Interactive Brokers Forex Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In my experience, Interactive Brokers (IBKR) is an excellent choice for seasoned forex traders. Its advanced tools and access to global currency markets provide a professional-grade solution that can handle the demands of complex trading strategies. Beginners may find the platform’s sophistication challenging across both web and desktop versions, though the newer IBKR Desktop platform has been simplified for ease of use.

While Interactive Brokers has worked to broaden its appeal to retail traders with new platforms, high-quality research, and education, I believe it remains best suited for experienced forex traders, including high-volume and institutional investors. With deep customization options and powerful trading capabilities, IBKR continues to stand out as a top-tier choice for forex trading.

-

Minimum Deposit:

$0 -

Trust Score:

99 -

Tradeable Symbols (Total):

8500

| Range of Investments | |

| Trading Fees | |

| Trading Platforms | |

| Research | |

| Mobile Trading | |

| Education |

Check out ForexBrokers.com's picks for the best forex brokers in 2026.

| #1 Education | Winner |

| #1 Professional Trading | Winner |

| #1 Range of Investments | Winner |

| #1 TradingView | Winner |

| #1 Thematic Investing | Winner |

| #1 Institutional Clients | Winner |

| #1 Interactive Educational Experience | Winner |

| #1 Futures Trading | Winner |

| #1 Canada Forex Broker | Winner |

| 2026 | #2 |

| 2025 | #2 |

| 2024 | #2 |

| 2023 | #3 |

| 2022 | #4 |

| 2021 | #4 |

| 2020 | #10 |

| 2019 | #10 |

| 2018 | #5 |

| 2017 | #6 |

Led by Steven Hatzakis, Global Director of Online Broker Research, the ForexBrokers.com research team collects and audits data across more than 100 variables. We analyze key tools and features important to forex and CFD traders and collect data on commissions, spreads, and fees across the industry to help you find the best broker for your needs.

We also review each broker’s regulatory status; this research helps us determine whether you should trust the broker to keep your money safe. As part of this effort, we track 100+ international regulatory agencies to power our proprietary Trust Score rating system.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on ForexBrokers.com. Learn more about how we test.

Can I open an account with this broker?

Yes, based on your detected country of US, you can open an account with this broker.

Table of Contents

Interactive Brokers pros & cons

Pros

- Access 170+ markets in 36 countries; 29 base currencies.

- TradingView launched for both manual and algo traders.

- TWS desktop offers powerful tools for advanced strategies.

- New IBKR InvestMentor app offers beginner-friendly finance courses in a simplified format.

Cons

- TWS platform is powerful but overwhelming for beginners.

- Neither the MetaTrader suite nor any copy trading tools are available.

- $2 minimum commission can be costly for small trade sizes.

My top takeaways for Interactive Brokers in 2026:

- Interactive Brokers is a highly trusted and well-capitalized broker, with a Trust Score of 99 and over USD 779.9 billion in client equity, catering to 4.399 million clients.

- Interactive Brokers’ improved web-based Client Portal is easy to use for forex trading, and includes integrated news headlines and an economic calendar.

- Trader Workstation (TWS) desktop platform offers a vast variety of advanced trading tools that seasoned traders and professionals will appreciate.

- Despite being great for professionals, Interactive Brokers’ Trader Workstation (TWS) desktop platform is likely too complicated for inexperienced traders.

- Unless you trade a Standard lot (100k units) or more at a time, the minimum commission of $2 per trade can make IBKR expensive for smaller-sized forex trades.

Trust score

Developed by ForexBrokers.com and in use for nearly 10 years, Trust Score is a proprietary rating system powered by a range of unique quantitative and qualitative metrics, including each company’s number of regulatory licenses. Trust Scores range from 1 to 99 (the higher a broker’s rating, the better). Learn more.

Is Interactive Brokers safe?

