eToro Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro is a winner for its easy-to-use copy-trading platform where traders can copy the trades of experienced investors – or receive exclusive perks for sharing their own trading strategies. This makes eToro especially appealing for beginners who want to learn by watching the trades of more experienced investors. I find eToro to be an excellent choice for those focused on copy trading or crypto, though active or high-volume traders might wish to seek out platforms with lower spreads.

With over 7,000 tradeable symbols, including CFDs, forex, crypto, exchange-traded securities, and options, eToro offers a comprehensive — albeit slightly pricey — multi-asset trading experience.

-

Minimum Deposit:

$50-$10,000 -

Trust Score:

97 -

Tradeable Symbols (Total):

7441

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Beginners | Winner |

| #1 Copy Trading | Winner |

| #1 Crypto Trading | Winner |

| 2026 | #9 |

| 2025 | #9 |

| 2024 | #9 |

| 2023 | #9 |

| 2022 | #10 |

| 2021 | #9 |

| 2020 | #19 |

| 2019 | #13 |

| 2018 | #18 |

| 2017 | #13 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

eToro pros & cons

Pros

- User-friendly platforms are great for casual traders and beginners.

- Excellent choice for copy trading and crypto trading.

- VIP-style perks are available to eToro Club members.

Cons

- eToro is slightly pricier than most of its competitors.

- Algo trading strategies are not supported.

- Mandatory stop-loss and take-profit orders may hinder certain trading strategies.

- Trading Central is only available to eToro Club members.

My top takeaways for eToro in 2025:

- eToro is excellent for copy trading and cryptocurrency trading.

- Fantastic for ease of use thanks to its user-friendly web platform and the eToro mobile app that is great for casual and beginner investors.

- eToro offers spot Bitcoin ETFs, in addition to a handful of popular crypto assets in the U.S.

- eToro has significantly expanded its educational content with new courses and an extensive selection of materials as part of its eToro Academy offering.

- Trading Central research and tools are only available to certain eToro Club members who have reached higher Club tiers.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is eToro safe?

eToro is considered Highly Trusted, with an overall Trust Score of 97 out of 99. eToro is not publicly traded, does not operate a bank, and is authorised by four Tier-1 regulators (Highly Trusted), one Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). eToro is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different eToro entities are regulated.

| Feature |

eToro eToro

|

|---|---|

| Year Founded | 2007 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

eToro offers a total of 7441 tradeable symbols, consisting of 6493 stocks, 735 ETFs, 106 cryptocurrency pairs, 18 indices, 34 commodity CFDs, and 55 forex pairs (note: product availability at eToro will depend on your country of residence and any application regulations).

Usability: eToro makes it clear and simple to choose how you want to trade, which is helpful for beginners still learning the differences between asset types. For example, eToro provides the ability to select between trading CFDs and the underlying assets directly from the trade-ticket window. A subtle feature, but very useful. eToro also recently added options trading to its range of instruments that you can trade across asset classes as part of its multi-asset brokerage offering. I found it easy to switch between the main account and the options account, in addition to it being simple to transfer funds between the two accounts.

Cryptocurrency: Cryptocurrency trading is available at eToro through CFDs and through trading the underlying asset (e.g. buying Bitcoin). eToro also offers the newly-approved spot Bitcoin ETFs. With its large number of crypto assets – both CFDs and the underlying assets – eToro was our No. 1 broker for Crypto Trading in our 2025 Annual Awards.

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to residents of the U.K. or the Netherlands. In addition, cryptocurrency trading at eToro is not available in Russia.

| Feature |

eToro eToro

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 7441 |

| Forex Pairs (Total) | 55 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | Yes |

| Cryptocurrency (Underlying) | Yes |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

eToro fees

eToro is a market-maker broker and lists a typical variable spread of 1 pip on the EUR/USD, which is slightly higher than the industry average. While not the cheapest for spreads, beginners may find that the ease-of-use and copy trading tools justify the slightly higher costs. Considering its trading fees, retail traders don't choose eToro for its spreads, but rather for its social copy trading platform capabilities.

VIP accounts: eToro offers a VIP club (called eToro Club) with five tiers of membership that range from Silver to Diamond. These tiers are for traders who maintain balances between $5,000-$250,000 and feature varying benefits depending on the level of membership. VIP perks range from access to Trading Central, to discounted withdrawal and deposit fees, to a dedicated account manager – among other VIP-style benefits.

Popular Investor program: eToro's Popular Investor program (for traders who allow other investors to copy their strategy) has four levels – ranging from Cadet to Elite – where traders can become eligible for various perks. To qualify for the Cadet tier you must have more than $1,000 in account equity, attract $500 in customer assets that copy your strategy, and maintain a risk score below 7 for at least two months. Benefits available to Popular Investors include spread rebates, monthly payments, and even a management fee for those who reach elite status.

