CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

Here’s how BlackBull Markets compares with HYCM (Henyep Capital Markets) on regulation and safety. ForexBrokers.com’s Trust Score scale is: 90–99 highly trusted, 80–89 trusted, 70–79 average risk, 60–69 high risk, and below 59 not trusted.

BlackBull Markets, founded in 2014, is not publicly traded or a bank, holds 1 Tier-1 license (considered highly trusted by ForexBrokers.com) and 0 Tier-2 licenses; its Trust Score is 77, which is in the average-risk range. HYCM, founded in 1977, is also not publicly traded or a bank, holds 2 Tier-1 and 1 Tier-2 licenses, and has a Trust Score of 85, which falls in the trusted range.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

2014

|

1977

|

|

Publicly Traded (Listed)

info

|

No

|

No

|

|

Bank

info

|

No

|

No

|

|

Tier-1 Licenses

info

|

1

|

2

|

|

Tier-2 Licenses

info

|

0

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

1

|

1

|

Fees

Comparing commissions and fees, both BlackBull Markets and HYCM (Henyep Capital Markets) earn 4.5 out of 5 stars. In ForexBrokers.com’s Commissions and Fees category, BlackBull ranks #9 out of 63 brokers, while HYCM ranks #18 out of 63. That suggests a slight edge to BlackBull overall, though your actual costs will depend on the account type you choose at each broker.

At BlackBull Markets, pricing varies by account. The Standard account is commission-free with no minimum deposit, but spreads are higher. The Prime account (minimum $2,000) typically delivers better value: in March 2024, the average EUR/USD spread was 0.16 pips, for a 0.76-pip all-in cost after adding the $3-per-side ($6 round turn) commission. Active traders can opt for the ECN Institutional account (minimum $20,000) with lower commissions of $2 per side ($4 round turn). Overall, BlackBull’s costs sit around the industry average, with the Prime account being the standout for frequent FX traders.

HYCM’s pricing is straightforward: the Raw account posts an all-in cost of about 0.6 pips on EUR/USD (after commission), which undercuts BlackBull’s Prime all-in by a hair on that pair. HYCM’s Classic account uses variable spreads from 1.2 pips, while its fixed-spread account is 1.5 pips. If you want the lowest possible EUR/USD costs and can use HYCM’s Raw account, HYCM can be marginally cheaper; if you prefer multiple pricing tiers—and potentially lower commissions at larger deposits—BlackBull’s Prime and ECN Institutional options are compelling.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$0

|

$20

|

|

Average spread (EUR/USD) - Standard account

info

|

1.16

info |

1.3

info |

|

All-in Cost EUR/USD - Active

info

|

0.76

info |

0.6

info |

|

Non-wire bank transfer

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

No

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

Yes

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

BlackBull Markets and HYCM (Henyep Capital Markets) both support forex trading as CFDs or spot and let you trade exchange‑listed stocks on U.S. and international exchanges (so you can buy shares like Apple or Vodafone, not just CFDs). The key difference is scale: BlackBull Markets lists about 26,000 tradable symbols and 72 forex pairs, while HYCM offers 1,199 symbols and 70 forex pairs. Both provide cryptocurrency CFDs (but not direct, delivered crypto). BlackBull also offers copy trading, whereas HYCM does not.

For range of investments, BlackBull Markets earns 5 stars and ranks #7 out of 63 brokers on ForexBrokers.com; HYCM earns 4 stars and ranks #27. If you want the widest selection and access to copy trading, BlackBull Markets stands out. If you prefer a simpler lineup that still covers major markets and crypto CFDs, HYCM is a solid alternative.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

26000

|

1199

|

|

Forex Pairs (Total)

info

|

72

|

70

|

|

U.S. Stocks (Shares)

info

|

Yes

|

Yes

|

|

Global Stocks (Non-U.S. Shares)

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

Cryptocurrency (Underlying)

info

|

No

|

No

|

|

Cryptocurrency (CFDs)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

BlackBull Markets and HYCM both check the core boxes for platform access and ease of use. Each broker offers a free demo account, supports MetaTrader 4 and MetaTrader 5, provides a Windows desktop download and a web-based platform, and lets you place trades directly from charts. For Trading Platforms and Tools, both earn 4 out of 5 stars from ForexBrokers.com.

