CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

Pepperstone (founded 2010) and HYCM (Henyep Capital Markets, founded 1977) are online brokers that are privately held and not banks. Pepperstone holds 3 Tier-1 licenses and 2 Tier-2 licenses, while HYCM holds 2 Tier-1 licenses and 1 Tier-2 license—tiers that ForexBrokers.com classifies as highly trusted and trusted, respectively. On the ForexBrokers.com Trust Score out of 99, Pepperstone scores 94 (highly trusted: 90–99) and HYCM scores 85 (trusted: 80–89).

In plain terms, both firms are regulated, but Pepperstone has a higher Trust Score and more top-tier licenses than HYCM. Since neither broker is publicly traded or a bank, these licenses and Trust Score ranges can help traders compare their oversight and overall trust level.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

2010

|

1977

|

|

Publicly Traded (Listed)

info

|

No

|

No

|

|

Bank

info

|

No

|

No

|

|

Tier-1 Licenses

info

|

3

|

2

|

|

Tier-2 Licenses

info

|

2

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

2

|

1

|

Fees

Pepperstone and HYCM (Henyep Capital Markets) both offer low-cost ways to trade, but their fee structures differ. For commissions and fees, Pepperstone earns 5/5 stars and ranks #6 out of 63 brokers, while HYCM earns 4.5/5 stars and ranks #18. Each broker offers a commission-based account for tighter pricing, alongside a commission-free option for simpler, spread-only trading.

On commission-based pricing, HYCM’s Raw account is slightly cheaper on EUR/USD with an all-in cost around 0.6 pips after commission. Pepperstone’s Razor account lists an average spread of 0.10 pips (as of July 2024) and about 0.70 pips in commission-equivalent, for an all-in cost near 0.80 pips. High-volume traders may narrow Pepperstone’s costs further via its Active Trader program, which provides rebates based on monthly trading volume.

For spread-only pricing, Pepperstone’s Standard account averages about 1.1 pips on EUR/USD (as of July 2024), while HYCM’s Classic account starts from 1.2 pips; HYCM also offers a fixed-spread account at 1.5 pips. Pepperstone’s Active Trader rebates can reduce costs for eligible Professional clients: in the UK/EU, rebates start at 15% per lot for £20M+ monthly forex volume and rise to 25% above £200M; in Australia, discounts start at 10% per standard lot (100+ lots over three months) and reach 30% for 3001+ lots per month.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$0

|

$20

|

|

Average spread (EUR/USD) - Standard account

info

|

1.1

info |

1.3

info |

|

All-in Cost EUR/USD - Active

info

|

0.8

info |

0.6

info |

|

Non-wire bank transfer

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

Yes

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

No

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Range of investments

Pepperstone and HYCM (Henyep Capital Markets) both support forex trading as CFDs or spot contracts. Pepperstone lists 1,726 tradeable symbols and 65 forex pairs, while HYCM offers 1,199 symbols and 70 forex pairs. Both brokers let you trade cryptocurrency via CFDs, but neither allows buying actual (delivered) crypto. Pepperstone also supports copy trading; HYCM does not.

When it comes to exchange-traded stocks, HYCM lets clients buy listed shares on U.S. and international exchanges, while Pepperstone does not offer exchange-traded shares. Both earn 4 out of 5 stars for Range of Investments. According to ForexBrokers.com, Pepperstone ranks 23rd out of 63 brokers in this category, and HYCM ranks 27th.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

1726

|

1199

|

|

Forex Pairs (Total)

info

|

65

|

70

|

|

U.S. Stocks (Shares)

info

|

No

|

Yes

|

|

Global Stocks (Non-U.S. Shares)

info

|

No

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

Cryptocurrency (Underlying)

info

|

No

|

No

|

|

Cryptocurrency (CFDs)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

Pepperstone and HYCM both cover the essentials for traders who want flexibility. Each broker offers a free demo (paper trading) account, its own proprietary platform, a Windows desktop app, and a browser-based web platform. They also support MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and both let you place orders directly from the chart. For Trading Platforms and Tools, both earn 4 out of 5 stars, though ForexBrokers.com ranks Pepperstone higher at 21st out of 63 brokers versus HYCM at 32nd.