Cryptocurrency trading: Overall, eToro’s pricing is close to the industry average for trading physical cryptocurrency. For each buy and sell position, users pay a single fixed fee of 1% (on top of the spread) on each side of the trade (both when opening and closing a position).

While trading bitcoin has become a little more expensive (when compared to its prior pricing at 0.75%), eToro has leveled the playing field on over 100 crypto assets with its 1% flat rate commission, which can be helpful when trading emerging cryptocurrencies that would have otherwise been more expensive (on its previous fee schedule).

Meanwhile, converting from crypto to crypto at eToro only costs 0.1% (in addition to prevailing spreads).

Exchange-Traded Securities: In addition to trading CFD shares, eToro also offers zero-dollar commission for stock trading to residents of the U.S. and the U.K. and supports fractional shares. Residents of other countries may have to pay a $1 or $2 commission depending on the exchange. To learn more, see our UK.StockBrokers.com review of eToro.

Other fees: Options trading for non-US residents carries a charge of $0.50 per contract. An inactivity fee of $10.00 per month also applies. Additionally, if you keep more than $5,000 across your eToro accounts, you will avoid the $2 monthly clearing fee that applies to eToro USA Securities customers.

| Feature |

eToro eToro

|

|---|---|

| Minimum Deposit | $50-$10,000 |

| Average spread (EUR/USD) - Standard account | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Non-wire bank transfer | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

eToro delivers an excellent mobile experience through its modern app. I consistently find it easy to use, no matter which section I’m navigating. The platform mirrors nearly all the features of its web version, making transitions between devices smooth and intuitive.

Apps overview: eToro offers two mobile apps: the main eToro app and eToro Money, which handles crypto and money transfers. Both are available on Google Play for Android and the Apple App Store for iOS. eToro also provides Delta, a digital asset app that includes support for NFTs. For this review, I focused solely on the eToro app.

Ease of use: When I tested the eToro app on Android, it felt almost identical to the web version, complete with dark and light mode options and synced watchlists that keep the experience consistent across devices. The app is full of subtle design enhancements. One standout is the economic calendar, which you can filter by your portfolio, watchlist, or popular assets. Tap a tab, and the calendar refreshes instantly to show events related to those assets.

The watchlist on the eToro mobile app shows popular assets for trading.

Charting: Charting on the mobile app maintains the responsive feel and design consistency of the web version, supported by TradingView’s default charts. That said, the absence of drawing tools stands out and would be a valuable improvement to an otherwise well-designed experience. The order entry flow is simple, though it lacks more sophisticated order types found on stronger platforms.

Cryptocurrency wallet: eToro Money, the brand’s dedicated wallet app, functions separately from the main platform and enables deposits and withdrawals of funds and supported cryptocurrencies. The interface looks and behaves much like the eToro trading app, complete with social features. Remember that crypto trading takes place in the main app; the wallet’s role is to store your assets and manage crypto transfers in and out.

Note: While crypto trading services are available for investors on the eToro platform, it should be noted that eToroX – the brand's crypto exchange – is no longer available to retail clients.

| Feature |

eToro eToro

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | No |

| Mobile Research - Economic Calendar | No |

| Mobile Charting - Indicators / Studies | 104 |

Trading platforms

eToro's main innovation is merging self-directed trading and copy trading under a unified trading experience. It is a winning combination. See our guide to the best copy trading platforms.

Platforms overview: The platform is designed with simplicity in mind, making it easy for first-time traders to explore markets without being overwhelmed. Traders gain access to functions such as the ability to create watchlists, as well as the option to add instruments simply by searching available markets. These design qualities helped eToro win #1 Ease of Use and rank Best in Class for the Beginners category in our 2025 Annual Awards.

Charting: Basic charts on the eToro platform are powered by TradingView. The platform’s charting capabilities truly open up when you switch to ProCharts, an enhanced version available to Silver-status users. I couldn’t immediately spot every difference, but I did notice that ProCharts lets you add more than five indicators at once, a limit usually imposed in the standard TradingView setup. eToro also highlights two key advantages of ProCharts: your chart settings are saved automatically, and you can analyze multiple charts simultaneously instead of being restricted to a single chart view.

