Tradu Forex Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Tradu is a newly launched trading brand that sits under Stratos Group, the same parent company behind FXCM. Both are owned by Jefferies (NYSE: JEF), a well-established global investment bank. This connection provides Tradu with a strong regulatory foundation and access to infrastructure developed over years of operating in the forex and CFD markets.

Built for multi-asset investors, Tradu’s trading platform and mobile app feature a modern design and streamlined user experience. Although new to the market, Tradu benefits from its ties to experienced industry players and is geared towards everyday multi-asset investors, featuring a simple and modern design theme.

-

Minimum Deposit:

50 -

Trust Score:

95 -

Tradeable Symbols (Total):

13000

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Trading Fees | Winner |

| 2026 | #18 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Table of Contents

Tradu pros & cons

Pros

- Backed by Jefferies and Stratos Group.

- 13,000+ tradeable assets.

- Includes TradingView and TipRanks tools.

- Offers fractional shares and crypto staking.

Cons

- $1 minimum stock commission.

- Crypto trading closed on weekends.

- No copy trading or algo support.

My top takeaways for Tradu in 2026:

- Provides easy access to trade CFDs or stocks from the same interface.

- The platform’s charting tools are advanced, with over 100 indicators, 14 chart types, 10 time frames, and more than 20 drawing tools.

- Crypto staking is available on 30+ tokens, in addition to trading the underlying assets and crypto CFDs.

- While crypto fees are low, there is no weekend trading.

- Tradu offers a significant range of 13,000 investment products as part of its multi-asset offering.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Tradu safe?

Tradu is considered Highly Trusted, with an overall Trust Score of 95 out of 99. Tradu is not publicly traded, does not operate a bank, and is authorised by four Tier-1 regulators (Highly Trusted), two Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Tradu is is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Canadian Investment Regulatory Organization (CIRO), European Union via MiFID, and the Financial Conduct Authority (FCA). Learn more about Trust Score.

| Feature |

Tradu Tradu

|

|---|---|

| Year Founded | 2001 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Range of investments

Tradu offers access to over 13,000 instruments, covering a wide mix of asset classes. This includes 3,000 CFDs and 8,000 exchange-traded stocks. Tradu’s multi-asset lineup spans forex, indices, commodities, cryptocurrencies, and thematic baskets.

In addition to crypto CFDs and spot trading, Tradu supports staking on more than 30 crypto tokens. The combination of traditional markets and digital assets makes Tradu suitable for traders seeking flexibility across asset types.

| Feature |

Tradu Tradu

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 13000 |

| Forex Pairs (Total) | 46 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | No |

| Cryptocurrency (Underlying) | Yes |

| Cryptocurrency (CFDs) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Tradu fees

Tradu’s fees vary depending on your account type, asset class, and country of residence. Each asset class is accessed through its own dedicated account: one for CFDs, one for listed stocks, one for spread betting (available only to U.K. residents), and one for crypto (not available to U.K. residents). Forex and CFD trading is not offered to U.S. residents.

Spread data: Based on data provided to us by the broker, average spreads at Tradu stood at 0.59 pips for the EUR/USD during the month of October 2025, which includes the rollover period where spreads can widen significantly. I was impressed by how low the spreads were, even during the rollover period. Excluding that period, the average drops to just 0.43 pips, based on all available tick data. This data shows that Tradu has highly competitive pricing, on par with what you would expect from the best brokers in this category.

Crypto fees: There’s no minimum to purchase cryptocurrencies on Tradu, but a $10 minimum withdrawal fee applies, which can reduce smaller withdrawal amounts significantly. Tradu also imposes a $30,000 limit per credit card transaction when funding a crypto account.

Deposit methods: Tradu supports a range of payment options, including PayPal, Skrill, and Google Pay. Deposits are generally processed quickly, though availability may vary by region.

Conversion fees: A 0.1% markup is applied to any currency conversion on deposits. While this is standard across many brokers, some do offer spot-rate conversions with no markup.

