CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

Swissquote and HYCM are both well-known online brokers, but their profiles differ. Swissquote, founded in 1996, is publicly traded and operates as a bank. HYCM, founded in 1977, is privately held and not a bank. In terms of regulation, Swissquote holds five Tier-1 licenses and two Tier-2 licenses, while HYCM holds two Tier-1 and one Tier-2 license—Tier-1 being the highest level of oversight as defined by ForexBrokers.com.

According to ForexBrokers.com’s Trust Score, Swissquote scores 99/99 (highly trusted, 90–99), and HYCM scores 85/99 (trusted, 80–89). For context, 70–79 is average risk, 60–69 high risk, and below 59 should not be trusted. If you value stronger regulation, a stock exchange listing, and bank status, Swissquote stands out, while HYCM still earns a trusted rating.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

1996

|

1977

|

|

Publicly Traded (Listed)

info

|

Yes

|

No

|

|

Bank

info

|

Yes

|

No

|

|

Tier-1 Licenses

info

|

5

|

2

|

|

Tier-2 Licenses

info

|

2

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

0

|

1

|

Fees

Comparing commissions and fees, HYCM (Henyep Capital Markets) is generally cheaper than Swissquote for trading popular pairs like EUR/USD. HYCM earns 4.5/5 stars and ranks #18 of 63 for Commissions and Fees, while Swissquote earns 3.5/5 stars and ranks #35 of 63. If your top priority is low costs, HYCM’s pricing structure has the edge; Swissquote’s appeal is more about banking stature than bargain spreads.

Swissquote’s costs vary by entity. In the U.K., traders can choose four accounts; the Elite account suits active traders who deposit at least $10,000, pairing lower spreads with a $5 commission per round-turn trade. The Standard account starts at 1.3 pips on EUR/USD, and the Prime account shows a minimum (not average) spread from 0.6 pips. The U.K. setup tends to have lower costs and lighter deposit requirements than Swissquote’s Switzerland and Luxembourg locations, but with a narrower product list. In Luxembourg, minimum spreads run from 1.5 pips (Standard, $1,000 minimum) to 0.8 pips (Prime, $50,000 minimum). In Switzerland, forex accounts start at 1.7 pips (Standard, $1,000), drop to 1.4 pips (Premium, $10,000), and 1.1 pips (Prime, $50,000), with custom pricing negotiable for high volume.

HYCM keeps pricing straightforward: the Raw account delivers an all-in cost around 0.6 pips on EUR/USD after commission, the Classic account has variable spreads from 1.2 pips, and the fixed-spread account sits at 1.5 pips. For traders focused on tighter all-in costs, HYCM’s Raw account is typically more attractive than Swissquote’s offerings.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$1000

|

$20

|

|

Average spread (EUR/USD) - Standard account

info

|

N/A

info |

1.3

info |

|

All-in Cost EUR/USD - Active

info

|

N/A

info |

0.6

info |

|

Non-wire bank transfer

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

Yes

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

Yes

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

Swissquote and HYCM both let you trade forex as CFDs or spot contracts, and both give access to real exchange-traded shares in the U.S. and on international markets (think Apple in the U.S. and Vodafone in London). HYCM lists more total tradable symbols overall (1199 vs. 472), while Swissquote offers more forex pairs (80 vs. 70). For Range of Investments, Swissquote earns 5 stars and ranks #2 out of 63 brokers at ForexBrokers.com, whereas HYCM scores 4 stars and ranks #27.

Where they differ most is in extras. Swissquote supports copy trading and lets you buy actual cryptocurrency in addition to crypto CFDs. HYCM does not offer copy trading or delivered crypto, but it does offer crypto CFDs. In short, pick Swissquote if you want copy trading, actual crypto, and a deeper list of forex pairs; pick HYCM if you value a bigger overall catalog of tradable symbols.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

472

|

1199

|

|

Forex Pairs (Total)

info

|

80

|

70

|

|

U.S. Stocks (Shares)

info

|

Yes

|

Yes

|

|

Global Stocks (Non-U.S. Shares)

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

Cryptocurrency (Underlying)

info

|

Yes

|

No

|

|

Cryptocurrency (CFDs)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

Comparing Swissquote vs HYCM on trading platforms and tools, both brokers check the key boxes: free demo (paper) trading, their own in-house platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), plus Windows desktop downloads and web-based platforms. Each lets you place trades directly from charts, which is handy for timing entries and exits.

The standout difference is copy trading: Swissquote offers it, while HYCM does not. Independent ratings from ForexBrokers.com back up the overall platform experience, with Swissquote scoring 4.5/5 stars and ranking #12 out of 63 brokers for Trading Platforms and Tools, compared with HYCM’s 4/5 stars and a #32 ranking. If copy trading and higher-rated tools matter to you, Swissquote may have the edge; if you simply need MT4/MT5 with both web and desktop access, either broker can fit the bill.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Desktop Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

86

|

30

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

Swissquote and HYCM (Henyep Capital Markets) both deliver capable mobile trading apps on iPhone and Android. Each app supports price alerts, 30 technical studies for charting, drawing trendlines, and automatically saving your chart drawings. One shared drawback is watchlist symbol syncing: neither broker syncs watchlists between the mobile app and your online account, so you’ll need to update lists separately on each platform.