Interactive Brokers is considered Highly Trusted, with an overall Trust Score of 99 out of 99. Interactive Brokers is publicly traded, does not operate a bank, and is authorised by eight Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and zero Tier-4 regulators (High Risk). Interactive Brokers is authorised by the following tier-1 regulators: Investment Industry Regulatory Organization of Canada (IIROC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), Central Bank of Ireland (CBI), Swiss Financial Market Supervisory Authority (FINMA), Commodity Futures Trading Commission (CFTC), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Interactive Brokers entities are regulated.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Year Founded | 1977 |

| Publicly Traded (Listed) | Yes |

| Bank | No |

| Tier-1 Licenses | 8 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

Range of investments

Interactive Brokers offers a significant range of tradeable global markets. However, the availability of those markets will depend on where you reside and which Interactive Brokers entity holds your account. For example, retail spot forex trading is not available to U.S. residents (unless you are designated as an ‘Eligible Contract Participant’ by Interactive Brokers), and CFDs are not available to clients in the U.S., Canada, or Hong Kong. For U.S. forex trading, see our U.S. forex brokers guide. In 2024, Interactive Brokers launched IBKR ForecastTrader, a web-based platform that allows you to speculate on economic and geopolitical events, such as the U.S. presidential election, as well as climate events, like predicting total global carbon dioxide emissions for the year.

Cryptocurrency: Interactive Brokers was featured among our top picks for the best crypto trading platforms. Cryptocurrency trading is not available at Interactive Brokers through CFDs, but is available through trading the underlying asset (e.g. buying Bitcoin) through Interactive Brokers' partnership with Paxos and Zero Hash, and via OSL Digital Securities (for HK residents). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

Account funding: In early 2026, Interactive Brokers introduced stablecoin-based account funding for eligible IB LLC clients, allowing deposits via USD Coin (USDC) with near-instant processing and 24/7 availability, including weekends and holidays. Once received, funds are automatically converted to U.S. dollars and credited to the brokerage account, so clients, particularly international traders facing slow or costly wire transfers, can fund accounts and access global markets more efficiently.

The following table summarizes the different investment products available to Interactive Brokers clients.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 8500 |

| Forex Pairs (Total) | 90 |

| U.S. Stocks (Shares) | Yes |

| Global Stocks (Non-U.S. Shares) | Yes |

| Copy Trading | No |

| Cryptocurrency (Underlying) | Yes |

| Cryptocurrency (CFDs) | No |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Interactive Brokers fees

Interactive Brokers does appear to offer competitive pricing; however, it is difficult to make a precise comparison as Interactive Brokers does not publish its average spreads for forex. That said, we were able to obtain average spreads for the EUR/USD at IBKR: 0.226 pips, or an effective all-in spread of 0.626 pips after the commission equivalent of 0.40 pips per round turn (based on 0.2 pips per side) after the commission equivalent of 0.40 pips per round turn (based on 0.2 pips per side).

Forex pricing summary: For forex trading, commissions per side start at 0.00002 (0.2 basis points) of the U.S. dollar trade value with a minimum of $2 per order ($4 per round turn), but can drop to 0.08 basis points if you are an exceptionally active trader.

Forex account example: Buying and then selling $100,000 worth of EUR/USD at Interactive Brokers would result in a commission-equivalent of roughly 0.40 pips in addition to any prevailing spreads. Overall, that is a low commission rate for forex trading (note: IBKR Lite and IBKR Pro accounts do support forex trading but are not commission-free).

Minimum charge per trade: Given the minimum commission of $2 per side per $100, 000 worth of currency, trading anything less than 100,000 units of currency becomes proportionally more expensive. The minimum charge by Interactive Brokers for forex is similar to Saxo’s $3 per-order fee charged when trading less than 50,000 units of currency.

Commissions and execution method: For forex traders, Interactive Brokers aggregates prices from 17 of the world's largest interbank forex dealers. Instead of marking up spreads, Interactive Brokers charges a commission per trade, which ranges from $16 to $40 per million round turn ($8 to $20 per side). This pricing is comparable to brokers that offer commission-based forex trading with agency execution.

