Saxo Review for Forex Trading

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Saxo is an exclusive multi-asset broker with brilliant research and a superb trading platform experience – as well as a stunning selection of over 71,000 tradeable instruments.

For active traders, Saxo provides an immersive, rich trading experience with a towering selection of tools, research, and premium features.

-

Minimum Deposit:

$0 -

Trust Score:

99 -

Tradeable Symbols (Total):

71000

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Research | Winner |

| #1 Desktop Platform | Winner |

| #1 VIP Client Experience | Winner |

| 2026 | #3 |

| 2025 | #3 |

| 2024 | #3 |

| 2023 | #2 |

| 2022 | #2 |

| 2021 | #2 |

| 2020 | #2 |

| 2019 | #2 |

| 2018 | #1 |

| 2017 | #2 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Saxo pros & cons

Pros

- Trade over 71,000 instruments including forex options.

- SaxoTraderGo has advanced tools and a clean interface.

- Offers algo orders, risk tools, and execution by order size.

- TradingView implementation supports Pine Script and API trading.

- Recently removed inactivity and platform fees.

Cons

- No progress tracking or quizzes in education content.

- Platinum and VIP accounts have high deposit requirements.

- SaxoTraderPRO lacks quick-start layouts.

- Can’t drag-to-edit orders on SaxoTraderGo charts.

My top takeaways for Saxo in 2026:

- Saxo has high minimum deposits for Platinum ($200,000) and VIP ($1,000,000) accounts which may be too steep for some. However, Saxo's Classic account pricing aligns with industry averages.

- The SaxoTraderGo platform includes everything that traders might need to navigate the market, however, it doesn’t allow quick order adjustments by dragging and dropping on charts.

- Saxo supports advanced order types, including algorithmic orders and risk management features.

Trust Score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Saxo safe?

Saxo is considered Highly Trusted, with an overall Trust Score of 99 out of 99. Saxo is not publicly traded, does operate a bank, and is authorised by seven Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and zero Tier-4 regulators (High Risk). Saxo is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Saxo entities are regulated.

| Feature |

Saxo Saxo

|

|---|---|

| Year Founded | 1992 |

| Publicly Traded (Listed) | No |

| Bank | Yes |

| Tier-1 Licenses | 7 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

Range of investments

Saxo is a multi-asset broker that offers investors and traders a vast selection of more than 71,000 tradeable symbols. In addition to electronically-tradeable markets that span nearly every asset type, Saxo offers spot forex, FX options, non-deliverable forwards (NDFs), Contracts for Difference (CFDs), stocks, stock options, exchange-traded funds (like Bitcoin ETFs), exchange-traded notes (ETNs), futures, and 33,000 bonds (available only via phone).

Exchange-traded securities: In addition to trading CFD shares, Saxo also offers ISA/SIPP accounts for share dealing. To learn more, see our U.K. StockBrokers.com review of Saxo.

Cryptocurrency: Saxo was featured among our top picks for the best crypto trading platforms. Cryptocurrency trading is available through derivatives, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The following table summarizes the different investment products available to Saxo clients.

| Feature |

Saxo Saxo

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 71000 |

| Forex Pairs (Total) | 190 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | No |

| Cryptocurrency (Underlying) | No |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Saxo fees

Overall, Saxo delivers excellent all-around pricing. For active traders, high-volume traders, and those able to maintain large account balances, Saxo's pricing is among the lowest in the industry.

Pricing summary: As of October 2025, Saxo’s average EUR/USD spreads were:

- Classic: 1.0 pip

- Platinum: 0.9 pips

- VIP: 0.8 pips

Saxo’s Platinum and VIP pricing is generally closer to the industry average, while the Classic account trends slightly higher based on the period referenced.

It’s also important to distinguish between minimum and average spreads. During the same timeframe, the minimum spread for each tier was roughly 0.3 pips lower than the average. For example, Classic posted a 0.7-pip minimum versus a 1.0-pip average.

Beyond FX pricing, Saxo has also improved its overall fee schedule in two notable ways:

- Custody fees: Saxo waives custody fees for share trading for clients who opt into securities lending.

- Inactivity fees: Saxo has removed its inactivity fees, reducing the cost of maintaining an account for lower-frequency traders.