Inactivity fee: Tradu charges a $50 inactivity fee after 12 consecutive months without trading activity.

| Feature |

Tradu Tradu

|

|---|---|

| Minimum Deposit | 50 |

| Average spread (EUR/USD) - Standard account | 0.43 |

| All-in Cost EUR/USD - Active | 0.6 |

| Non-wire bank transfer | No |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Tradu offers two mobile apps: its own proprietary app and the standard TradingView mobile app. For this review, we focused on the Tradu app for Android, which is also available on iOS via the App Store.

The app features a clean interface with four main sections in the bottom navigation: Discover, Watchlists, Research, and Portfolio.

Discover: This tab allows you to browse tradeable instruments by asset class, including forex, stocks, indices, ETFs, and cryptocurrencies. Tradu also includes 24-hour share trading on select equities and thematic indices. Some categories, like “Hot” and “Popular,” act as pre-built screeners that adapt to market activity.

Watchlists: This tab houses your favorited assets. Users can easily create and manage multiple custom watchlists. I found it easy to create a watchlist and add assets to it, as it will pre-load the “hot” and “popular” lists, with the option to click “view all” to expand your search. The app makes it simple to add multiple instruments at once and provides a streamlined way to explore trending assets. You can also save multiple custom watchlists, compared to platforms where there is only one favorites list.

Research: This section includes news headlines from Benzinga and FXStreet, a Trading Central-powered technical analyzer, a global economic calendar, and a stock screener powered by TipRanks. The screener offers detailed views such as analyst ratings, valuation metrics, and performance data.

Portfolio: The portfolio tab displays account activity, including open and closed positions, working orders, and account reports, all within a single view. Having these elements combined improves usability compared to apps where they’re separated.

Overall, the Tradu app has a good foundation for ease of use with integrated third-party research and analytics tools. Its modern interface and clean layout make it a strong option for traders who want a mobile-first experience.

A preview mode on the Tradu mobile app that shows a list of popular currency pairs with an integrated micro chart.

| Feature |

Tradu Tradu

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | No |

| Mobile Watchlists - Syncing | No |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 114 |

