Best Forex Brokers in the UK for 2026

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

The United Kingdom remains one of the most active global hubs for retail and institutional forex trading, supported by deep liquidity and a long-established regulatory framework. For anyone evaluating the best forex brokers in the U.K., the starting point is always the Financial Conduct Authority (FCA). As the U.K.’s financial regulator, the FCA authorizes firms, supervises conduct, and enforces standards designed to protect clients and maintain orderly markets.

The FCA’s rulebook influences nearly every aspect of a broker’s offering, including capital requirements, client fund segregation, product disclosures, and the oversight of complex instruments such as CFDs. Traders also benefit from the broader ecosystem surrounding the FCA, including established reporting rules, transparent oversight, and a clearly defined complaints process. Together, these elements shape a trading environment where expectations and protections are well understood.

This guide highlights the top FCA-regulated forex brokers serving U.K. residents. You’ll find insights into platforms, pricing, research quality, and the factors that matter most when choosing a broker under the FCA’s regulatory umbrella.

Best UK Forex Brokers for 2026

After testing and reviewing the top forex brokers in the U.K., I’ve focused on the ones that stand out for their trustworthiness, trading costs, platform quality, and overall user experience. Each broker is evaluated across multiple devices and platforms, with thousands of data points analyzed to ensure only the most reliable options make this list.

| Company | Accepts GB Residents | Authorised or Regulated by the FCA | Average spread (EUR/USD) - Standard account | Minimum Deposit | Overall Rating |

IG IG

|

0.91 | £1 |

|

||

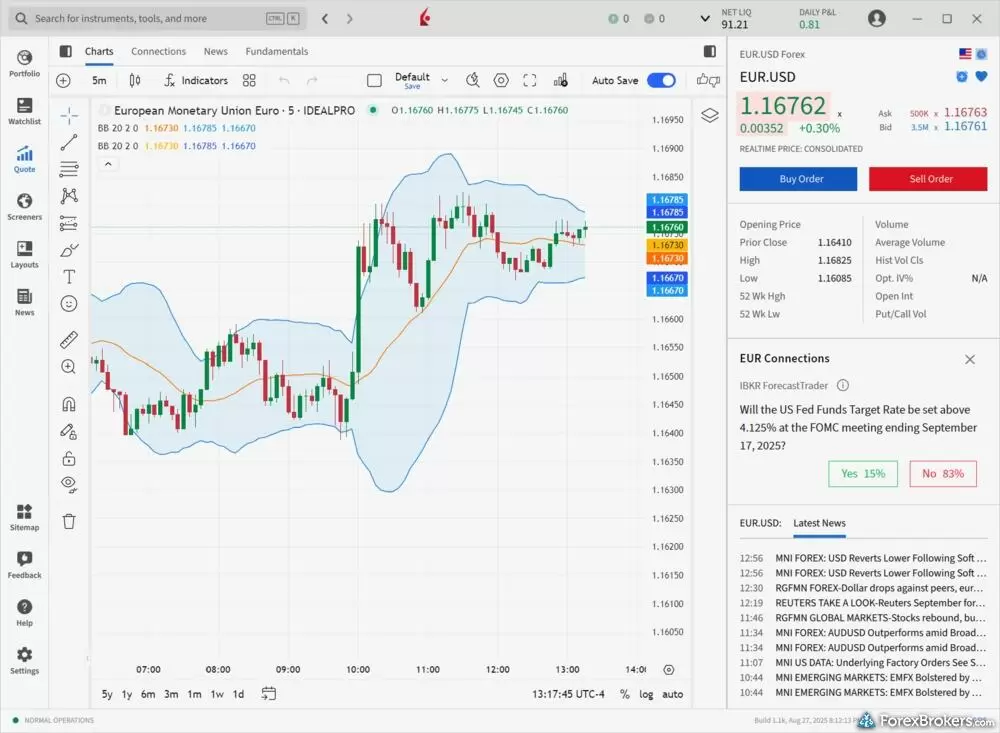

Interactive Brokers Interactive Brokers

|

0.226 | $0 |

|

||

Saxo Saxo

|

1.0 | $0 |

|

||

FOREX.com FOREX.com

|

1.00 | $100 |

|

||

CMC Markets CMC Markets

|

1.3 | $0 |

|

||

XTB XTB

|

0.92 | $0 |

|

||

City Index City Index

|

1.4 | £100.00 |

|

||

eToro eToro

|

N/A | $50-$10,000 |

|

||

FXCM FXCM

|

0.9 | Starts from $50 |

|

||

Capital.com Capital.com

|

0.64 | $20 |

|

||

Plus500 Plus500

|

1.3 | €50 |

|

||

Pepperstone Pepperstone

|

1.1 | $0 |

|

||

FxPro FxPro

|

1.6 | $100 |

|

||

Tickmill Tickmill

|

1.70 | $100 |

|

||

Trading 212 Trading 212

|

2.7 | €1 |

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

1.3 | $20 |

|

||

ActivTrades ActivTrades

|

1.08 | $0 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

||

Spreadex Spreadex

|

0.81 | $0 |

|

||

FP Markets FP Markets

|

1.3 | $100 AUD |

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

||

BlackBull Markets BlackBull Markets

|

1.16 | $0 |

|

||

Questrade Questrade

|

N/A | $250 |

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Financial Conduct Authority (FCA)

- The United Kingdom is a Trusted, Tier-1 regulatory jurisdiction. Learn more about international forex regulation and why it matters.

