CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

Comparing online brokers Charles Schwab and HYCM (Henyep Capital Markets): Charles Schwab, founded in 1971, is a publicly traded U.S. bank and broker, while HYCM, founded in 1977, is privately held and not a bank. Schwab’s status as a listed company adds transparency for investors, whereas HYCM operates as a non-bank broker without public shares.

On regulation, Schwab holds 5 Tier-1 licenses and 0 Tier-2 licenses; HYCM holds 2 Tier-1 and 1 Tier-2 license. ForexBrokers.com rates Schwab with a Trust Score of 99 (90–99 = highly trusted) and HYCM at 85 (80–89 = trusted). For context, 70–79 is average risk, 60–69 high risk, and below 59 should not be trusted.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

1971

|

1977

|

|

Publicly Traded (Listed)

info

|

Yes

|

No

|

|

Bank

info

|

Yes

|

No

|

|

Tier-1 Licenses

info

|

5

|

2

|

|

Tier-2 Licenses

info

|

0

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

0

|

1

|

Fees

Charles Schwab charges no commissions for forex; your cost is the bid/ask spread. Its average EUR/USD spread was 1.35 pips in October 2024, which is on the higher side versus peers. There’s no minimum deposit for its main brokerage accounts. Forex is available through the Schwab One account with trades settled in U.S. dollars; the smallest trade size is 10,000 units, implying about $500 in minimum margin at 20:1 leverage. Schwab Global lets you trade in 12 international markets in local currencies, with currency conversion fees ranging from 0.2% to 1% depending on your balance. Schwab also displays overnight financing (carry) charges inside the thinkorswim platform.

HYCM offers three pricing choices: the Raw account averages about 0.6 pips all-in on EUR/USD (after commission), the Classic account has variable spreads starting from 1.2 pips, and the Fixed account posts a 1.5-pip spread. Compared with Schwab’s typical 1.35-pip EUR/USD spread, HYCM’s Raw account is generally cheaper for active forex traders, while its Classic and Fixed options may appeal to those who prefer simpler pricing.

Ratings and rankings for Commissions and Fees: Charles Schwab — 4 out of 5 stars, ranked 23rd of 63 brokers. HYCM (Henyep Capital Markets) — 4.5 out of 5 stars, ranked 18th of 63 brokers.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$0

|

$20

|

|

Average spread (EUR/USD) - Standard account

info

|

1.27

info |

1.3

info |

|

All-in Cost EUR/USD - Active

info

|

1.27

info |

0.6

info |

|

Non-wire bank transfer

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

No

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

No

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

Charles Schwab edges out HYCM (Henyep Capital Markets) for range of investments, offering about 40,000 tradeable symbols compared with HYCM’s 1,199. Both brokers support forex trading (CFD or spot), with Schwab listing 73 currency pairs and HYCM close behind at 70. Each lets you buy exchange-traded securities on U.S. markets (think Apple) and on international exchanges (such as Vodafone). Neither broker offers copy trading. If you want crypto exposure, both provide cryptocurrency CFDs, but neither allows you to buy actual, delivered crypto.

For breadth, Charles Schwab earns 5 stars and ranks #5 out of 63 brokers for Range of Investments, while HYCM scores 4 stars and ranks #27. Choose Schwab if you want a very wide selection across markets and asset types; pick HYCM if you’re comfortable with a smaller lineup that still covers key markets and includes crypto CFDs.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

40000

|

1199

|

|

Forex Pairs (Total)

info

|

73

|

70

|

|

U.S. Stocks (Shares)

info

|

Yes

|

Yes

|

|

Global Stocks (Non-U.S. Shares)

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

No

|

No

|

|

Cryptocurrency (Underlying)

info

|

No

|

No

|

|

Cryptocurrency (CFDs)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

Charles Schwab vs HYCM (Henyep Capital Markets): both brokers provide free paper trading (demo accounts), in-house platforms, downloadable Windows desktop software, and web-based platforms. Each supports trading directly from charts and offers watchlists. Neither broker offers copy trading. A key difference is MetaTrader support: HYCM includes both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), while Charles Schwab does not.