Classic account minimums: The entry-level Classic account minimum deposit was recently reduced to $0 for new customers in all regions.

Platinum account minimums: The minimum deposit for the Platinum account is $200,000 (or AUD 300,000 if you are a forex trader in Australia, where Saxo has rebranded to Totality). Traders with the Classic account can qualify to be upgraded to Platinum by earning volume-related Loyalty points through Saxo’s Loyalty Program. For example, trading over $40 million worth of forex would earn you 120,000 points – which would be enough to upgrade from Classic to Platinum for 12 months.

VIP account minimums: Saxo won our 2026 Annual Award for the #1 VIP Client Experience. Saxo’s VIP account, which offers the most savings on pricing, is reserved for elite investors who either deposit at least $1,000,000, or who qualify to be upgraded under Saxo’s loyalty rewards program. Traders looking to have their account tier upgraded to VIP would need to trade at least $167 million in forex volume – this upgrade would be valid for one year. The VIP account also provides access to exclusive events and connections to Saxo analysts.

Commission-free: Saxo is commission-free, which means it makes money off the spread, when it comes to forex trading. There is one exception; traders who trade less than 50,000 units (half of one standard lot) per month are charged a ticket-fee of $3 per side.

Best execution: Saxo is committed to the FX Global Code, an evolving interbank standard focused on enhanced disclosures and execution best practices. The mission of the FX Global Code is to promote integrity and transparency across the global foreign exchange market. Saxo's reliable market maker execution earned it a spot on my list of the best market makers.

| Feature |

Saxo Saxo

|

|---|---|

| Minimum Deposit | $0 |

| Average spread (EUR/USD) - Standard account | 1.0 |

| All-in Cost EUR/USD - Active | 0.8 |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Saxo does a great job of unifying the excellent SaxoTraderGO web-based platform experience across devices. Saxo’s SaxoTraderGO mobile app is a favorite of mine, and one of the top mobile apps along with some of the best forex brokers for mobile, such as IG, CMC Markets, and Charles Schwab (U.S. citizens only). Saxo earned Best in Class honors for Mobile Trading Apps in our 2026 Annual Awards.

Apps overview: One of the strengths of Saxo’s platform suite is how closely the SaxoTraderGO web-based platform experience mirrors Saxo’s flagship mobile app offering.

Ease of use: The SaxoTraderGO mobile app is an absolute pleasure to use, due to its impressive, intelligent design. One standout feature that I really appreciate is the ability to access such an abundance of useful information within each tab for a given asset. For example, when viewing the EUR/USD pair, traders can see related videos, articles, news headlines, market research, and trading signals. The intuitive design of the SaxoTraderGO app and the plethora of available information makes it easy for traders to make clear-headed decisions when assessing markets and managing trading positions. Saxo is a true leader in this category.

Charting: SaxoTraderGO’s charting capabilities are rich with nearly 20 drawing tools and 62 indicators, and – touching on a theme here – closely matches the experience of the platform’s web-based version. In addition to syncing watchlists, charts in the SaxoTraderGO mobile app sync with the browser-based version of the platform. For example, if you draw trend lines and add indicators in the web version, they will appear in the mobile app (and vice versa).

SaxoTraderGO's mobile charts depict multiple concurrent indicators and trend lines when trading EUR/USD.

Trading tools: Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app, including the trade ticket window, watch list and screener features, and all research tabs. The platform’s economic calendar, educational videos, market news from top-tier sources such as Dow Jones Newswire, and pattern recognition analysis from Autochartist are all accessible on the mobile app – just as they are on the web version. Finally, the options strategy finder comes with 13 predefined strategies that let you easily create related multi-leg options orders for a given instrument.

| Feature |

Saxo Saxo

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 64 |

Trading platforms

There’s no question; Saxo's proprietary trading platforms are terrific, thanks to their streamlined designs and robust trading tools. Saxo took home our 2026 Annual Award for #1 Desktop Platform.

Platforms overview: Saxo’s flagship trading suite includes SaxoTraderGO (web) and SaxoTraderPRO (desktop), alongside third-party platforms such as TradingView, MultiCharts, and trading connectivity via API. Saxo has also recently rolled out SaxoInvestor, a simplified web app for passive investors, which includes the ability to set up recurring investments into ETFs to cater to longer-term strategies.