The key differences come down to extra features. HYCM offers its own proprietary platform, while BlackBull Markets does not. On the flip side, BlackBull Markets supports copy trading, and HYCM does not. In the category ranking from ForexBrokers.com, BlackBull Markets places #25 out of 63 brokers, while HYCM ranks #32. If you want copy trading, BlackBull Markets may suit you; if you prefer an in-house platform experience, HYCM may be the better fit.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Desktop Trading Platform

info

|

No

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

109

|

30

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

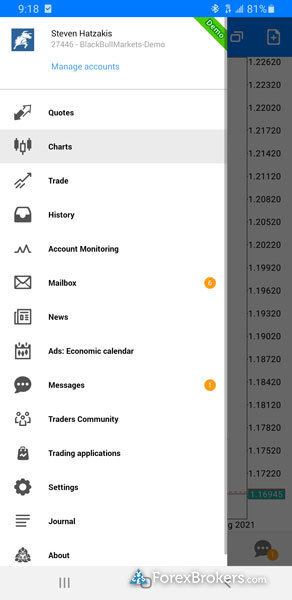

Forex trading apps

BlackBull Markets and HYCM (Henyep Capital Markets) both deliver mobile trading apps for iPhone and Android. Each app supports stock and forex price alerts, offers 30 built-in technical studies for charting, lets you draw trendlines, and auto-saves your chart annotations. Overall, the core charting and alert tools are similar, and both brokers earned 4 out of 5 stars for Mobile Trading Apps.

There are a few differences to note. BlackBull Markets syncs your watchlists across mobile and the web, so changes carry over between devices, while HYCM does not offer watchlist syncing. In ForexBrokers.com’s Mobile Trading Apps rankings, BlackBull placed 27th out of 63 brokers, compared with HYCM at 30th. If seamless watchlist syncing matters to you, BlackBull has the edge; otherwise, traders will find comparable mobile features with either broker.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Price Alerts