The key difference is copy trading: Pepperstone provides it, while HYCM does not. If social or mirror trading is on your wish list, Pepperstone has the edge. If you simply want tried-and-true platforms like MT4/MT5 along with a demo account and the option to trade from charts on desktop or web, both brokers fit the bill.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Desktop Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

15

|

30

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

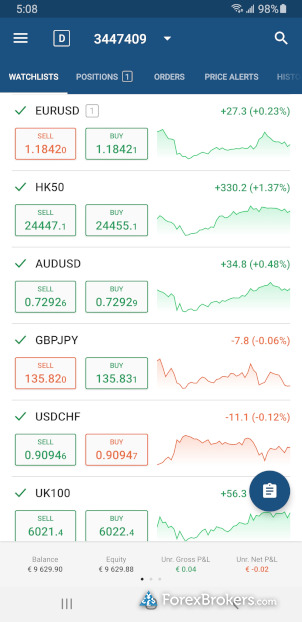

Pepperstone and HYCM (Henyep Capital Markets) both deliver full-featured mobile trading apps for iPhone and Android. Each app supports price alerts, 30 technical studies for charting, the ability to draw trendlines, and auto‑saving of chart drawings. Both are rated 4 out of 5 stars for mobile trading apps.

The key difference is watchlist syncing: Pepperstone syncs watchlists between the mobile app and your online account, while HYCM does not. Looking at third‑party rankings from ForexBrokers.com for the Mobile Trading Apps category, Pepperstone places #19 out of 63 brokers, whereas HYCM ranks #30. If synced watchlists and a higher category ranking matter to you, Pepperstone has an edge; if you mainly need alerts and solid charting with 30 indicators, either app can fit the bill.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Price Alerts

