you can switch between instant (dealer, or market maker) and market (agency) execution.

Zero Spread: Exness’ “zero spread” account charges a per-trade commission of $3.5 per side ($7 per round turn) and provides market execution, with no restrictions on leverage or stop-out, although margin calls trigger at 30%.

Raw: The Raw account also charges a per-trade commission of up to $7 per round turn lot ($3.5 per side) and features lower spreads with market execution, no restriction on leverage or stop-out, and a 30% trigger on margin calls.

Exness accepts deposits in different cryptocurrencies, available from within the client portal under its wallet section.

Active Trader program: Exness offers a Premier Program with various perks available depending on your total lifetime deposits and quarterly trading volumes, akin to an active trader program.

While there are no discounts in spread or commissions, there are three tiers: you qualify for Preferred if your total accrued deposits are at least $20,000 with $50 million or more in trading volume per quarter, Elite if you have at least $50,000 in deposits and $100 million or more in volume, and Signature if you have at least $100,000 in deposits and $200 million or more in volume. All tiers provide priority customer support, exclusive educational content, and trading analytics, along with special promotions and rewards from Exness. The benefit to the higher tiers are lifestyle benefits, such as access to events and unique experiences.

While some lifestyle perks can be valuable depending on your style and tastes, I am more of a fan of discounts on trading costs for active traders and believe educational content should be free regardless of the need to recoup the costs of providing such content to traders.

| Feature |

Exness Exness

|

|---|---|

| Minimum Deposit | $10 |

| Average spread (EUR/USD) - Standard account | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Alongside the full MetaTrader suite, including both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), Exness offers its flagship mobile app, the Exness Trade app for Android and iOS Devices.

Exness Trade app: The Exness Trade app is available on the App Store for iOS and on Google Play for Android. It closely mirrors the web platform and offers a well-balanced mix of trading, charting, and market analysis tools. I especially appreciated the subtle, minimalist integration of Trading Central signals, visible even within the watchlist, and the intuitive ability to drag to adjust stop-loss or take-profit levels after placing a trade.

Using the Exness mobile app to trade from the chart, using the drag to modify feature to add a stop loss limit.

News headlines stream from FXStreet, and predefined watchlist screeners such as Most Traded Pairs and Top Movers make it easy to spot potential opportunities. The Insights tab also adds value with integrated signals and upcoming economic events. Overall, Exness keeps the mobile layout clean and modern while still delivering advanced features, placing it comfortably above the industry average.

MetaTrader: The MT4 and MT5 mobile apps come standard for Android on the Google Play Store and on the Apple App Store for iOS devices. To learn more, read my full guide about MetaTrader.

Social Trading App: The Exness Social Trading app is dedicated to supporting the three social trading accounts at Exness, available for Android devices on the Google Play Store. However, due to a country restriction I was unable to test the app (even with a VPN). See my overview of the web app version below.

Overall, Exness has made slow but steady progress in innovating its Exness Trade app and Social Trading app, bringing several useful features and touches to the trading experience. Still, the Exness Trade mobile app has a way to go to catch up to the best brokers for mobile trading.

| Feature |

Exness Exness

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | No |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 35 |

Trading platforms

In addition to offering the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, Exness also provides its Terminal web platform which features robust charting and order types in an otherwise minimalist design.

MetaTrader: MetaTrader at Exness, whether MT4 or MT5, offers a standard, out-of-the-box experience. The key differences come down to the range of available markets and the trading costs, including spreads and any applicable commissions, which vary by account type.

