Best US Forex Brokers of 2026

close

Steven Hatzakis

Steven Hatzakis

Steven Hatzakis is the Global Director of Online Broker Research for ForexBrokers.com. He is a forex industry expert and an active fintech and crypto researcher.

Why you can trust us

Why you can trust us

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

The global foreign-exchange market has never been larger — in April 2025 the Bank for International Settlements (BIS) reported that average daily FX turnover reached over $9 trillion, and the U.S. Dollar remained on one side of roughly 89 % of all trades worldwide.

Unlike many jurisdictions where retail forex rules vary widely, the United States maintains a uniquely stringent framework designed to protect traders and ensure financial stability. Brokers must register with the Commodity Futures Trading Commission (CFTC), become members of the National Futures Association (NFA), and comply with requirements that include minimum net capital of US $20 million, strict reporting standards, leverage limits, and tighter rules on trading practices.

The result is a regulatory structure that prioritizes transparency and consistent standards for retail FX traders. In this guide, I’ll walk you through the best U.S.-regulated forex brokers, what makes them trustworthy, and what you should look for when choosing a broker under CFTC and NFA oversight. Whether you're a beginner or experienced trader, understanding the regulatory landscape is key to trading forex safely and effectively.

Best US Forex Brokers for 2026

Each broker in this guide is licensed by the CFTC and NFA to offer forex trading in the U.S. and has been reviewed against our industry-standard scoring methodology. Each year, I hand-collect thousands of data points and evaluate account types, commission structures, advanced trading platforms, and mobile trading apps to help you find a reliable, regulated U.S. forex broker. Learn more about Trust Score and how we test brokers.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Commodity Futures Trading Commission (CFTC) & National Futures Association (NFA)

- The United States is a Trusted, Tier-1 regulatory jurisdiction. Learn more about international forex regulation and why it’s important.

- The Commodity Futures Trading Commission (CFTC) oversees U.S. derivatives markets, including retail forex, while the National Futures Association (NFA) serves as the industry self-regulatory organization under CFTC supervision.

- Only firms registered with the CFTC as Futures Commission Merchants (FCMs) or Retail Foreign Exchange Dealers (RFEDs) and that are members of NFA can legally offer off-exchange retail forex trading to U.S. residents.

- Always confirm your broker’s registration status and NFA membership using the free NFA BASIC database.

Best forex brokers in the US

1. tastyfx - Best overall broker, most trusted

| Company |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

tastyfx tastyfx

|

|

1.15 info |

$1 |

tastyfx takes the top position in this year’s U.S. forex rankings because it delivers a complete trading experience built on IG’s long-established infrastructure. The rebranding from IG US doesn’t change the underlying mechanics; execution quality, pricing, platform stability, and research all carry over intact. What makes tastyfx compelling for U.S. traders is how these components work together to support consistent day-to-day trading across a wide range of currency pairs.