info

|

Yes

|

Yes

|

|

Mobile Watchlists - Syncing

info

|

Yes

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

30

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Trendlines Autosave

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

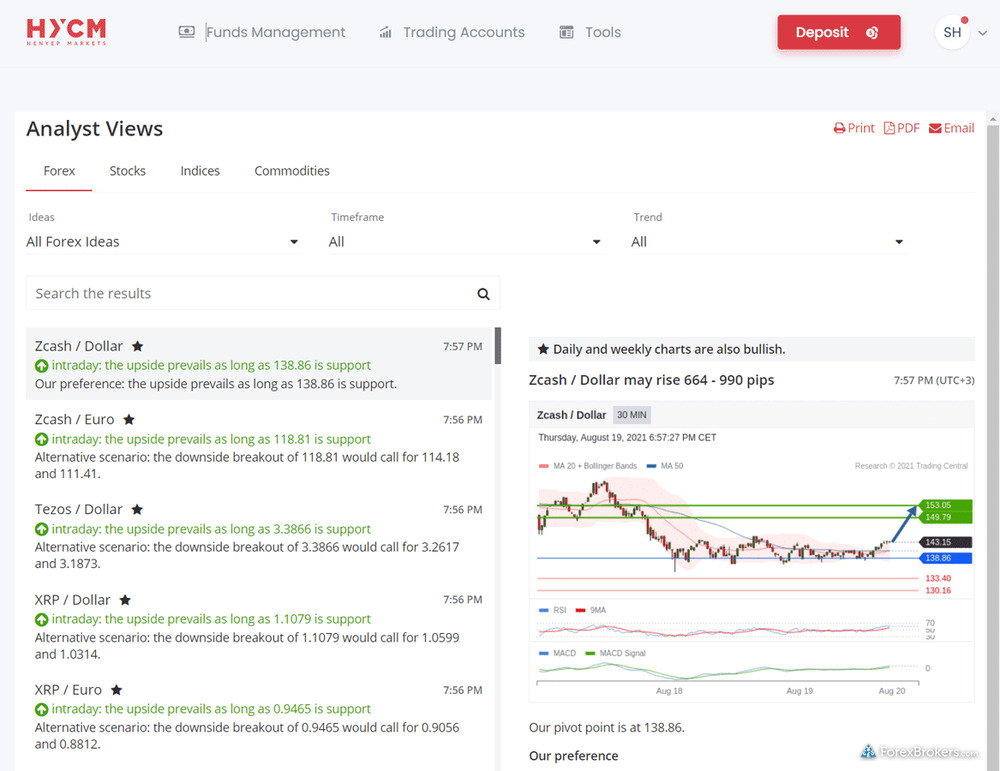

Market research

When it comes to market research, both BlackBull Markets and HYCM (Henyep Capital Markets) deliver daily market commentary and an economic calendar to track key events. HYCM stands out for integrated forex news from leading outlets like Bloomberg or Reuters, while BlackBull Markets does not include this kind of premium news feed.

For research tools, BlackBull Markets offers Autochartist and a sentiment tool showing long/short positioning, but it does not provide Trading Central. HYCM takes the opposite approach: it includes Trading Central but lacks Autochartist and a sentiment tool. Neither broker features TipRanks or Acuity Trading tools. Based on ForexBrokers.com, BlackBull Markets earns 4.5 out of 5 stars for Research (ranked 17th of 63), while HYCM scores 3.5 out of 5 stars (ranked 29th of 63). Choose HYCM if built-in premium news is a priority, or BlackBull Markets if you prefer extra chart-pattern and sentiment insights.

|

Feature |

BlackBull Markets BlackBull Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary (Articles)

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

No

|

Yes

|

|

Autochartist

info

|

Yes

|

No

|

|

Trading Central

info

|

No

|

Yes

|

|

Client sentiment data

info

|

Yes

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Acuity Trading

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

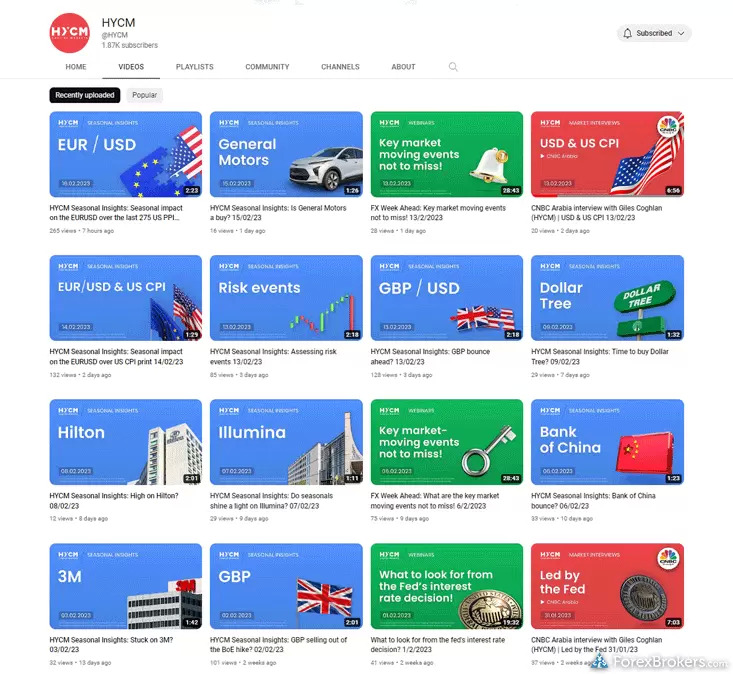

Beginners and education

Comparing beginner education, both BlackBull Markets and HYCM offer forex and CFD education with at least 10 learning pieces. BlackBull Markets holds an edge for ongoing learning thanks to monthly client webinars. Both brokers provide at least 10 beginner-friendly trading videos, but BlackBull Markets also offers 10+ advanced videos for traders who want to keep leveling up, while HYCM does not provide that same depth for experienced users.