Saxo’s proprietary platform suite continues to improve with expanded research modules while maintaining its existing look and feel. Hot Topics tab, and integrated webinars – among other more subtle improvements. All of these advanced options put Saxo on my list of the best brokers for day trading forex.

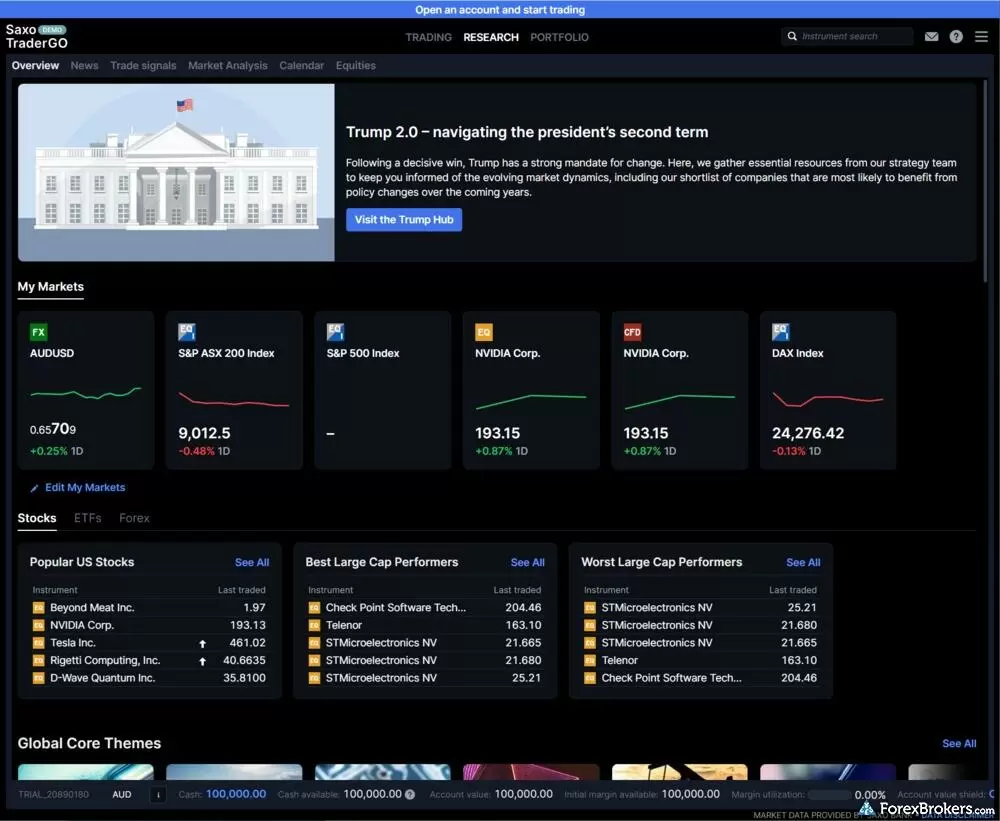

SaxoTraderGO "Hot Topics" feature upcoming educational and research webinars as well as past webinars.

Charting: For this review I focused on Saxo’s proprietary platform suite. While the SaxoTraderGO web-based app is designed for ease of use, it also delivers advanced trading and charting capabilities. The watch-list, screener, and alerts work together in unison, and the platform is designed to bring tools and features within reach without making the experience cluttered or confusing.

My biggest grievance is the inability to drag-to-modify stops and limits when viewing your orders on a chart within SaxoTraderGO and SaxoTraderPRO. Given that this feature is quickly becoming the industry standard and available on platforms like TradingView, I would hope Saxo adds this feature to help improve its platform for active traders.

Steven's take:

"Saxo sets a high bar for platform design and UX, staying intuitive without sacrificing depth, making it less overwhelming than complex rivals. As modern web frameworks help peers catch up, Saxo still offers a near-perfect mix of ease and advanced tools that's hard to beat."

Like the platform itself, charts are versatile and powerful, with 62 indicators, 20 drawing tools, and nine selectable chart types – all of which sync across devices. Swapping between instruments is a breeze, and I really like the product overview section, which shows related news and trade signals from Autochartist.