Active traders: For active traders, there are discounts that become available when certain monthly trading volume minimums are met. For example, if you trade over $1 billion worth of forex, the minimum charge drops from $2 per order to $1.5, and can go as low as $1 per order when reaching $5 billion per month in volume. Also, Interactive Brokers can handle large order sizes on a Request For Quote (RFQ) basis to minimize market impact and deliver the best possible execution to clients.

Other thoughts: I would like to see Interactive Brokers publish its average forex spreads, especially since it competes so well in other asset classes – like U.S. equities trading (stock trading).

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Minimum Deposit | $0 |

| Average spread (EUR/USD) - Standard account | 0.226 |

| All-in Cost EUR/USD - Active | 0.226 |

| Non-wire bank transfer | Yes |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

IBKR offers three mobile apps, catering to a wide variety of customer needs whether you are a passive investor, beginner, or more active trader, which is why its part of the top mobile trading apps. Starting with its most advanced mobile app for forex trading, customizing IBKR Mobile for forex trading can be an involved process, but the app offers a robust trading experience that competes among the industry's best multi-asset brokers. Interactive Brokers’ recently launched IMPACT app, focused on ESG screening, won our award for Innovation in 2025. Finally, the IBKR GlobalTrader app is more for passive investing with an easier to use interface.

Apps overview: All three of the mobile apps from Interactive Brokers are available for iOS on the Apple App Store and for Android devices on Google Play. The IBKR app is rich with features, many of which mirror what’s available on the web platform, whereas the IMPACT and IBKR GlobalTrader are more simplified for beginners and less demanding traders.

When it comes to innovation, one such feature is IBKR's Impact dashboard, where you can assess portfolio metrics in relation to Environmental Social Governance (ESG) factors. For this review I focused on the IBKR mobile app which is more geared towards forex and CFD trading. There is an extensive list of predefined watchlists (including two specifically for forex) and an economic calendar, that features the ability to add alerts and can be configured to only show forex-specific economic events — which I thought was a nice touch.

Charting: The IBKR mobile app features rich charting, and the ability to execute trades from within the charts themselves. There are 155 available indicators, and though there is a lack of drawing tools, I was pleased to find that indicators automatically sync with the TWS desktop platform.

Ease of use: When viewing a given chart, related news headlines display in an adjacent field – a truly helpful feature for comparing the impact of news on market prices. I was pleased to see videos and streaming TV available in the IBKR Mobile app, another feature that mirrors the desktop experience. However, the IBKR app can be generally tricky to use, especially when compared to the best mobile trading apps from category leaders.

The watchlist on the IBKR mobile app, showing the quick view chart for the selected EUR/USD forex pair.

Innovation: The IBot tool (also available in TWS) lets you chat with an AI-powered bot (either by typing or via voice command). This thoughtfully-developed tool can recognize and act upon commands such as, "Show me a chart of the EUR/USD." In this example, IBot would return a relevant chart that can be opened directly from the search results.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Price Alerts | Yes |

| Mobile Watchlists - Syncing | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Research - Economic Calendar | Yes |

| Mobile Charting - Indicators / Studies | 155 |

Trading platforms

Interactive Brokers stands out for its growing suite of trading platforms developed in-house, including its flagship TWS software and recently added web and IBKR Desktop trading platform – all of which provide access to advanced trading tools and global financial markets (including forex and CFDs). Interactive Brokers’ web-based platforms are geared towards everyday retail traders, whereas the TWS platform is highly-complex, and challenging to use and customize – even for professionals. By comparison, its recently launched IBKR Desktop aims to bridge the gap, balancing ease of use with advanced features — a never ending challenge for the best platforms.