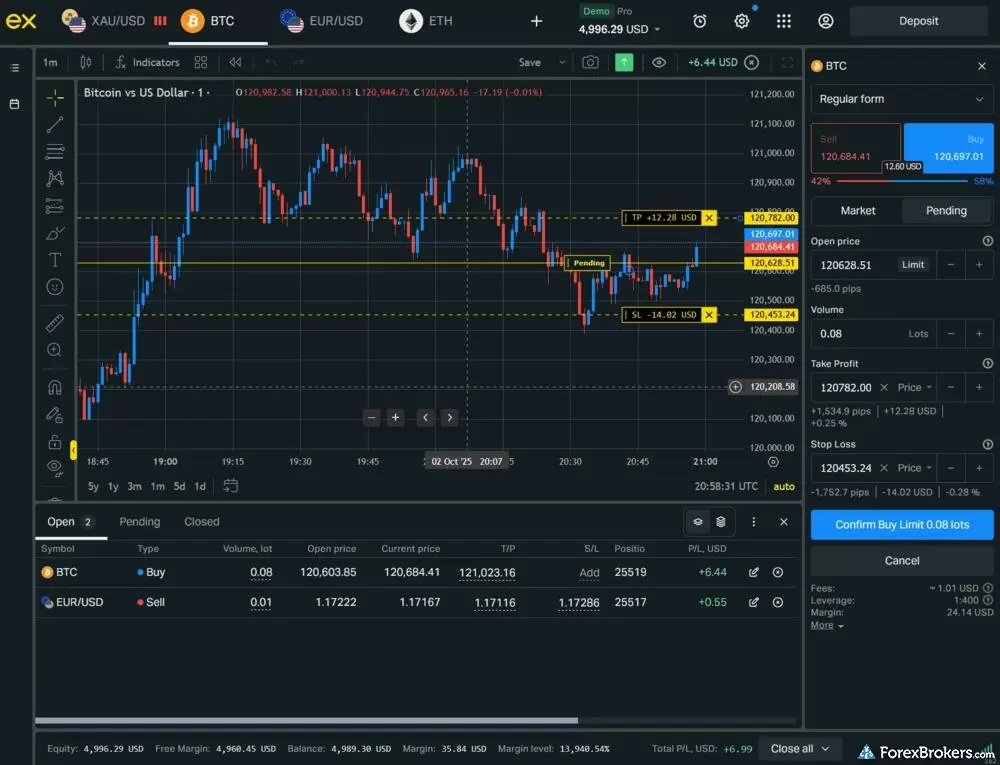

Exness Terminal: The Exness Terminal is the broker’s flagship web platform, offering a few clever features within an otherwise simple TradingView-powered design. What stood out to me is the ability to drag to adjust stop-loss and limit orders before placing a trade, as well as after a position is open, something many platforms reserve for post-trade only. There’s also a convenient Close All button that lets you exit every position at once, or only your winners or losers, functioning almost like an advanced order type. Trading Central is integrated into both the watchlists and the charts, complete with directional arrows for potential signals and pivot points that map support and resistance levels.

You are able to trade from the chart and see open positions on the Exness web terminal.

Exness Terminal Charts: Charts in Terminal are powered by TradingView, with the option to switch to Exness’s own chart library in the settings. TradingView has become an industry standard thanks to its extensive open-source tools, and Exness has layered in two subtle enhancements that I appreciated: integrated Trading Central analysis and economic calendar events displayed directly within the charts.

The calendar events within the Exness Terminal charts can be clicked on once they appear as their respective source country flag, revealing the event details, whereas to see the analysis from Trading Central you have to click on an arrow within a green or red square and the article appears as a hovering window. Overall, these are both nice touches to otherwise powerful charts, loaded with over 100 indicators and almost as many drawing tools.

Exness Social Trading: The web app for social trading provides details such as maximum drawdown and monthly returns, and a simplified performance statistic metric called Trading Reliability Indicator which averages the safety score and Value at Risk (VaR) of each provider.

Performance metrics like these are common in the best social copy trading platforms and I was pleased to see them included in the Exness Social Trading platform, although additional parameters and settings could be helpful to filter across the 1,434 available providers. For example, it is easy to find the most copied providers and “best” strategies but not the least copied or worst performing ones, which can result in a database bias when sorting through providers.