SaxoTraderPRO desktop: Saxo’s award-winning flagship desktop platform is SaxoTraderPRO, which resembles SaxoTraderGO in both look and feel. Functionality is similar; however, the PRO platform offers a larger selection of professional trading features. For example, PRO supports up to six monitors, streaming Level 2 order books, streaming time and sales, and algorithmic orders.

Note, additional data subscriptions are required to use tools like the streaming Level 2 order book, which is a standard industry practice. Charting on SaxoTraderPRO is equally powerful as the web version. Subtle touches are seamlessly incorporated, such as the count-down timers which display the time remaining in each candle.

The only minor drawback I found when comparing PRO to GO is that many of the research features that load by default in GO must be added manually by using the “add module” tab. It’s also worth noting that additional data subscriptions are required to use tools like the streaming Level 2 order book – though this is a standard industry practice. Still, the desktop version of SaxoTraderPRO is so immersive and so massive that it felt as though I was in an IMAX theater, especially when going full-screen on a large monitor.

Ease of use: As noted earlier, Saxo provides a universal platform experience across devices, and is again my favorite for the Ease of Use category. The user experience across platforms and devices is consistent, and customized charts and watch lists automatically save and sync with the mobile app.

All in all, Saxo’s close attention to detail can be seen throughout its proprietary platforms. For example, in SaxoTraderGO, the trade ticket comes with advanced options such as the ability to switch between forex CFDs, futures, forwards, or forex options. Also, the Quick Trade option allows you to set price tolerance for slippage when you need immediate fills. Another feature I really appreciate in SaxoTraderGO is the ability to customize your default order parameters, including stop-loss and limit levels, within the platform settings.

Innovative tools: For risk-management purposes, there is an Account Value Shield feature that lets you specify the maximum risk across your account balance. If triggered, this feature will attempt to close all open positions (except for bonds and mutual funds). There are also at least thirteen advanced algorithmic order types available for various supported markets.

Third-party platforms: Saxo supports a variety of third-party platforms, including TradingView, MultiCharts, Updata, Dynamic Trend, and the OpenAPI for Excel.

TradingView

TradingView is a popular trading platform that delivers a range of powerful charting functions, robust analysis tools, and engaging community features. Learn more by checking out our TradingView Guide.

| Feature |

Saxo Saxo

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| Charting - Indicators / Studies (Total) | 61 |

| Charting - Trade From Chart | Yes |

Research

Saxo earned our #1 Best Broker for Research award in 2026 and is a top choice for traders who want in-depth forex research. Saxo goes to great lengths to raise the bar in this category, delivering institutional-grade insights to retail clients. The Saxo research team’s passion, and clear focus on helping clients succeed, comes through in its in-house analysis, the extensive trading ideas published across its website and platforms, and the high-quality content available from its top-tier third-party research partners.

Overall, Saxo continues to build out the variety and depth of research available within its platform suite, including with the introduction of geopolitical theme-based coverage, such as its resource hub that covered the U.S. elections in 2024.

Research overview: Saxo offers a diverse research offering across its websites and platforms, in a variety of formats (video, articles, podcasts and headlines). It provides in-house content, such as the daily updates published by its own analysts in Saxo’s Market Analysis section, as well as third-party content such as the news headlines that stream from sources like Dow Jones, NewsEdge, and RanSquawk. Furthermore, trading signals from Autochartist are fully integrated into the Saxo platform experience, making it seamless to copy a signal with the forecast and expected trading range visible on a chart.

Podcasts: There are also daily podcast updates from the SaxoStrats team, as part of the Saxo Market Call. I find that they integrate nicely with their research analysis articles.

Market news and analysis: Saxo does an outstanding job of centralizing its research within the SaxoTraderGO and SaxoTraderPRO platforms. Third-party trading signals and analysis are provided by Autochartist, which is nicely integrated into the software. The Market Quick Take series is a great quick summary of high-level themes across the global financial markets and available as quick read blog post on the Saxo website.

I found it easy to discover relevant content, as Saxo’s research is organized by asset class and geopolitical themes, though I prefer accessing it in the platform rather than on the Saxo website. In-platform, for example, you’ll see related news and trading ideas alongside a given instrument. To find shortcomings, I had to be picky: Saxo includes an integrated economic calendar, but it isn’t particularly interactive.