Platforms overview: Trader Workstation (TWS), Interactive Brokers' flagship desktop trading platform, can be best described as knotty. It’s packed full of features that cover the whole spectrum of trading products, but its complexity may make it less accessible to beginner traders. Sophisticated day traders however will certainly enjoy the advanced, but complicated, range of trading tools. The IBKR Desktop platform, on the other hand, offers a simplified user experience while delivering a good balance of features for both beginner and intermediate traders. I found it very simple and easier to navigate than all of IBKRs platforms, including its client portal, and research is well-integrated alongside news headlines from multiple providers including Dow Jones Global News and Institutional News, Reuters, and Benzinga, among other providers.

Interactive Brokers’ Client Portal is a web-based trading platform that has a good balance of features, such as forex news headlines and related economic calendar events, trading, and even syncing watch lists. This platform is far more approachable for casual investors, and I found it enjoyable to use in my own testing.

FXTrader is the main terminal within TWS for trading forex, and provides access to 91 forex CFDs or 105 cash forex pairs offered by Interactive Brokers. When adding forex pairs to a watch list, users can choose from both spot forex cash rates and forex CFDs from either the IDEALPRO or SMART venue.

Charting: TWS charts offer 127 available studies, which is far above the industry average but less than, say, thinkorswim by Charles Schwab – which offers over 300. That being said, there’s no question; TWS offers a powerful charting experience. Interactive Brokers’ Client Portal also features charts powered by TradingView that allow traders to select from 98 indicators and add as many as 8 at a time. TradingView's popular platform delivers a range of powerful charting functions and robust analysis tools; learn more by checking out our TradingView Guide.

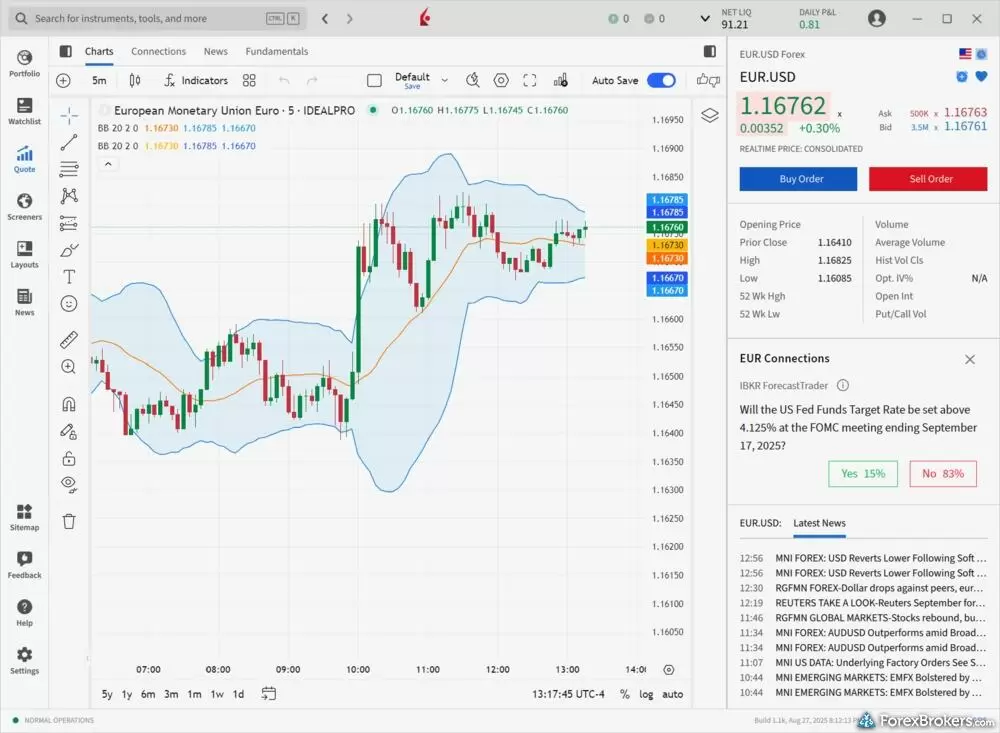

My layout on the IBKR Desktop platform includes a chart of the EUR/USD pair, a trading panel, and news headlines from Reuters.