The Exness Social Trading offering has potential but needs some important refinements, including potentially moderating the claims made by providers which more strict regulators could frown upon. For instance, I came across one strategy called “Risk Free Forex” and another called “Forex safe 2,” which can be misleading strategy names - since forex trading always involves a high level of risk. The Forex safe 2 strategy provider describes its strategy as “forex safe profits second strategy very safe welcome everyone,” yet had a maximum drawdown of -42.81% at one point despite showing an overall return of 35% as of July 8th, 2024, with a medium trading reliability of 61 out of 100, per Exness.

| Feature |

Exness Exness

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Charting - Indicators / Studies (Total) | 107 |

| Charting - Trade From Chart | Yes |

Research

Exness has been a long-time provider of Trading Central to complement its in-house research offering, including videos with technical and fundamental market analysis. Headlines from FXStreet also stream within the Exness MetaTrader platform suite, client portal and in the web platform.

Video content: Beyond its third-party videos and articles, Exness offers a weekly market outlook featuring commentary from its in-house analysts. These videos are also published on the official Exness YouTube channel. More recently, the broker launched its Trading Talks podcast, which I found to be high-quality and rich with discussions that blend research insights and educational themes.

Exness produces a variety of slick and engaging YouTube videos and podcasts on market developments.

Overall, I found Exness’s research content to be well produced. That said, expanding the volume of videos and written research would strengthen its standing, as it still trails the top brokers in this category. The Exness Insights blog is almost entirely educational, and I’d like to see more technical and fundamental analysis articles, alongside the occasional market-analysis videos the broker already provides.

| Feature |

Exness Exness

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | Yes |

| Client sentiment data | Yes |

Education

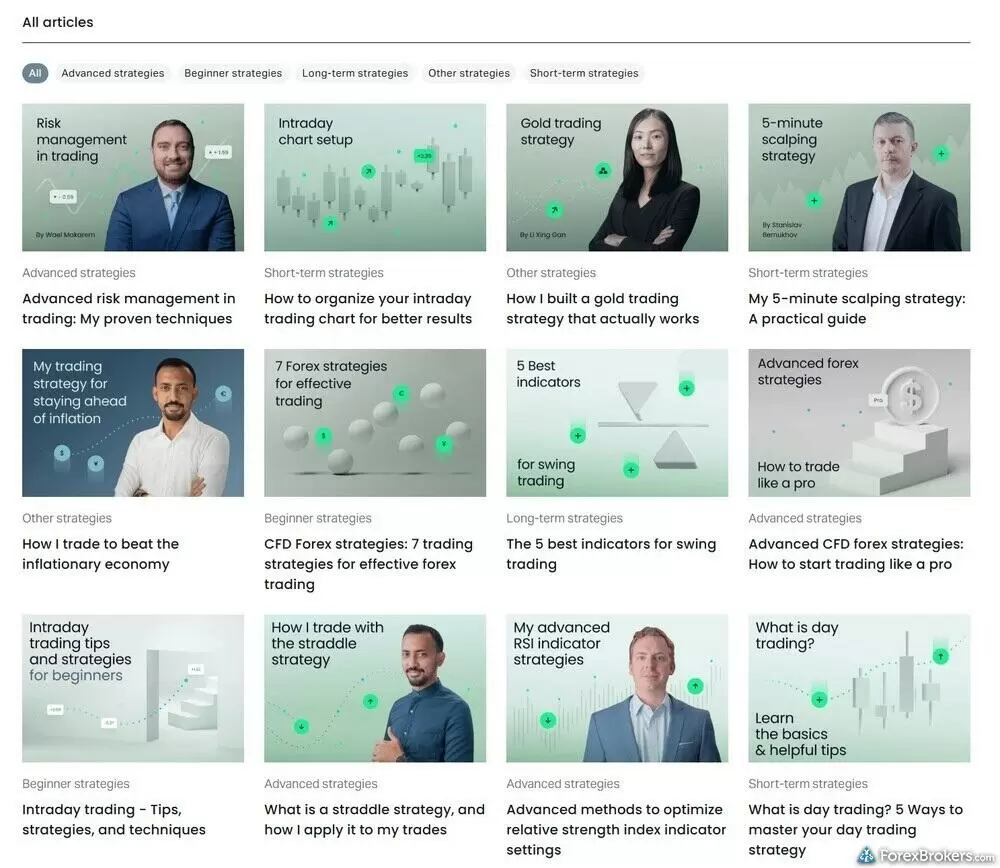

Exness has made significant year-over-year progress in the Education category, turning its blog into a strong beginner-friendly resource through the addition of its new Insights portal.