SaxoTraderGO’s Research Overview distinguishes itself with high-level curated content, such as the "Trump 2.0" strategy hub, which helps investors navigate complex geopolitical shifts with expert analysis. This dashboard effectively pairs these strategic insights with granular market data, displaying customizable "My Markets" tiles and real-time performance lists for immediate tracking of top movers and global core themes.

Video content: Video research is seamlessly integrated into the Saxo website and its proprietary platforms. I found the video content itself to be of high quality, like Saxo’s Fintech Unfiltered series, for example. Saxo also includes playlists on YouTube, though it’s worth mentioning that many of Saxo’s videos are unlisted, and thus not easy to find or identify. Saxo’s focus seems to be on its websites and trading platforms, rather than its YouTube channel. This approach provides a much cleaner customer experience, and prevents the need to bounce between YouTube and a trading platform. That said, bringing all of its video content into one place would help highlight Saxo’s video content, and make it easier for traders to discover.

Reports: Saxo’s research team delivers quarterly outlooks and yearly forecast reports, available in PDF and including accompanying videos. These reports are excellent for traders and investors seeking to take a theme-based position based on quality research. Being proprietary, the reports are also engaging. For example, I personally enjoy reading the annual “Outrageous Predictions” forecast each year.

| Feature |

Saxo Saxo

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central | No |

| Client sentiment data | Yes |

Education

Saxo provides a diverse selection of quality educational materials in both written and video format. The scope of educational resources available at Saxo rises above the industry average, yet falls slightly behind category leaders.