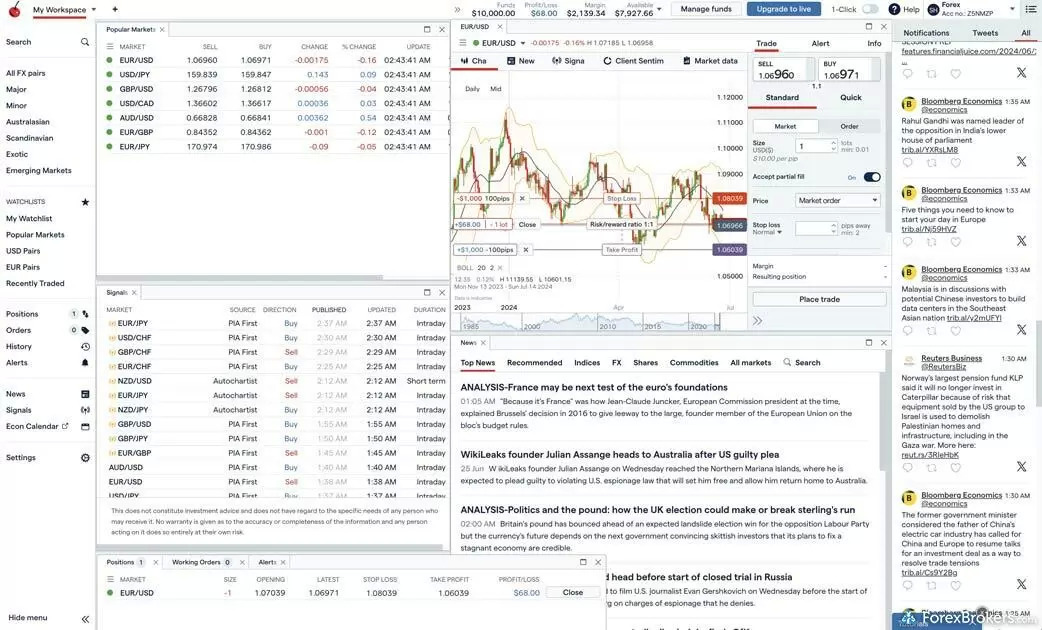

Trading platforms: tastyfx offers access to MetaTrader4 and ProRealTime, which are two platforms well suited to traders who rely on structured charting workflows or want to automate parts of their process. ProRealTime, in particular, remains one of the stronger desktop charting environments available to U.S. traders, with reliable order handling and a layout that supports detailed technical analysis. tastyfx also benefits from IG’s liquidity relationships and routing framework, allowing it to process larger orders without unnecessary slippage, which matters for traders who scale positions or work in fast-moving markets.

Trading fees: Spreads remain competitive across major and minor pairs, and traders can supplement their analysis with third-party signals from AutoChartist and PIA First, which are tools that add structure to trade planning without dictating strategy. Research produced across IG’s global network continues to inform the tastyfx experience, giving traders access to market commentary that is generally timely and practical.

Tastyfx web platform in fullscreen layout with watchlist signals news positions charts and news headlines in view.

Steven's take:

"I’ve found tastyfx to be a straightforward platform that still has enough depth for serious traders. The layout makes it easy to stay oriented, and the execution quality reflects IG’s scale behind the scenes."

Steven Hatzakis

The platform environment is clean and navigable, and U.S. clients operate under CFTC and NFA oversight, rules that shape leverage, disclosures, and capital standards. For traders who want a stable, well-built forex workflow backed by a publicly traded parent with extensive regulatory coverage, tastyfx offers one of the most complete U.S.-available packages.

2. Interactive Brokers - Best for professional traders

| Company |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

Interactive Brokers Interactive Brokers

|

|

0.226 info |

$0 |

Interactive Brokers (IBKR) remains one of the strongest choices for seasoned forex traders because its platform ecosystem is built to support complex, data-driven decision making. The combination of TWS, IBKR Desktop, and the web-based Client Portal covers a wide spectrum of trading needs, from high-touch manual execution to structured, multi-asset workflows. Many retail traders find the layout demanding, but for traders who rely on customization, order control, and market depth, that complexity is often a feature rather than a drawback.