Ease of use: While the number of customizations available in the TWS desktop platform is impressive, the inherent complexity and the long lists of possible configurations can be intimidating for unseasoned investors. For example, the watchlist alone can be configured with over 650 different available columns. Saxo, CMC Markets, and IG all also offer robust trading platforms, but they are more streamlined and far easier to use.

Advanced orders: Interactive Brokers’ TWS platform supports complex orders such as its Basket order (much like thinkorswim's Blast order or the Custom Basket order offered by XTB) along with One Cancels All orders and many others. This deep level of complexity can be an advantage for traders who are looking to use advanced strategies.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Desktop Trading Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Copy Trading | No |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| Charting - Indicators / Studies (Total) | 155 |

| Charting - Trade From Chart | Yes |

Research

Out of all brokers reviewed on ForexBrokers.com, Interactive Brokers still offers the widest array of third-party research in 2025.

IBKR offers 176 services from 70 news and research providers (some of which require a paid monthly subscription), with 22 directly covering forex and crypto news and research and 6 additional sources overall recently being added. Interactive Brokers has an overall excellent research offering. I was pleased to see more forex-related research added in IBKR Desktop, along with the addition of Acuity and Trading Central into the web platform.

Research overview: Interactive Brokers’ research content will satisfy the vast majority of traders – but you have to know how to find it. Much of the third-party research is available in Trader Workstation (TWS) and on the Client Portal. Content from in-house and guest authors featuring articles published throughout the trading week can be found on the Traders' Insight blog. Interactive Brokers also streams market headlines and news from sources like Reuters, Dow Jones, and Market News International (MNI), and its economic calendar is powered by providers like Econoday. Finally, institutional investors gain access to UBS Live Desk market analysis.

Market news and analysis: Interactive Brokers provides forex research produced in-house as well as from dozens of third-party providers, including both free and premium (paid) subscriptions. There is a growing selection of forex-specific articles and related written content on the Traders Insights blog. Additional research resources are integrated into the web-based Client Portal, including investment themes powered by Reflexivity and providers such as Acuity, Trading Central, TipRanks, and others, all found within the Discover tab in the research section. For instance, AnalysisIQ offers trading signals powered by Acuity, as well as Featured Ideas powered by Trading Central, both available in the IBKR web platform.

An example of the daily analysis and research to be found on the Traders Insights blog. Featured here is an article from Darren Chu describing USDJPY Bull Flag pattern analysis.

Video content includes Bloomberg Television (U.S. and Asia), daily market updates from IBKR Traders' Insight, and The Fly Squawkbox Live podcast. Though forex is not its main focus, the Traders' Insight daily video update is produced by IBKR's Chief Strategist, which I found to be a great quality. Likewise, IBKR provides a superb video integration of TipRanks, a great resource for non-forex asset classes.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Daily Market Commentary (Articles) | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central | Yes |

| Client sentiment data | Yes |

Education

Interactive Brokers’ wide variety of quality educational content (including a growing selection of forex-specific content) ranks way above the industry average, putting it just shy of becoming an industry leader for education. However, the primary focus of Interactive Brokers’ educational offering is the stock market (share trading) – not forex or CFDs.

Learning center: Interactive Brokers offers several dedicated resources for education, including its Traders' Academy portal, IBKR Quant blog, and IBKR Campus. Created by in-house staff and third-party educators, I found the content to be plentiful, diverse, and of high quality.

The Traders' Academy portal effectively covers broader financial market sectors, with lessons and accompanying videos that are organized by experience level. There is also a small but growing selection of forex courses (two newly added in 2021) which include quizzes and progress tracking, as well as a Coursera course that Interactive Brokers has developed with a University-style syllabus.