For platform quality, ForexBrokers.com rates Charles Schwab 5 stars and ranks it 7th out of 63, while HYCM earns 4 stars and ranks 32nd. If you need MT4 or MT5, HYCM is the clear pick. If you want a top-rated, in-house platform experience with paper trading, Charles Schwab stands out.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Desktop Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

No

|

No

|

|

MetaTrader 4 (MT4)

info

|

No

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

No

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

374

|

30

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

Charles Schwab and HYCM (Henyep Capital Markets) both offer full-featured mobile trading apps for iPhone and Android. Each app supports price alerts, drawing trendlines on charts, and autosaving your chart drawings. A key difference is watchlist syncing: Schwab syncs watchlists between the mobile app and your online account, while HYCM does not, which can matter if you switch devices or trade on the go.

For charting depth, Schwab provides 374 technical studies versus HYCM’s 30, giving active traders far more tools to analyze markets. Schwab also earns a higher user score (5 stars vs. HYCM’s 4 stars) and ranks #6 out of 63 brokers for Mobile Trading Apps on ForexBrokers.com, compared with HYCM’s #30. In short, Schwab’s mobile app is better suited to traders who want advanced charting and seamless syncing, while HYCM covers the basics for simpler mobile trading needs.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Price Alerts

info

|

Yes

|

Yes

|

|

Mobile Watchlists - Syncing

info

|

Yes

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

374

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Trendlines Autosave

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

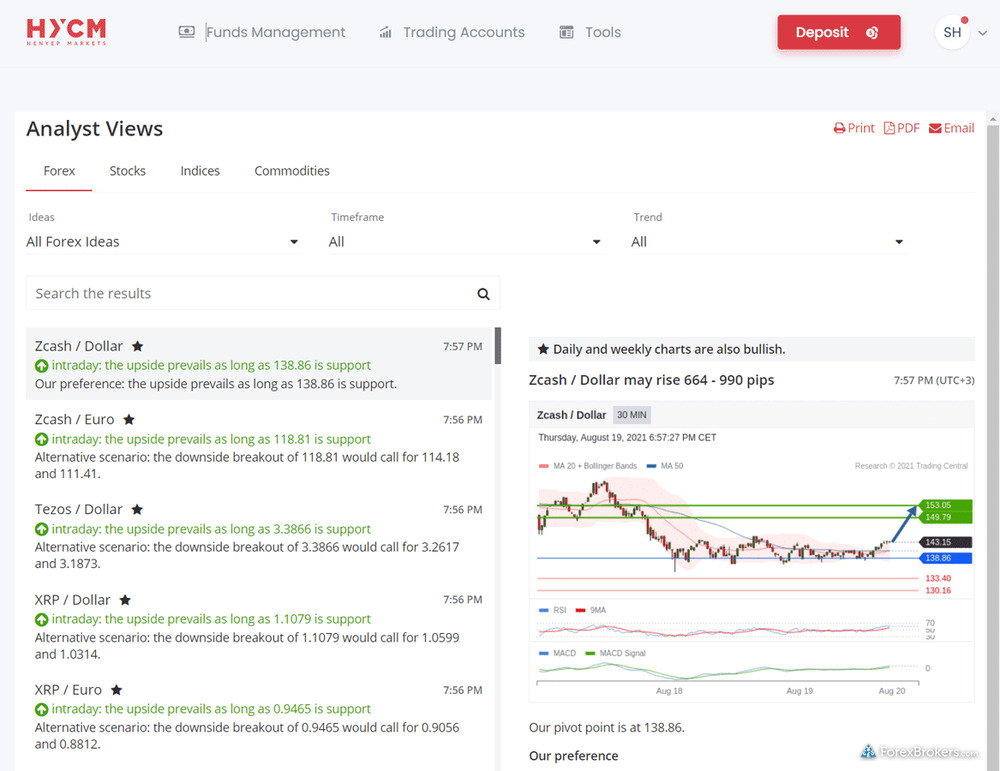

Comparing market research at Charles Schwab vs HYCM (Henyep Capital Markets): both brokers deliver daily market commentary and stream forex news from top-tier sources like Bloomberg, Reuters, or Dow Jones. Each provides an economic calendar for upcoming global events. Neither broker offers Autochartist, TipRanks, Acuity Trading tools, or a sentiment gauge showing long/short positioning. One key difference is HYCM’s access to Trading Central analytics, which Charles Schwab does not include.