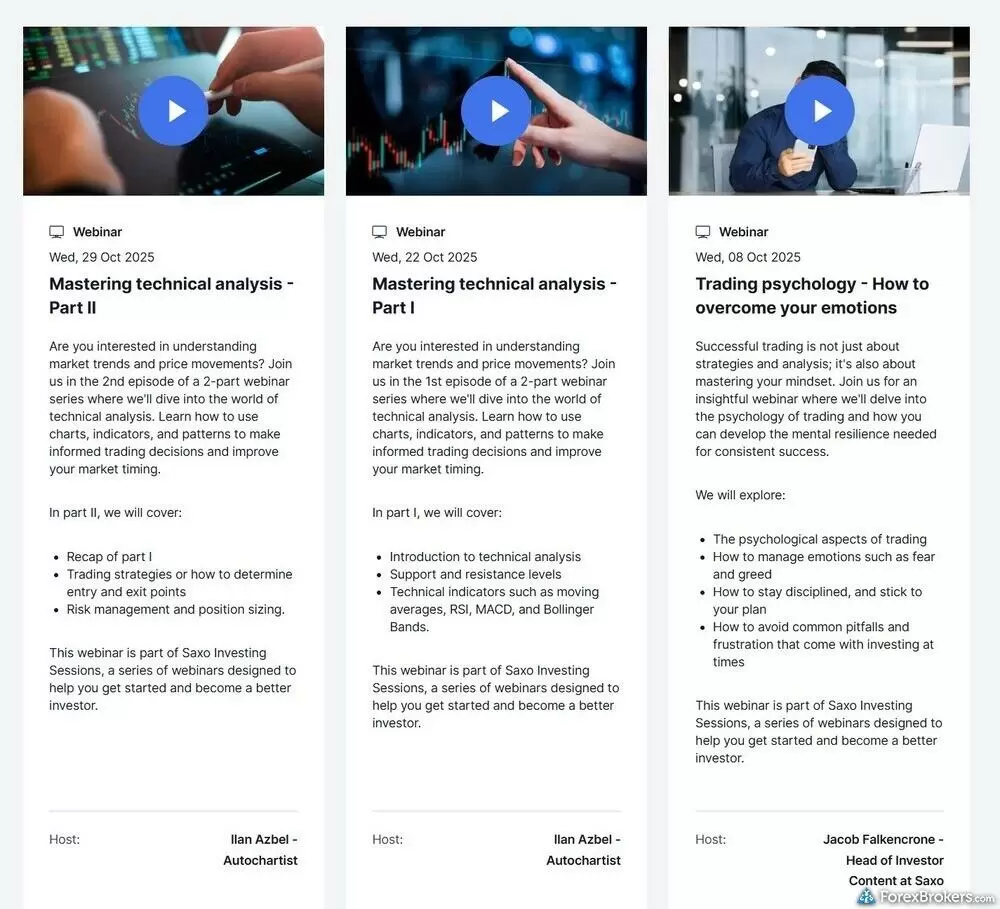

Webinars: New in late 2025, Saxo launched a webinar series under its Saxo Investing Sessions, with archived video recordings available on its website. I found the content to be high quality, with both in-house staff and third parties contributing to the recordings. The webcasts cover a broad selection of investment themes and concepts, from specific asset classes to mastering technical analysis.

Learning center: Under its Insights section, Saxo provides market analysis articles produced by the firm’s in-house Saxo Strategy (Saxo Strats) team, which can be filtered by analyst or asset class. These articles are updated multiple times a day, and feature client sentiment data and market movers. The Insights section also contains 20 videos for beginners, which range in length from 5 to 20 minutes. I also found the Thought Starters series to be helpful, featuring short articles that cover concepts such as using indicators for technical analysis or risk management strategies.

Saxo’s "Investing Sessions" provide a structured educational series through expert-led webinars that tackle essential trading pillars, ranging from multi-part technical analysis masterclasses to strategies for mastering trading psychology. Hosted by specialists from partners like Autochartist and internal Saxo strategists, these on-demand recordings offer traders deep, actionable guidance on market timing, risk management, and emotional discipline.

Room for improvement: Aside from 41 platform video tutorials available in Saxo’s flagship platform suite, I counted at least eleven for risk-management, eight for fundamental analysis, and six for fundamental analysis. Some of Saxo’s videos are produced by in-house staff, while CME Group powers the rest of the courses.

There is a lot to like about Saxo’s video content, and there’s a lot of it – there are 41 platform tutorials alone, alongside educational videos covering subjects like risk management and fundamental analysis. That said, bringing all of the educational video content into one easily-accessible location, and then organizing it by experience level or category would make the content easier to find and navigate. Lastly, Saxo's YouTube channel is simply not very active, and falls short when it comes to financial markets education.

| Feature |

Saxo Saxo

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

Saxo is a highly trusted, global brand that delivers just about everything that traders need. The client experience is seamless, and is rich with advanced tools and quality market research.

Saxo also does an excellent job of unifying its desktop, web, and mobile platforms. Saxo was Best in Class across eight categories for 2026, and won our awards for #1 Desktop Platform, #1 Research, and #1 VIP Client Experience.

With the minimum deposit reduced from $2,000 down to $0 for clients in 2024, Saxo's Classic account provides the complete package for discerning traders. For its Platinum and VIP accounts, if the steeper deposit requirement is a deal-breaker, I recommend checking out IG or CMC Markets.

Saxo's Star Ratings

| Feature |

Saxo Saxo

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Read next

- Best Forex Brokers for 2026

- Best Forex Trading Apps for 2026

- Compare Forex Brokers

- Best Low Spread Forex Brokers for 2026

- International Forex Brokers Search

- Best Brokers for TradingView for 2026

- Best Forex Brokers for Beginners of 2026

- Best Copy Trading Platforms for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

More Forex Guides

Popular Forex Broker Reviews

About Saxo

Established in 1992, Saxo is one of the leading retail forex and multi-asset brokerages, servicing nearly 1.3 million clients from its regulated entities across 15 international jurisdictions, including the U.K., Denmark, and Singapore, under the Saxo Bank Group. Saxo employs over 2,327 full-time staff and is majority-owned by China-based Geely Holding Group. Catering to both retail and institutional clients, Saxo has processed over 58 million transactions in 2024 alone holding over $130 billion (converted from 853 billion Danish krone to U.S. dollars) in client assets as of its 2024 annual report, and following its integration of BinckBank. Saxo was recently designated as a Systemically Important Financial Institution (SIFI) from the Danish FSA, in addition to receiving an investment-grade A- rating from S&P Global Ratings. Saxo powers over 440 wholesale partners and financial intermediaries, with over 200 million requests to its OpenAPI daily.

Article Resources

Saxo Regulation, Saxo Education, Saxo YouTube channel