Trading platforms

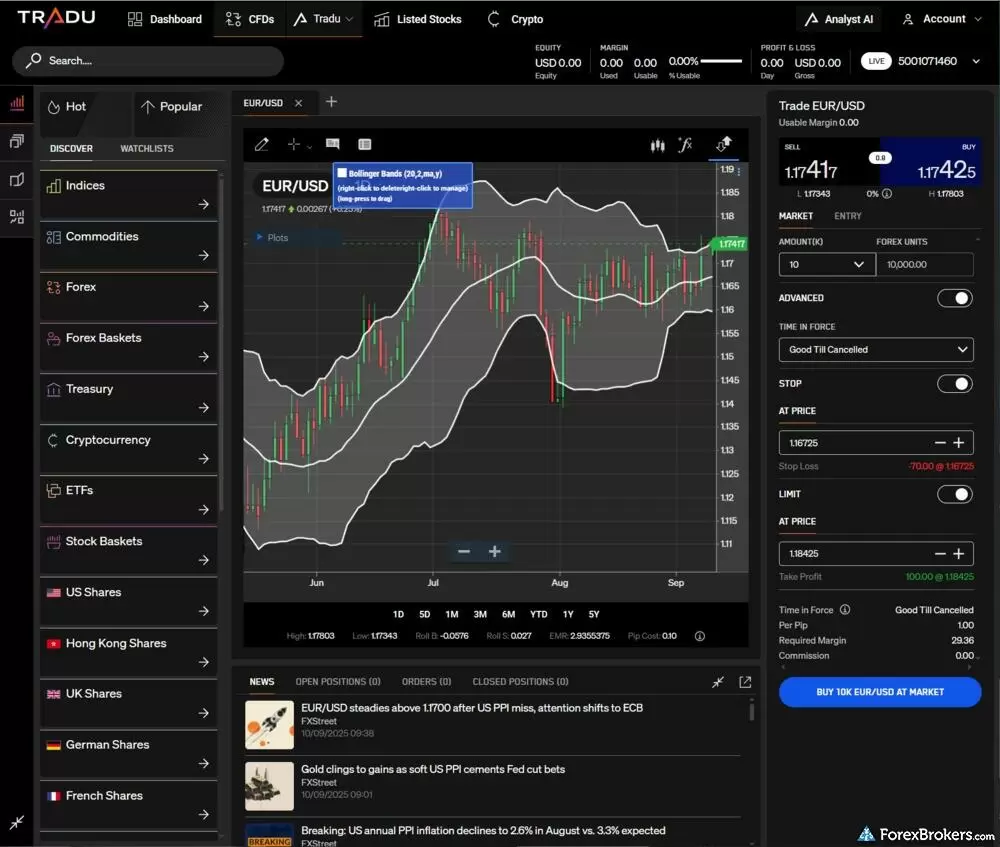

Tradu offers access to its proprietary web platform and the TradingView interface. The Tradu web platform features a clean, modern layout, with tabs for Trading, Portfolio, Research, and Charts. Users can switch between account types, such as CFDs, listed stocks, or crypto, depending on the assets available in their region. A wallet tab is also included for managing deposits and withdrawals.

On the Tradu platform you can create a CFDs layout and monitor chart trading tickets, news headlines, and access the asset library all at once.

Trading tab: This is the main workspace, featuring a standard layout with asset navigation on the left, chart in the center, and trade ticket on the right. Tabs at the bottom allow quick access to open positions, pending orders, and streaming news headlines. While the layout is fixed and windows cannot be detached or floated, most modules can be hidden, minimized, or maximized to adjust the view.

Trade ticket: The trade ticket is straightforward and includes useful features like drag-to-modify functionality. This drag-to-modify feature is quickly becoming the new industry standard, and I was pleased to see that Tradu has adopted this feature to make trading more seamless, especially when day trading.

Charts: Tradu offers advanced charting with support for over 100 indicators, 14 chart types, and 10 timeframes. Charts can be arranged in multiple layouts, and you can apply several indicators at once. I was able to add multiple concurrent indicators and zoom in and out of charts, and compress prices easily by dragging vertically on the price axis.

Research tab: This section integrates tools from Trading Central and TipRanks, alongside an economic calendar and streaming headlines from Benzinga and FXStreet. It mirrors the mobile app’s research features but provides a larger, more flexible layout.

Portfolio tab: This area combines open positions, pending orders, closed trades, and account statements in one view. It’s a practical layout that simplifies tracking your account activity without needing to switch between multiple sections.

Navigation is generally intuitive, though some deeper settings menus require using a small back arrow to return to the previous screen. Minor as it is, it’s something to be aware of when getting familiar with the platform.

Overall, Tradu’s web platform offers a polished and functional experience for multi-asset trading. Charting is well-equipped, trade execution is streamlined, and third-party research is integrated effectively, all within a simple, well-organized interface.

| Feature |

Tradu Tradu

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| Charting - Indicators / Studies (Total) | 114 |

| Charting - Trade From Chart | Yes |

Tradu crypto review

Tradu offers access to nearly 30 cryptocurrencies, available for trading 24 hours a day, Monday through Friday. Depending on your region and account type, you can either trade crypto CFDs or purchase the underlying asset directly. For example, crypto CFDs are not available in the U.K., but spot crypto trading is.

Pricing models: Tradu offers two pricing models for crypto trades: Zero Commission and Raw Spread, both with an effective cost of 0.10%. In the Zero Commission model, a 0.1% markup is applied to the spread. With Raw Spread pricing, the spread is left unmarked, and a 0.1% commission is charged instead. The result is nearly identical, and traders can choose the structure they prefer.