For overall quality, BlackBull Markets earns 4.5 out of 5 stars and ranks #24 out of 63 brokers for Education on ForexBrokers.com. HYCM scores 3.5 out of 5 stars and ranks #27. If you want regular webinars and a fuller path from beginner to advanced topics, BlackBull Markets is the stronger choice. If you mainly need beginner videos to learn the basics of forex and CFDs, HYCM can still fit the bill.

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 63 of the best forex brokers, our research and account testing finds that BlackBull Markets is better than HYCM (Henyep Capital Markets). BlackBull Markets finished with an overall rank of #22, while HYCM (Henyep Capital Markets) finished with an overall rank of #26.

BlackBull Markets is a growing broker best known for its broad platform support, including MetaTrader, cTrader, TradingView, and copy trading tools, along with a large range of tradeable instruments.

FAQs

Can you trade cryptocurrency with BlackBull Markets or HYCM (Henyep Capital Markets)?

In a quick comparison, online brokers BlackBull Markets and HYCM (Henyep Capital Markets) do not support buying actual (delivered) cryptocurrencies, but both do offer cryptocurrency CFD trading.

What funding options does each broker offer?

BlackBull Markets vs HYCM (Henyep Capital Markets): for deposits and withdrawals, BlackBull supports ACH/SEPA along with Skrill and bank wire (no PayPal), while HYCM lacks ACH/SEPA but offers Skrill and bank wire (also no PayPal).

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Broker Screenshots

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Broker Gallery (click to expand) info

|

|

|

|

|

Regulation

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

77

|

85

|

|

|

Year Founded info

|

2014

|

1977

|

|

|

Publicly Traded (Listed) info

|

No

|

No

|

|

|

Bank info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

info

|

No

info

|

|

|

Tier-1 Licenses info

|

1

|

2

|

|

|

Tier-2 Licenses info

|

0

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

1

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

No

|

No

|

|

|

Canada (CIRO Authorised) info

|

No

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

No

|

Yes

|

|

|

Japan (FSA Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

No

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

|

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

No

|

Yes

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

Yes

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

|

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

No

|

No

|

|

|

UAE (DFSA, FSRA, or CMA Authorised) info

|

No

|

Yes

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

|

|

|

|

Investments

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

26000

|

1199

|

|

|

Forex Pairs (Total) info

|

72

|

70

|

|

|

U.S. Stocks (Shares) info

|

Yes

|

Yes

|

|

|

Global Stocks (Non-U.S. Shares) info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

Cryptocurrency (Underlying) info

|

No

|

No

|

|

|

Cryptocurrency (CFDs) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Average spread (EUR/USD) - Standard account info

|

1.16

info

|

1.3

info

|

|

|

All-in Cost EUR/USD - Active info

|

0.76

info

|

0.6

info

|

|

|

Inactivity Fee info

|

No

|

No

|

|

|

Order execution: Agency info

|

No

|

Yes

|

|

|

Order execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$0

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

No

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Non-wire bank transfer info

|

Yes

|

No

|

|

|

Trading Platforms

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Desktop Trading Platform info

|

No

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

Yes

|

No

|

|

|

Trading Tools

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Price Alerts info

|

Yes

|

Yes

|

|

|

Charting - Indicators / Studies (Total) info

|

109

|

30

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Price Alerts info

|

Yes

|

Yes

|

|

|

Mobile Watchlist [DELETED] info

|

|

|

|

|

Mobile Watchlists - Syncing info

|

Yes

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

30

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Trendlines Autosave info

|

Yes

|

Yes

|

|

|

Mobile Research - Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary (Articles) info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

No

|

Yes

|

|

|

Autochartist info

|

Yes

|

No

|

|

|

Trading Central info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Client sentiment data info

|

Yes

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

BlackBull Markets |

HYCM (Henyep Capital Markets) |

|

|

Webinars info

|

Yes

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

arrow_upward