Best Forex Brokers in Ghana for 2026

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Trading forex (currencies) in Ghana is popular among residents. The Bank of Ghana acts as the primary financial regulator in Ghana and is responsible for overseeing forex and contract for difference (CFD) trading activities and financial institutions, (including broker dealers).

The Bank of Ghana regulates the banking and credit sectors and is responsible for overseeing the stability of the overall financial system. It is also mandated to ensure the safety of depositors’ funds, oversee adherence to regulatory requirements, and promote fair competition among banks while assuring their solvency, liquidity, and assets.

Best Forex Brokers in Ghana for 2026

To find the best forex brokers in Ghana, we created a list of all forex brokers that accept residents of Ghana, then ranked them by their Overall ranking.

Here is our list of the top forex brokers available in Ghana:

Comparison of the Best Forex Brokers in Ghana

Compare the best forex and CFDs brokers available to residents of Ghana using our forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts GH Residents | Average spread (EUR/USD) - Standard account | Minimum Deposit | Overall Rating |

IG IG

|

0.91 | £1 |

|

|

Interactive Brokers Interactive Brokers

|

0.226 | $0 |

|

|

FXCM FXCM

|

0.9 | Starts from $50 |

|

|

AvaTrade AvaTrade

|

0.93 | $100 |

|

|

XM Group XM Group

|

2 | $5 |

|

|

Pepperstone Pepperstone

|

1.1 | $0 |

|

|

FP Markets FP Markets

|

1.3 | $100 AUD |

|

|

FxPro FxPro

|

1.6 | $100 |

|

|

IC Markets IC Markets

|

0.62 | $200 |

|

|

Tickmill Tickmill

|

1.70 | $100 |

|

|

HFM HFM

|

1.8 | $0 |

|

|

ActivTrades ActivTrades

|

1.08 | $0 |

|

|

Questrade Questrade

|

N/A | $250 |

|

|

Eightcap Eightcap

|

1.0 | $100 |

|

|

IUX IUX

|

0.86 | 10 |

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which forex broker in Ghana is best for beginners?