Withdrawals: Crypto withdrawals carry a fee of 0.08%, with a minimum of $10. While this may seem small, it can significantly impact smaller withdrawal amounts. For example, withdrawing $100 would result in a 10% effective fee due to the $10 minimum.

Volume-based rebates: Tradu offers crypto trading rebates for high-volume traders. Orders over $5,000 receive a 0.02% rebate (reducing the fee from 0.10% to 0.08%), while trades above $20,000 qualify for a 0.05% rebate, lowering the fee to just 0.05%.

Overall, Tradu’s crypto offering is competitive, with clear pricing, flexible models, and additional value for larger trades. The platform also supports crypto staking on select assets, which adds to its appeal for longer-term crypto investors.

Research

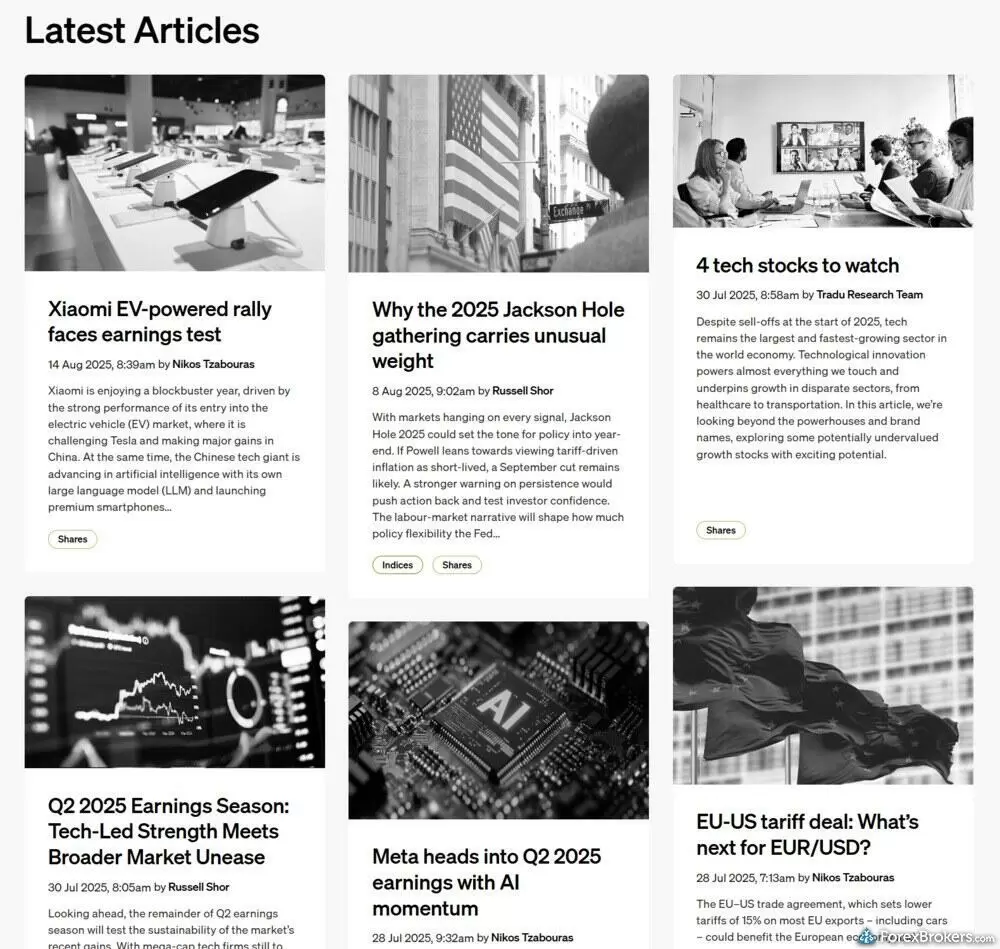

Tradu’s research offering combines a range of third-party tools with limited, but growing, in-house content. While not yet at the level of top-tier research brokers, the foundation is strong and well-integrated within the platform.