Trading tools: Another innovative tool from eToro is its CopyPortfolios feature, which groups traders into single funds for copy trading. CopyPortfolios help to bridge the gap for investors who want to use eToro on a passive basis, as they can create a portfolio based entirely on one or more CopyPortfolios. On the other hand, self-directed traders can also use CopyPortfolios to diversify their trading, making it a potentially useful tool for all eToro clients. eToro also recently introduced Tori, which it promotes as an AI analyst. In my testing, however, it behaved more like a standard chatbot and was unable to answer questions about asset prices or trading strategies.

Cryptocurrency tools: eToro users can find crypto-trading ideas and copy other individuals or groups of traders across 106 supported cryptocurrency pairs. Investors looking to withdraw underlying crypto assets from their eToro account can use the eToro Mobile wallet app. This app acts as a custodian with a multi-signature scheme and closely mirrors the brand's forex mobile app.

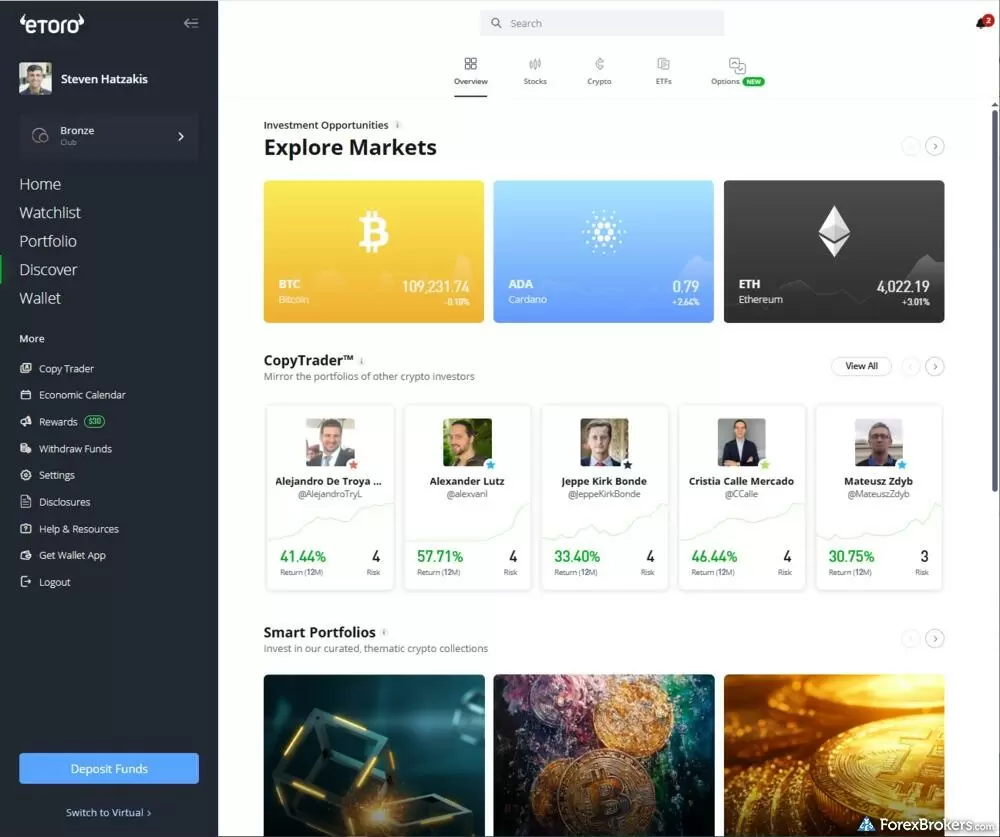

The overview page of the Discover tab on the eToro web platform provides a variety of trading ideas and providers to copy.

Copy trading structure: Fully automated trading systems (i.e. algo trading) such as those supported on MetaTrader are not permitted at eToro. Therefore, when you copy another trader on eToro, you can be sure they are placing each trade manually. This is quite useful to know, as many other social trading platforms that aggregate the performance of traders usually permit discretionary (manual) trading as well as automated strategies.

| Feature |

eToro eToro

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | No |

| Web Platform | Yes |

| Copy Trading | Yes |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| Charting - Indicators / Studies (Total) | 106 |

| Charting - Trade From Chart | Yes |

Research

eToro's research offering is competitive and continues to improve year-over-year. The addition of weekly video updates that include market analysis alongside research articles from in-house analysts has elevated eToro's research offering, bringing it into closer competition with the best brokers for market research.

Research overview: eToro offers a standard economic calendar, an earnings reports calendar, news headlines, daily market analysis series, and podcasts. While not every research tool will be relevant for beginners right away, eToro’s platform gives new traders the opportunity to explore and grow into more advanced analysis over time. That said, several of these features are not directly integrated into the eToro platform. Trading Central is also available, but is not offered to all clients – it’s reserved for eToro club members that have reached a specific tier status. There are also research reports for stocks available to funded account holders. eToro has the distinction of being one of the first brokers to integrate TipRanks, a superb resource for research on the other asset classes the broker offers besides forex.