- The Financial Conduct Authority (FCA) supervises retail forex and CFD trading in the U.K., setting rules for authorization, conduct, financial reporting, and consumer protection.

- Only firms authorized and regulated by the FCA may legally offer forex and CFD trading to U.K. residents.

- You can verify a broker’s license and regulatory permissions using the FCA’s public register.

Other UK brokers I tested

6. XTB - Well-balanced offering

| Company | Accepts GB Residents | Authorised or Regulated by the FCA | Overall Rating | Average spread (EUR/USD) - Standard account | Minimum Deposit |

XTB XTB

|

|

0.92 | $0 |

XTB is a multi-asset broker offering a wide range of forex pairs, CFDs, stocks, ETFs, commodities, indices, and crypto from a single account. Its xStation 5 platform is central to the experience, with heat maps, sentiment data, and integrated news in an intuitive layout. Education and research are well organized, with 200+ Trading Academy lessons and regular analysis. Standard-account pricing is near the industry average, though XTB lacks MetaTrader support and mobile charting is modest.

7. City Index - Wide range of markets

| Company | Accepts GB Residents | Authorised or Regulated by the FCA | Overall Rating | Average spread (EUR/USD) - Standard account | Minimum Deposit |

City Index City Index

|

|

1.4 | £100.00 |

City Index, part of the StoneX Group, provides access to over 13,500 markets, including 80+ forex pairs and spread betting for U.K. residents. Its Web Trader platform is responsive and equipped with TradingView charts, while the mobile app offers synced watchlists and integrated research. Pricing is generally average, with limited MT4 support. Research and education are solid, featuring daily commentary, Trading Central tools, and structured learning, though content depth trails top-tier research brokers.

Best Forex Brokers UK Comparison

Compare U.K. authorized forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts GB Residents | Authorised or Regulated by the FCA | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | Average spread (EUR/USD) - Standard account |

IG IG

|

Yes | Yes | 0.91 | ||

Interactive Brokers Interactive Brokers

|

No | No | 0.226 | ||

Saxo Saxo

|

No | No | 1.0 | ||

FOREX.com FOREX.com

|

Yes | Yes | 1.00 | ||

CMC Markets CMC Markets

|

Yes | Yes | 1.3 | ||

XTB XTB

|

No | No | 0.92 | ||

City Index City Index

|

Yes | No | 1.4 |

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

More about UK forex markets and regulation

The United Kingdom remains one of the world’s most established and reputable financial hubs, with retail forex and CFD trading governed by a single, highly stringent authority: the Financial Conduct Authority (FCA). The FCA oversees all investment firms offering leveraged trading services to U.K. residents, including market conduct, capital requirements, safeguarding of client funds, and transparency in pricing and disclosures. Any broker wishing to accept U.K. clients must hold an FCA licence, which can be verified using the FCA’s Financial Services Register, where traders can confirm a firm’s permissions, approved personnel, and regulatory status.

FCA-regulated brokers must adhere to rigorous standards, including segregation of client money, participation in the Financial Services Compensation Scheme (FSCS), and compliance with rules governing communications, best execution, and complaint-handling procedures. These safeguards, combined with some of the world’s most comprehensive consumer-protection rules, make the FCA one of the highest-tier regulators globally.

The U.K. also permits spread betting, a tax-advantaged product available only to residents, alongside CFDs and leveraged forex trading. Crypto-asset derivatives remain prohibited for retail traders, and brokers must operate within leverage caps mandated by the U.K.’s implementation of ESMA measures (e.g., 30:1 for major forex pairs).

Within this environment, our research team verifies each broker’s FCA authorization and cross-references their regulatory footprint across other trusted jurisdictions. This ensures U.K. traders receive accurate, up-to-date information about the firms they engage with. Learn more about our Trust Score and the 100+ regulatory bodies tracked globally by the ForexBrokers.com research team.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Compare UK Brokers

Popular Forex Guides

- International Forex Brokers Search

- Best Copy Trading Platforms for 2026

- Best Forex Trading Apps for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Low Spread Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- Best Brokers for TradingView for 2026

- Best Forex Brokers for 2026

- Compare Forex Brokers

Find the best forex brokers in Europe

- Best Forex Brokers in Austria for 2026

- Best Forex Brokers in Cyprus for 2026

- Best Forex Brokers in Denmark for 2026

- Best Forex Brokers in Finland for 2026

- Best Forex Brokers in France for 2026

- Best Forex Brokers in Germany for 2026

- Best Forex Brokers in Ireland for 2026

- Best Forex Brokers in Italy for 2026

- Best Netherlands Forex Brokers of 2026

- Best Forex Brokers in Norway for 2026

- Best Forex Brokers in Poland for 2026

- Best Forex Brokers in Portugal for 2026

- Best Forex Brokers in Spain for 2026

- Best Forex Brokers in Sweden for 2026

- Best Switzerland Forex Brokers of 2026

- Best Forex Brokers in Turkey for 2026

- Best Forex Brokers in Ukraine for 2026

- Best Forex Brokers in the UK for 2026

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.