info

|

Yes

|

Yes

|

|

Mobile Watchlists - Syncing

info

|

Yes

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

30

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Trendlines Autosave

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

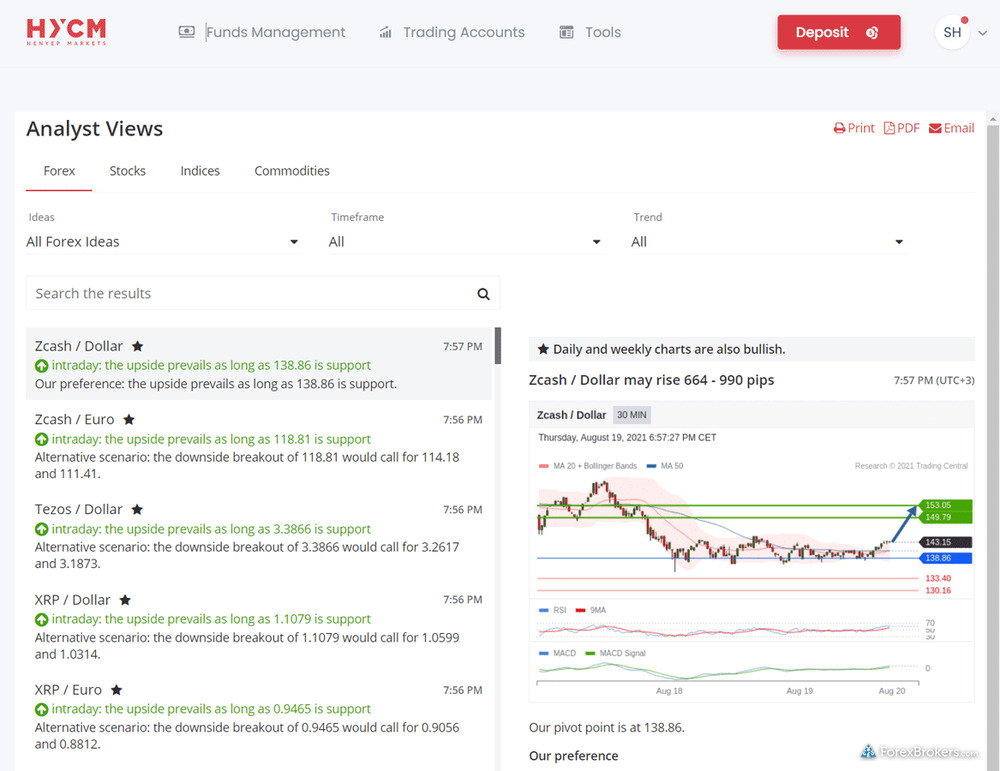

Pepperstone and HYCM (Henyep Capital Markets) both cover the basics of market research: you get daily market commentary, premium forex news from top-tier sources like Bloomberg/Reuters/Dow Jones equivalents, and an economic calendar to track upcoming events. The key differences are in their toolkits. Pepperstone includes Autochartist for pattern and setup ideas and offers a sentiment tool that shows the long/short ratio across instruments. HYCM does not provide Autochartist or a sentiment gauge, but it does include Trading Central for technical and fundamental insights. Neither broker integrates TipRanks or Acuity/Signal Centre.

On performance, ForexBrokers.com rates Pepperstone’s Research at 4.5 stars and ranks it #12 out of 63 brokers, while HYCM earns 3.5 stars and ranks #29. If you want automated chart pattern scanning and crowd sentiment, Pepperstone is the stronger pick; if you prefer Trading Central’s research style, HYCM can be a good match. Both brokers deliver daily insights and timely news to support your trading decisions.

|

Feature |

Pepperstone Pepperstone

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary (Articles)

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

Yes

|

No

|

|

Trading Central

info

|

No

|

Yes

|

|

Client sentiment data

info

|

Yes

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Acuity Trading

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

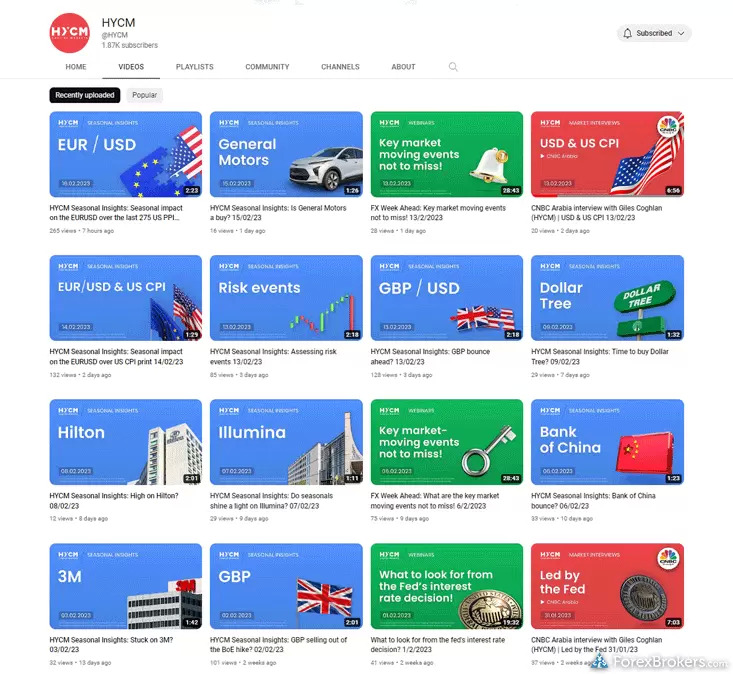

Comparing Pepperstone and HYCM (Henyep Capital Markets) for beginner-friendly trading education, Pepperstone comes out ahead. Both brokers offer at least 10 beginner videos that explain forex and CFD basics, but Pepperstone adds monthly live webinars and a deeper set of advanced videos for when you’re ready to level up. That fuller path is reflected in the ratings: Pepperstone earns 4.5 out of 5 stars for Education and ranks #15 out of 63 brokers on ForexBrokers.com, while HYCM earns 3.5 out of 5 stars and ranks #27.