Market analysis: eToro does an excellent job incorporating fundamental analysis into its platform for shares trading, and in the daily articles posted to eToro’s blog. It's worth noting that eToro has made considerable progress in this category, with the addition of eToro Plus, Digest & Invest, Trader Talks, and its Weekly Crypto Roundup series. Its new In-Depth series crowdsources analysis from popular investors, and I found the content to be consistently structured and thoughtfully presented.

News headlines: News headlines aggregated by CityFalcon, from sources such as FXStreet, Finbold, Benzinga, CoinDesk, and FXEmpire, were consistently high quality and relevant to the asset coverage within the eToro platform. In addition, automated technical analysis insights from CoinFi support crypto assets, tracking fundamentals like recent commits and forks on a cryptocurrency’s official GitHub repo as indicators of developer activity and interest.

A screengrab of recent Digest & Invest podcasts with leading technical analysis.

Sentiment data: Only the trades of top traders at eToro are used to calculate sentiment data, rather than showing sentiment based on data from all users. This takes it a step above the usual sentiment tools brokers provide, and is similar to how CMC Markets displays this data.

Wall newsfeed: eToro uses a Twitter-style wall feed of collective commentary for each given instrument. This public feed appears as a stream of updates from other eToro users, designed to give you an idea of what other traders are posting about in the eToro network. As the content is sourced by eToro users, it can vary in quality. It is certainly unique; that said, I find content that is generated by in-house staff or from third-party professionals to generally be of higher quality. Still, this social feature is a welcome addition. It allows you to share your trades with the community, follow other investors, and customize the feed in your local language.

| Feature |

eToro eToro

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | Yes |

| Client sentiment data | Yes |

Education

eToro's Learning Academy offers a great balance of educational content, including videos, articles, and webinars. It also recently revamped its Academy offering by adding new courses. Overall, eToro has made significant progress in this category, and the addition of new educational courses and content on the eToro Academy helped eToro earn Best in Class honors for Education in our 2025 Annual Awards. The range of tutorials, courses, and articles is particularly helpful for beginners learning the basics of trading and financial markets.

Learning center: eToro offers an online trading academy containing dozens of videos and articles that are organized by category and experience level. While eToro has made significant progress with the introduction of dedicated courses, it was hard to distinguish a course from a guide even with the added quizzes at the end, and I believe there is still room for improvement on the major progress it has already made.

Integrated educational tidbits: eToro provides extra details for beginners next to each symbol available within its platform, such as information about trading instruments (like the EUR/USD currency pair), and general facts to consider before investing.

The landing screen to the course description and overview of a typical beginner's educational lesson on the eToro platform.

Room for improvement: eToro has a decent number of videos on its YouTube channel, including archived webinars and market analysis, but I found it hard to distinguish between research, promotional, and educational videos. Organizing educational content by playlist and separating platform tutorials from financial market education would help to balance eToro’s video content in this category.

| Feature |

eToro eToro

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

eToro is great for retail traders who want to crowdsource investment ideas using the power of copy trading, or for highly-experienced active traders who want to be rewarded for sharing their ideas with other traders.

New traders will appreciate eToro’s intuitive platform and the ability to learn by copying experienced investors. Algo trading is not supported at eToro.

Steven's expert take

eToro is excellent for copy trading and offers a solid social experience, but it’s not ideal for active or high-volume traders due to higher spreads and small trade limits. These issues matter less if others copy your strategy or you qualify for discounts through the eToro Club or Popular Investor program.

eToro is an excellent choice for copy trading and crypto trading, earning first place ranking for both categories in our 2025 Annual Awards.

eToro Star Ratings

| Feature |

eToro eToro

|

|---|---|

| Overall Rating |

|

| Trust Score | 97 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

View eToro Features List

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

eToro Regulation, eToro Learning Academy, eToro YouTube channel

Read next

- Best Forex Trading Apps for 2026

- Best Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Copy Trading Platforms for 2026

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2026

- Best Low Spread Forex Brokers for 2026

- Best Brokers for TradingView for 2026

- Compare Forex Brokers

More Forex Guides

Popular Forex Broker Reviews

About eToro

An early pioneer in social copy trading, eToro was founded in Israel in 2007 as a financial trading technology developer. After launching its first product, it has since grown to service over 32 million registered users with an innovative platform that continually evolves to be one of the largest social networks globally, with clients in over 140 countries, and $7.5 billion in assets under administration. eToro has added ESG scores for over 2,700 tradeable stocks.