Where they differ is user feedback and industry ranking. Swissquote’s mobile trading app holds a 4.5-star rating and is ranked 12th out of 63 brokers for Mobile Trading Apps by ForexBrokers.com. HYCM’s app earns 4 stars and ranks 30th. If you want a higher-rated, more polished mobile experience, Swissquote has the edge; if you’re satisfied with similar charting tools and alerts, HYCM remains a solid alternative.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Price Alerts

info

|

Yes

|

Yes

|

|

Mobile Watchlists - Syncing

info

|

No

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

30

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Trendlines Autosave

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

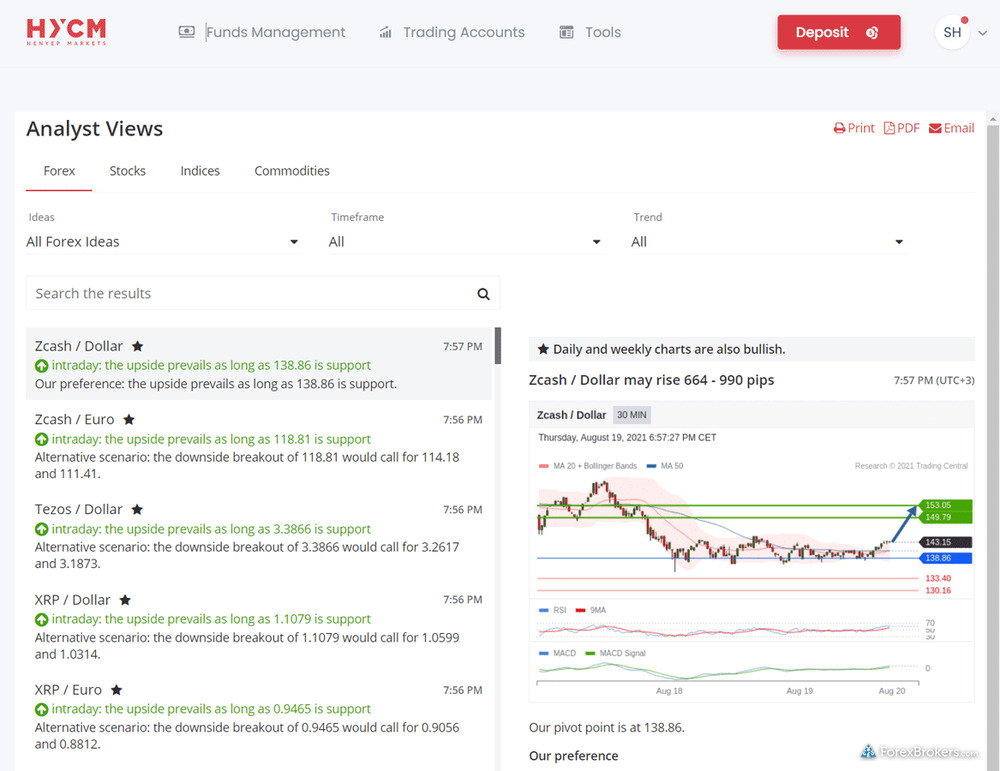

Comparing Swissquote vs HYCM for market research: both brokers deliver daily market commentary and stream forex news from top-tier sources such as Bloomberg, Reuters, or Dow Jones. Each also provides an economic calendar. The key difference lies in their analytics tools—Swissquote integrates Autochartist for chart patterns and trade ideas, while HYCM offers Trading Central’s analysis suite. Neither broker includes a sentiment-based positioning tool, and neither features research from TipRanks or Acuity Trading.

According to ForexBrokers.com, Swissquote scores 4.5/5 stars for Research and ranks 15th out of 63 brokers, while HYCM scores 3.5/5 and ranks 29th. Choose Swissquote if you want Autochartist; pick HYCM if Trading Central is your preference. For everyday news, commentary, and event tracking, both platforms cover the essentials.

|

Feature |

Swissquote Swissquote

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary (Articles)

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

Yes

|

No

|

|

Trading Central

info

|

No

|

Yes

|

|

Client sentiment data

info

|

No

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Acuity Trading

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

Comparing education for beginners at Swissquote and HYCM (Henyep Capital Markets), both brokers provide at least 10 beginner-friendly trading videos, making it easy to learn the basics of forex and CFD trading. Swissquote goes further with ongoing online client webinars (at least one per month) and at least 10 advanced trading videos designed for more experienced traders. HYCM, by contrast, does not host monthly educational webinars and does not meet the bar for advanced video depth, which may limit your learning path as you progress.