For overall research quality, Charles Schwab stands out with a 5-star rating and a #5 rank out of 63 brokers on ForexBrokers.com, while HYCM holds 3.5 stars and ranks #29. Choose HYCM if you value Trading Central’s signals and insights; pick Charles Schwab if you want higher-rated in-house research, strong daily commentary, and premium news coverage.

|

Feature |

Charles Schwab Charles Schwab

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary (Articles)

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

No

|

No

|

|

Trading Central

info

|

No

|

Yes

|

|

Client sentiment data

info

|

No

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Acuity Trading

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

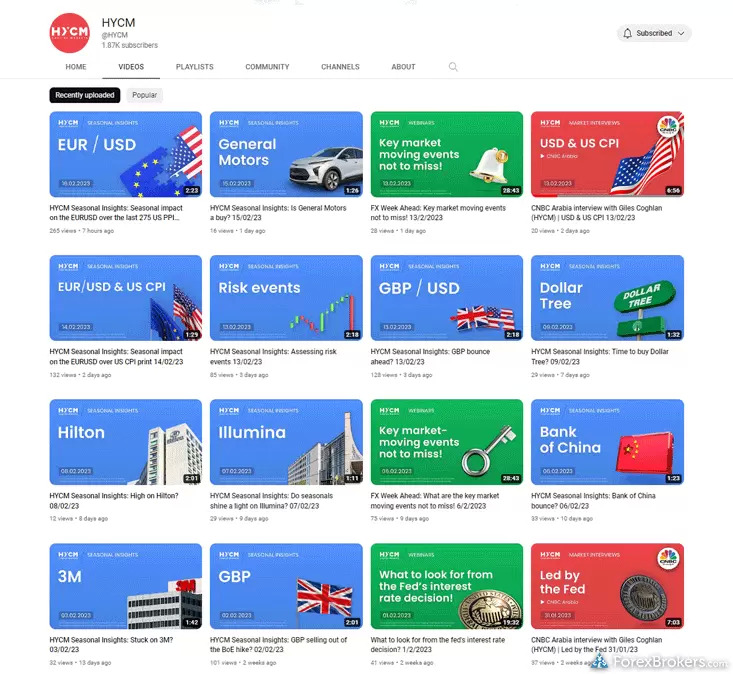

For beginners comparing education, Charles Schwab offers a more complete learning path than HYCM. Schwab hosts ongoing client webinars (at least one per month), provides 10+ beginner-friendly trading videos, and also delivers 10+ advanced videos for when you’re ready to level up. HYCM supplies 10+ beginner videos but does not run monthly educational webinars and lacks 10+ advanced videos. Based on the data provided, it’s not confirmed whether either broker meets the bar of 10 or more forex/CFD-specific pieces of content.

Independent ratings back up the gap: Schwab earns 5 stars for Education and ranks #6 out of 63 brokers at ForexBrokers.com, while HYCM is rated 3.5 stars and ranks #27. If you want steady guidance plus room to grow from basics to advanced topics, Schwab is the stronger choice. If you only need quick, beginner video lessons, HYCM can still get you started.

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 63 of the best forex brokers, our research and account testing finds that Charles Schwab is better than HYCM (Henyep Capital Markets). Charles Schwab finished with an overall rank of #6, while HYCM (Henyep Capital Markets) finished with an overall rank of #26.

Charles Schwab is a highly trusted financial institution and multi-asset broker catering to U.S.-based and international forex traders. Schwab's award-winning thinkorswim platform offers over 70 tradeable currency pairs alongside impressive tools, research, and education. That said, the broker’s forex offering is still largely limited to what is available on thinkorswim.

FAQs

Can you trade cryptocurrency with Charles Schwab or HYCM (Henyep Capital Markets)?