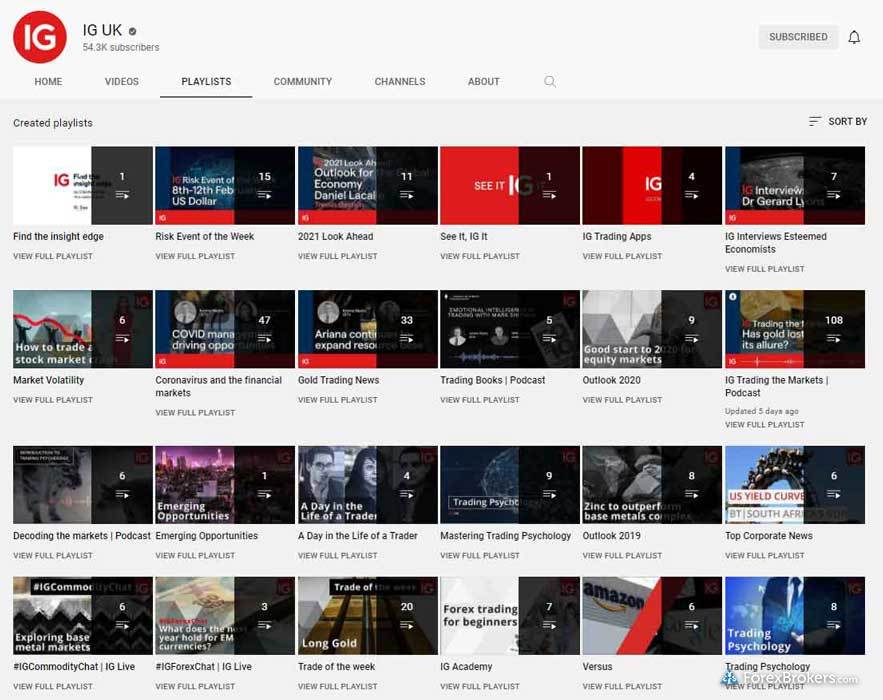

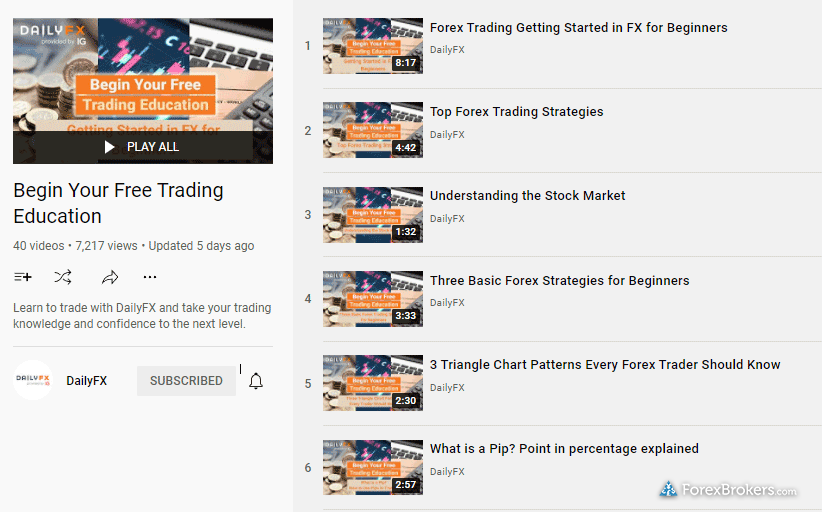

IG is the best broker for beginner forex traders in Ghana in 2025. IG delivers an excellent selection of educational materials and resources for residents of Ghana who are just getting started with forex and CFD trading, including learning courses and easy-to-use trading platforms. IG also offers an app exclusively dedicated to education as part of its IG Academy, along with an extensive array of resources curated from its IG Community forum. The ease-of-use factor is especially important for beginners who are learning how to use a broker’s trading platforms, and IG’s sleek mobile apps and well-designed trading platforms make for a painless, intuitive experience for all traders.

Check out a gallery of screenshots of IG's educational resources, taken by our research team during our product testing.

Is forex trading legal in Ghana?

The Foreign Exchange Act of 2006 (Act 723) allows local and foreign investors the ability to participate in various investment schemes using local and foreign currency when investing in the capital markets and local stock exchange in Ghana.

That said, the regulations in Ghana, including the Securities Industry Act of 2016 (Act 723), appear to pertain more to the use of physical currencies, rather than trading forex for speculative reasons (such as when using a derivative, CFD, or spot contract).

Regulation of the Ghana Stock Exchange exists in the form of the Securities and Exchange Commission (SEC) in Ghana, which is responsible for monitoring and safeguarding the securities trading markets. The SEC in Ghana regulates broker dealers and financial institutions. While there are a number of brokers that are regulated in other countries that accept Ghanaian residents, it is currently unclear whether the SEC has any objections when residents use a broker that is not regulated locally.

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

Ghana’s financial markets

The primary stock market in Ghana is the Ghana Stock Exchange (GSE), based in Accra. Recognized in Ghana as an authorized Stock Exchange in 1990, and officially launched in 1991, the exchange is a member of the African Securities Exchanges Association (ASEA). As of 1994, the GSE is a public company limited by guarantee. The financial markets in the Republic of Ghana include are relatively small, consisting of a bond, equity, forex, and derivatives market.

Do forex traders pay tax in Ghana?

Yes, residents of Ghana are obligated to pay taxes in Ghana, while non-residents are obligated to pay taxes in their country of residence. It is always best to consult with your accountant for tax issues related to your unique circumstances and your country of residence.

How can I trade forex in Ghana?

These practical steps for getting started with forex trading in Ghana are applicable regardless of your experience level or forex trading goals. This is not intended to be an exhaustive list of forex first steps, but should be just enough to help get you started:

- The first step when opening a live forex trading account is choosing a broker that accepts residents of Ghana. Be sure to read your broker’s full terms and conditions, which will ultimately govern the relationship you have with your broker. We always recommend choosing a highly regulated, well-trusted broker, but you should always read the fine print of your account agreement, no matter which broker you choose. Learn more by checking out our Trust Score page.

- Next, you’ll want to ensure that your broker’s trading platforms are supported on the device(s) you plan on using to access your trading account. You should test any of the web, mobile, or desktop software that your broker provides, and make sure that your devices are compatible (whether it’s on your phone, tablet, laptop, or desktop computer).

- Once you have your broker, account, and trading platforms sorted out, it’s best to familiarize yourself with you broker’s available products and services. Explore its educational content, research, trading tools, and investment products.

- Pro tip: Forex demo accounts are a great way to test your broker’s trading platforms with virtual funds before taking the leap into trading in a live account with real money. It’s a good way to develop a trading strategy and try it out on a small scale, without risking your capital.

Compare Ghana Brokers

Popular Forex Guides

- Best Forex Brokers for Beginners of 2026

- Best Brokers for TradingView for 2026

- Best Forex Brokers for 2026

- Compare Forex Brokers

- Best Forex Trading Apps for 2026

- Best Copy Trading Platforms for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Low Spread Forex Brokers for 2026

- International Forex Brokers Search

More Forex Guides

Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services. We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Our research team collects and validates thousands of data points each year.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s regulatory status and number of held regulatory licenses.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.