These differences show up in their education scores: Swissquote earns 4.5 out of 5 stars and ranks #19 out of 63 brokers for Education on ForexBrokers.com, while HYCM is rated 3.5 stars and ranks #27. If you want live sessions and a clear path from beginner to advanced, Swissquote is the stronger pick. If you mainly want starter videos to learn the basics, both Swissquote and HYCM can help you get going.

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 63 of the best forex brokers, our research and account testing finds that Swissquote is better than HYCM (Henyep Capital Markets). Swissquote finished with an overall rank of #11, while HYCM (Henyep Capital Markets) finished with an overall rank of #26.

Traders choose Swissquote for its quality research and vast multi-asset offering – as long as they are willing to pay a premium to have their brokerage account held with a Swiss bank.

FAQs

Can you trade cryptocurrency with Swissquote or HYCM (Henyep Capital Markets)?

Swissquote enables investors to buy actual (delivered) cryptocurrencies as well as trade cryptocurrency CFDs, whereas HYCM (Henyep Capital Markets) offers cryptocurrency CFDs only and does not provide direct ownership of the underlying coins.

What funding options does each broker offer?

Online broker Swissquote vs HYCM (Henyep Capital Markets): Swissquote supports ACH/SEPA, PayPal, Skrill, and bank wires for deposits and withdrawals, while HYCM supports Skrill and bank wires only and does not offer ACH/SEPA or PayPal; Visa/Mastercard availability is not specified for either broker.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Overall Rating

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Overall Rating info

|

|

|

|

|

Trading Fees |

|

|

|

|

Range of Investments |

|

|

|

|

Trading Platforms |

|

|

|

|

Mobile Trading |

|

|

|

|

Research |

|

|

|

|

Education |

|

|

|

|

Trust Score info

|

99

|

85

|

|

|

Winner |

check_circle

|

|

|

|

Review |

Swissquote Review

|

HYCM (Henyep Capital Markets) Review

|

|

|

Broker Screenshots

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Broker Gallery (click to expand) info

|

|

|

|

|

Regulation

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

99

|

85

|

|

|

Year Founded info

|

1996

|

1977

|

|

|

Publicly Traded (Listed) info

|

Yes

|

No

|

|

|

Bank info

|

Yes

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-1 Licenses info

|

5

|

2

|

|

|

Tier-2 Licenses info

|

2

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

0

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

No

|

No

|

|

|

Canada (CIRO Authorised) info

|

No

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

Yes

|

Yes

|

|

|

Japan (FSA Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

Yes

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

Yes

|

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

Yes

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

|

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

Yes

|

No

|

|

|

UAE (DFSA, FSRA, or CMA Authorised) info

|

Yes

|

Yes

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

|

|

|

|

Investments

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

472

|

1199

|

|

|

Forex Pairs (Total) info

|

80

|

70

|

|

|

U.S. Stocks (Shares) info

|

Yes

|

Yes

|

|

|

Global Stocks (Non-U.S. Shares) info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

Cryptocurrency (Underlying) info

|

Yes

|

No

|

|

|

Cryptocurrency (CFDs) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Average spread (EUR/USD) - Standard account info

|

N/A

info

|

1.3

info

|

|

|

All-in Cost EUR/USD - Active info

|

N/A

info

|

0.6

info

|

|

|

Inactivity Fee info

|

Yes

|

No

|

|

|

Order execution: Agency info

|

Yes

|

Yes

|

|

|

Order execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$1000

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

Yes

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Non-wire bank transfer info

|

Yes

|

No

|

|

|

Trading Platforms

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Desktop Trading Platform info

|

Yes

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

No

|

No

|

|

|

Trading Tools

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Price Alerts info

|

Yes

|

Yes

|

|

|

Charting - Indicators / Studies (Total) info

|

86

|

30

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Price Alerts info

|

Yes

|

Yes

|

|

|

Mobile Watchlist [DELETED] info

|

|

|

|

|

Mobile Watchlists - Syncing info

|

No

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

30

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Trendlines Autosave info

|

Yes

|

Yes

|

|

|

Mobile Research - Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary (Articles) info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

Yes

|

No

|

|

|

Trading Central info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Client sentiment data info

|

No

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

Webinars info

|

Yes

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

|

Major Forex Pairs

|

Swissquote |

HYCM (Henyep Capital Markets) |

|

|

GBP/USD [DELETED] info

|

|

|

|

|

USD/JPY [DELETED] info

|

|

|

|

|

EUR/USD info

|

Yes

|

Yes

|

|

|

USD/CHF [DELETED] info

|

|

|

|

|

USD/CAD [DELETED] info

|

|

|

|

|

NZD/USD [DELETED] info

|

|

|

|

|

AUD/USD [DELETED] info

|

|

|

|

|

Review |

Swissquote Review

|

HYCM (Henyep Capital Markets) Review

|

|

arrow_upward