Charles Schwab vs HYCM (Henyep Capital Markets): neither broker supports buying actual (delivered) cryptocurrency, but both allow trading cryptocurrency CFDs.

What funding options does each broker offer?

Charles Schwab vs HYCM (Henyep Capital Markets): Schwab supports ACH/SEPA and bank wire transfers but not PayPal or Skrill, while HYCM supports Skrill and bank wires but not ACH/SEPA or PayPal; Visa/Mastercard availability is not specified for either broker.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Broker Screenshots

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Broker Gallery (click to expand) info

|

|

|

|

|

Regulation

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

99

|

85

|

|

|

Year Founded info

|

1971

|

1977

|

|

|

Publicly Traded (Listed) info

|

Yes

|

No

|

|

|

Bank info

|

Yes

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

|

No

info

|

|

|

Tier-1 Licenses info

|

5

|

2

|

|

|

Tier-2 Licenses info

|

0

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

0

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

No

|

No

|

|

|

Canada (CIRO Authorised) info

|

Yes

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

Yes

|

Yes

|

|

|

Japan (FSA Authorised) info

|

|

No

|

|

|

Singapore (MAS Authorised) info

|

Yes

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

|

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

Yes

|

|

|

USA (CFTC Authorized) info

|

Yes

|

No

|

|

|

New Zealand (FMA Authorised) info

|

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

No

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

|

|

|

|

Israel (ISA Authorised) info

|

|

No

|

|

|

South Africa (FSCA Authorised) info

|

|

No

|

|

|

UAE (DFSA, FSRA, or CMA Authorised) info

|

|

Yes

|

|

|

India (SEBI Authorised) info

|

|

No

|

|

|

Jordan (JSC Authorised) info

|

|

|

|

|

Investments

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

40000

|

1199

|

|

|

Forex Pairs (Total) info

|

73

|

70

|

|

|

U.S. Stocks (Shares) info

|

Yes

|

Yes

|

|

|

Global Stocks (Non-U.S. Shares) info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

No

|

No

|

|

|

Cryptocurrency (Underlying) info

|

No

|

No

|

|

|

Cryptocurrency (CFDs) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Average spread (EUR/USD) - Standard account info

|

1.27

info

|

1.3

info

|

|

|

All-in Cost EUR/USD - Active info

|

1.27

info

|

0.6

info

|

|

|

Inactivity Fee info

|

No

|

No

|

|

|

Order execution: Agency info

|

Yes

|

Yes

|

|

|

Order execution: Market Maker info

|

No

|

Yes

|

|

|

Funding

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$0

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

No

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

No

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Non-wire bank transfer info

|

Yes

|

No

|

|

|

Trading Platforms

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Desktop Trading Platform info

|

Yes

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

No

|

No

|

|

|

MetaTrader 4 (MT4) info

|

No

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

No

|

Yes

|

|

|

cTrader info

|

No

|

No

|

|

|

Trading Tools

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Price Alerts info

|

Yes

|

Yes

|

|

|

Charting - Indicators / Studies (Total) info

|

374

|

30

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Price Alerts info

|

Yes

|

Yes

|

|

|

Mobile Watchlist [DELETED] info

|

|

|

|

|

Mobile Watchlists - Syncing info

|

Yes

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

374

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Trendlines Autosave info

|

Yes

|

Yes

|

|

|

Mobile Research - Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary (Articles) info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

No

|

No

|

|

|

Trading Central info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Client sentiment data info

|

No

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

Webinars info

|

Yes

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

|

Major Forex Pairs

|

Charles Schwab |

HYCM (Henyep Capital Markets) |

|

|

GBP/USD [DELETED] info

|

|

|

|

|

USD/JPY [DELETED] info

|

|

|

|

|

EUR/USD info

|

Yes

|

Yes

|

|

|

USD/CHF [DELETED] info

|

|

|

|

|

USD/CAD [DELETED] info

|

|

|

|

|

NZD/USD [DELETED] info

|

|

|

|

|

AUD/USD [DELETED] info

|

|

|

|

|

Review |

Charles Schwab Review

|

HYCM (Henyep Capital Markets) Review

|

|

arrow_upward