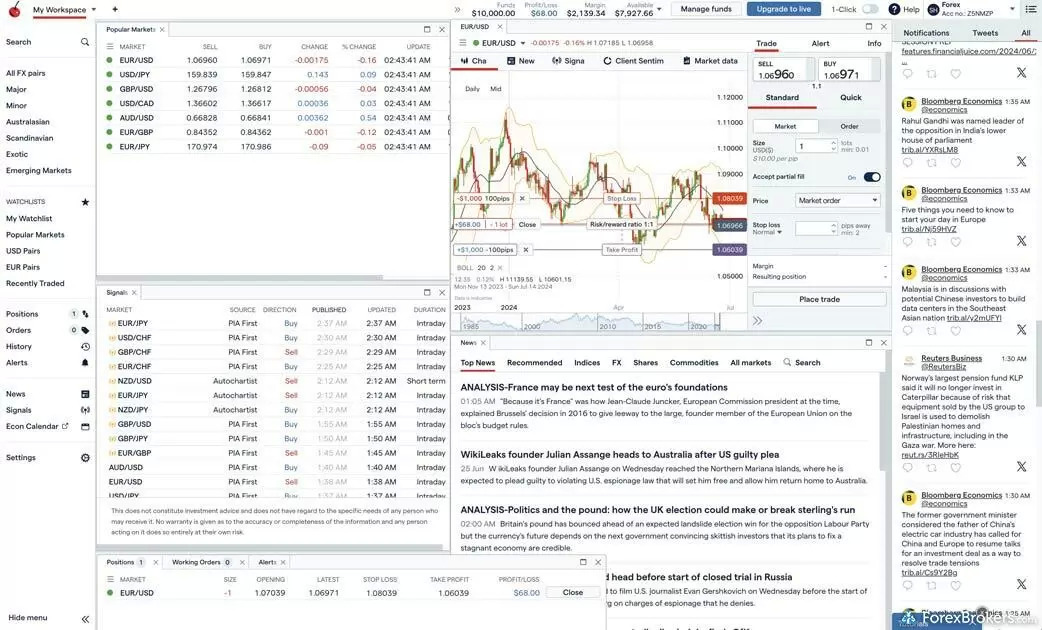

Trading fees and execution: What distinguishes IBKR in forex is its execution framework. Instead of marking up spreads, IBKR aggregates pricing from a large group of interbank dealers and charges a commission per trade. The result is transparency: spreads often remain tight, and costs are tied directly to trading volume. This structure particularly benefits traders who routinely work with standard-lot order sizes or who have strategies that demand precise fills. High-volume traders can also qualify for reduced minimum commissions, a meaningful factor for those running systematic or intraday approaches that generate frequent tickets.

Research and analysis: IBKR’s platforms integrate headlines from major newswires, economic calendars, and a broad library of third-party services. The Traders’ Insight blog and additional in-house content add context during active market periods, while premium providers fill in the specialized analysis that many advanced traders rely on. The breadth can be overwhelming at first, but it gives experienced traders the ability to shape their information flow rather than work around preset defaults.

An example of the daily analysis and research to be found on the Traders Insights blog. Featured here is an article from Darren Chu describing USDJPY Bull Flag pattern analysis.

IBKR is not designed to simplify forex trading; it’s designed to give knowledgeable traders the tools, data, and routing control needed to execute sophisticated strategies. For those who prefer depth over ease, its platform suite remains one of the most capable options available to U.S. residents who qualify for forex access.

3. FOREX.com - Great for educational content

| Company |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

FOREX.com FOREX.com

|

|

1.00 info |

$100 |

FOREX.com is backed by StoneX Group Inc. and has built its reputation on pairing a broad product offering with platforms that feel approachable for a wide range of traders. For U.S. clients, the focus is squarely on spot forex under CFTC and NFA rules, but the underlying technology is the same framework that supports thousands of symbols globally. What makes FOREX.com stand out in this guide is how well its tools and education work together for traders who want structure around their learning curve.

Trading platforms: FOREX.com’s Advanced Trading desktop platform and Web Trading platform give traders two clear paths: a more configurable, tool-heavy environment for active users, and a simpler browser-based experience for those who prefer clean navigation. Both are powered by strong charting, with TradingView integration providing familiar layouts, multiple timeframes, and a wide range of indicators. MetaTrader 4 and MetaTrader 5 remain available for traders who prefer that ecosystem, which is helpful if you already have templates or EAs you rely on. Performance analytics, built from the Chasing Returns acquisition, add another layer by surfacing patterns in your own behavior rather than just market data.

Research and education: Education is where FOREX.com earns its spot in this guide. The Trading Academy, along with written content and video series, gives traders a detailed, modular way to build skills over time. Courses are organized by experience level, and the combination of interactive lessons, quizzes, and regular video updates makes it easier to connect platform features with real market situations.

An example of a beginner-level educational course on FOREX.com, including an accompanying video.

4. Charles Schwab - Great support and platform suite

| Company |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

Charles Schwab Charles Schwab

|

|

1.27 info |

$0 |

Charles Schwab brings its scale as a large, multi-asset institution into the forex space, but keeps trading tightly centered on the thinkorswim platform. For U.S. residents who already rely on Schwab for stocks, options, or futures, adding forex on thinkorswim can be a logical extension rather than a separate workflow. The platform’s charting includes hundreds of indicators, flexible layouts, and tools like tick charts that help active traders track short-term price shifts.

Schwab’s broader ecosystem matters here, too. Support staff are generally knowledgeable across markets, and the firm’s extensive research and education, while not forex-specific, gives traders a steady stream of market context. The trade-off is that forex access is limited to thinkorswim and comes with a 10,000-unit minimum trade size, which won’t suit everyone. For platform-focused traders who want forex inside a larger brokerage relationship, Schwab is a sensible fit.

5. OANDA - Trusted broker, great research

| Company |

Overall Rating |

Average spread (EUR/USD) - Standard account |

Minimum Deposit |

OANDA OANDA

|

|

1.68 info |

$0 |

OANDA is a long-established, research-driven broker that appeals to U.S. traders who want clear market commentary and an easy-to-navigate platform. Its regulatory footprint spans several Tier-1 jurisdictions, and in the U.S. it is one of the few firms permitted to offer retail spot forex. The Trade platform and mobile app are intuitive, and support for TradingView, MT4, and API connectivity gives active traders flexibility in how they build and test their workflow.