For new traders, this means Pepperstone provides more ways to learn—live sessions each month plus ample advanced content—so you can move from fundamentals to more complex strategies in one place. HYCM still gives beginners a useful library of videos, but it does not run monthly educational webinars and has fewer advanced videos. Choose Pepperstone if you want live teaching and room to grow; pick HYCM if you mainly need beginner videos and prefer to learn at your own pace.

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 63 of the best forex brokers, our research and account testing finds that Pepperstone is better than HYCM (Henyep Capital Markets). Pepperstone finished with an overall rank of #17, while HYCM (Henyep Capital Markets) finished with an overall rank of #26.

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms.

FAQs

Can you trade cryptocurrency with Pepperstone or HYCM (Henyep Capital Markets)?

In a head-to-head comparison, online brokers Pepperstone and HYCM (Henyep Capital Markets) both do not support buying actual (delivered) cryptocurrencies, but each offers cryptocurrency CFD trading for speculating on crypto price movements.

What funding options does each broker offer?

Between Pepperstone and HYCM (Henyep Capital Markets), Pepperstone supports ACH/SEPA, PayPal, and bank wire transfers but not Skrill, whereas HYCM supports Skrill and bank wire transfers but not ACH/SEPA or PayPal; availability of Visa/Mastercard funding was not specified.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Broker Screenshots

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Broker Gallery (click to expand) info

|

|

|

|

|

Regulation

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

94

|

85

|

|

|

Year Founded info

|

2010

|

1977

|

|

|

Publicly Traded (Listed) info

|

No

|

No

|

|

|

Bank info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-1 Licenses info

|

3

|

2

|

|

|

Tier-2 Licenses info

|

2

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

2

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

Yes

|

No

|

|

|

Canada (CIRO Authorised) info

|

No

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

No

|

Yes

|

|

|

Japan (FSA Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

No

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

|

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

Yes

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

Yes

|

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

No

|

No

|

|

|

UAE (DFSA, FSRA, or CMA Authorised) info

|

Yes

|

Yes

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

|

|

|

|

Investments

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

1726

|

1199

|

|

|

Forex Pairs (Total) info

|

65

|

70

|

|

|

U.S. Stocks (Shares) info

|

No

|

Yes

|

|

|

Global Stocks (Non-U.S. Shares) info

|

No

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

Cryptocurrency (Underlying) info

|

No

|

No

|

|

|

Cryptocurrency (CFDs) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Average spread (EUR/USD) - Standard account info

|

1.1

info

|

1.3

info

|

|

|

All-in Cost EUR/USD - Active info

|

0.8

info

|

0.6

info

|

|

|

Inactivity Fee info

|

No

|

No

|

|

|

Order execution: Agency info

|

Yes

|

Yes

|

|

|

Order execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$0

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

Yes

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

No

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Non-wire bank transfer info

|

Yes

|

No

|

|

|

Trading Platforms

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Desktop Trading Platform info

|

Yes

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

Yes

|

No

|

|

|

Trading Tools

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Price Alerts info

|

Yes

|

Yes

|

|

|

Charting - Indicators / Studies (Total) info

|

15

|

30

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Price Alerts info

|

Yes

|

Yes

|

|

|

Mobile Watchlist [DELETED] info

|

|

|

|

|

Mobile Watchlists - Syncing info

|

Yes

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

30

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Trendlines Autosave info

|

Yes

|

Yes

|

|

|

Mobile Research - Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary (Articles) info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

Yes

|

No

|

|

|

Trading Central info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Client sentiment data info

|

Yes

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

Webinars info

|

Yes

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

|

Major Forex Pairs

|

Pepperstone |

HYCM (Henyep Capital Markets) |

|

|

GBP/USD [DELETED] info

|

|

|

|

|

USD/JPY [DELETED] info

|

|

|

|

|

EUR/USD info

|

Yes

|

Yes

|

|

|

USD/CHF [DELETED] info

|

|

|

|

|

USD/CAD [DELETED] info

|

|

|

|

|

NZD/USD [DELETED] info

|

|

|

|

|

AUD/USD [DELETED] info

|

|

|

|

|

Review |

Pepperstone Review

|

HYCM (Henyep Capital Markets) Review

|

|

arrow_upward