In-house research: Tradu’s in-house team publishes a handful of research articles per week through the Insights section on its website. This cadence is lower than brokers that produce multiple articles daily, but the content that is available is timely and relevant.

Tradu offers research webinars on its YouTube channel.

Third-party tools: Inside the web platform, the Insights tab includes access to tools from TipRanks, such as Analyst Consensus and Price Target. Additional TipRanks data is available in the stock analysis sections, providing further granularity for equity traders.

News coverage: Streaming headlines are powered by Benzinga, offering real-time updates across asset classes. I found the articles to be well written and what you would expect from a premium news service. They come with a disclaimer that they are partially produced with the help of AI tools, but are reviewed by Benzinga editors.

Fundamental data: Tradu includes real-time stock data from dxFeed, featuring tools such as a bid/ask feed, real-time scanner, and a full suite of company financials. The Financials tab offers data on valuation metrics, income statements, and key operating ratios, making it a useful resource for fundamental analysis.

While the volume of in-house research is limited for now, Tradu’s use of established providers like TipRanks, Benzinga, and dxFeed helps round out a capable research suite for most traders.

| Feature |

Tradu Tradu

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | Yes |

| Client sentiment data | Yes |

Education

Tradu’s educational content is housed in its Knowledge Centre, which currently features over 20 written articles grouped by category. The material covers key trading concepts and is suitable for beginners through to intermediate-level traders.

Tradu offers more text-forward education for beginners through intermediate-level traders.

While the quality of the content is solid, the format is limited. Most articles are text-heavy, with few illustrations, tables, or interactive elements. Tradu does not offer structured courses, progress tracking, or quizzes, which are features commonly found at brokers with stronger educational programs.

It's also worth noting that while Tradu itself does not currently offer video content or trading courses, its sister company, FXCM, provides more comprehensive educational resources.

Overall, education is one area where Tradu has room to expand. Adding more visual content, interactive tools, and structured learning paths would better support traders at all experience levels and help align its education offering with industry leaders.

| Feature |

Tradu Tradu

|

|---|---|

| Webinars | No |

| Videos - Beginner Trading Videos | No |

| Videos - Advanced Trading Videos | No |

Final thoughts

Tradu has made meaningful progress in a short time, delivering a clean and functional trading experience across web and mobile. Backed by Stratos Group and FXCM, under the umbrella of Jefferies Financial Group (NYSE: JEF), Tradu enters the market with a strong foundation of trust and industry experience.

As a multi-asset broker, Tradu offers a broad range of features, including access to over 13,000 instruments, TradingView integration, fractional shares, 24-hour stock trading, and crypto staking. Its platform design and range of supported products make it well-suited for traders seeking a modern, streamlined interface.

That said, the platform’s educational offering is limited, and there is no support for copy trading or algorithmic strategies. Advanced tools and more comprehensive features remain largely concentrated under the FXCM brand.

Overall, Tradu presents a compelling option for multi-asset investors looking for a clean user experience and access to both traditional and digital markets, all under the banner of an established financial group.

Tradu Star Ratings

| Feature |

Tradu Tradu

|

|---|---|

| Overall Rating |

|

| Trust Score | 95 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Read next

- Best Brokers for TradingView for 2026

- Best Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Compare Forex Brokers

- Best Forex Brokers for Beginners of 2026

- Best Low Spread Forex Brokers for 2026

- International Forex Brokers Search

- Best Copy Trading Platforms for 2026

- Best Forex Trading Apps for 2026

More Forex Guides

Popular Forex Broker Reviews

About Tradu

Launched in 2023 under Stratos Group, Tradu is a multi-asset trading platform backed by Jefferies Financial Group (NYSE: JEF). Built for modern investors, Tradu offers access to over 13,000 instruments, including stocks, CFDs, and cryptocurrencies, with platform support for TradingView and crypto staking. Tradu serves a global client base with a streamlined web and mobile experience.