Costs are the main consideration. Standard spreads tend to run higher than the industry average. Traders who deposit at least $10,000 can access OANDA’s Core Pricing, which lowers spreads but adds a per-side commission. For heavier traders, the Elite Trader program adds further rebates. For those who prioritize research quality and usability over the lowest spreads, OANDA remains a practical option.

Best MetaTrader brokers in the US

Compare U.S. registered forex brokers that offer MetaTrader 4 or MetaTrader 5 in the table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Average spread (EUR/USD) - Standard account |

tastyfx tastyfx

|

Yes |

No |

1.15 info |

FOREX.com FOREX.com

|

Yes |

Yes |

1.00 info |

OANDA OANDA

|

Yes |

Yes info |

1.68 info |

How to start forex trading in the US

Verify CFTC and NFA authorization

Before choosing a broker, confirm that it is legally permitted to serve U.S. residents. Retail forex brokers must register with the Commodity Futures Trading Commission (CFTC) as a Retail Foreign Exchange Dealer (RFED) or Futures Commission Merchant (FCM) and must also be Forex Dealer Members (FDMs) of the National Futures Association (NFA). These firms must meet strict financial requirements, including maintaining at least $20 million in regulatory capital, segregating client funds, and complying with detailed reporting and risk-disclosure rules.

Start by checking the broker’s regulatory disclosure, usually found at the bottom of its U.S. homepage, then validate the firm’s status using the NFA’s free BASIC database. This is the most reliable way to ensure the broker is legitimate and properly supervised.

Know which brokers are legally available in the U.S.

U.S. rules limit the number of firms eligible to offer leveraged forex trading. Based on current CFTC and NFA registration data, only a small group of brokers are legally approved for retail forex: tastyfx (formerly IG U.S.), FOREX.com, OANDA, Trading.com, and Charles Schwab (institutional forex only). Interactive Brokers generally serves institutional clients for spot forex. Any broker not regulated by both the CFTC and NFA cannot legally accept U.S. retail forex traders.

Understand U.S. trading rules and protections

The U.S. market offers strong consumer safeguards, but its rules differ from many international jurisdictions. Leverage is capped at 50:1 for major pairs and 20:1 for minors, hedging within the same account is not allowed, and FIFO (first-in, first-out) execution rules apply. These restrictions aim to limit excessive risk while ensuring transparent pricing and consistent execution. U.S. brokers must also maintain detailed financial records and follow strict audit, supervision, and conduct standards.

Open and fund your account

Once you choose a regulated broker, complete the standard application and identity-verification steps. Funding methods typically include bank wire, ACH, debit card, and, in some cases, PayPal. Before trading live, it’s wise to practice on a demo account to learn the platform’s tools, order types, and charting features.

Develop a trading plan

A structured trading plan helps reinforce discipline. Define your goals, risk-tolerance, time commitment, and preferred trading style. Consider how you will size positions, identify setups, and manage stop-loss and take-profit levels. Keeping a trading journal can help track your progress and refine your strategy. If you're new to forex, resources such as our Forex 101 series can help build foundational skills before trading with real capital.

FAQs

Is forex trading legal in the United States?

Yes, forex trading is legal in the U.S. and regulated by the Commodity Futures Trading Commission (CFTC). Forex brokers in the U.S. are required to register as Futures Commission Merchants (FCMs) and Forex Dealer Members (FDMs) with the CFTC and NFA. In addition to complying with CFTC regulations and NFA member rules, brokers that offer forex trading to retail clients in the U.S. must maintain at least $20 million in regulatory capital as a Retail Forex Exchange Dealer (RFED) with the CFTC (and as a member of the NFA). These stringent regulatory requirements have made the U.S. one of the most trusted regulatory hubs for forex traders.

Which forex brokers are legal in the U.S.A?

According to the CFTC’s most recent regulatory data (as of October 31st, 2022), there are 62 registered Futures Commission Merchants (FCMs) in the U.S., and at least six of those FCMs hold sufficient regulatory capital and the required licenses to legally offer forex trading to U.S. residents. Based on the CFTC’s own data, the following brokers offer legal forex trading in the U.S.:

- tastyfx - Legally available to retail clients in the U.S.

- FOREX.com - Legally available to retail clients in the U.S.

- OANDA - Legally available to retail clients in the U.S.

- Charles Schwab - Legally available to retail clients in the U.S.