IBKR InvestMentor app: Interactive Brokers recently released a mobile app for investor education called IBKR InvestMentor, available on iPhone and Android. After trying the app and completing a lesson, my takeaway is that InvestMentor is a sleek, modern tool that makes learning simple. You mostly swipe and tap to move forward. Each course only took me a few minutes to finish, with quizzes at the end to check progress and knowledge. While I couldn’t skip ahead, since advanced lessons unlock only after completing earlier ones, I liked the clean layout and think it will resonate with both Gen Z and new traders. Overall, it’s a strong first step toward more comprehensive courses and broader asset-class coverage, even if it doesn’t yet offer forex-specific lessons beyond indirect references to economic factors like monetary policy.

A list of available courses on the new IBKR InvestMentor app ranges from an overview of the basics of asset classes to a run-down on futures.

Room for improvement: Given the complexity of its TWS platform, I was not surprised to find that many of the broker’s educational videos are platform tutorials. On Interactive Brokers’ YouTube channel, I found very few videos about forex and CFDs, despite a large variety of content related to other asset classes. It’s worth noting that Interactive Brokers has slowly and steadily expanded its forex content, and has a growing selection of financial markets content relevant for foreign exchange.

A typical educational video on the IBKR Podcast. Featured is an episode entitled: "Lean In, to Implied Volatility."

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

Final thoughts

Interactive Brokers continues to make major strides in its product offering with the ongoing expansion of both new and existing platforms. Though its focus has traditionally been on sophisticated traders, Interactive Brokers has begun to expand into the retail trader market with a well-rounded offering and a variety of trading platforms suitable for forex traders of all experience levels. That said, patience may be required if you are new to exploring IBKR's platform suite. My suggestion would be to start with the IBKR Desktop app for usability, along with the web-based Client Portal, if ease of use is a key factor for you.

Steven's expert take

"Low-volume or beginner forex and CFD traders should take note: miscellaneous fees, such as market data subscriptions, and the complexity of its proprietary platforms should be taken into consideration when deciding which Interactive Brokers platform may be a good fit for your trading style."

For institutional clients, IBKR is No. 1 again in 2025, and earned our 2025 Annual Award for #1 Range of Investments. Interactive Brokers also earned Best in Class honors in multiple important categories, including Crypto Trading, Algo Trading, TradingView, Mobile Trading Apps, Professional Traders, Platform & Tools, Commissions & Fees, Research, Education, Trust Score, and Overall (see Interactive Brokers' full list of 2025 Annual Awards).

Interactive Brokers Star Ratings

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Overall Rating |

|

| Trust Score | 99 |

| Range of Investments |

|

| Trading Fees |

|

| Trading Platforms |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Interactive Brokers Regulation, Traders' Academy, YouTube channel

Read next

- Best Brokers for TradingView for 2026

- International Forex Brokers Search

- Best Copy Trading Platforms for 2026

- Best Low Spread Forex Brokers for 2026

- Best Forex Brokers for Beginners of 2026

- Compare Forex Brokers

- Best Forex Brokers for 2026

- Best MetaTrader 4 (MT4) Brokers for 2026

- Best Forex Trading Apps for 2026

More Forex Guides

Popular Forex Broker Reviews

About Interactive Brokers

Founded in 1977, Interactive Brokers is one of the oldest online brokerages in the U.S. and has been listed publicly (NASDAQ: IBKR) since 2007. As of its latest annual report for 2024, Interactive Brokers has over 3.45 million clients and is well-capitalized with $11.7 billion in excess regulatory capital, and has USD 591.4 billion in client equity as of February 2025. In the last few years IBKR has significantly increased its speed and breadth of development when it comes to new technology and innovations, expanded its platform and product range and available services.

Interactive Brokers was one of the first brokers to offer a multi-asset solution that now includes equities, options, forex, futures, and bonds across more than 170 market centers in 36 countries, with account denomination and funding supported in 29 currencies from a single trading account.

While retail forex is not available to U.S. residents at Interactive Brokers, Eligible Contract Participants (ECPs) with at least $10 million in assets are still eligible. Read more on Wikipedia.