Exness Insights: Exness Insights provides a great foundation of well-crafted articles, enriched by first-hand demonstrations of how the authors apply indicators, charting tools, and asset-specific strategies in real trading situations.

The content is clearly organized and thoughtfully themed. Developing a structured educational course would be a natural evolution and would strengthen a part of Exness’s educational lineup that still needs more depth.

Team Pro: There is a group of nearly a dozen traders under the “Team Pro” at Exness who share their methodologies in an influencer-educator style with Exness customers. While I enjoyed much of the content and it is certainly well-crafted, it did appear partly promotional and not purely educational. The promotional aspect - which may just be incidental - is that you can follow and copy some of these Team Pro traders' live positions via Exness’s social copy trading platform.

Beyond the sales pitch, I enjoyed much of the content from the Team Pro, despite a few unbalanced claims. However, it’s worth noting that some of them claim to be full-time traders willing to share their experience with Exness clients, so while it could be a mutually beneficial relationship for the broker, its educators, and its traders, clients must be aware of the potential conflicts of interest at play.

Overall: Exness has achieved substantial improvement here, establishing a solid base from which to grow its educational offering. The articles are engaging and deliver real value, though the absence of formal courses and a steadier stream of video content, better tied into the Insights portal, leaves room for growth. Still, I was impressed by how far Exness has come, especially the strong writing quality and the consistent, experience-based structure of its articles.

A variety of educational articles offered by Exness to explain a wide range of different trading strategies.

| Feature |

Exness Exness

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

Exness is a viable option if you reside outside of the U.S., the U.K., and the EU. Despite its small product range, you can choose from multiple account types, the full MetaTrader suite, or use its simple web Terminal platform which comes with some innovative features for active and beginner traders.

Exness has refined its business by leveraging its network of affiliates and clients to incentivize its more experienced traders to help teach its community of less experienced beginners and intermediate investors while marketing to new customers.

Steven's expert take

"I genuinely enjoyed much of the content in the new Insights portal and see real value in Exness’s efforts on the educational front. The platform is also easy to use, although some gaps remain, like the limited range of available markets."

While Exness is a Trusted Broker, its retail clients are onboarded to less strict jurisdictions where certain business practices could be easier to carry out in a more lax regulatory environment. Still, I am glad to see Exness continue to acquire new licenses across the globe, adding to its Trust Score.

Exness is one of the largest forex brokers globally by trading volumes, handling several trillion dollars worth of volume. If it continues to grow, I would like to see it begin to accept retail clients in its Tier-1 regulatory jurisdictions which would help it be more competitive with Highly Trusted brokers.

Exness Star Ratings

| Feature |

Exness Exness

|

|---|---|

| Overall Rating |

|

| Trust Score | 80 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Read next

- Compare Forex Brokers

- Best Brokers for TradingView for 2026

- Best Forex Brokers for Beginners of 2026

- Best Copy Trading Platforms for 2026

- Best Forex Brokers for 2026

- Best Forex Trading Apps for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Low Spread Forex Brokers for 2026

- International Forex Brokers Search

More Forex Guides

Popular Forex Broker Reviews

About Exness

Founded in 2008, Exness serves over 800,000 clients across its regulated entities, including in the U.K., Cyprus, South Africa, Kenya, Jordan, Seychelles, Mauritius, the British Virgin Islands, and other offshore entities. Exness has continued to refine its offering and has grown considerably over the last five years, expanding its account offering and releasing its proprietary web platform and social trading offering, which have helped scale its business into one of the largest forex brokers in terms of staff and trading volumes. In addition to numerous regulatory licenses, Exness is also a member of the Financial Commission, an External Dispute Resolution (EDR) organization.