- Interactive Brokers - Legally available in the U.S., but only to institutional clients.

- Trading.com - (U.S. brand under XM Group’s parent company, Trading Point) - Legally available to retail clients in the U.S.

Do you pay tax on forex trading in the U.S.?

Yes, U.S. residents and U.S. citizens must report their worldwide income in the U.S. – including any gains from forex trading. These can be taxed as capital gains (or may be treated as business income, if you have a corporate account). In any case, U.S. residents and/or citizens may be liable to pay taxes on any gains from forex trading – regardless of whether your broker sends you a form 1099-B.

It’s important to communicate to your tax professional the exact type of trading you are doing. For example, trading spot forex in the OTC markets may be treated differently (for tax purposes) than trading an exchange-traded forex futures contract, and certain forex contracts may be treated as a commodities contract (under Section 1256g), depending on the elections made by your tax professional.

What is the best forex broker in the U.S.?

tastyfx is my pick for the best forex broker in the U.S. in 2025. tastyfx is IG's brand for US forex traders. This means that tastyfx clients gain access to the award-winning trading experience that earned IG our #1 Overall Broker award in 2025. Though the name and logo have changed, the core business remains the same; existing U.S. clients at IG will experience a seamless transition when logging into their tastyfx account. In addition to being regulated by the CFTC and a member of the NFA, tastyfx's parent company is publicly traded, well-capitalized, and holds more regulatory licenses around the world than any of the 60+ forex brokers we review on ForexBrokers.com.

tastyfx offers a wide range of asset classes beyond forex trading, and consistently ranks at the top of nearly all of the categories we factor into our forex broker reviews. Read my tastyfx review to learn why we consider it to be the top choice for U.S. forex traders.

Which U.S. forex broker has the best mobile trading app?

When it comes to U.S.-regulated forex brokers, the best mobile trading app in 2025 is offered by tastyfx. Designed by IG, tastyfx' parent company, the wide range of powerful design innovations and trading tools continue to set tastyfx’s proprietary mobile app apart, such as trading signals (for U.S. traders who are interested in social copy trading), seamlessly integrated research, and a sophisticated order entry dialogue that makes managing trades a breeze. The mobile app also features the most advanced charting I’ve ever used on a mobile device.

To round out its mobile trading app offering, tastyfx also offers the popular MetaTrader 4 (MT4) app (check out our full guide to MetaTrader).

smartphoneForex trading on the go?

Mobile forex trading is more popular than ever, and many of the best international forex brokers offer multiple mobile apps and well-designed mobile trading platforms. Check out my guide to mobile forex trading to see my picks for the best mobile apps.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

More about US forex markets and regulation

The United States maintains one of the world’s strictest regulatory environments for retail forex trading, anchored by a dual-agency framework led by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The CFTC serves as the primary federal regulator for derivatives markets, including leveraged forex trading. Any firm offering retail forex to U.S. residents must be registered as a Retail Foreign Exchange Dealer (RFED) or Futures Commission Merchant (FCM) with the CFTC. The NFA, an industry self-regulatory organization, enforces compliance through ongoing supervision, routine audits, and mandatory disclosure standards.

U.S.-regulated brokers must meet some of the world’s highest financial and operational thresholds, including maintaining substantial net capital, segregating client funds, and adhering to strict reporting requirements. All registered entities can be verified using the NFA’s Background Affiliation Status Information Center (BASIC) database, which lists registration details, disciplinary actions, and regulatory status. This verification step is essential: many offshore brokers claim to accept U.S. clients but do so without proper authorization, placing traders at significant risk.

In addition to federal oversight, the U.S. structure prohibits certain products, most notably CFDs, which cannot be offered to U.S. residents. Forex trading instead operates within a tightly controlled leverage framework, capped at 50:1 for major pairs and 20:1 for minors, designed to protect retail traders by limiting excessive risk.

Against this robust backdrop, our research team independently validates every broker’s regulatory status, ensuring they are duly registered with the CFTC and NFA, or in cases where the broker is not U.S.-regulated, clearly outlining the implications for American traders. Learn more Trust Score and the 100+ regulators monitored globally by ForexBrokers.com.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Compare US Brokers

Popular Forex Guides

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis is the Global Director of Online Broker Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans is the Managing Editor at ForexBrokers.com. An experienced media professional, John has a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck is a Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

tastyfx

tastyfx

Interactive Brokers

Interactive Brokers

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

OANDA

OANDA